Today’s edition is brought to you by Kraken. Your bridge to the world of crypto since 2011. First time US clients can earn $50 in credit 👇

It’s Wednesday, the day Bitcoin pulls off another feat and we are back with another edition of The Token Dispatch.

Bitcoin shattering long-held assumptions

BlackRock's dominance in the Bitcoin ETF market

MicroStrategy's unrelenting Bitcoin buying spree and the risks involved

The ongoing crypto investment surge

Plus, a powerful quote from the Bitcoin bull himself, Michael Saylor

Consider signing up for pay-what-you-want subscription to support our work - which is possible thanks to support from readers like you.

If you want to reach out to 175,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

"There is only one boss. The customer." - Sam Walton.

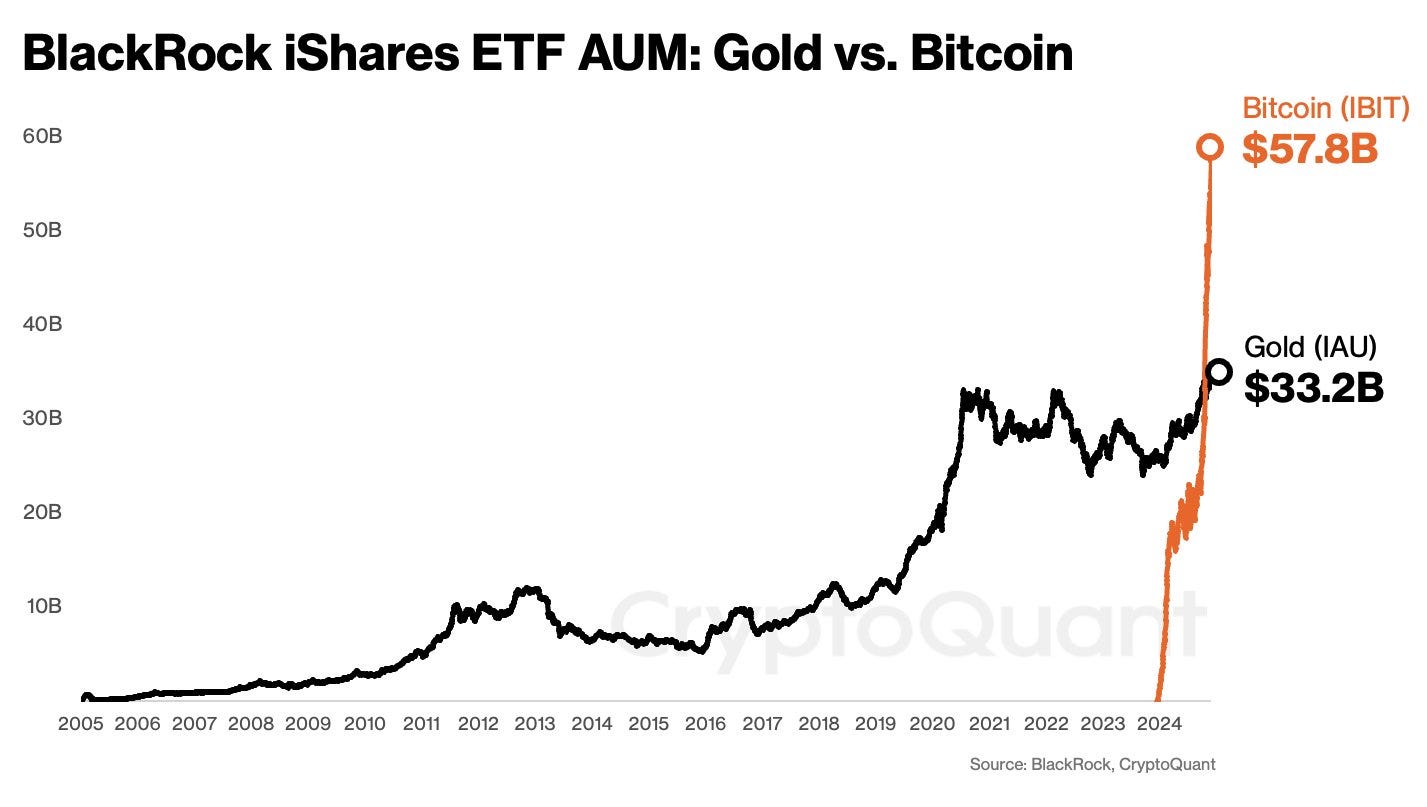

The day the unthinkable happened: Bitcoin flips gold.

It was a moment that would have been dismissed as pure fantasy just a year ago.

The kind of far-fetched scenario that crypto enthusiasts might dream up, only to have sober-minded finance types roll their eyes and cite the immutable laws of markets.

And yet, here we are - staring down the barrel of a reality that has shattered long-held assumptions and rewritten the rules of the game.

Yeah we are little dramatically poetic today. Why not?

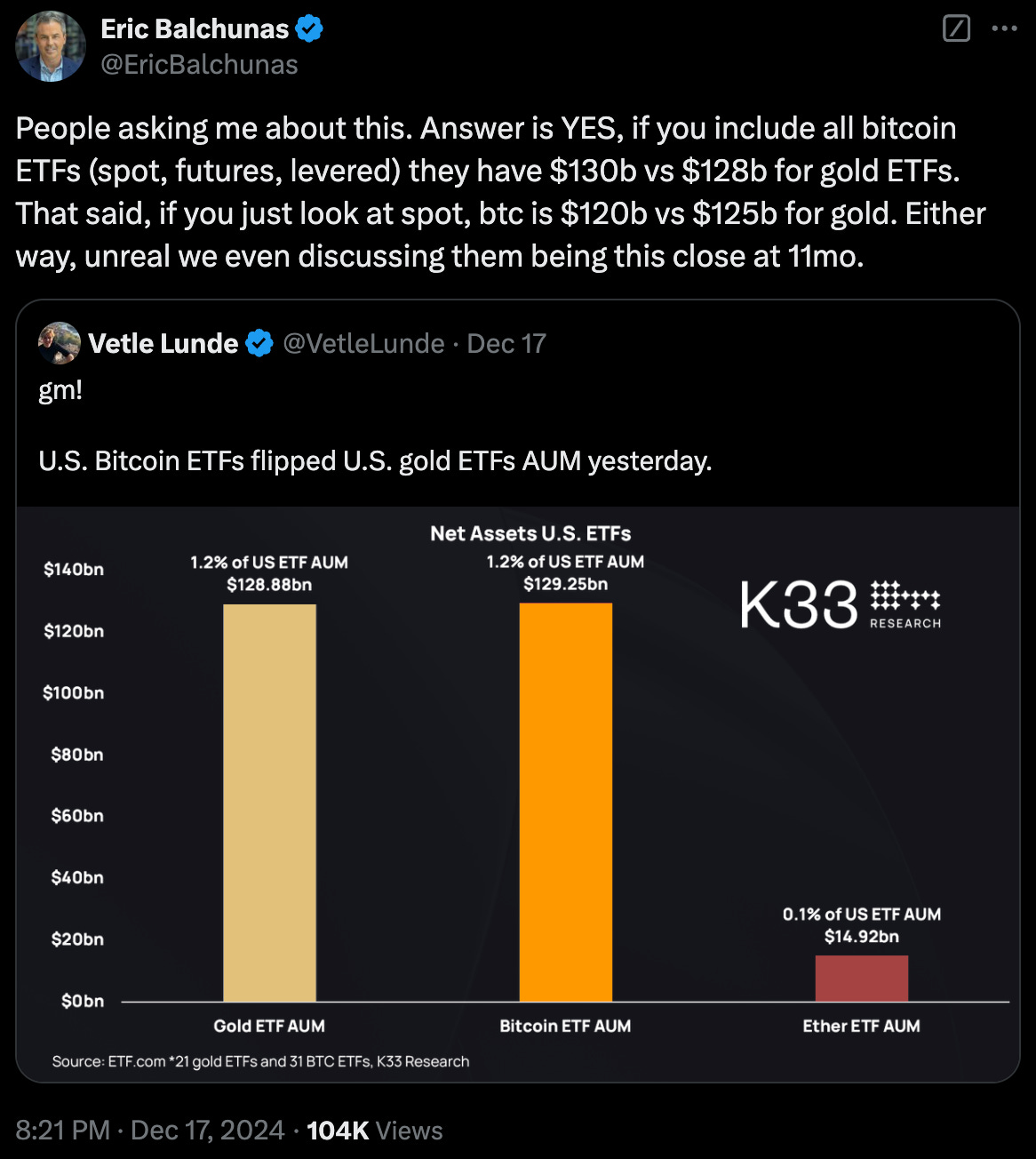

According to the data from K33 Research, the assets held by US Bitcoin exchange-traded funds (ETFs) - an infant in the investment world - had surpassed those of the venerable gold ETFs.

$129 billion to $128.68 billion, a narrow but undeniable victory for the digital upstart over its analog counterpart.

"Unreal," uttered Bloomberg's Eric Balchunas, his words dripping with a blend of awe and disbelief.

"Bitcoin funds are even competing with gold in this way after just 11 months.”

How did this come to pass?

What unseen forces had conspired to elevate this cryptocurrency, this code made flesh, to such lofty heights?

The answers, it seemed, lay not in the relics of the past, but in the promise of a future still unwritten. (Okay, that’s enough drama, let’s get real now.)

The Flipping of the Guard

The AUM figure includes spot BTC ETFs as well as ETFs that track Bitcoin’s performance using financial derivatives, such as futures.

The rapid growth of Bitcoin ETFs has been fuelled by a few key factors.

First and foremost, there has been a notable shift in institutional adoption and sentiment surrounding the crypto since the 2024 US election.

Known factor. Hail Trump!

The election of a more crypto-friendly administration, coupled with the emergence of high-profile Bitcoin proponents like Senator Cynthia Lummis, has bolstered investor confidence in the digital asset.

Suddenly, allocating a slice of one's portfolio to Bitcoin has become a more palatable proposition, even for traditionally risk-averse institutional players.

Read: Saylor Strategy: 0️⃣ Interest, ♾️ Bitcoin?

And of course the success of those who accumulated loads of BTC at the right time: MicroStrategy, El Salvador and even Bhutan - the country.

Read: Thunder Dragon's $1B Bitcoin Stack 🇧🇹

"The BTC ETFs are one of the largest cohorts of Bitcoin holders at over 1.13 million BTC," - noted the Bitfinex analysts in their latest market report.

This massive inflow of institutional capital has been a driving force behind Bitcoin's meteoric rise.

In contrast, gold ETFs have struggled to maintain the same level of allure.

While the yellow metal has long been viewed as a safe haven asset, its relatively stagnant performance in recent years has caused some investors to look elsewhere for portfolio diversification.

Bitcoin, with its sky-rocketing valuation, has emerged as an attractive alternative.

Bitcoin Breaks Record After Record

Bitcoin just broke its own price record for the third straight day, smashing past $108K before dropping.

The coin is now at $107,020, up nearly 12% over 7 days. This surge came as XRP jumped over 6% on Ripple's stablecoin launch.

Bitcoin's new all-time high of $108,135 comes amid growing investor interest after Trump's election win.

The incoming administration may even create a US Bitcoin reserve. Money is flooding into crypto ETFs, with over $600M going into US spot Bitcoin funds on Monday alone.

In the altcoin space? XRP and Stellar are the biggest gainers, though still below 2018 highs. Meme coin Bonk is also up over 4%. Exchange tokens like Bitget and Cronos have jumped 11% in the past day as well.

Bitcoin to Gold Ratio

The Bitcoin to gold ratio, which measures BTC's purchasing power relative to gold, reached a new all-time high at 40 gold ounces per BTC.

Veteran trader Peter Brandt predicted the ratio could reach 89:1.

BlackRock Rules As Always

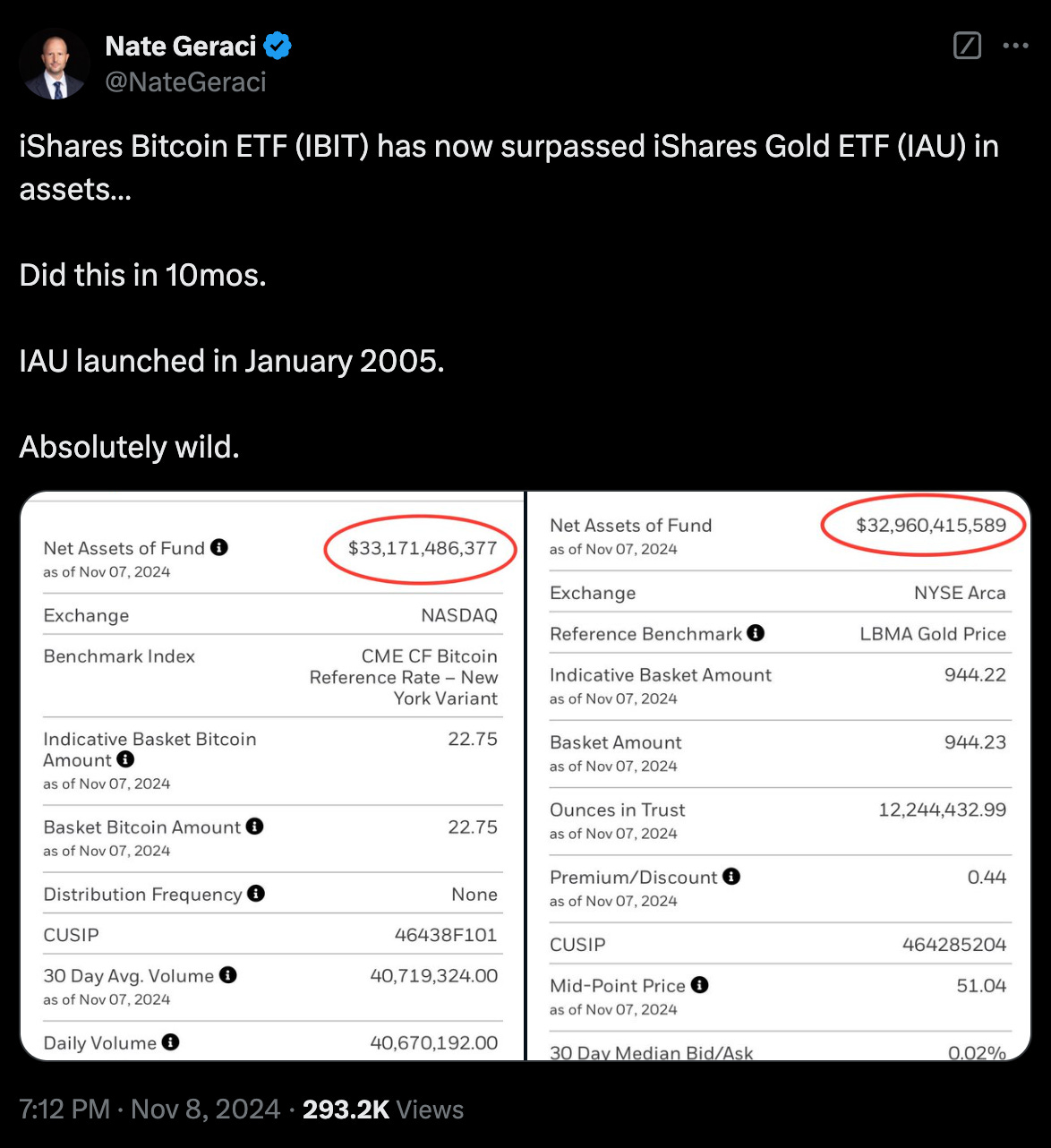

BlackRock's iShares Bitcoin Trust (IBIT) is the clear leader in the Bitcoin ETF market.

IBIT has the highest total net assets of $58.57B, representing over 48% of the total $121.68B in net assets across all US Bitcoin ETFs.

IBIT's cumulative total net inflow of $37.04B is the highest among the Bitcoin ETFs shown, indicating strong and consistent investor demand.

IBIT's total value traded of $60.73B is also the highest, further underscoring its dominance.

The data shows IBIT as the top gainer over the time period with a 0.85% increase in price, outperforming the other Bitcoin ETFs.

That’s not all.

The world's largest asset manager with $11.5T in AUM, has released a 3-minute educational video on Bitcoin. This follows BlackRock's recent advice to investors to allocate up to 2% of their portfolio to BTC.

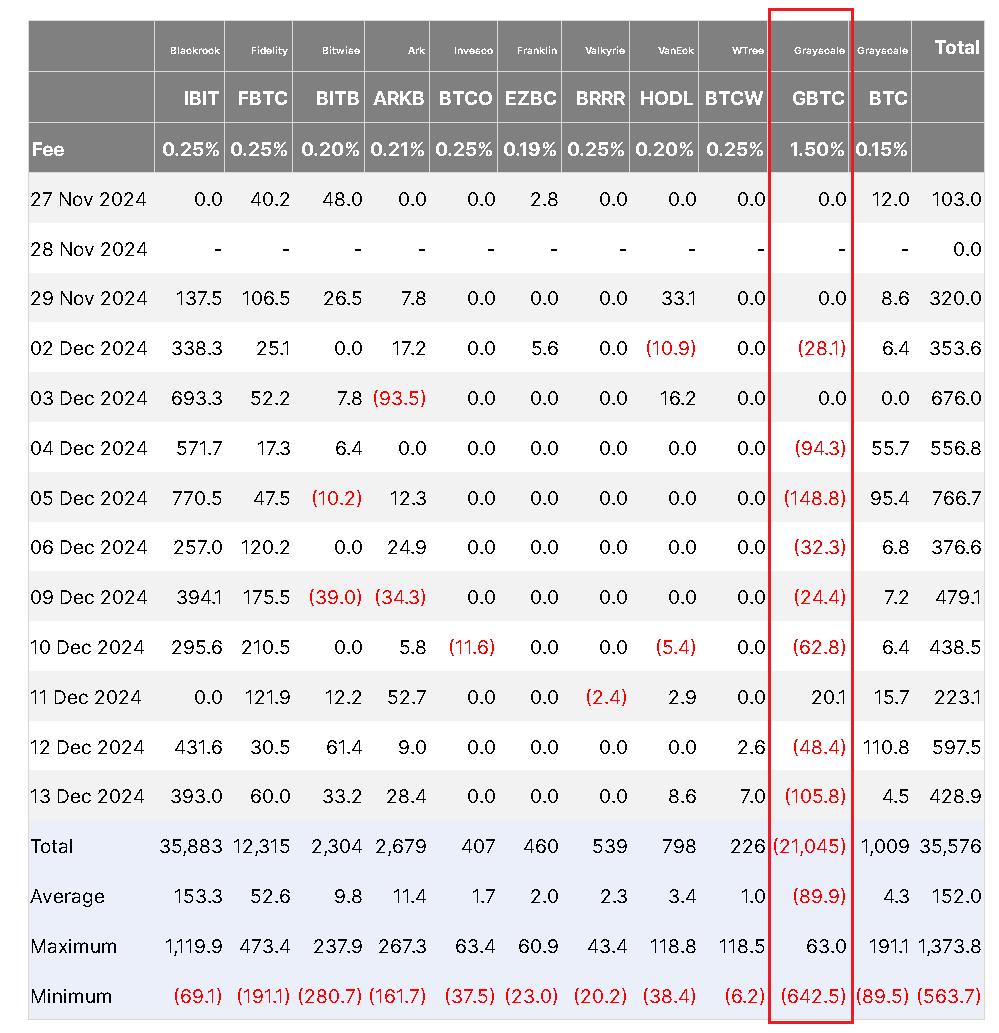

Not all crypto funds are seeing inflows. The Grayscale Bitcoin Trust (GBTC) has had over $21 billion in outflows since January, the only US spot Bitcoin ETF with negative net investment. This overshadows the $20.7 billion in inflows to the 9 other spot Bitcoin ETFs.

Financial Freedom Starts Here

Kraken is one of the largest and oldest crypto exchanges in the world, founded in 2011. Spot, Futures, Margin, NFTs, Staking & OTC Buy, sell, trade, earn, explore and learn - it’s your bridge to the crypto world.

It is dedicated to making cryptocurrency accessible and available to the world and enabling people from all walks of life to invest in their independence 🫵

In The Numbers 🔢

$3.2B

Record 10th consecutive week of inflows the crypto products saw - CoinShares.

Cryptocurrency investors have maintained their purchasing spree as Bitcoin set new highs, with crypto investment products hitting their 10th consecutive week of inflows.

$3.2 billion of inflows in the trading week of Dec. 9–13

Follows a record $3.85 billion in weekly inflows during the previous period

Brings total inflows for 2024 to $44.5 billion

10-Week inflows milestone

$20.3 billion in inflows over the past 10 weeks

Accounts for 45% of all inflows in 2024

Bitcoin leads with $2 Billion in inflows

$2 billion in inflows for Bitcoin investment products

Brings total inflows since the U.S. presidential election to $11.5 billion

BlackRock's iShares Bitcoin Trust ETF led with $2 billion in inflows

Grayscale's Bitcoin Trust saw $145 million in outflows

Short Bitcoin products saw $14.6 million in inflows

Block That Quote 🎙

MicroStrategy's Michael Saylor

"We'll just keep buying the top forever."

Saylor made a bold comparison between his company's aggressive Bitcoin acquisition strategy and the perpetual growth of Manhattan's real estate sector during a recent CNBC interview.

Saylor told CNBC Money Movers

"Every time Manhattan real estate goes up in value, they issue more debt to develop more real estate,”…. "That's why your buildings are so tall in New York City. It's been going on for 350 years. I would call it an economy."

MicroStrategy, which has been steadily accumulating Bitcoin since 2020, officially joined the prestigious Nasdaq-100 index on Friday, cementing its status as a leading institutional player in the crypto space.

The Token Dispatch View 🔍

Of course, the story isn't over. Gold has had centuries to solidify its position as the go-to safe haven asset. Bitcoin, on the other hand, is just scratching the surface of its potential.

It's not just about speed, it's about market evolution.

2003: Gold ETF had to educate market about ETFs themselves.

2024: BTC ETF enters a mature ETF ecosystem + sophisticated crypto market + institutional FOMO.

Bitcoin has flipped gold, and the implications of this shift will continue to reverberate through the financial world. The question is, will you be along for the ride?

As Bitfinex's analysts note, the future looks bright for Bitcoin, with their minimum price estimate standing at $145,000 by mid-2025, and a best-case scenario of $200,000.

Of course, volatility is to be expected, but the broader trend suggests continued price growth, driven by institutional inflows and increasing global adoption.

In the end, the day Bitcoin flipped gold may come to be seen as a seminal moment in the asset's history - a clear marker of its transition from the fringes to the mainstream.

The real story? Digital assets are native to today's investors - no educational curve needed. They get it. That's the paradigm shift.

Who knows how high the cryptocurrency's AUM could climb in the years to come.

What is certain, however, is that the times are changing.

For those who have long believed in the transformative power of this decentralised, digital currency, it's a validation of their vision. And for the rest of the world, it's a wake-up call. The times, they are a-changin' - and Bitcoin is leading the charge.

The Surfer 🏄

Bloomberg analysts Eric Balchunas and James Seyffart anticipate a significant wave of new cryptocurrency ETFs in 2025, including potential funds for Bitcoin, Ethereum, Litecoin, and XRP, following changes in SEC leadership.

Coinbase has responded to a lawsuit from BiT Global, a firm linked to Justin Sun, which seeks to block the exchange's delisting of wrapped Bitcoin (wBTC).

Bitwise Asset Management has launched a Solana staking ETP in Europe, branded as BSOL, partnering with Marinade as its staking provider.

A recent Emerson College poll found that about 20% of US voters have invested in, traded, or used cryptocurrency, with younger voters under 40 making up the largest segment of crypto users.

President-elect Donald Trump met with Crypto.com CEO Kris Marszalek to discuss potential appointments in the crypto industry and the establishment of a national Bitcoin reserve.

If you want to make a splash with us, book a demo call 🤟

You can check out partnership opportunities🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us ... either ways do tell us✌️

So long. OKAY? ✋

Did not ask for yuug