Dear Dispatchers,

We all thought AI was a game only billionaires could play?

Well, a scrappy Chinese startup just flipped the table with a $6-million mic drop that sent Bitcoin under $98K, although temporarily, and wiped $600 billion off Nvidia's market cap.

We'll explore how DeepSeek, dubbed "AI's Sputnik moment," is challenging everything we thought we knew about artificial intelligence, and why its shockwaves are being felt from Wall Street to your crypto wallet.

This changes everything?

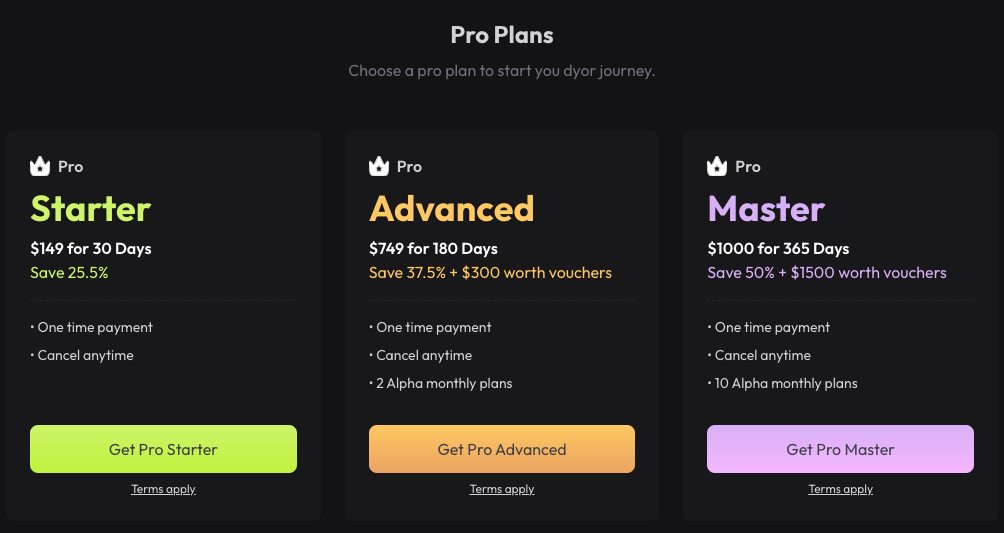

One Simple Platform. Everything You Need.

Dyor offers blockchain data and features for digital asset trading strategies, risk management and on-chain research.

Aggregated Fundamental Data

Asset Model Price

Crypto Trading Datasets

Alpha Telegram Bot

Data AI Agent (Upcoming)

Get more data and better analytics with Dyor Pro.

DeepSeek's Rise and Silicon Valley's Reckoning

Sometimes the biggest market earthquakes start with the smallest tremors.

On a quiet Sunday in January, an obscure Chinese AI app called DeepSeek climbed to the top of Apple's App Store.

By Monday morning, it had wiped more than $1 trillion off the global tech market and sent Bitcoin below $100,000 for the first time since Trump’s inauguration.

To understand why a single app could cause such chaos, we need to start with a number - $6 million.

That's how much it cost DeepSeek to build an AI model that matches or surpasses ChatGPT's capabilities.

For comparison, OpenAI has burned through billions, and tech giants like Microsoft and Meta are committing upwards of $65 billion each to AI infrastructure this year.

If that sounds impossible, you're not alone — Wall Street just had its "emperor has no clothes" moment.

We have been learning so many market wisdoms in the past two days.

Sharing them with you, use ‘em wisely.

Upgrade to paid to get full access to our weekly premium features (HashedIn, Wormhole, Rabbit hole and Mempool) and subscribers only posts. 2025 New Year special limited time offer - 38% off on our annual subscription.

"Sometimes the smallest mines find the biggest diamonds." — Market Wisdom

For the past year, we've been told that building competitive AI models requires three things: massive amounts of computing power, cutting-edge chips (preferably from Nvidia), and billions of dollars in capital to fund them.

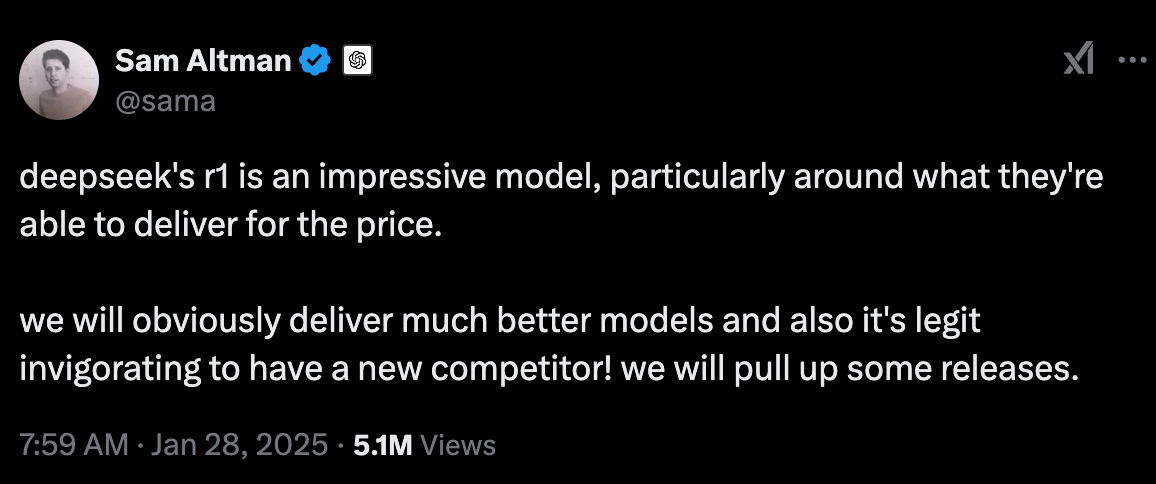

DeepSeek just proved that narrative wrong.

Founded in 2023 by quant hedge fund wizard Liang Wenfeng, DeepSeek has accomplished what was supposed to be impossible: building a world-class AI model on a startup budget.

Their R1 model not only matches OpenAI's performance on key benchmarks but does it while charging 14 cents per million tokens compared to OpenAI's $15.

It's 99% cheaper.

The DeepSeek Difference

At its core, DeepSeek is more than just another chatbot — it's a fundamental rethinking of how AI models are built and trained.

Unlike traditional AI models that rely on brute-force computing power, DeepSeek uses a novel approach called "reasoning-first architecture."

Before answering any query, it explicitly maps out its thinking process, similar to how a human might write out the steps to solve a math problem.

This architectural difference is crucial.

Traditional models like ChatGPT are trained to predict the next word in a sequence, requiring massive amounts of data and computing power.

DeepSeek instead focuses on understanding the logical structure of problems first, then generating responses. It's the difference between memorising every possible answer and learning how to think.

The model's efficiency comes from three key innovations.

Streamlined Training: Instead of processing enormous amounts of raw data, DeepSeek uses carefully curated datasets focused on reasoning patterns

Efficient Architecture: The model's structure prioritises logical connections over raw pattern matching

Resource Optimisation: By focusing on reasoning first, the model requires significantly less computational power to achieve similar results

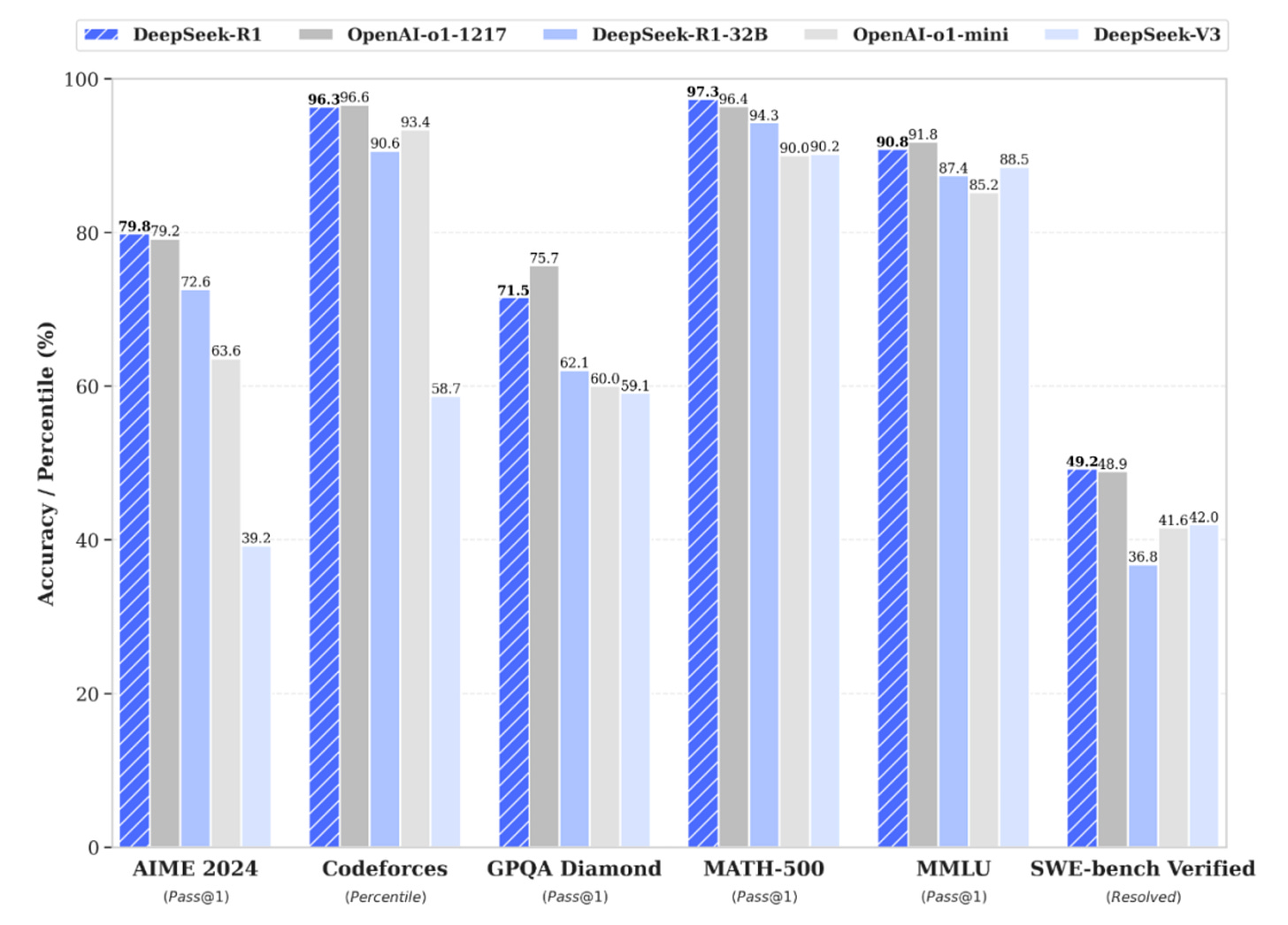

This approach allows DeepSeek to match or exceed ChatGPT's performance on key benchmarks like mathematical reasoning (AIME 2024), general knowledge (MMLU), and question-answering (AlpacaEval 2.0) — all while using a fraction of the resources.

Deepseek Performance Benchmarks

The Bitcoin Connection

But why did an AI efficiency breakthrough tank Bitcoin?

The answer lies in the growing correlation between crypto and tech stocks, particularly in the "risk-on" category of assets.

As Standard Chartered's Geoffrey Kendrick explains, "Bitcoin's correlation to the Nasdaq has been strengthening since late December."

Simply put, when tech stocks sneeze, crypto catches a cold.

The timing couldn't have been worse.

The market was already primed for a correction after what many saw as over-enthusiastic expectations for Trump's crypto policies.

Add in an upcoming Federal Reserve meeting, and you have the perfect storm for a market pullback.

"One company's efficiency is another's existential crisis." — Market Wisdom

What happens to the tech industry, now that we know AI doesn't require billions to build?

Date: 27/01/2025. Event: A market in freefall.

When markets opened Monday, the carnage was immediate.

Nvidia's stock plunged 16% on Monday, its largest single-day drop in history. The tech-heavy Nasdaq followed, falling 3.5% and dragging crypto markets down with it.

The damage spread quickly.

Microsoft dropped 8% on concerns about its $65 billion AI infrastructure commitment

Meta fell 7% as investors questioned its similar-sized AI bet

The Nasdaq tumbled 3.5%, its worst day since September 2022

Global tech stocks collectively shed nearly $1 trillion in value

But that was just the beginning.

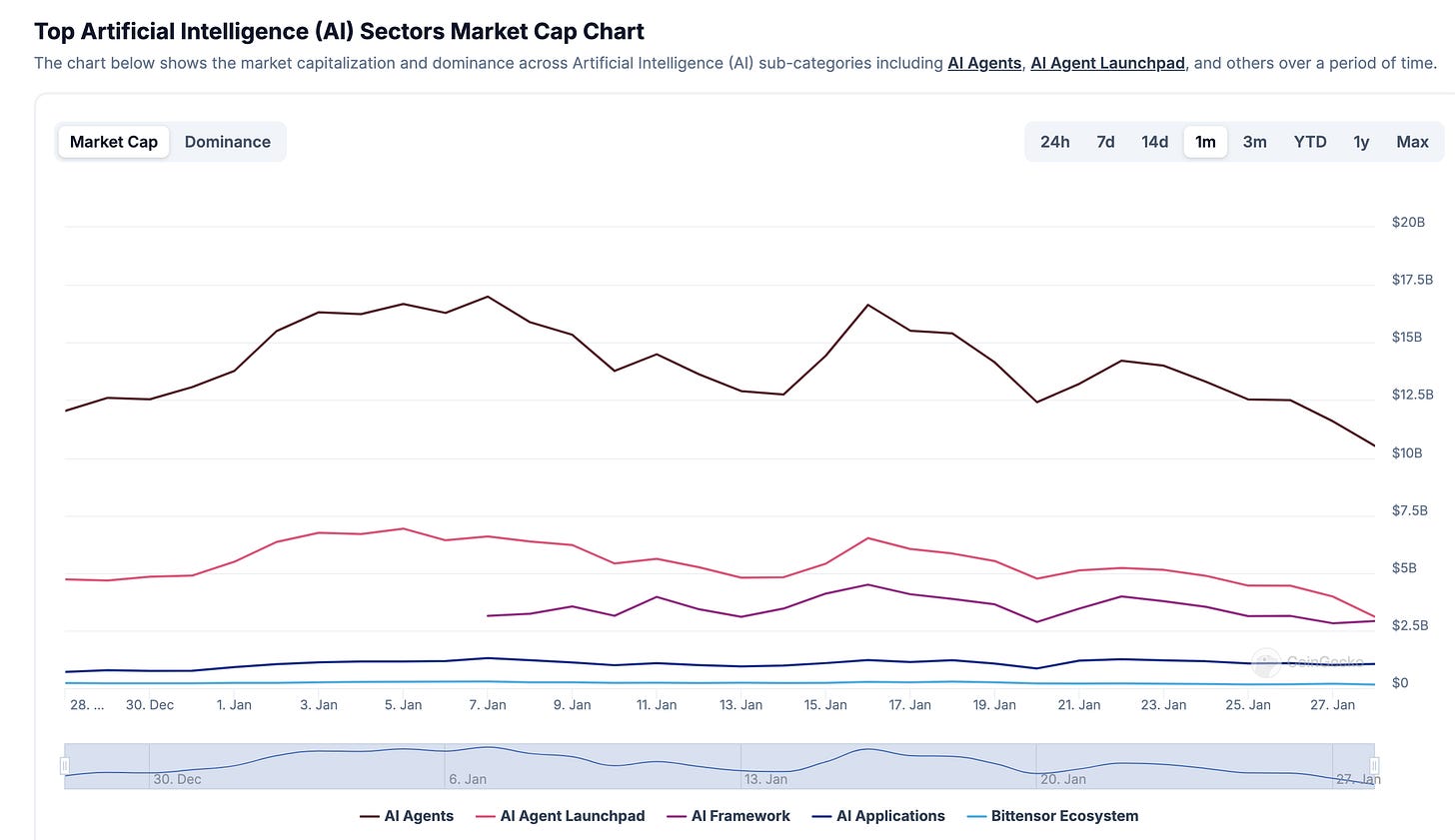

The AI Token Bloodbath

Crypto's AI sector, which had been riding high on the tech boom, faced an even harsher reality check.

AI agents crashed 23.5%

AI meme coins dropped 24%

AI agent launchpad tokens plummeted 38.3%

The Virtuals protocol ecosystem collapsed 33%

The total market cap of AI-related tokens plunged 23.5% in 24 hours, with some projects seeing losses of up to 40%.

Even Bitcoin, which had been trading above $105,000, got caught in the crossfire. It briefly dipped below $98,000, triggering a cascade of liquidations totalling nearly $1 billion across the crypto market, but, we are back to $102,000 today.

Markets survived after all.

The Mining Problem

Bitcoin miners who pivoted to AI infrastructure after the halving are feeling particular pain. Core Scientific and Cipher Mining saw their stocks crater over 30% as investors realised efficient AI models might not need massive data centres.

The irony? These miners moved into AI hosting to diversify away from crypto's volatility, only to find themselves at the epicentre of an AI efficiency earthquake.

Beyond the Trading Floor

DeepSeek's impact extends beyond market prices. The startup is forcing a fundamental rethink of how AI development should work.

The closed vs open source debate is shifting as DeepSeek proves transparency can coexist with excellence. The assumption that AI progress requires endless computing power is crumbling.

US export controls on AI chips to China appear increasingly futile. The belief that only tech giants can advance AI is evaporating.

And just as markets were digesting this reality shift, DeepSeek dropped another bombshell: a new image generation model that outperforms both DALL-E 3 and Stable Diffusion, suggesting their efficiency advantage isn't a fluke — it's a feature.

The Trump administration's response, a hasty $500 billion "Stargate" AI initiative, feels like bringing a checkbook to an efficiency fight.

"When there's blood in the streets, there are scammers in the tweets." — Market Wisdom

In crypto, market chaos inevitably breeds opportunity — both legitimate and fraudulent.

The DeepSeek phenomenon is no exception.

Within 24 hours of DeepSeek hitting the headlines, over 75 fake tokens emerged across Ethereum and Solana. One particularly ambitious scam token briefly touched a $48 million market cap before collapsing, while another reached $13 million

Beware of the Copycats

DeeperSeek (DEEPERSEEK) - $4 million market cap

DeepCat (DEEPCAT) - ~$4 million market cap

— all for projects with zero connection to the actual DeepSeek company.

How do we know? DeepSeek has explicitly stated they haven't issued any cryptocurrency.

The Venice Phenomenon

But amid the scams, a legitimate project emerged. Venice AI, founded by Bitcoin pioneer Erik Voorhees, launched a token to provide permissionless access to private and uncensored machine intelligence. Within two hours, it hit a fully diluted valuation of $1.6 billion.

Venice's success highlights a crucial market reality: while DeepSeek's efficiency threatens some business models, it creates opportunities for others.

The platform promises to offer DeepSeek's capabilities without sending data to China — a potential solution to the privacy concerns plaguing the original.

Behind DeepSeek's Curtain

But there's more to DeepSeek's story than market efficiency. Two controversial speculations are sending additional shockwaves through the industry.

The Nvidia Mystery

Scale AI CEO Alexander Wang dropped a bombshell on CNBC: DeepSeek might be sitting on 50,000 Nvidia H100 chips — the very same chips that US export controls were supposed to keep out of China.

At current market prices, that's billions worth of restricted hardware.

The implications are staggering

US export controls might be fundamentally broken

China has alternative supply channels for advanced AI chips

The "chip advantage" narrative could be a paper tiger

If true, this wouldn't only be about DeepSeek — it would suggest China's entire AI ecosystem has more advanced resources than previously thought.

The State Connection

Then there's the elephant in the room: DeepSeek's potential state connections. While there's no explicit evidence of state sponsorship, the timing is interesting. On January 20, DeepSeek's founder Liang Wenfeng attended a closed-door symposium with Chinese Premier Li Qiang — just days before the app went viral globally.

This raises uncomfortable questions.

Is DeepSeek's efficiency genuinely innovative, or is it backed by hidden state resources?

Could this be part of China's strategy to overcome Western tech restrictions?

What role does state support play in China's AI advancement?

More critically, if state support is involved, this could transform from a tech story into a geopolitical one — with all the market volatility that implies.

Token Dispatch View 🔍

"The most expensive moat is often the first to dry up." — Market Wisdom

DeepSeek's emergence isn't merely disrupting markets — it's shattering fundamental assumptions about AI development. Let's connect the dots.

The Economics Revolution

OpenAI: $15 per million tokens, billions in development

DeepSeek: 14 cents per million tokens, $6 million total cost

Alleged Arsenal: 50,000 Nvidia H100 chips (despite export controls)

Results: Matching or exceeding Western AI capabilities

It's about the entire AI development paradigm. Whether DeepSeek's resources come from clever engineering, state support, or creative chip procurement, one thing is clear: the "billions or bust" narrative is dead.

The Death of the AI Premium?

The market reaction goes beyond simple price movements. DeepSeek's rise challenges fundamental assumptions about the AI industry's economics.

This efficiency gap is forcing a wholesale reevaluation of AI-focused companies and their valuations. The market is suddenly questioning whether those massive AI investments by tech giants will ever generate returns to justify their costs.

As the dust settles, several key questions emerge.

Will US regulators restrict DeepSeek access like they did with TikTok?

Can tech giants justify their massive AI investments in an efficiency-first world?

Will open-source AI development become the new normal?

How will crypto markets adapt to this new AI paradigm?

Some analysts are beginning to whisper about an "AI winter" — a period of disillusionment following the hype. But this misses the point. What we're seeing isn't the death of AI; it's the death of inefficient AI.

Consider the parallels with crypto's own history. Just as Bitcoin made financial transactions more efficient, DeepSeek is making AI development more efficient. And just as Bitcoin faced resistance from traditional finance, efficient AI faces resistance from traditional tech.

The immediate future likely holds more volatility as markets digest this paradigm shift. But several trends seem clear.

AI development will prioritise efficiency over raw computing power

Open-source models will challenge closed-source dominance

The AI industry will split between high-cost, private solutions and efficient, open alternatives

Crypto markets will need to find new narratives beyond "AI requires massive infrastructure"

One thing is certain: the AI landscape has changed permanently. A small team in China just proved that artificial intelligence doesn't require artificial barriers to entry.

As one analyst put it: "The AI revolution will not be centralised."

For crypto markets, this means rethinking the relationship between digital assets and AI. Perhaps the future isn't about who can build the biggest AI infrastructure, but who can build the most efficient AI ecosystem.

The $6 million AI that broke the market might end up fixing it too.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

I'm looking forward to trying their image generator. I heard that just dropped recently and I'm like "jeeeez they're moving fast". I would prefer to try it though Venice but either way, I love this. Not to mention, I heard it's more environmentally friendly