The Dogefather troubles 🐕 😵💫

Elon Musk is accused of insider trading by investors in Dogecoin lawsuit. TikTok influencer launders $420K in COVID relief loans. ChatGPT can’t beat human smart contract auditors yet.

Hello, y'all. It's Saturday, the brother of Sunday. We dispatching all days.

OpenAI wants to stop AI from hallucinating and lying.

You can chill. Check out »» Muzify ««

This is The Token Dispatch. Hit us on telegram 🤟

The Dogefather troubles 🎅

Elon Musk, the CEO of Twitter, Tesla, and SpaceX, is facing a class-action lawsuit filed by unhappy Dogecoin (DOGE) investors. The lawsuit, filed in Manhattan, accuses Musk of intentionally inflating the price of Dogecoin and then selling off his holdings for personal gain.

O boy, here we go.

Investors are claiming that Musk played a sneaky game of insider trading and manipulated the cryptocurrency Dogecoin, leaving them billions of dollars poorer.

How did he allegedly do it?

Well, according to the investors, Musk used his magical powers of Twitter posts, paid online influencers, and even his appearance on "Saturday Night Live" to make profitable trades at their expense. Talk about pulling out all the stops!

One particular incident that caught the investors' attention was when Musk replaced Twitter's iconic blue bird logo with Dogecoin's adorable Shiba Inu dog logo. Apparently, that move alone caused a whopping 30% jump in Dogecoin's price.

The investors claim that this was just one of many instances where Musk engaged in what they call a "deliberate course of carnival barking, market manipulation, and insider trading." Quite the colourful description, don't you think?

Musk is no stranger to controversy.

He's the proud owner of not only Tesla but also SpaceX, a company that deals with rockets and spacecraft. And let's not forget that he bought Twitter last October, so he clearly knows a thing or two about the power of social media. But as for these allegations, Musk's lawyer, Alex Spiro, isn't saying a word, and the investors' lawyer is being mysteriously silent too.

This lawsuit has been going on for a while now, starting back in June of last year. Musk and Tesla have tried to have it dismissed, calling it a "fanciful work of fiction."

They argued that another amendment to the complaint was unnecessary, but US District Judge Alvin Hellerstein seems to think otherwise. He's "likely" to allow the investors to amend their complaint for a third time.

The defendants have until June 14, 2023, to file an opposition to the amended complaint. The original lawsuit sought $258 billion, but the current market cap of dogecoin is around $10 billion.

So, it seems like the legal battle is heating up with fresh allegations, and the case continues to grab attention due to the involvement of a high-profile figure like Elon Musk.

TTD Con 🤦♀️

Danny Sahadevan, also known as TikTok sensation "Danny Devan," has come out clean and courting some deep trouble.

He pleaded guilty to a series of charges in federal court.

What happened?

This social media influencer, who gained popularity on TikTok for his videos on stocks and cryptocurrency, tried to defraud lenders and the US government for a whopping $1.2 Million in COVID-19 relief loans.

Get-rich-quick scheme #fail

Devan allegedly went all out in his fraudulent activities, creating fake tax forms and bank statements to support his applications for Paycheck Protection Programs (PPP) and Economic Injury Disaster Loans (EIDL).

He thought he could outsmart the system.

Well, that didn't quite happen.

He was caught red-handed.

The audacity didn't stop there.

Devan applied for a staggering 71 PPP loans, with a potential payout of $941,000. While he only received $146,000 from that, he managed to successfully obtain $238,000 through 8 EIDLs. It's a classic case of greed leading to his downfall.

Instead of enjoying his ill-gotten gains discreetly, Devan attempted to launder the government funds, settling personal debts and even transferring some money to his girlfriend.

The authorities didn't miss a beat.

Devan's extravagant lifestyle caught up with him when police raided his six-bedroom mansion in Potomac, Maryland. They discovered a treasure trove of evidence, including 18 driver's licenses belonging to other people, $17,000 in cash, and even a physical Bitcoin in a fancy black case.

His TikTok career is on hold indefinitely.

Devan is facing the consequences of his actions. He awaits sentencing and could potentially spend up to 20 years in federal prison for wire fraud, 10 years for money laundering, and an additional two years for aggravated identity theft.

As part of his plea agreement, Devan will have to forfeit the cash and Bitcoin he acquired through his fraudulent activities. In addition, he'll be required to pay a hefty sum of $429,000 in restitution.

TTD ChatGPT 💬

Executives at blockchain security firm OpenZeppelin aren't buying into ChatGPT, they aren't impressed. Read the thread

A recent experiment using OpenAI's GPT-4 model demonstrated the continued need for human auditors in the field of security.

The study tested GPT-4's ability to identify vulnerabilities in smart contracts by attempting various challenges. While GPT-4 showed promise by solving many of the challenges, it also exhibited significant limitations.

The model lacked knowledge of events occurring after September 2021 and could not learn from its experience. Additionally, it struggled to provide reliable reasoning and often provided incorrect or made-up information. In cases where GPT-4 did provide correct solutions, a security expert had to offer additional guidance.

OpenZeppelin concluded that while AI advancements may impact developer jobs and inspire tooling innovations, human auditors are unlikely to be replaced in the near future due to the limitations and weaknesses of AI models like GPT-4 in security assessments. OpenZeppelin, however, sees potential for LLMs like ChatGPT in creative and open-ended tasks, encouraging further experimentation within the company.

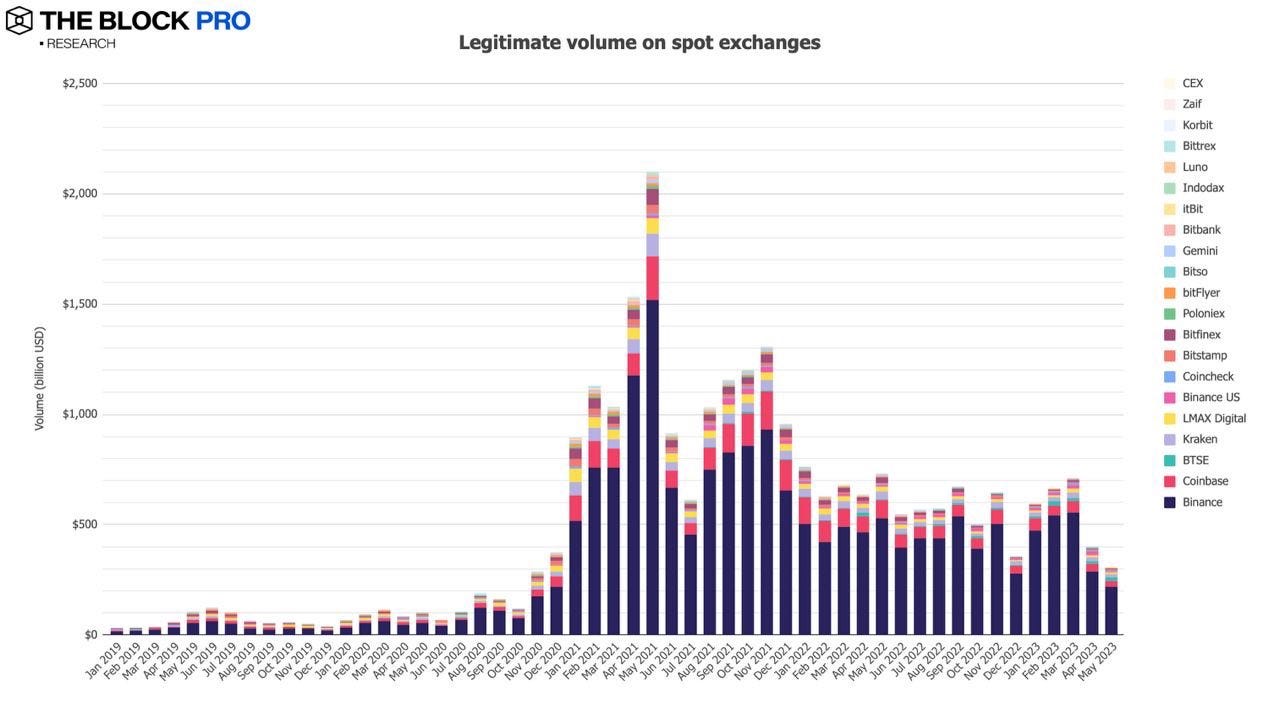

TTD Numbers 🔢

$307 Billion

Trade volume on crypto exchanges in May 2023

The Block Research's Legitimate Volume Index

May saw exchanges post $307.4 Billion. Decline of 23.2% from April.

The May figure represents the lowest level since November 2020.

Exchange volumes have slid in recent months, with May's numbers continuing that trajectory.

Binance claimed a 71% market share for May, followed by Coinbase and BTSE at 8.7% and 5.1%, respectively.

TTD Blockquote 🔉

Kenya’s Central Bank (CBK) don't quite dig central bank digital currency (CBDC) no more.

“The allure of CBDCs is fading.”

The Central Bank of Kenya (CBK) has taken a firm stance that a CBDC is not a compelling priority in the short to medium term. The CBK believes that the global allure of CBDCs is fading. However, the CBK remains open to monitoring CBDC developments globally and collaborating with other central banks that have issued their own digital currencies.

So far, 11 countries — most of them Caribbean nations — have created CBDCs, according to the Atlantic Council’s CBDC tracker.

TTD Surfer 🏄

Taurus, a Swiss crypto infra firm, integrates with Polygon network for its tokenisation and custody platforms, and can digitise any asset.

Private ID verification wins Binance metaverse-based Web3 reality show called Build The Block to win an investment from Binance Labs.

Hong Kong-based First Digital Group launches redeemable USD-backed stablecoin FDUSD, promises the stability of USD with the reliability of Asian regulation.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us some love on Twitter & Instagram🤞

So long. OKAY? ✋