Hello, y'all. Happy Saturday.

We wrote about MicroStrategy dropping the ‘Micro’ from its name in a rebranding exercise barely a week ago. Making a statement about its unwavering focus on stacking Bitcoin. Hell of a Bitcoin advocacy, you’d think, right?

What if we told you there was a company like Strategy (formerly MicroStrategy), but more ambitious?

A company that didn't just stack crypto on its balance sheet but actually helped build the network it was betting on. Enter Sol Strategies.

In today’s Wormhole, we explore how a former blockchain innovation and digital asset investment company plans to pull off for Solana what Strategy is doing with Bitcoin - or even do one better than Strategy.

Choose the Right Ledger Wallet for You

Ledger wallet comes with key features to ensure accessibility and security for you wallet. With Ledger live app you can manage and stake your digital assets, all from one place. Ledger recover helps to restore access to your crypto wallet in case of a lost, damaged, or out of reach Secret Recovery Phrase.

Story of Sol Strategies

Five months ago, it was Cypherpunk Holdings - a sideways-trading company with big dreams. It was then rebranded to Sol Strategies. Decided to go all in on Solana.

Not just a little bet – we're talking selling everything, including even Bitcoin and their second largest holding - a stake in Animoca Brands.

Ever since, its stock has shot up more than 1800% to 3.78 Canadian Dollar (CAD) from 0.195 Canadian Dollar (CAD). In fact, in January this year, the rally peaked at 3000% when its stock crossed the 6-CAD mark.

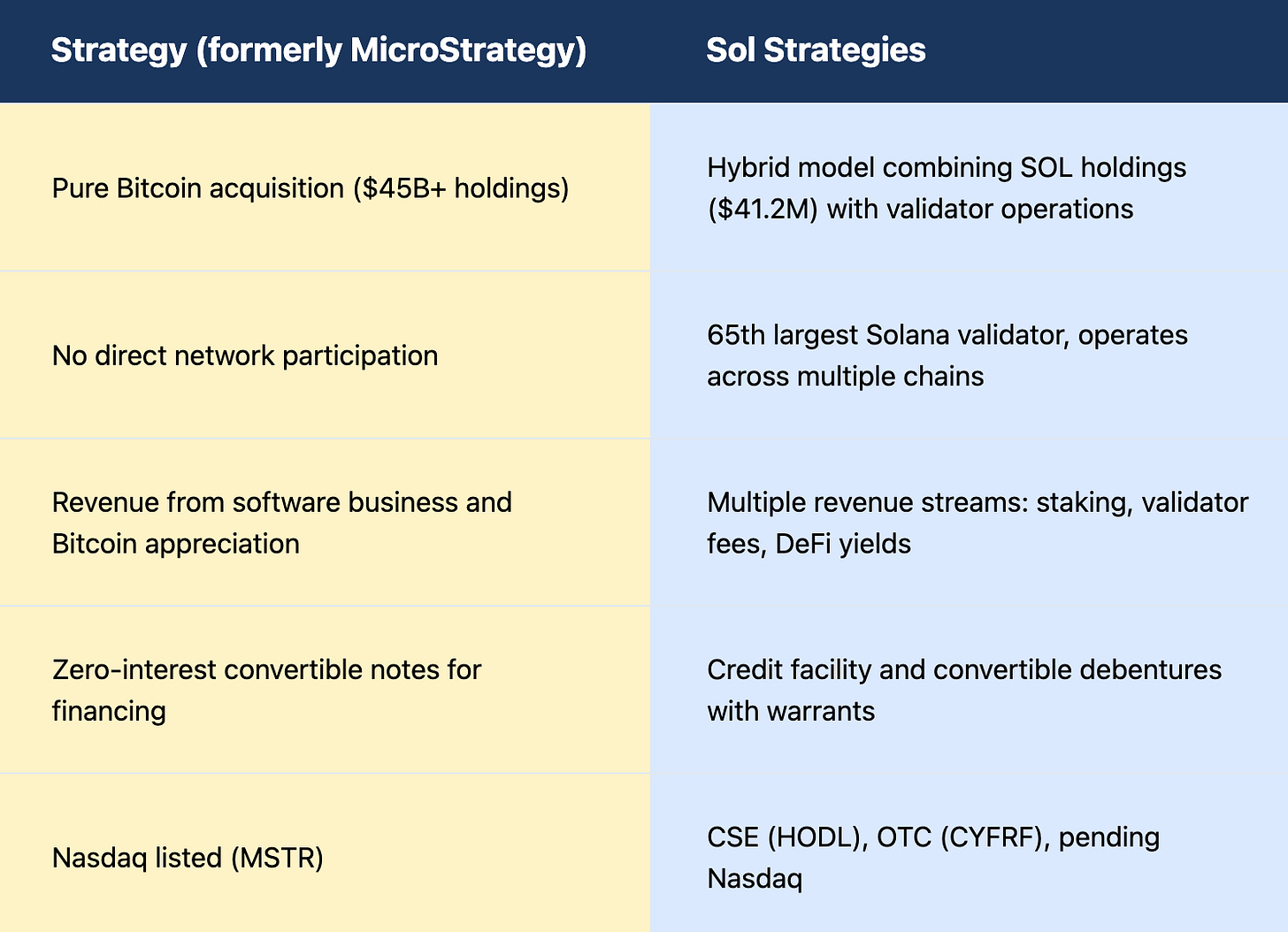

Despite their stock ticker being "HODL", they do much more than hodling and providing financial products designed to give investors exposure to Solana. While Strategy perfected passive Bitcoin accumulation, Sol Strategies is writing a new playbook altogether.

The company now holds 214,342 SOL worth more than $42 million, runs network validators, and this week, they made their biggest move yet.

Landed a deal to power the world's first Solana Staking ETF. Global investment manager 3iQ picked them to be the staking provider for their Solana ETF.

Get 17% discount on our annual plans and access our weekly premium features (HashedIn, Wormhole, Rabbit hole and Mempool) and subscribers only posts.

What does this deal mean?

It sets up the blueprint for institutional Solana adoption.

3iQ manages $1 billion in assets and is proposing the world's first Solana Staking ETF. By choosing Sol Strategies as their staking provider, they're effectively endorsing their infrastructure and operational expertise.

For traditional investors, this means accessing Solana's staking rewards through a regulated vehicle for the first time.

For Sol Strategies, it means transitioning from a Solana accumulator to a key infrastructure provider in the institutional crypto landscape.

Still don’t understand? Think of the credibility Bitcoin ETFs brought to Bitcoin in Wall Street.

Who’s Behind the SOL Show

Leah Wald, the former Valkyrie CEO who has a Wall Street-crypto connection. The same person who pioneered Bitcoin futures ETFs.

While MicroStrategy's busy playing "buy and hold" with Bitcoin, Wald is busy orchestrating a symphony with Solana at Sol Strategies. She’s betting big on the ecosystem with significant skin in the game.

Less than a month ago, Sol Strategies launched a new mobile application from Orangefin, a recent acquisition and provider of non-custodial staking.

The app is the first to provide non-custodial staking solution that allows investors to stake Solana (SOL) directly from their phones.

The market loved it so much their stock shot up another 70% in about two days.

Sol Strategies vs Saylor’s Strategy

Leah Wald, CEO of Sol Strategies

"We're more dynamic.”

That’s how she explained the difference between Sol Strategies and Strategy during her podcast on Lightspeed.

When Michael Saylor's Strategy began accumulating Bitcoin in 2020, the playbook was simple: buy Bitcoin, hold Bitcoin, repeat. Gain from the price rise of Bitcoin and give their shareholders the benefit through its share premium.

Read: Saylor Strategy: 0️⃣ Interest, ♾️ Bitcoin?

Sol Strategies saw an opportunity to write a different story for Solana - active participation.

While Strategy remains a passive Bitcoin holder, Sol Strategies operates three mainnet validators, actively processing Solana transactions.

Their 1.77 million SOL delegation ranks them as the 65th largest validator. Third-party delegations increased by 166,000 SOL in January alone - a clear market validation of their operational expertise.

The infrastructure commitment runs deeper. Their recent deployment of the Firedancer validator client is a move beyond accumulating tokens - they are strengthening Solana's network resilience.

The revenue streams of Sol Strategies are also diverse.

Its validator operations span multiple chains: Solana, Sui, Monad, and ARCH. Each network brings unique revenue streams through staking rewards and validation fees.

The company also invests directly in DeFi protocols and provides liquidity for new projects. This ecosystem engagement creates value beyond token appreciation.

Financial Engineering 2.0

Sol Strategies brings fresh thinking to crypto treasury management. Their $25 million revolving credit facility serves multiple purposes beyond token acquisition.

Their convertible debenture structure differs notably from Strategy's approach.

The recent $2.5 million placement was more than a fundraise - it included warrants that align investor interests with both SOL appreciation and ecosystem growth. This hybrid financial instrument reflects their broader vision of institutional participation in blockchain networks.

These new tools are bridging institutional capital with network operations. And their approach is paying off.

All of the 214,342 SOL worth $41.2 million Sol Strategies holds, unlike Strategy's Bitcoin holdings, generate ongoing staking yields.

The market is noticing.

Sol Strategies' stock surged 3,000%+ in six months on the Canadian Securities Exchange. Their recent upgrade to OTCQX Best Market expands US investor access.

A Nasdaq listing application awaits approval. This could bring institutional credibility similar to Strategy's MSTR ticker.

Trading volumes spiked after their OTC upgrade. Real-time Level 2 quotes now give investors deeper market insight.

The Road Ahead: Hurdles and Headwinds

Sol Strategies faces more complex challenges than Strategy's straightforward Bitcoin custody.

Unlike Strategy's NASDAQ 100 status that enables zero-interest bond raises, Sol Strategies operates with tighter financial constraints. Their $25 million CAD credit facility, while useful, comes at a 5% interest rate.

The stock's premium to NAV enables their accumulation strategy, but this premium remains vulnerable to SOL price swings. A market downturn could squeeze their ability to raise capital for further acquisitions.

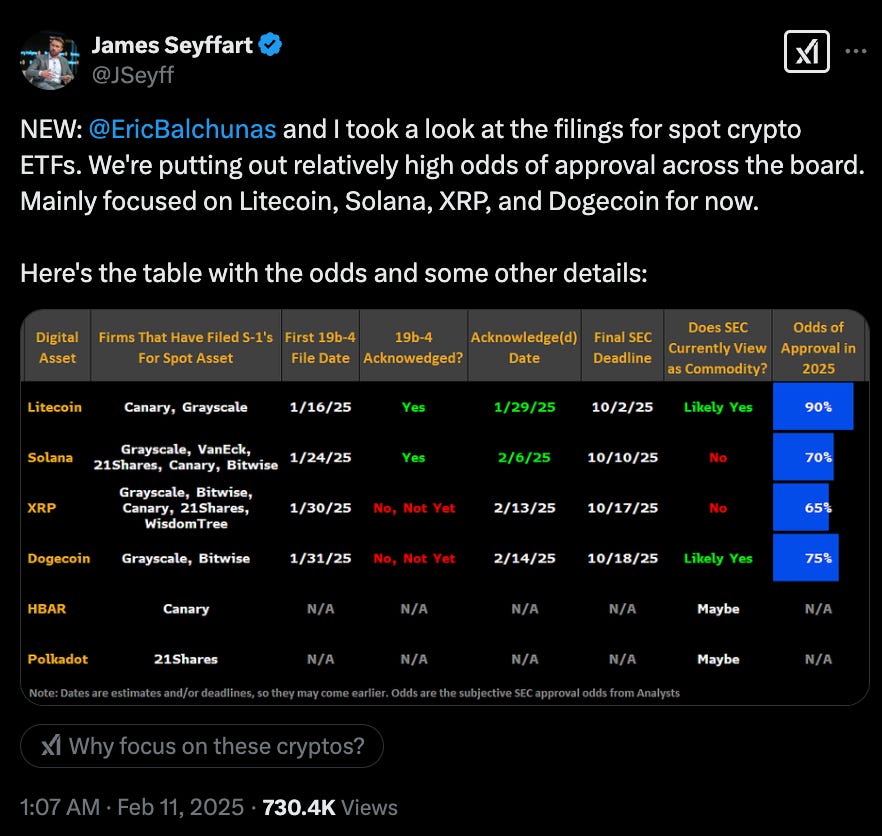

The ETF Shadow

Bloomberg analysts estimate 70% odds for spot Solana ETF approval this year. VanEck and Grayscale are already in line. These ETFs could offer investors direct SOL exposure, potentially eroding Sol Strategies' appeal as an investment vehicle.

Even their validator revenues face pressure. If ETFs incorporate staking yields, Sol Strategies' $57,000 monthly validator rewards might lose their competitive edge.

Network Dependencies

Operating validators brings unique risks. Solana's history of network congestion and outages directly impacts Sol Strategies' revenue streams. A 17-hour outage in 2021 serves as a reminder of these infrastructure vulnerabilities.

Their 1.77 million SOL delegation requires constant uptime and security vigilance. The recent departure of their CIO highlights the challenge of maintaining technical expertise.

Ecosystem Exposure

Sol Strategies bet heavily on Solana's ecosystem. While their 214,342 SOL position shows conviction, it also means concentrated exposure to a single blockchain's success.

The company invests in Solana-based projects facing high failure rates typical of early-stage crypto ventures. Their validator operations across Sui, Monad, and ARCH add complexity but don't reduce their core Solana dependency.

Token Dispatch View 🔎

Sol Strategies is setting a precedent by redefining institutional crypto engagement. Their evolution from Cypherpunk Holdings shows how traditional companies can transform into Web3 infrastructure providers, not just asset holders.

The 3iQ partnership validates this vision. While Strategy's Bitcoin holdings make it a proxy for Bitcoin exposure, Sol Strategies is positioning itself as essential Solana infrastructure. This distinction matters as institutional crypto adoption evolves beyond simple token exposure.

Their journey from Cypherpunk Holdings to Solana's institutional backbone carries broader implications. As proof-of-stake networks mature, the line between holding crypto and participating in networks blurs. Companies that master both traditional finance and network operations will shape institutional crypto adoption.

The challenges ahead are significant. Operating validators isn't as simple as storing Bitcoin in cold wallets. Market dynamics and upcoming ETFs could test their model. Yet these very challenges highlight why Sol Strategies' approach matters - they're building expertise that can't be replicated overnight.

It won’t be important to see if Sol Strategies can become the Strategy of Solana. They're already charting a different course - one where participation matters more than possession. Strategy's Bitcoin-only approach may see limited scope as institutional crypto engagement evolves beyond passive holding. This is where Sol Strategies is likely to stand apart.

Perhaps, the best way to follow a pioneer is to forge a different path altogether and play a bigger game with higher stakes involved.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

Great information, thank you very much for sharing! I will be featuring your story on HODL in this week's CryptoCurated!