The best asset of H1 2023? Bitcoin 🚀

In H1 2023, Bitcoin's price surged, institutional interest in spot ETFs grew, but regulatory pressures in the US led to charges and company relocations to jurisdictions with crypto-friendly policies.

Hello, y'all. Bitcoin in 2023 👇 Spin some tunes on »» Muzify «« will ya?

This is The Rabbit Hole, join our telegram. Please? 🤟

It's been the year of Bitcoin.

Data shows that in the first half of 2023, Bitcoin increased by 83.8%, ranking first, far exceeding other major assets in the world.

The Nasdaq index rose 31.7%, ranking second, and other major national stock markets rose. The price of natural gas fell by 37%, ranking the bottom, and the prices of other energy sources all fell.

Institutional interest drives Bitcoin price in first half of 2023

Bitcoin experienced a significant price surge in the first half of 2023, nearly doubling from $16,000 to above $30,000 by June 30.

Traditional financial institutions, including BlackRock and Fidelity, applied for Bitcoin spot ETFs, signalling increased institutional interest in BTC.

Ordinal Inscriptions emerged on the Bitcoin network, providing new utility and adoption for the flagship digital asset.

Despite positive developments, regulatory pressure in the United States intensified, leading to charges against major crypto exchanges and some firms exiting the country.

Bitcoin price skyrockets: Best-performing asset of the year

Bitcoin's price rose over 80% in the first six months, outperforming other significant assets such as gold, S&P 500, and Nikkei 225 index.

Closing above $30,000 on June 30, Bitcoin demonstrated its strength as the best-performing asset.

Traditional Institutions Show Interest in BTC Spot ETFs

BlackRock, the world's largest asset management firm, filed an application for a Bitcoin spot ETF, followed by similar applications from institutions like Fidelity.

While the SEC initially deemed these applications inadequate, the firms quickly addressed the concerns, raising hopes for the approval of the first spot ETF in the United States.

Emergence of Bitcoin Ordinal inscriptions

Ordinal Inscriptions, similar to NFTs, gained popularity on the Bitcoin network during the first half of the year.

These inscriptions allowed the embedding of text, audio, and images into the smallest unit of Bitcoin, Satoshi.

While some BTC maximalists criticised Ordinals for their impact on the blockchain, a Grayscale report suggested that they could boost Bitcoin adoption.

Regulatory challenges and global policies

US regulatory authorities, including the SEC and CFTC, intensified their scrutiny of the crypto industry, filing charges against exchanges like Binance and Coinbase.

Financial firms such as Beaxy and Paxful exited the US, citing unfavourable regulatory conditions.

Conversely, countries like Hong Kong, Singapore, the UK, and Nigeria introduced pro-blockchain policies to attract crypto entrepreneurs.

Crypto scams in H1 2023

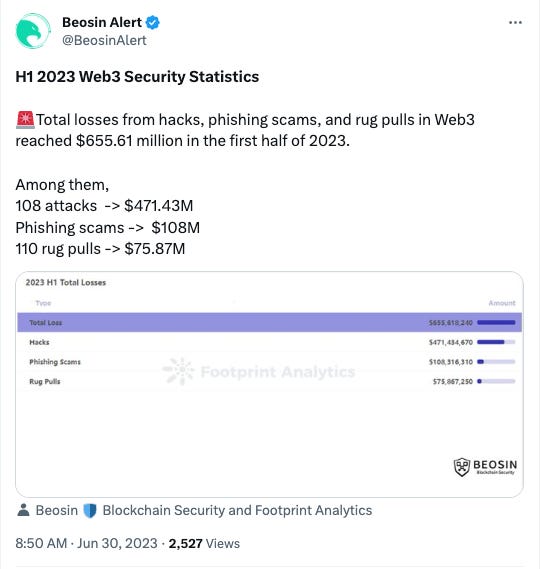

According to a June 30 report by Web3 security firm Beosin, the total value of cryptocurrencies lost in scams, hacks and rug pulls amounted to $656 Million during the first half of 2023.

$471.43 Million in 108 protocol attacks.

$108 Million in various phishing scams.

$75.87 Million over 110 rug pulls.

For hacks, the amount represented a significant decrease over H1 2022 and H2 2022, where $1.91 Billion and $1.69 Billion were lost, respectively.

In addition, Beosin analysts wrote: “Approximately $215 Million of stolen assets were recovered, accounting for 45.5% of all stolen assets. In contrast, in 2022, only 8% were recovered. $113 Million of stolen assets were transferred to mixers: $45.38M into Tornado Cash and $68.14M into other mixers."

In a dashboard compiled by Beosin and Footprint Analytics, only one project was hacked for more than $100 Million, that being Euler Finance’s $195 Million flash loan hack on March 13. The firm opened redemptions on April 12 after hackers returned most of the stolen assets.

The vast majority of crypto lost in H1 2023 were coins and tokens minted on the Ethereum blockchain, at 75.6%. Meanwhile, the second largest stolen asset class, Binance Smart Chain tokens, came at just 2.6%.

Furthermore, most of the stolen crypto was lost due to smart contract vulnerabilities (56%), while 21.4% had no clear identifiable reasons for the loss. Nevertheless, the numbers represent a significant decrease over H2 2021, when a record $2.1 Billion in crypto was lost due to hacks, phishing scams and rug pulls.

TTD Week That Was 📆

The week of lawsuits, SEC and the regulators push for crypto as securities.

Saturday: Crypto - This time for Africa 🌍

Friday: FTX reboot 🛎️

Thursday: Prime Trust bites the dust 🧹

Wednesday: Firms with $27T in assets 😘 crypto 🎯

Tuesday: The FTX 🏅 $7 Billion in 🏃 $2 Billion to go 🏊♀️

Monday: The NFT winter? ❄️

TTD Week in Funding 💰

Mythical Games $37 Million. Develop Web3 games, including popular titles like NFT Rivals and Blankos Block Party.

One Trading $32.7 Million. Institutional-focused crypto trading platform, previously known as "BitPanda Pro" before rebranding.

PWN $2 Million. Peer-to-peer (P2P) loan marketplace backed by various digital assets such as tokens and NFTs.

Anichess $1.5 Million. Build a decentralised chess game in collaboration with Animoca Brands and chess.com.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us some love on Twitter & Instagram🤞

So long. OKAY? ✋