The Million Dollar Sales 💰

Big week for collectibles - Epic Sat, Buy Bitcoin notepad and CryptoPunk 635. Stripe brings back crypto payments. Consensys sues SEC over Ethereum as a security. Boomers to pour $300B into crypto?

Hello, y'all. If you think you know your music, then this is for you frens. A complete go. Check out 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

It's been a hot week for crypto collectibles.

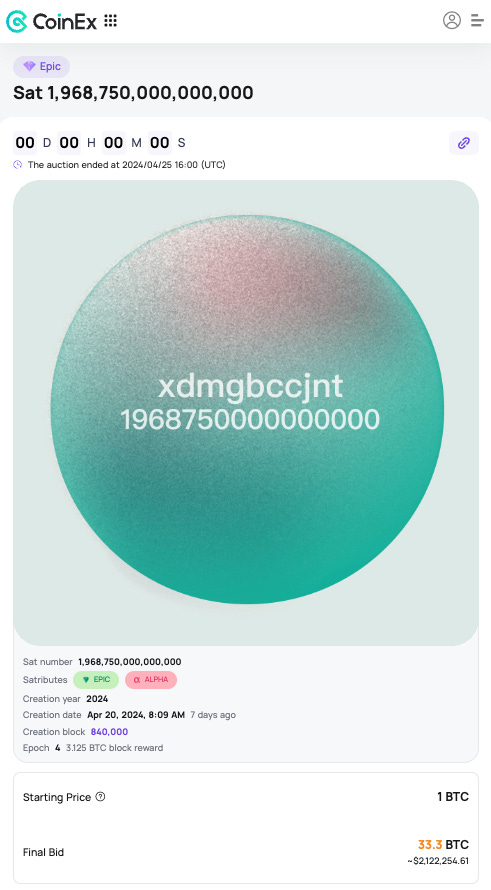

$2.1 million Epic Sat

The first satoshi mined after the Bitcoin halving event, known as was sold at auction for $2.1 million (33.3 BTC).

The halving event occurs every four years, where the block reward for miners is cut in half, reducing the supply of new Bitcoin entering circulation.

This particular "epic sat" was the first and only one to be auctioned off.

$1 million ‘Buy Bitcoin' Notepad

Back in 2017, a 22 year-old intern scribbled ‘Buy Bitcoin’ on a yellow legal notepad. He held the pad up during a televised House Financial Services Committee hearing. Seven years later, that pad has sold for $1.019 (16 BTC) million.

The auction was hosted by the New York City Bitcoin bar Pub Key, and the winning bidder was a pseudonymous user named "Squirrekkywrath".

This sale set a new record price for the auction house.

$12.41 million CryptoPunk 635

CryptoPunk NFT with an alien theme was sold for 4,000 Ethereum, around $12.41 million.

This sale marks one of the biggest NFT sales ever, placing CryptoPunk 635 as the fourth highest-valued CryptoPunk in the collection.

The sale was brokered by the NFT platform Fountain and the buyer was an anonymous collector.

All-time record sale: The largest CryptoPunk sale ever occurred in early 2022, when a crypto startup CEO bought Alien Punk #5822 for 8,000 ETH, worth over $23.7 million at the time.

In early March 2024, an anonymous buyer purchased Punk #3100 for $16.03 million worth of ETH. Weeks later, another Alien Punk, #7804, sold for $16.42 million in ETH, becoming the second-most expensive Punk sale in history.

Block That Quote 🎙️

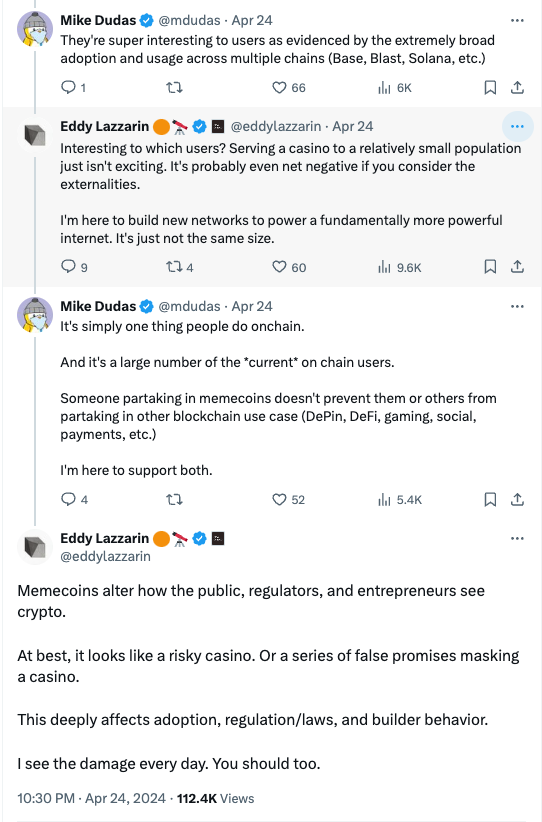

Andreessen Horowitz CTO Eddy Lazzarin

"At best, it looks like a risky casino. Or a series of false promises masking a casino … I see the damage every day.You should too."

Lazzarin isn't pleased, he is concerned and he has a lot to say 👇

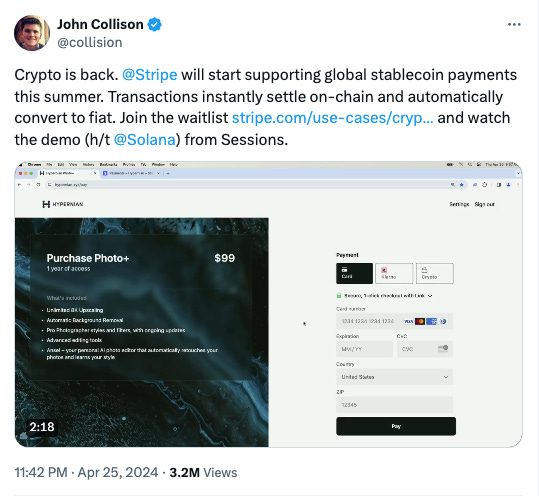

Stripe Re-Embraces Crypto Payments

Back in 2014, Stripe became one of the first major companies to accept Bitcoin payments. The initiatives fizzled in 2018, as the company shut it down citing rising costs on the world's biggest blockchain.

Six-Year Hiatus Ends: Stripe to allow merchants to accept USDC stablecoin payments on blockchains like Solana, Ethereum, and Polygon.

Focus on Stability: It has stopped supporting Bitcoin in 2018 due to its volatility. Shift from volatile Bitcoin to USDC highlights focus on transaction efficiency.

Deeper Integration: This move follows 2022's USDC payout rollout. Stripe aims to integrate competing payment providers for a broader finance ecosystem.

Balancing Innovation and Reliability: This decision aligns with Stripe's core approach, evident in their $1 trillion transaction volume and $65 billion valuation.

In the Numbers 🔢

$300 billion

The amount Morgan Creek Capital CEO Mark Yusko anticipates that baby boomers will pour into the crypto markets within the next 12 months. He was speaking on The Wolf Of All Streets podcast.

Wealth Drives Opportunity: Fuelled by the estimated $30 trillion in wealth held by baby boomers, potentially pushing the crypto market cap to $6 trillion.

Retirement Funds the Source: Capital to come from baby boomers' retirement accounts managed by financial advisors, who control a vast $114.1 trillion assets.

Early Signs of Movement: Spot Bitcoin ETFs has already triggered some movement, with around 10% of the expected $300 billion flowing in from registered investment advisors.

Social Acceptance on the Rise: Yusko expressed optimism that the increased adoption of cryptocurrencies by baby boomers could improve the social acceptance of digital assets - "No more 'you're not welcome because you're a crypto person in the family."

Consensys Sues SEC

Lawsuit Accuses SEC of Power Grab: Consensys, the Ethereum software company, has filed a lawsuit against the US Securities and Exchange Commission (SEC).

The lawsuit alleges that the SEC is attempting to exert undue control over the future of cryptocurrency by classifying Ethereum as a security.

Consensys seeks a court declaration that Ethereum is not a security.

Contradiction with Previous Stances: The complaint highlights that the SEC's current stance contradicts previous assurances that Ethereum is not a security.

Concerns Over Regulatory Overreach: Consensys argues that the SEC, under Chair Gary Gensler, is overstepping its authority in attempting to regulate Ethereum. The lawsuit also mentions a Wells Notice received from the SEC regarding the MetaMask wallet, indicating potential regulatory action.

The Surfer 🏄

The venture firm Pantera Capital is looking to raise $1 billion for a new crypto fund - Pantera Fund V. The firm has $5.2 billion in assets under management. Pantera has won the bid for another block of Solana tokens from the FTX bankruptcy estate, according to Bloomberg.

The US SEC has filed fraud charges against Texas-based crypto mining company Geosyn and its two co-founders Caleb Ward and Jeremy McNutt for $5.6 million fraud scheme.

Johann Steynberg, linked to a $1.8 billion Ponzi scheme, dies in Brazil. Steynberg faced legal action, including a $3.46 billion fine by US Court, amidst accusations of fraud.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋