The lobbying war ⚔️

Senator Elizabeth Warren takes on the crypto industry again. Bitcoin ETF as a game-changer on Wall Street? Marathon Digital acquires more. What is "shib"?

Hello, y'all. If you think you know your music, then this is for you frens 👇

Guess-the-song game for the artist you pick.

Leaderboard to share your scores with other fans.

Bragging rights to take home.

A complete go. Check out 👉 Asset - Music Nerd.

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

Senator Elizabeth Warren, D-Mass, is back in action, sharpening her words against the crypto industry.

She has an issue with crypto lobbying efforts.

Warren expressed concerns that these partnerships could obstruct bipartisan regulatory efforts in a letter to Coinbase, Coin Center, and the Blockchain Association.

Warren's Letter Highlights

Warren cited a Politico article suggesting the crypto industry's use of former defense and law enforcement officials.

Argued that this practice might undermine legislation aimed at curbing crypto's role in terrorist financing.

Warren believes that these partnerships portray the industry as legitimate while opposing crucial regulations.

Claims that crypto is throwing money around to buy legitimacy while resisting rules that could dent their profits.

What worries Warren?

Crypto super PAC network:

Prominent figures like Brad Garlinghouse, the Winklevoss twins, and Brian Armstrong invest $78 million to support pro-crypto candidates for the US elections.

The coalition seeks to shape crypto-friendly policies by endorsing candidates who champion innovation, transparency, and consumer protection.

Read here: A $78 Million fund To Support Pro-Crypto Candidates for 2024 US elections.

A "Not-So Secret Weapon"?

Warren accused industry groups of wielding a "not-so-secret weapon." What's this weapon, you ask?

It's a group of former defense and law enforcement officials who've taken jobs in the crypto world.

According to Warren, this is all part of an attempt to thwart Congress's efforts to deal with crypto's role in financing terrorist groups, like Hamas.

The Crypto Defense

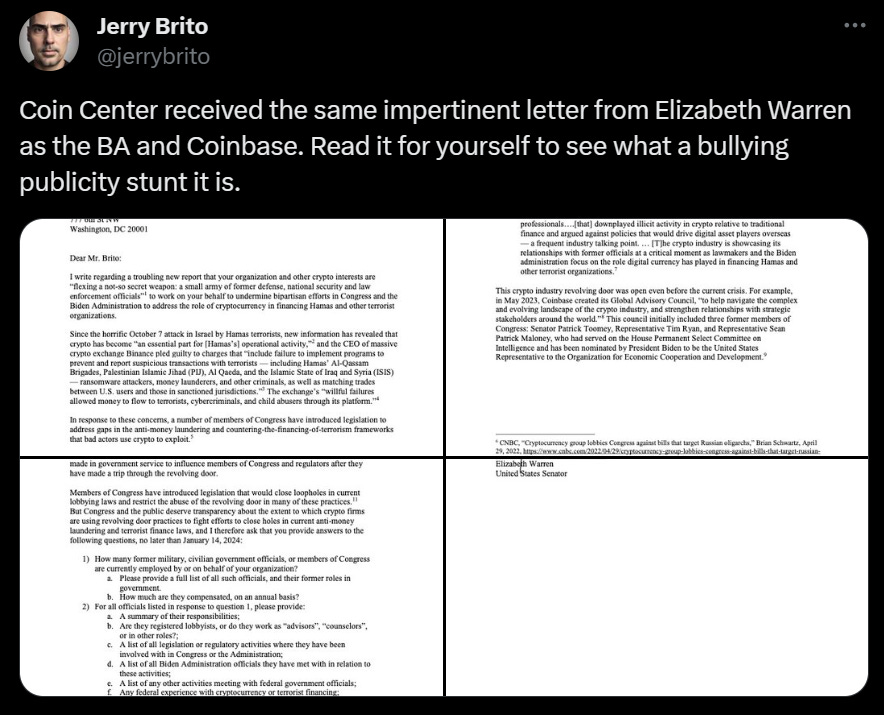

Jerry Brito, Executive Director of Coin Center, pushed back against Warren's accusations, labelling them as a "bullying publicity stunt." He defends the right to freely associate and petition the government.

The Blockchain Association's Kristin Smith emphasized the industry's willingness to engage with policymakers.

Read👇

Warren wants answers, and she wants them by January 14th.

She's particularly interested in knowing how many former military or members of Congress are working for crypto organisations and what they're up to.

Warren appears to have increased her efforts in Congress to gain support for her Bill.

Digital Asset Anti-Money Laundering Act

Name of the Bill: Digital Asset Anti-Money Laundering Act

Sponsored by: Senator Elizabeth Warren and Senator Roger Marshall

Aim: Combat illicit activities involving digital assets, such as money laundering, ransomware attacks, and terrorist financing.

Approach

Treats all developers and wallet providers as potential criminals.

Imposes Bank Secrecy Act (BSA) responsibilities and Know Your Customer (KYC) requirements on digital asset developers.

Targets privacy tools, like digital asset mixers and anonymity-enhancing technologies.

Impact on Innovation

Could stifle innovation in the crypto space.

Creates onerous regulations that make it difficult for crypto to compete with traditional finance.

Overreach

Extends BSA rules to include digital assets.

Requires individuals engaged in transactions over $10,000 in digital assets through offshore accounts to file reports.

It may place unnecessary burdens on legitimate users.

Warren's Track Record on Bills:

According to data from GovTrack, Warren has introduced 330 bills during her 11-year tenure as a senator, with only one becoming law.

The one enacted bill: The National POW/MIA Flag Act

GovTrack notes that very few bills introduced by legislators are enacted into law.

Lawmakers often engage in legislative activities such as amendments and committee work, which may not result in enacted bills.

TTD Blockquote 🎙️

Michael Saylor, MicroStrategy CEO.

Spot Bitcoin ETF "may be the biggest development on Wall Street in 30 years."

Michael Saylor, a well-known Bitcoin advocate, stated in a recent interview with Bloomberg that the approval of a spot Bitcoin ETF could be as groundbreaking as the creation of the S&P 500 index fund.

“The last thing that was this consequential was the creation of the S&P index and the ability to invest in all 500 S&P companies via one trade at the same time.”

Accessibility for Mainstream Investors: Saylor says that a spot Bitcoin ETF would provide mainstream retail and institutional investors with easy and compliant access to Bitcoin, potentially driving significant demand.

Supply Shock Anticipation: Saylor anticipates a "supply shock" in April due to the Bitcoin halving event coinciding with increased ETF-driven demand, potentially resulting in substantial price gains.

He predicts a major cryptocurrency bull run in 2024.

Saylor confirmed that MicroStrategy will continue its investment strategy, seeking ways to acquire more Bitcoin per share for shareholders.

MicroStrategy's Bitcoin Holdings: 174,530 BTC with an average purchase price of $30,252, representing a $2.1 billion profit on its Bitcoin investment.

TTD Numbers 🔢

$178.6 million

Marathon Digital is doubling down on its efforts to increase its hash rate by making a substantial acquisition.

What are they upto?

All set to acquire two Bitcoin mining facilities in Texas and Nebraska for $178.6 million in cash.

The move aims to expand its mining capacity by 390 megawatts, which could lead to a doubling of its hash rate within the next couple of years.

This will be the first time the company fully owns and operates mining sites.

Currently, only 3% of its 584 megawatts of capacity are located in sites owned by the company.

After the deal, this figure will skyrocket to 45%.

What else would the deal do?

Cut Marathon's bitcoin production costs at these sites by around 30%.

Potentially double Marathon's hash rate from around 23.1 exahashes per second (EH/s) to approximately 50 EH/s within the next 18 to 24 months.

Diversify its mining methods and expand globally, reducing reliance on any location or hosting provider.

The acquisition positions Marathon Digital well for the upcoming Bitcoin halving.

TTD SHIB 🐶

Shiba Inu has a bone to pick with the internet – or should we say, a bone to share! The crypto's developers are cooking up a plan to introduce a shiny new internet domain.

They're not just dreaming of ".com" or ".net," but – ".shib"!

They're teaming up with D3 to secure the ".shib" top-level domain.

Shiba Inu is getting ready to submit their application through ICANN – the global internet domain authority.

The idea? Linking wallet owners to domain names, creating digital identities on the blockchain.

Imagine proving who you are in the digital world with your very own ".shib" domain – A web3 passport.

While crypto enthusiasts are familiar with domains like ".eth" or ".crypto," these are mainly used for directing crypto wallets, not traditional websites.

Shiba Inu wants to change the game by being the first crypto domain to integrate with the mainstream internet.

Where’s ETF? 🚨

The approval of spot Bitcoin ETFs in the U.S. is now looking highly likely for January, according to K33 Research.

BlackRock's Move

BlackRock has thrown a curveball by submitting an amended filing with the SEC. The filing included a new cash redemption model that's apparently gaining favor with the SEC. It also kept the door open for an "in-kind" process pending regulatory approval.

BlackRock's move could be a smart strategic play, giving them more flexibility in managing the ETF portfolio.

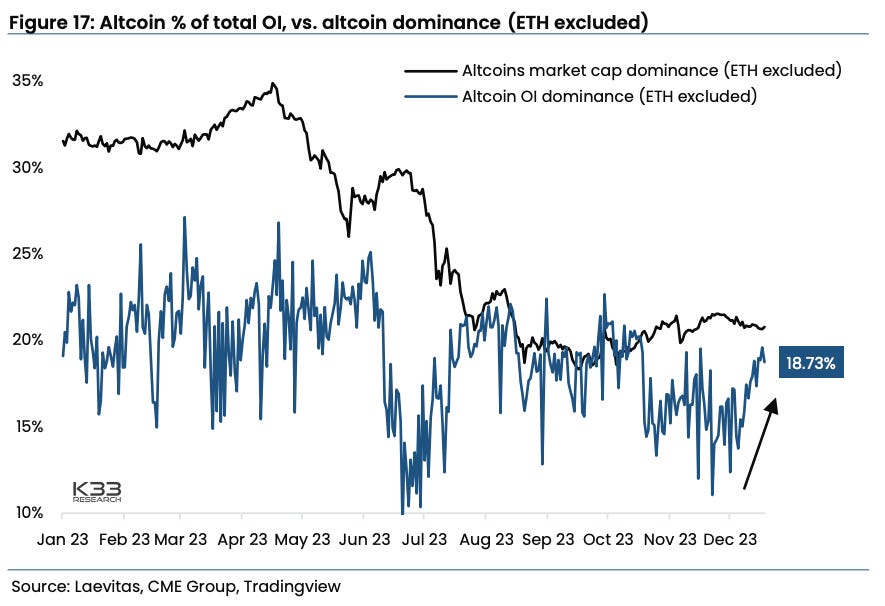

Altcoins have been the focus of the leveraged frenzy, with open interest surges in tokens like ORDI, BONK, and TIA.

Betting on ETF Approval

K33's analysts believe recent updates from ETF filers, despite the less efficient cash model, are signalling a positive outcome for ETF approvals within the next three weeks.

Bloomberg Intelligence's James Seyffart suggests that the ideal timeframe for a spot Bitcoin ETF approval is between January 8th and 10th, with a 90% chance by January 10th.

TTD Surfer 🏄

The Central Bank of Ireland has approved Ripple as a virtual asset service provider.

Immutable has launched its "Passport" tool, aimed at increasing interoperability across multiple video games and marketplaces.

Terra founder Do Kwon has avoided extradition to the United States, at least for now.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋