Trash-to-Treasure 🗑️💰

Landfill methane turned into Bitcoin mining energy. Clean & green. What did Chastain do at OpenSea? Sam's journey from billionaire buffet to bread. And hey, what's Jurat Network?

Hello, y'all. Make sure you've claimed your collectible on Asset, and don't forget to give your books a »» Muzify «« spin? 🙌

Who is the unluckiest? A throwback👇

This is The Token Dispatch, you can hit us on telegram 🤟

Two problems, one solution.

A trash to Bitcoin approach?

Problem 1: The landfill dilemma

Landfills have a problem. The methane problem. While efforts have been made to reduce our reliance on landfills, the methane emissions continue to be a significant challenge. Though 80 times more potent than CO2, it's often burned to lessen its impact.

Problem 2: Bitcoin mining consumption

Bitcoin mining is notorious for its high energy consumption. Historically, this has given it a less-than-stellar reputation among environmental advocates.

Bitcoin miners have spotted an opportunity in those methane-packed landfills.

Now, marrying methane and mining

The idea is simple: capture that methane from landfills and use it to make electricity. This electricity then powers the Bitcoin mining process.

Double victory 🏆🏆: The method reduces harmful methane emissions, directly combating climate change, and simultaneously supplies a steady, eco-friendly energy source for Bitcoin miners, decreasing their dependency on polluting fossil fuels.

Shoutout to Nodal Power

Now this idea is exactly what Bitcoin mining startup, Nodal Power thought. After securing $13 million in funding, the startup's mission is to convert methane gas from landfills into electricity.

While a good chunk of this electricity is sold back to the local grid, some of it fuels Bitcoin mining. Matthew Jones, Nodal Power's co-founder, highlights that Bitcoin mining serves as a secondary tool for them, utilised mainly in their data centres.

“Probably noteworthy that our largest facility is the smallest Bitcoin deployment because a majority of the time we dispatch the electricity to the grid instead of using it ourselves,” said Jones.

They currently run two mining data centres in the US, with a third one waiting in the wings for a 2024 launch.

Their first location is the small fry, prioritising selling the energy back to the grid.

The second, however, is a more significant setup in the mountains.

And the third? It's gearing up to be as powerful as the second, thanks to that fresh $13 million investment.

A KPMG report indicates that the flared methane in North America could theoretically power the entire Bitcoin network. It further says:

The United Nations Environment Programme states methane is roughly 80 times more impactful than carbon dioxide (CO2) over 20 years, responsible for about 30% of global warming effects.

Gas flaring, which involves burning methane, decreases the impact of direct methane release.

Flared gas in the US and Canada could power the entire Bitcoin network.

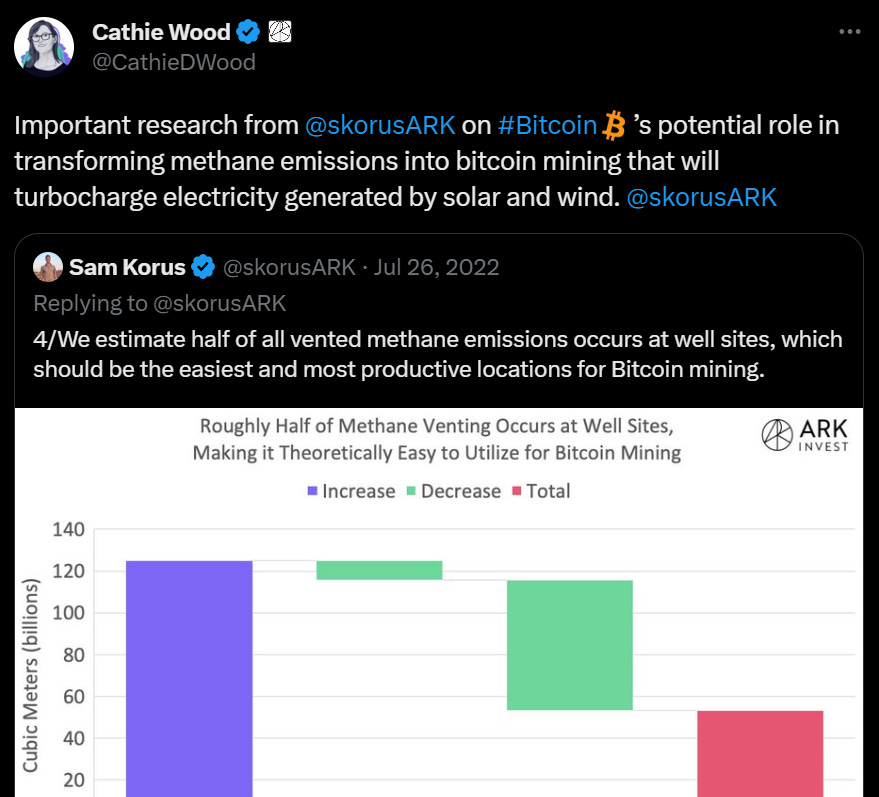

What would Cathie Wood say?

Also👇

Despite this green wave, some folks are raising their eyebrows. They argue that these emissions aren't just magically appearing—they're results of fossil fuel extraction.

The Bitcoin Mining Council's recent report shows that the mining industry is actually greening up its act. Their use of sustainable energy has grown, making them - wait for it - one of the most eco-friendly sectors around.

A new study suggests that Bitcoin mining could actually help drive the transition to renewable energy sources. The researchers argue that the demand for cheap electricity by Bitcoin miners could incentivize increased production of renewable energy.

Other Sustainable Energy Methods for Bitcoin Mining:

Hydropower: Using flowing water for power.

Solar Power: Electricity generation via solar panels.

Wind Power: Converting wind energy to electricity.

Geothermal Energy: Harnessing Earth's inner heat.

Nuclear Power: Carbon-neutral, provides consistent power.

Tidal/Wave Energy: Power from ocean tides and waves.

Biomass: Burning organic waste materials for energy.

Waste-to-Energy: Burning garbage to generate electricity. (not just methane)

Heat Recovery: Using mining rig-generated heat.

Battery Storage/Grid Balancing: Miners act as a power buffer.

Carbon Capture: Offset environmental impacts of traditional energy.

TTD Fraud 🤸♀️

Nathaniel Chastain, the ex-head honcho of product at OpenSea, found himself in hot waters when he used his position's privileged information to make a quick buck (or 50,000 of them) on NFTs.

Just imagine someone at a big online store buying up products right before they're highlighted as "Top Picks" and then reselling them for a profit. That's essentially the drama we're diving into here.

Chastain's defence? They said NFTs aren't really securities, and the info he had wasn't confidential. But the court wasn't buying that argument.

This is the first-ever insider trading case involving digital assets. Chastain exploited his access to OpenSea's internal systems to gain information about NFTs that would be featured on the platform's homepage. He then secretly purchased these NFTs before they were featured

“In addition to the prison term, CHASTAIN, 31 […] was sentenced to three months of home confinement, three years of supervised release, a $50,000 fine, and ordered to forfeiture the Ethereum he made trading the featured NFTs.” - statement from the US Attorney’s Office.

The fall from grace

After making waves in the digital world, Chastain waved goodbye to OpenSea in 2021. He lost his position and his stake in the company, which could've been worth a pretty penny (read: millions). He didn't stop at just using insider info; the guy went all out and created multiple wallets and accounts to hide his sneaky trades.

And in China?

A Chinese official has been sentenced to life in prison for running a $329 million Bitcoin mining enterprise and for corruption charges. Xiao Yi, a former government member, was found guilty of abuse of power and bribery from 2008 to 2021. He provided financial and electricity subsidies to a Bitcoin mining firm and covered up the operation by fabricating reports.

Where’s ETF?🚨

European crypto exchange traded products (ETPs) have seen an increase in inflows after BlackRock applied to launch a bitcoin fund in the US👇🏻

TTD Tool 🛠️

The U.S. District Court just flexed its tech-savvy muscles by using on-chain tech to serve justice. Specifically, the court used the Jurat Network's on-chain enforcement tool to slap sanctions on some crypto mischief-makers. They were laundering money and using ransomware to boost North Korea's weaponry arsenal.

Meet Jurat: born from a Bitcoin fork in late 2022, Jurat isn't your average blockchain. This layer-1 protocol has a unique feature: it connects blockchain nodes to court systems, letting courts enforce their rulings directly on the blockchain. Essentially, it's like giving a judge a digital gavel.

Mike Kanovitz, the brains behind Jurat, acknowledges the potential backlash. Some die-hard decentralisation devotees might not be fans of blending blockchain and bureaucracy.

"Some of the people who currently think that there should not be effective law enforcement on-chain would feel differently if they got hacked, defrauded, or lost their private keys. Then they would be relieved that they can recover their property," he said.

How does it all work?

Tech Talk: In traditional courts, freezing crypto assets has been a challenge. But with Jurat's on-chain enforcement tool, justice gets a tech upgrade.

Here's the process:

During a lawsuit, both parties give the court a hash (a kind of digital fingerprint) that represents their desired outcome.

Once the judge bangs the gavel, the court inputs the winning hash.

Jurat's system then checks online court dockets and autonomously carries out the court's orders.

TTD DeFi ⛓️

Remember the jolt the crypto market felt on August 17?

Well, it left a trail of worried investors in its wake, with global altcoin market capitalisation plunging by a whopping 11%. But, as the waves settled, crypto whales, always on the lookout for the next big thing, have cast their nets around three mega altcoins.

The Trio of Hope:

The digital currency world might have its eyes on Bitcoin (BTC), but savvy whales have swum in another direction. The altcoins of the moment? MakerDAO (MKR), Uniswap (UNI), and Optimism (OP).

Maker (MKR)

Maker (MKR) isn't just any token; it’s the governance token of the MakerDAO, and it's making waves. All thanks to a key DAI savings rate jump to 8%. Whales have been snapping up this token, with on-chain data showing significant boosts in their holdings.

Uniswap (UNI)

Even though Uniswap’s (UNI) price took a 30% hit since its August peak, bullish whales aren’t deterred. The numbers don't lie; whale transactions involving UNI witnessed a 420% surge in just a week.

Optimism (OP)

Even the market's flash crash couldn't deter these optimistic whales. They've bulked up their wallet balances in just five days with a neat 3.22 million OP tokens.

If history and the behaviour of whales are anything to go by, it's usually a beacon of hope when whales get behind a token during market turbulence.

TTD WWF 💁🏻♂️

Sam Bankman-Fried, once crypto's darling, is now swapping his billionaire buffets for a diet of bread, water, and a dollop of peanut butter in Brooklyn's infamous Metropolitan Detention Center - says lawyers.

🍞 A vegan's struggle

Deprived of his vegan diet essentials, Bankman-Fried is reportedly living on bread, water, and the occasional peanut butter.

Lack of dietary supplements raises health concerns.

💻 Tech troubles

Sam's attorney raises alarms about the lack of computer access, hindering their defense strategy.

Judge grants limited laptop time: A mere 6.5 hours from 8:30 a.m. to 3 p.m. at the courthouse.

💊 Medication

Deprivation of necessary medications since August 12.

Promises from Judge Netburn to address medication and dietary woes.

The notorious jail

Metropolitan Detention Center, Brooklyn: A place that's no stranger to high-profile inmates. Strict limitations on Sam, with fears of him communicating with media or witnesses.

TTD Surfer 🏄

The daily transactions on Base have surpassed those on the Ethereum network itself, thanks to the social app Friend.tech.

The Reserve Bank of Australia has completed a pilot program exploring the use cases for a central bank digital currency (CBDC).

BlockFi is fighting against FTX and Three Arrows Capital (3AC) to retain billions of dollars in disputed creditor funds.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋