Trump v Harris Showdown and Bitcoin 🔮

Crypto has got a seat at the table for the 2024 US Presidential Elections. The consensus is split on the impact of Trump or Harris win: What does it mean for the longterm outlook for the industry?

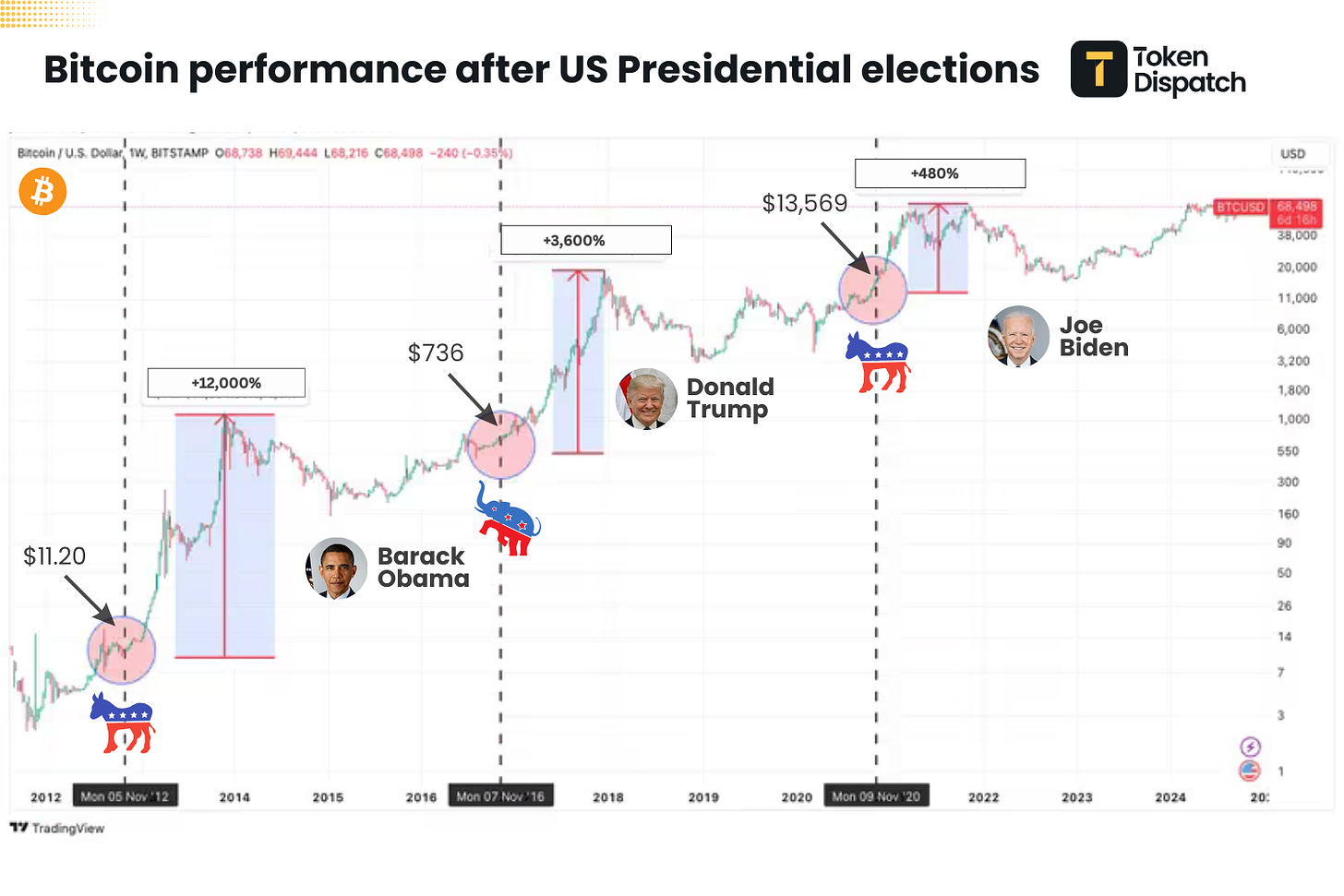

Holla Tuesday. It’s the D-day … so why not show some Token Dispatch ❤️👇

It’s the season of betting … how about you bet on us for your crypto rollercoaster👇

November 5.

The D-Day is here.

In a few hours, we will start seeing the early trends of which side the US is tilting for the next four years.

What are you betting on? A Trump Triumph or a Harris Hit?

We are putting our money on … crypto.

We always will ... we always loyal 🤦♀️

Bitcoin goes up or down? $90,000 or $50,000?

We're less than 24 hours away from the US election.

And analysts have thrown a lot of numbers around.

Team Trump Win

Bernstein: $80K-$90K short term

Standard Chartered: $125K by year-end

Team Harris Victory

Bernstein: Initial drop to $50K

Standard Chartered: More optimistic at $75K

A Trump win is expected to keep Bitcoin well above current levels, many are calling it onset of the journey to towards $100k.

If Kamala Harris makes it to the White House, most analysts expect short-term uncertainty, but predict eventual recovery.

So which analyst should you bet your money on?

Hang on. There’s another perspective.

History says: “Come what may, Bitcoin is going up after the elections.”

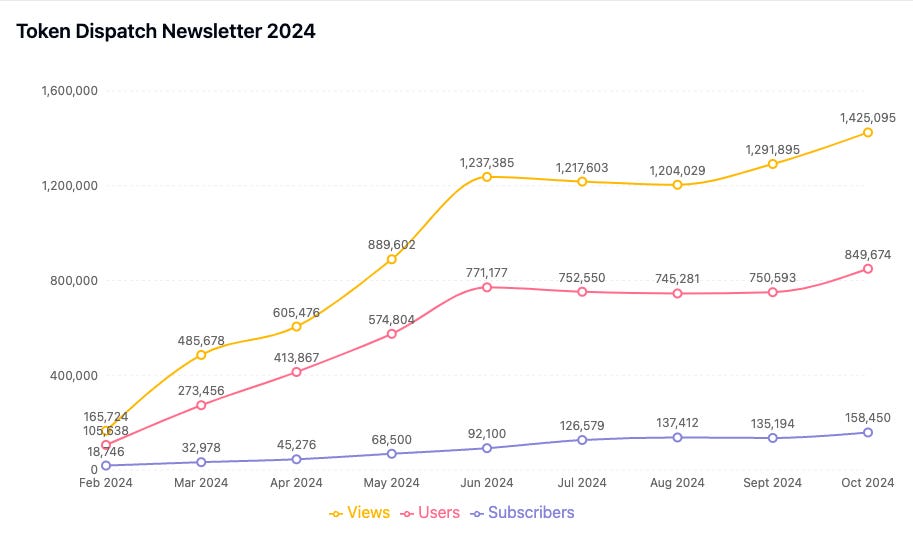

Bitcoin's been through three US elections.

2012: +12,000% post-election rally

2016: +3,600% surge

2020: +478% climb

In fact, in the long run, even Bernstein is optimistic about Bitcoin’s bullish run.

"The Bitcoin genie is out of the bottle, and it is hard to reverse this course," says Bernstein's team, projecting $200K by 2025 regardless of who wins.

And here’s the proof: Bitcoin has never gone below the price on election day.

Excited much? Wait, there are short-term things you need worry about though.

Volatility experts are preparing for fireworks

$6K-$8K price swings expected

112% annualised volatility

Options market pricing 7-8% moves

Traders loading up on $70K-$90K calls

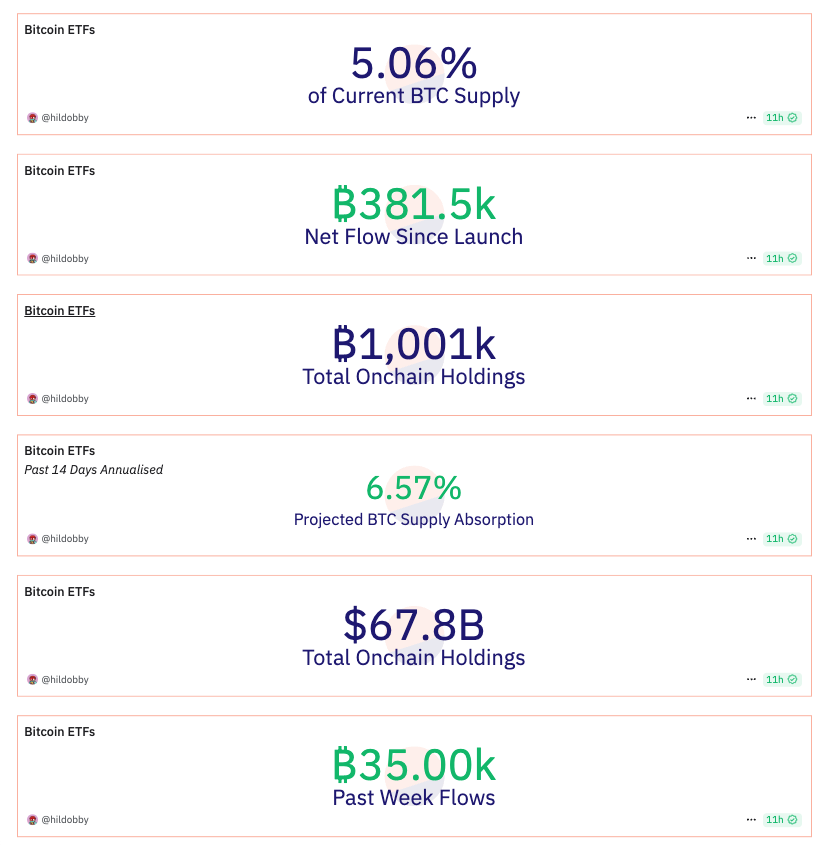

Even the surging Bitcoin spot ETFs have caught the election fever in the last couple of days.

In fact, November 4 saw a record net outflows of $541 million.

That’s the second worst daily performance for Bitcoin ETFs since its launch in January this year.

Something to worry? Maybe.

But all this is just the short-term outlook.

The bigger picture?

ETF flows remain strong

Institutional interest growing

Bitcoin dominance above 60%

Technical indicators showing resilience

Token Dispatch View

If you ask us, we say stay calm and HODL.

There are two scenarios

Trump Win → Quick pump

Harris Win → Short dip

Our say? Neither matters in the long run.

24 hours to go.

$68K starting point.

Democrats or Republicans? 🤔

In The Numbers 🔢

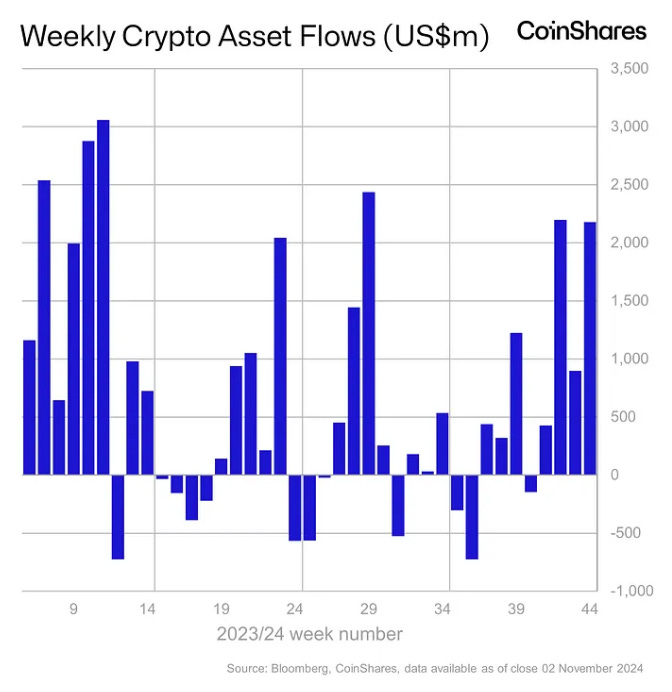

$2.2 Billion

Crypto investment products inflows for the last week in the run-up to elections.

YTD inflows smash records at $29.2 billion

Total AUM crosses $100 billion (second time ever)

Trading volume jumps 67% to $19.2 billion

Represents 35% of total Bitcoin trading

BlackRock's IBIT hits single-day record of $872 million

Where's all this money going?

Bitcoin absorbing the entire $2.2 billion

Short-Bitcoin positions adding $8.9 million

Ethereum barely managing $9.5 million

Solana attracting $5.7 million

US market dominating flows

Why such massive moves?

"Election euphoria," says CoinShares' James Butterfill.

Don’t Miss Out on Our Weekly Features

Connecting dots to bridge the narrative that's shaping the crypto world. Saturday analysis written by 👇

Crypto world can be a maze. Lot of information, not much context. Lot of noise, not much insight. Sunday explainers written by 👇

Memecoins Go Political

If you thought prediction markets are the only way to gauge election sentiment … think again.

Memecoins haven’t forgotten politics. Not just yet.

Memecoins have got a "President Memecoin Index."

What's that? Imagine tracking every Trump and Harris-themed token out there.

Launched by Hype, a new trading platform on Solana and Base.

Block That Quote 🎙️

Cody Carbone, president of The Digital Chamber, a crypto lobbying group told Decrypt.

“Your position on crypto matters not just until November 5”

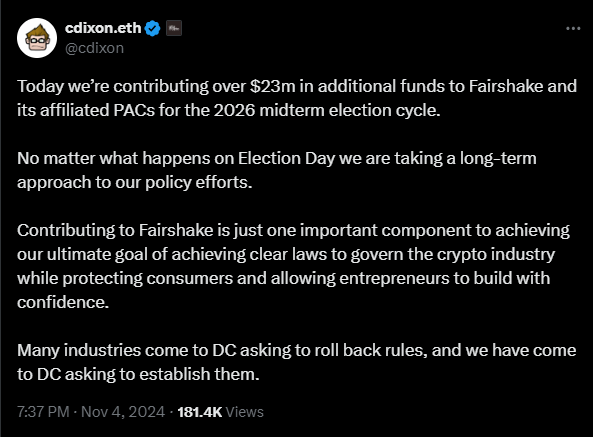

$78,000,000 - that's how much Fairshake PAC raised.

For what? 2026 elections.

Nope. That’s not a typo. It’s what you might call foresight.

We did mean 2026 elections.

But one pressing question. Why announce this before 2024 election results?

DC insiders call it the "loaded gun" strategy.

“The message intended is that regardless of the election outcome, crypto intends to stay highly involved politically; and no matter what happens tomorrow, we're not going away.”

A clear message from the crypto industry: “We are not here for the sprint.”

Crypto’s here to stay and they want the world to know it.

“Your position on crypto matters not just until November 5. Your position matters long-term. We’re going to be compared to the banking industry and the real estate industry in terms of the political influence we wield for the next two, four, eight years,” Carbone perceived the fundraise.

And Fairshake PAC's war chest is growing

Fresh $25 million from Coinbase

New $23 million from Andreessen Horowitz

$30 million already in bank

Historic $300 million raised for 2024-26

Three major players: Coinbase, a16z, Ripple

The Surfer 🏄

Mt. Gox transferred approximately 32,371 BTC (worth $2.19 billion) to unmarked wallets on Monday, according to Arkham data. This transfer included 30,371 BTC to an unknown wallet and 2,000 BTC to a Mt. Gox cold wallet, which was later moved to another unmarked wallet.

Semler Scientific has invested $71 million to acquire 1,058 Bitcoin, with plans to continue purchasing more. The company added 181 Bitcoin in Q3 and early November, increasing its holdings to nearly $72 million as Bitcoin prices hover around $68,000.

Major firms like Robinhood, Kraken, and Paxos have teamed up to create a regulation-compliant network for stablecoins. The network supports Paxos' newly launched USDG stablecoin, pegged to the US dollar, aimed at enhancing global adoption.

Justin Sun claims Coinbase requested $330 million in total fees to list Tron (TRX), including 500 million TRX tokens and a $250 million Bitcoin deposit. Sun noted that Binance did not charge any fees for listing Tron, contrasting with Coinbase's high demands.

A UK-based pension scheme has allocated 3% of its fund to Bitcoin. The decision follows a thorough training and due diligence process. The scheme cites a "long investment time horizon" as a reason for the allocation.

If you want to make a splash with us, check out partnership opportunities 🤟

Our sponsorship storefront on Passionfroot 🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋

And the industry is keen on showing that it wishes to stay that way. Fairshake's fundraise for 2026 elections is a strong testimony to that.

Crypto’s role in this election shows it’s no longer fringe but a central economic player, regardless of who wins.