Today’s edition is brought to you by Muzify. A platform to unlock your music fandom through quizzes, stats and a lot of fun tools. Can you guess the track in 5 seconds 🫵

It’s Wednesday. Today’s crypto dispatch dives into Justin Sun's world of calculated chaos and the art of attention economy 🤔

How one expensive fruit sparked a TRX rally to $0.43

The Trump connection: Sun's $30M investment in WLF

South Korea's martial law chaos fuelling Tron's surge

The "Dino rotation" sweeping old Altcoins

Tron's growth: 275M users and $30B locked

Consider signing up for pay-what-you-want subscription to support our work - which is possible thanks to support from readers like you.

If you want to reach out to 170,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

"Art isn't always about pretty things. It's about who we are, what happened to us, and how our lives are affected." — Elizabeth Broun

Remember when a banana duct-taped to a wall sold for $120,000? That was 2019, and everyone thought the art world had gone bananas.

Well, hold my fruit.

Justin Sun, the founder of Tron, paid $6.2 million for another version of the same artwork.

Sounds absurd? Well, welcome to Justin Sun's world of calculated chaos.

But unlike the previous buyers who treated Maurizio Cattelan's "Comedian" as a pure art piece, Sun turned his expensive snack into something far more valuable: a catalyst for billions in market movements.

Last week, crypto's most theatrical founder walked into Hong Kong's Peninsula Hotel, gave a speech about his newly acquired "iconic" artwork – literally a banana duct-taped to a wall – and then ... ate it 🤦

Block That Quote🎙️

Justin Sun, Founder of Tron

"It's much better than other bananas."

— He declared, mid-chew. "It's really quite good."

The crypto world chuckled.

Art critics cringed.

But Sun? He was already three steps ahead.

See, what looked like an expensive lunch was actually the first domino in a masterfully orchestrated series of events that would send TRX soaring to unprecedented heights.

Now, let's unpack this banana-sized butterfly effect.

🔢 In The Numbers

$36 Billion

That’s where Tron’s (TRX) market cap hit on December 4.

TRX surged to $0.43, an 80% increase in 24 hours.

The thing is, Sun didn't just buy a banana - he bought attention.

And boy, did it pay off.

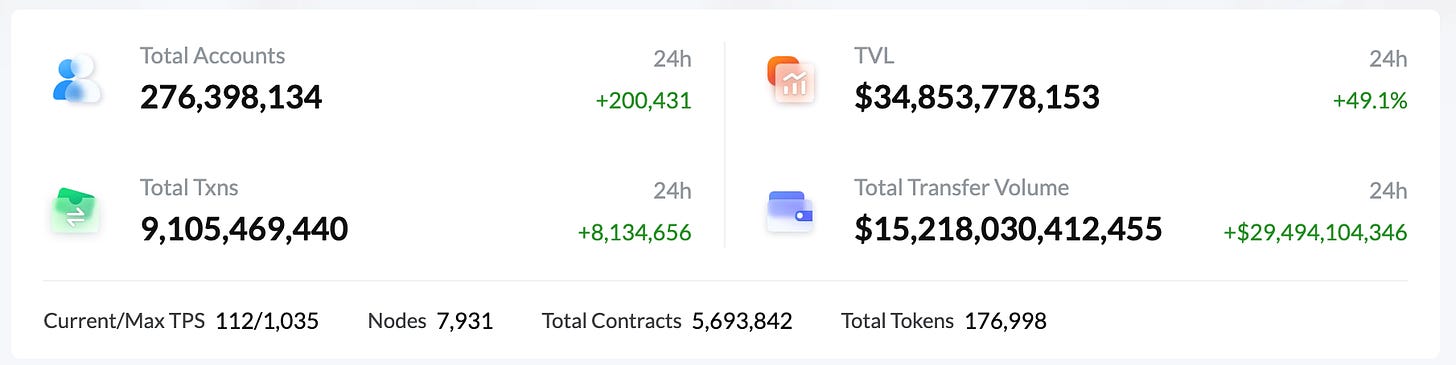

Tron's growth numbers tell their own story.

According to TRONSCAN, over 275 million total user accounts, more than $30 billion in total value locked, and status as the largest host of USD Tether stablecoin.

That's quite a return on a $6.2 million investment in potassium.

The Home for All the Music Lovers

Muzify is a journey into the world of music. An interactive experience through quizzes, stats and a lot of fun tools.

For artists it’s a powerful tool to connect with their fans. For fans it’s building deeper connect with the artists.

Through custom quizzes artists can engage their audience, receive direct feedback, and build a loyal following eagerly anticipating their next release.

The platform offers a direct line to fans, fostering a sense of connection that goes beyond mere listening.

The Sun Empire

The crypto mogul's empire is more extensive than most realise, and keeping track of it all feels like trying to count seeds in a fruit basket.

There's Tron, of course - but that's just the beginning.

The Tron ecosystem has quite a spread.

The Tron blockchain (home to TRX token)

BitTorrent (acquired and tokenised)

The Uniswap wallet

A growing suite of DeFi protocols

His role as Permanent Representative of Grenada to the WTO

Advisory position at HTX (formerly Huobi)

And now, advisor to Trump's World Liberty Financial

It's a sprawling empire that processes over $9 billion in daily transactions, challenging Ethereum's dominance in stablecoin transfers.

Since April 2021, Tron has hosted the largest circulating supply of USD Tether (USDT) in the crypto ecosystem - a feat that often goes under appreciated.

What exactly is Tron? Launched in 2017 with a $70 million ICO, it's evolved far beyond its initial pitch as a decentralised content distribution platform. Today, Tron operates as a high-throughput blockchain platform that's become a crucial piece of crypto infrastructure, particularly in Asia.

The Art of the Steal

What makes this story particularly fascinating isn't just the price tag - it's the masterful way Sun has leveraged it.

In the art world, a banana duct-taped to a wall might be worth millions because of its conceptual value.

For those unfamiliar with Cattelan's "Comedian," it's worth noting that what Sun actually bought wasn't just a banana and some duct tape. The artwork comes with a certificate of authenticity and detailed instructions about banana placement, tape angle, and how often to replace the fruit. Yes, really.

But Sun wasn't interested in the artistic merit of proper banana placement.

He was playing a different game entirely.

The Trump Card

The banana purchase didn't happen in isolation.

Just days before, Sun had made headlines by investing $30 million in World Liberty Financial, Donald Trump's struggling crypto project.

That investment was strategic - it pushed the project over its minimum threshold, triggering a payout of at least $15 million to the Trump family.

The timing wasn't coincidental. Sun has a history of making bold moves that generate maximum attention.

As one market analyst put it, "Sun's playful stunt involving the conceptual artwork sparked community engagement and indirectly boosted related tokens."

But here's where the story takes an unexpected turn.

The Korean Catalyst

Just as the banana buzz was starting to fade, political chaos erupted in South Korea - one of the world's most reactive crypto markets.

On Tuesday night, South Korean President Yoon Suk-yeol declared emergency martial law, a first in over 40 years.

Though he called it off five hours later, the damage - or in Sun's case, the opportunity - was already in motion.

The country's largest crypto exchanges, Upbit and Bithumb, reported service suspensions due to unprecedented activity.

Traders, desperate to move their assets, turned to Tron's TRX token as a transfer medium.

Why? Because TRX has long been one of the preferred tokens for moving assets between exchanges, especially in Asia.

And that’s why TRX surged to the sky in the last 24 hours.

The Dino Rotation

But there's more to this surge than just Korean politics.

Analysts point to what they call the "Dino rotation" - a phenomenon where funds are moving out of Bitcoin and newer tokens into older, undervalued projects.

"Most older projects are fully circulated and have dropped over 90% from their peaks, allowing small amounts of capital to significantly boost prices and attract market liquidity," explains Pat Zhang, head of WOO X Research.

The Perfect Storm

What makes Sun's moves particularly effective is their compounding nature. Each headline builds on the last.

The Trump investment established him as a major player in political-adjacent crypto

The banana purchase created viral attention and meme potential

The banana-eating ceremony kept the spotlight going

The Korean crisis provided unexpected rocket fuel

Add to this the speculation around Tron's potential inclusion in Grayscale's investment assets, and you have a perfect storm of attention and opportunity.

Token Dispatch View 🔍

Beyond the immediate price action, Sun's moves reveal something deeper about the crypto market's evolution.

In an industry where attention is increasingly fragmented, the ability to create and sustain narrative momentum becomes a crucial skill.

And the numbers? These aren't just numbers - they're validation of Sun's attention-first strategy.

The meme effect: The ripple effects extend beyond TRX itself. Tron-based meme coins have seen explosive growth, with tokens like FoFar (FOFAR) gaining 240% in 24 hours.

Even Sundog (SUNDOG) maintained over $163 million in trading volume at a market cap of $172 million.

This isn't just market movement - it's ecosystem building through attention arbitrage.

The long game: Critics might dismiss Sun's moves as mere stunts, but that misses the bigger picture. In a market where narrative drives value, the ability to command attention becomes a form of capital itself.

Consider the parallels with traditional art markets.

Just as a banana duct-taped to a wall derives its value not from the materials but from the conversation it generates, Sun has understood that in crypto, attention isn't just a byproduct of value - it's often the source of it.

The next time someone tells you art isn't a good investment, remind them that sometimes it's not about the art itself, but about what you do with it.

Just ask Justin Sun - if you can catch him between his headline-grabbing moves.

After all, in a world where attention is currency, sometimes you have to go bananas to make it big.

Just remember to save the receipt. And maybe the banana too - you never know when you might need it for your next performance.

The Surfer 🏄

Grayscale has filed with the SEC to launch a spot Solana ETF, joining competitors like 21Shares and VanEck. The proposed Grayscale Solana Trust (ticker GSOL) would convert the existing trust into an ETF, holding approximately $134.2 million in assets.

Stanislav Moiseev, founder of the Hydra darknet market, sentenced to life in prison by a Russian court. Hydra reportedly generated over $5 billion in cryptocurrency during its operation from 2015 to 2022.

Roger Ver, known as "Bitcoin Jesus," is seeking to dismiss US tax evasion charges, claiming they are unconstitutional. He argues that the IRS's exit tax for renouncing US citizenship with over $2 million in assets is "inscrutably vague" and violates the Constitution.

Binance leads crypto exchanges in Bitcoin deposits for 2024, with an average daily deposit increase of 2.77 BTC. Average Bitcoin deposits across exchanges surged from 0.36 BTC in 2023 to 1.65 BTC in 2024, reflecting growing institutional interest.

Australia’s new draft guidelines mandate that most crypto firms must obtain financial licenses, making compliance essential. The Australian Securities and Investment Commission (ASIC) released a consultation paper on December 4, categorising many digital assets as financial products.

If you want to make a splash with us, book a demo call 🤟

You can check out partnership opportunities🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us ... either ways do tell us✌️

So long. OKAY? ✋

“This isn't just market movement - it's ecosystem building through attention arbitrage.”

Many thanks for eloquently defining the essence of phenomenon!