Trump's Got A Job for Musk 😲

Promises to have Elon Musk lead government efficiency task force. Crypto lobby spend up 3,475% since 2017. Blockchain Association ‘investigating’ Fed. Circle VP warns US falling behind in stablecoin.

Hello, y'all. Enjoy long-form articles trusted by the best in Web3? Get them right in your inbox 👇

Brought to you by Joel John, Saurabh Deshpande, Shlok Khemani and Siddharth.

Everyone’s got their favourite Donald Trump promise.

Ours?

“On day one, I will fire Gary Gensler.”

Second favourite?

“The US will be the crypto capital of the planet.”

Read: Hello Bitcoiners 👋

A few new bunch of Trump’s crypto promises are out now.

Not that one.

During a speech at the Economic Club of New York, Donald Trump declared his ambition to make the US the “world capital of crypto and Bitcoin.”

Government Efficiency Commission?

That’s right, Trump proposed creating a government efficiency commission, suggested by Elon Musk, to audit federal government operations and eliminate fraud, aiming to save trillions of dollars.

“As the first order of business, this commission will develop an action plan to totally eliminate fraud and improper payments within six months. This will save trillions of dollars. For the same service you have now, trillions of dollars are wasted, and nobody knows where it went.”

Musk will lead this task force, despite Musk's busy schedule with multiple companies?

Musk is all in.

Trump promised to eliminate 10 regulations for every new one introduced, emphasizing a pro-crypto stance and the need to embrace future industries.

Trump has proposed establishing a strategic Bitcoin reserve using the existing 210,000 bitcoins held by the US government.

Then we also have World Liberty Financial

Trump and his sons are promoting a new DeFi project called World Liberty Financial.

The aim? Drive the adoption of stablecoins and decentralised finance.

18-year-old Barron Trump is reportedly the "DeFi visionary" behind the project, which will be built on the Aave platform.

Read: What is Trump’s crypto project?

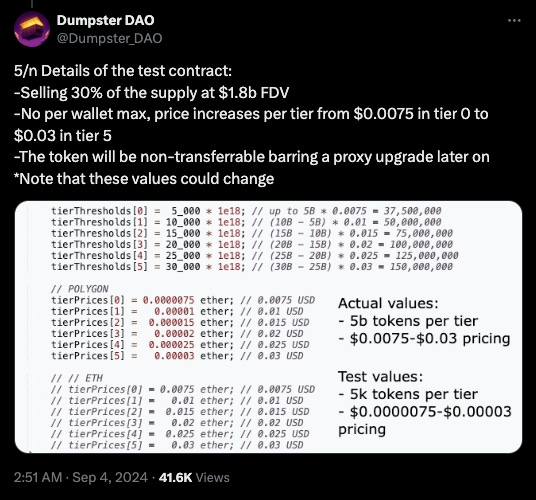

The project is also planning to sell 30% of its WFLI token supply at a $1.8 billion valuation, potentially generating $537 million if all tokens are sold.

And yet, not all techies are in line with Trump’s promises.

Who’s still supporting VP Kamala Harris?

88 corporate leaders.

They have publicly endorsed Vice President Kamala Harris for president in a letter according to CNBC.

Notable signers?

James Murdoch (former CEO of 21st Century Fox)

Michael Lynton (Chairman of Snap)

Jeremy Stoppelman (CEO of Yelp)

Chris Larsen (co-founder of Ripple)

Key figures from Wall Street?

Tony James (former president of Blackstone)

Bruce Heyman (former managing director at Goldman Sachs)

Peter Orszag (CEO of Lazard)

Silicon Valley representation?

Ron Conway (venture capitalist)

Mark Cuban (entrepreneur)

Reid Hoffman (former LinkedIn CEO)

The name Ripple in there is a bit unusual since Ripple has been in a long battle with the US Securities and Exchange Commission.

Ripple CEO Brad Garlinghouse has previously made a prediction regarding the future of SEC Chair Gary Gensler.

During a press conference at Korea Blockchain Week 2024 he stated that he would "make a gentleman's bet" that Gensler's tenure would end, regardless of the outcome of the upcoming US presidential election.

Unlock Web3 Insights by the Web3 Builders

A weekly podcast that takes you closer and deep into things that are shaping the world of crypto and Web3. Senior executives from 140+ enterprises trust them to keep them updated on what's going on in crypto.

Do tune in for depth, insight & numbers on how the internet is evolving.

In The Numbers 🔢

1,386%

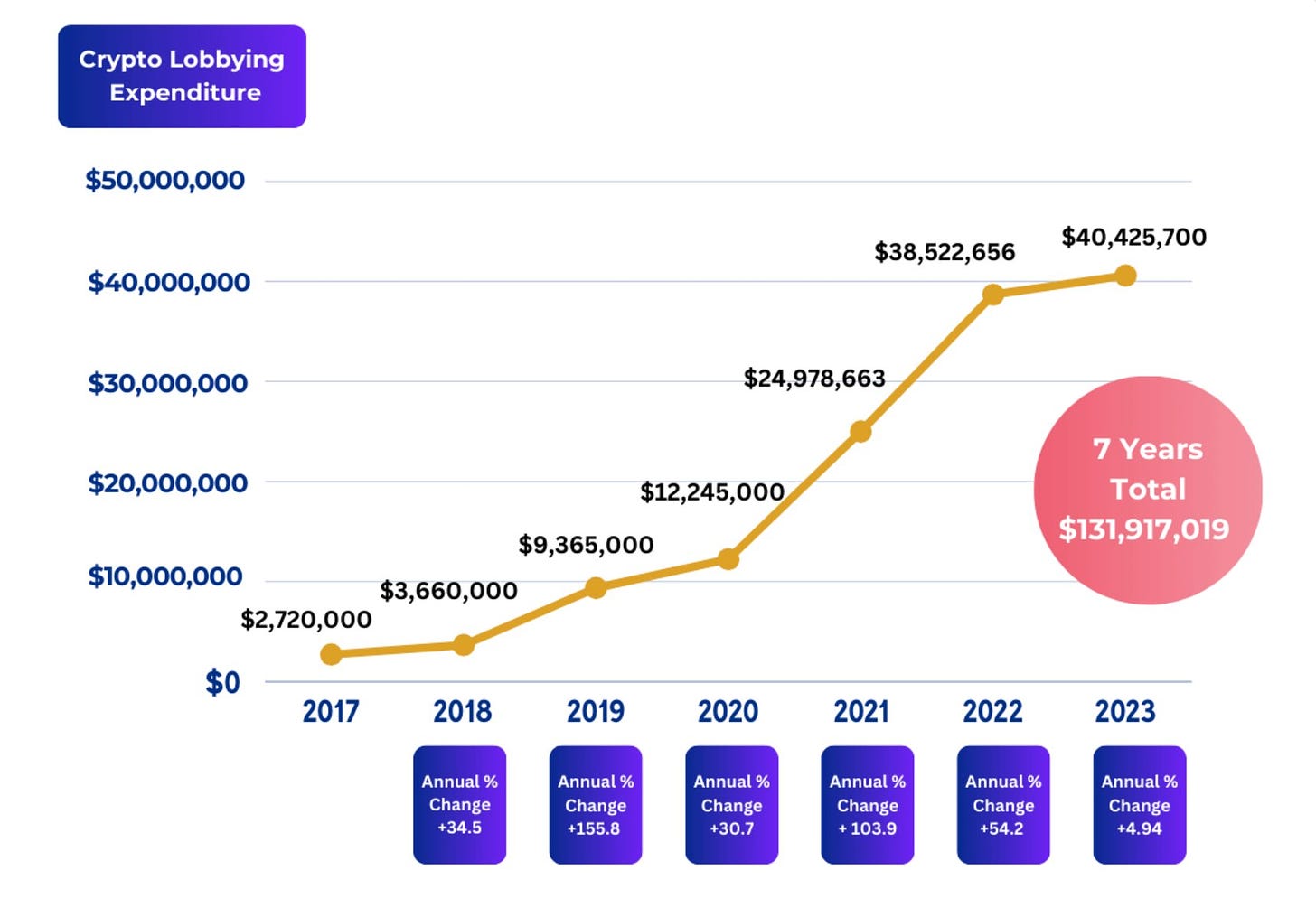

Crypto lobby spending jump since 2017.

Coinbase's expenditure: Increasing its lobbying spend by 3,475% from $80,000 in 2017 to $2.86 million in 2023.

Ripple's growth: Ripple Labs saw a 1,780% increase in lobbying costs, from $50,000 to $940,000 in 2023.

Binance.US investment: Binance.US invested $1.2 million in lobbying in 2023, a 656% increase from $160,000 in 2017.

Tether and other firms: Tether spent $1.2 million on lobbying in 2023, while Uniswap and Block Inc. invested $280,000 and $1.7 million, respectively.

Legal challenges: Many lobbying firms face legal battles and regulatory scrutiny, with Ripple involved in a long-standing dispute with the SEC and Binance.US and Coinbase facing accusations of operating as unregistered exchanges.

Recent spending trends: Nearly 60% of the total $131.91 million spent on crypto lobbying occurred in the last two years, amounting to $78.94 million between 2022 and 2023.

Top Spenders: Apollo Global Management topped the list with $7.56 million spent in 2023 and a total of $28.7 million over seven years. The Managed Funds Association followed with $2.86 million in 2023 and $21.9 million since 2017.

Blockchain Association ‘investigating’ Fed.

The Federal Reserve issued a cease-and-desist order against United Texas Bank, raising concerns about regulatory overreach in the cryptocurrency industry.

AML compliance issues: The central bank identified "significant deficiencies" in the bank's risk management and compliance with anti-money laundering laws, related to "foreign correspondent banking and virtual currency customers."

Laura Sanders, policy counsel at the Blockchain Association.

“It’s no secret there is a coordinated attempt to choke off the digital asset industry’s access to the traditional banking system.”

Pattern of regulatory actions: Previous enforcement actions against other crypto-friendly banks, including Custodia Bank, which had its application denied by the Federal Reserve due to safety and soundness risks associated with its crypto focus.

Continued advocacy: The Blockchain Association plans to further investigate Operation Choke Point 2.0, and the importance of banking access for the digital asset industry, which has created tens of thousands of American jobs.

Block That Quote 🎙️

Circle's Vice President, Yam Ki Chan

“This is the thing about US politics: there are policies, and then there are politics.”

Chan warned that the US risks falling behind in stablecoin regulation amid global competition, highlighting the need for a clear regulatory framework.

“Major jurisdictions around the world have set a minimum baseline for what a well-regulated stablecoin looks like … The one that doesn't have it fully yet is the US at a national level.”

In the US, stablecoin issuers face a fragmented regulatory environment, needing to navigate various state laws, which increases compliance costs and hampers innovation.

The US House Financial Services Committee passed the "Clarity for Payment Stablecoins Act of 2023," aiming to establish a regulatory framework for stablecoins, but further legislative processes are required for it to become law.

He highlighted the importance of regulators having visibility into the market.

"What's important is for the US to upgrade and have a structure to define what a well-regulated stablecoin looks like. We have lots of private companies working with us who are also speaking with the regulators; this is not a ‘go alone’ conversation. It's really important to understand how it works for us legally. What kind of risk are we taking on?”

Telegram CEO Breaks Silence Since Arrest

Pavel Durov, CEO of Telegram, was arrested on August 25 in Paris and charged with facilitating illegal activities through the platform, including drug trafficking, organised fraud, and child pornography distribution.

Allegations of inaccessibility: French authorities claimed that Telegram had not adequately responded to inquiries regarding criminal activity on the platform.

Durov's defense: In a Telegram post, Durov opened up about the event. Contacting his company was straightforward and that Telegram has an official EU representative for law enforcement requests.

“The claims in some media that Telegram is some sort of anarchic paradise are absolutely untrue. We take down millions of harmful posts and channels every day. Telegram’s abrupt increase in user count to 950 million caused growing pains that made it easier for criminals to abuse our platform. That’s why I made it my personal goal to ensure we significantly improve things in this regard.”

Commitment to principles: Telegram has previously refused government demands that conflict with its values, leading to bans in Russia and Iran.

Critique of legal approach: Durov criticised the French government's strategy of holding CEOs criminally liable for third-party actions on their platforms, arguing it could hinder technological innovation.

Current status: Durov has been released on judicial supervision and is required to stay in France during the investigation.

The Surfer 🏄

Robinhood has settled with the California DOJ for $3.9M over restrictions that prevented users from withdrawing crypto from 2018-2022. Mandates them to allow withdrawals to external wallets and enhance transparency about asset custody.

Michael Smith, 52, from North Carolina, faces charges of wire fraud and money laundering for allegedly using AI-generated songs and bots to fraudulently earn over $10 million in streaming royalties from 2017 to 2024.

The UK's Financial Conduct Authority (FCA) has reported that 87% of crypto registration applications failed to meet anti-money laundering standards in the 2023-24 fiscal year. Only 4 out of 35 approved.

This is The Token Dispatch 🙌 and you can find all about us here 🤟

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋