This Time Ethereum? ⏳

Odds of Ethereum ETF approval and the Dencun upgrade. Where are the bull run millionaires? Bitcoin love - Saylor calls is digital gold. Trump says it's an additional currency. Coinbase sues SEC.

Hello, y'all. If you think you know your music, then this is for you frens. A complete go. Check out 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

All eyes are on Ethereum.

The upcoming Dencun Upgrade.

The ETF approval anticipation.

Bitcoin ETFs got the green light in January, raising hopes for Ethereum.

But wait, the dream of an Ethereum ETF by May is looking unlikely.

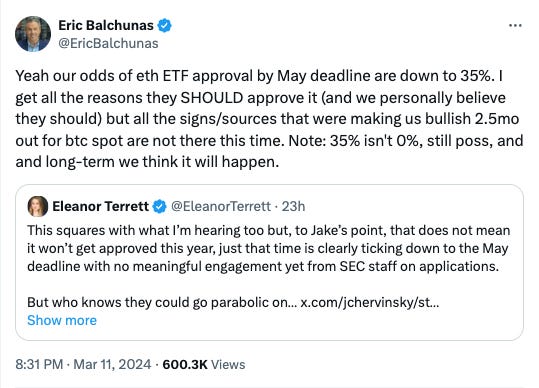

Bloomberg's Eric Balchunas slashed the chances of approval to a mere 35%.

Radio Silence: The SEC's lack of communication with applicants is a major concern. Approvals usually involve back-and-forth discussions, which haven't happened.

Ticking Clock: With only 73 days left till the deadline, the lack of progress suggests applications might be denied altogether.

A spot Ether ETF is inevitable; the timeline is just uncertain.

Who else has a word on it?

Nate Geraci, ETF Store President: Found it strange that the SEC would approve ETH futures ETFs but not spot products.

Matt Corva, General Counsel at Consensys: Suggested that an ETH ETF denial could be a positive development in the long term.

Scott Johnsson, VB Capital General Partner: Speculated that the SEC's meeting focused on the correlation between the prices of ETH and BTC futures compared to spot might be used to approve or deny the ETF, leaning towards denial as more likely.

Possible Reasons for Delay

Shifting SEC stance: Chairman Gensler might be warier of Ethereum compared to Bitcoin.

Political pressure: Senator Warren's anti-crypto stance could be influencing the SEC.

Ethereum price: Surged anyway, still at $4000.

8% up in 7 days.

Why? It's fuelled by the upcoming Dencun upgrade and lingering ETF dreams.

Ethereum's Dencun Upgrade

Ethereum's gearing up for a major upgrade dubbed Dencun.

Here's why

Lower fees: Dencun's key feature, protodanksharding, is expected to slash gas fees significantly on Ethereum's layer two (L2) networks.

Ethereum's pivot: Instead of directly handling every transaction, it will focus on settling transactions processed by these L2 networks.

Big institutions like JPMorgan predict Dencun to be a game-changer for Ethereum. They believe it could propel ETH's price above Bitcoin's (BTC) in 2024.

Read: Ethereum's Dencun Upgrade 🦋

Meanwhile Bitcoin went ballistic

Reached a fresh all-time high above $72,000.

ETF inflows: Record-breaking $2.7 billion last week, pushing the year-to-date total to nearly $10.3 billion.

Bitcoin is even predicted to reach $150,000 per coin by global investment firm AllianceBernstein.

The Bull Run Millionaires

Bitcoin just reached an all-time high, yet something strange is happening - the number of new "millionaire" wallets isn't keeping pace.

Where are the whales?

New daily Bitcoin millionaires are trickling in at around 1,500, a far cry from the 4,000+ seen during the last peak.

Even million-dollar wallet growth resembles July 2022, when Bitcoin was closer to $20,000.

Possible explanations

Investors might be waiting for the rally to solidify before diving in.

Existing whales could be cashing out at the high.

Whales might be storing Bitcoin with custodians instead of personal wallets, hiding their activity.

El Salvador's Bitcoin gamble pays off though

Their treasury is now $80+ million in the green - a 70% gain on their initial investment.

Total BTC holdings are now worth over $206 million.

The country aggressively purchased Bitcoin in 2021, acquiring 2,861 BTC at an average price of $42,599 each.

Block That Quote 🎙️

All the love for Bitcoin.

Remember, it just keeps going higher and higher. Well, so far true … 👇

MicroStrategy CEO, Michael Saylor

“Bitcoin is certainly at least digital gold, it’s going to eat gold,” ... “It’s got all of the great attributes of gold and it’s got none of the defects of gold.”

He highlights Bitcoin's ease of transport compared to physical gold and its potential to attract capital from other assets like the S&P 500.

While still far behind gold's $14.7 trillion valuation, Bitcoin recently surpassed silver to become the world's eighth most valuable asset.

Read: Bitcoin Flips Silver 🪙

Former United States President, Donald Trump

“If you think of it, it’s an additional form of currency. […] They’re crazy new currencies. That’s what I call them, you know, whether it’s Bitcoin or others.”

Trump indicates he might be tolerant of cryptocurrency if elected.

Trump previously called cryptocurrency a "scam" and told Treasury Secretary to "go after Bitcoin."

JPMorgan CEO, Jamie Dimon

“I don’t know what the bitcoin itself is for, but I defend your right to smoke a cigarette, I’ll defend your right to buy a bitcoin. I won’t personally ever buy a bitcoin.”

Dimon hit the brakes on market expectations for a swift rate cut by the Federal Reserve. He believes the Fed needs to focus on inflation and shore up its credibility before easing monetary policy.

Where’s ETF?🚨

Bitcoin spot ETFs March 11 recap. Total net inflows $505 million.

GrayscaleETF GBTC had a single-day net outflow of US$494 million.

The single-day net inflow of BlackRockETF IBIT was US$562 million.

The single-day net inflow of FidelityETF FBTC was US$215 million.

The total net asset value of Bitcoin spot ETFs is $58.36 billion.

Meanwhile the ETF fees war just got spicier👇

Bitcoin Devs Unite for BRC-20 Tokens

A group of top Bitcoin developers just joined forces to wrangle the booming world of BRC-20 tokens.

Remember those Bitcoin Ordinals and all the new meme coins popping up? Yeah, things were getting a little chaotic on the Bitcoin blockchain.

Enter the Layer 1 Foundation, a newly formed group aiming to bring some law and order to this digital frontier.

Their mission: Standardise BRC-20 tokens and ensure everyone plays by the same rules.

Here's the gist

Taming the Token Tango: This group wants to make sure everyone using BRC-20 tokens is on the same page.

Safety First: The focus is on making safe changes to the protocol and keeping everyone's tokens secure.

Open Communication: Transparency is key. They want everyone involved in discussions and decisions.

Community Matters: They'll consider the needs of the entire BRC-20 community before making any big changes.

Coinbase is taking the SEC

The top US crypto exchange is arguing that the regulator's refusal to create clear rules for crypto blatantly disregards the law.

Coinbase claims the SEC's reason for dodging rule-making - existing securities laws work fine - is a lame excuse.

They argue the SEC is being unfair by suing crypto companies under unclear regulations.

What happened?

Coinbase wants clear rules: They filed a petition requesting the SEC establish specific regulations for the crypto industry.

SEC says no: The agency rejected the petition, leaving the industry in a state of uncertainty.

Coinbase sues: They argue the SEC's inaction is "arbitrary and capricious," essentially claiming the agency is neglecting its duties.

The Surfer 🏄

Binance executives Tigran Gambaryan and Nadeem Anjarwalla have been detained in Nigeria since Feb. 26.

Thailand SEC has allowed certain investors to invest in US-listed spot Bitcoin ETFs.

Hong Kong has launched a sandbox arrangement for stablecoin issuers.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋