Hello dispatchers!

The crypto market is bleeding out, no clue where or when it is going to stop.

Bitcoin crashed below $77,000, ~ 30% down from its January high

The Crypto Fear & Greed Index is at "extreme fear"

A staggering $4.75 billion exodus from crypto products over a month

Nearly $1.5 billion in liquidations as leveraged positions get wiped out

In the middle of this carnage, a bold theory is grabbing eyeballs: What if the market crash isn't just collateral damage from Trump's tariff threats and is, in fact, part of a deliberate strategy to force down interest rates?

Today, we tell you all about the genesis, the rationale and the practicality of such a controversial idea and exploring what it could mean for crypto's recovery timeline.

Buy Once, Earn Daily Bitcoin Forever

Infinity Hash brings the best aspects of cloud and colocation mining into a transparent and reliable system that provides long-term cash flow.

The Crypto Carnage Update

The crypto market's decline has gone from concerning to alarming.

Bitcoin dropped to nearly $76,500 late Monday, marking a 30% decline from its January peak of $109,588. The selling pressure has been relentless, with four consecutive weeks of outflows from crypto investment products.

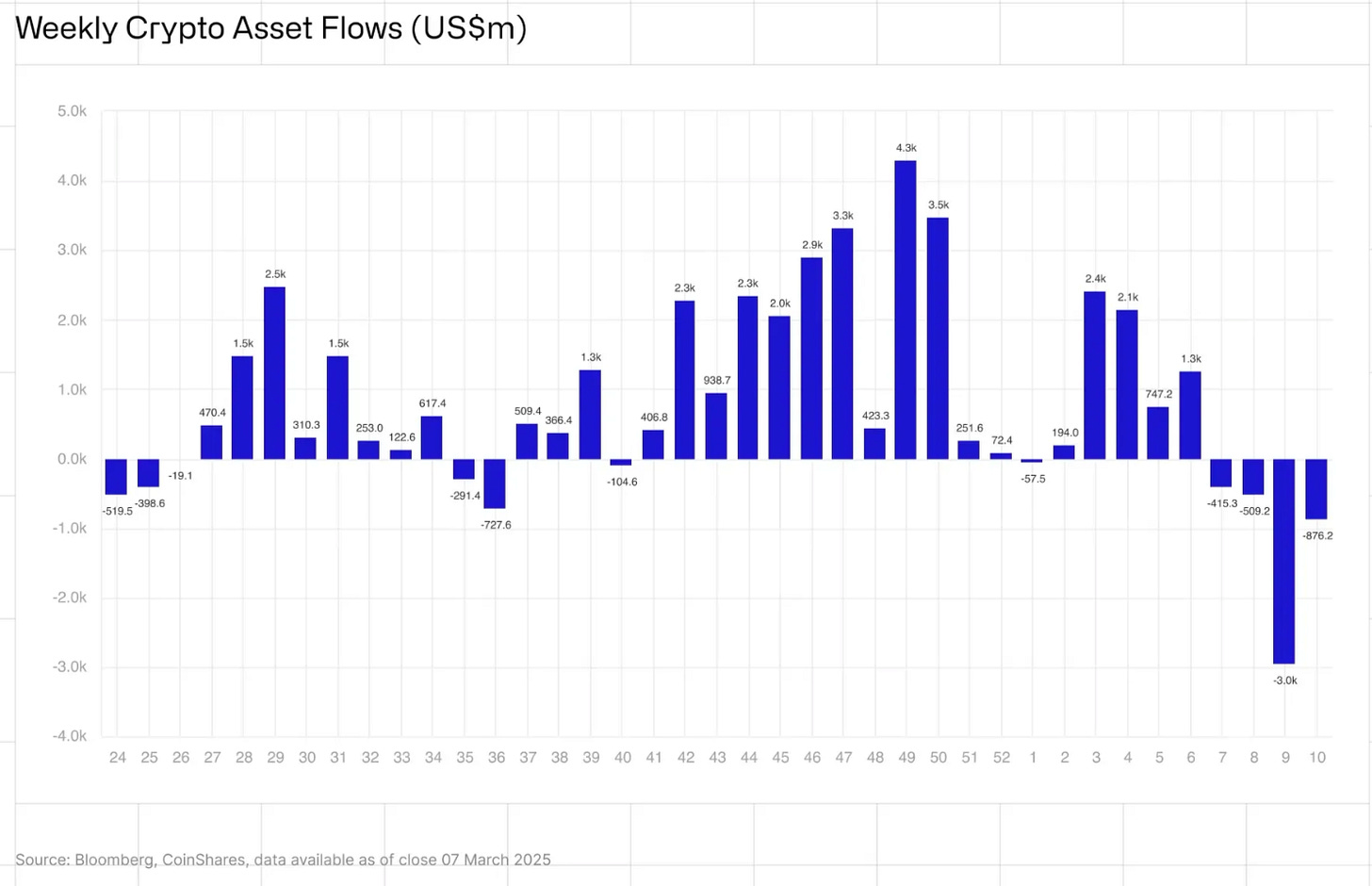

Global crypto investment funds shed another $876 million last week, bringing the four-week total to an eye-watering $4.75 billion. These sustained withdrawals and the ongoing price decline have erased major chunks of gains made since Trump's election victory, pushing total assets under management down by $39 billion to $142 billion.

Get 17% discount on our annual plans and access our weekly premium features (HashedIn, Wormhole, Rabbit hole and Mempool) and subscribers only posts. Also, show us some love on Twitter and Telegram.

"Although this indicates a slowdown in the pace of outflows, investor sentiment remains bearish," CoinShares Head of Research James Butterfill noted in Monday's report.

Bitcoin-focused products bore the brunt of the exodus, with $756 million in outflows. Interestingly, short-Bitcoin products also saw outflows of $19.8 million — the largest since December — which Butterfill suggested could indicate that "investors are close to capitulation."

The crypto fear and greed index, a widely-followed sentiment indicator, has plummeted to its lowest level since mid-2023.

The index, which measures investor emotions on a scale from 0 (extreme fear) to 100 (extreme greed), now stands at just 15 - deep in "extreme fear" territory, further down from 25 on Saturday.

This dramatic shift in sentiment came after the White House Crypto Summit on March 7 failed to deliver the bold announcements many had anticipated.

The summit did result in a framework for stablecoin legislation by August and promises of lighter regulation. Just not enough to stem the market's decline.

Instead, the focus has shifted to macroeconomic concerns, particularly Trump's aggressive tariff policies against Canada, Mexico, and China, which have rattled global markets and raised fears of inflation, economic slowdown, and potential recession.

Read: Macros Dump Crypto Despite Trump Pump💸

So it’s this bunch of macro concerns causing all the dump? Well, at least that’s what we thought - until conspiracies took over.

Trump's Market Crash Conspiracy

A theory gaining traction among market analysts suggests this market downturn isn't a side effect of Trump's policies but potentially their intended consequence.

Hypothesis? Trump is deliberately engineering market weakness to force interest rates down.

"At this point, it should be perfectly clear that Trump is purposely trying to crash the economy. Why? To crater consumer sentiment and cause a massive deflationary headwind, forcing the Fed to cut rates sooner and lower the budget deficit,” wrote Kris Patel on X.

Still don’t understand?

The US Federal Reserve, which is tasked to balance the monetary measures and care for the nation’s economy, is an independent central bank that is not bound by anybody. No - not even by the President of the United States.

And Trump has been explicit about his desire for lower interest rates so that it could let the money printer go brrr and get some respite in addressing the great US debt crisis (more on this later).

A market crash followed by a constrained public spending provides a perfect condition for the US Fed to consider a rate cut.

Get the drift?

At the World Economic Forum in Davos on January 23, Trump had said: "With oil prices going down, I'll demand that interest rates drop immediately."

He added that the economy faced "a period of transition," and did not rule out a recession.

In another televised segment, he advised viewers yesterday: "You can't watch the stock market right now."

The evidence supporting this theory isn't merely rhetorical. Since Trump's inauguration on January 20, the S&P 500 has dropped 2.6% amid a flurry of tariff announcements and economic uncertainty. The benchmark index has given away all the gains since his reelection on November 7 and some more.

Read: The Trump-Pump-Dump Trifecta is Complete ⛳

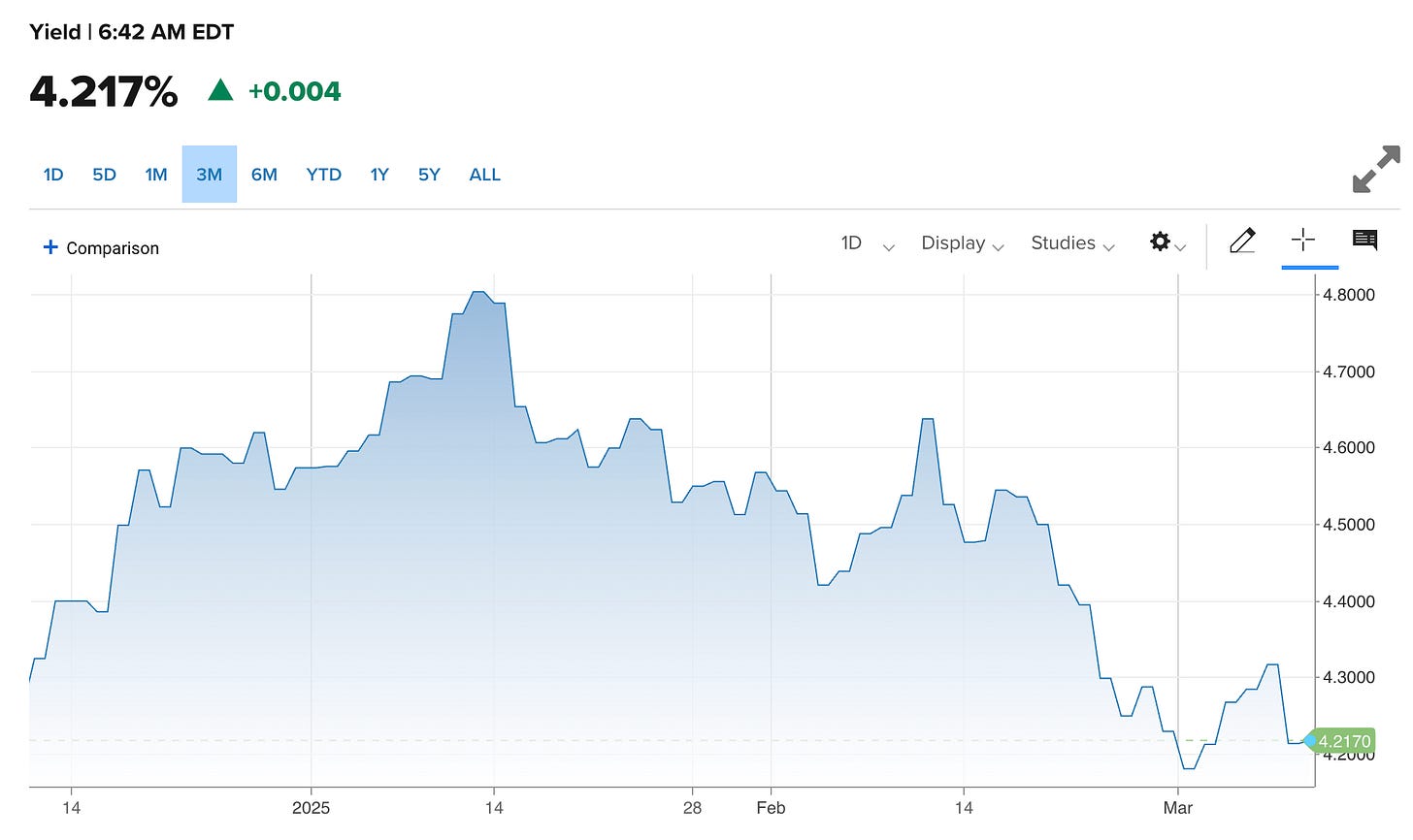

Meanwhile, 10-year Treasury yields have fallen from post-election highs to below 4.25%, down from 4.8% in January.

"They are crashing asset prices in an attempt to force Jerome Powell to cut interest rates. We will see who blinks first," Anthony Pompliano, investor and founder of Professional Capital Management, said in his newsletter.

The proposed mechanism involves market psychology.

While conventional wisdom suggests tariffs are inflationary and should drive bond yields higher, the opposite has occurred.

"It's actually going down because it's bringing so much uncertainty to equity markets that people are selling stocks and buying bonds! Which is exactly what the Trump administration wants to happen," said Amit in a post on X.

As investors flee to the safety of Treasury bonds, their prices rise and yields fall. This flight-to-safety trade appears to be working as intended, with the 10-year yield already dropping more than half a percentage point this year.

Why does the Trump administration want lower rates though?

The Impending Debt Conundrum

The answer to that question lies in a significant, urgent fiscal challenge of staggering proportions.

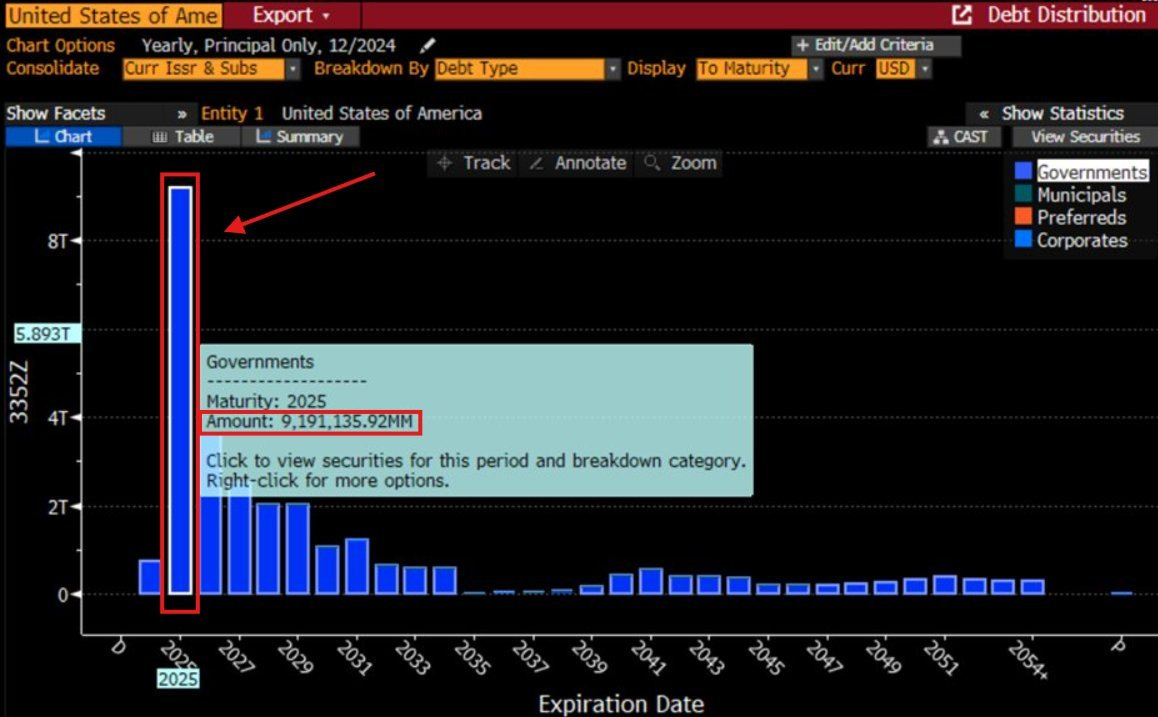

The US faces a looming need to refinance about $9.19 trillion worth of debt maturing in 2025 and about $7 trillion over the next six months. With the national debt already exceeding $36 trillion, the interest rate at which this refinancing occurs will have enormous budgetary implications.

The mathematics are straightforward. If the US refinances $7 trillion at 4.2% versus 3%, the difference amounts to hundreds of billions in additional interest payments over time.

For an administration grappling with a projected $1.9 trillion annual deficit in 2025, according to Congressional Budget Office estimates, even marginal improvements in borrowing costs represent significant fiscal relief.

Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick appear to be key architects of this approach. By creating economic uncertainty through tariff threats and trade war rhetoric, they're effectively driving a "risk-off" sentiment that pushes investors toward the perceived safety of Treasury bonds.

This flight to safety has already shown results. The 10-year Treasury yield has fallen from 4.8% in January to 4.25% currently, with prediction markets like Kalshi now giving greater than 75% odds of two or more Federal Reserve rate cuts this year.

Is This a Viable Strategy?

The "crash for lower rates" strategy comes with profound risks that could spiral into a full-blown financial crisis.

Market backlash presents the most immediate danger. The Conference Board's consumer confidence index dropped below 80 in February 2025 — a classic recession signal. Eroding consumer and business confidence could shrink GDP, reducing tax revenue and worsening the debt-to-GDP ratio already above 120%.

"The true risk is our political leaders doing something wildly irresponsible that unnerves financial markets … political blunders have always been the more concerning potential trigger for an American fiscal crisis," warned Wendy Edelberg and Ben Harris from the Brookings Institution.

Historical is even more alarming. Turkish President Erdogan's disastrous experiment with pressuring the Turkish central bank to cut rates led to the Turkish lira plunging from 9 to 27 against the dollar between 2021-2023, wiping out more than half its value.

"We have to hope that Mr. Trump might learn from Mr. Erdogan's experience that it is unwise to exert political pressure on the central bank to lower its interest rate at a time when economic circumstances do not justify such action," cautioned Desmond Lachman.

The inflation risk is substantial. JP Morgan estimates Trump's tariffs on Mexico and Canada could boost inflation by 0.5-1% if prolonged. This inflation spike might force the Fed to maintain or even raise rates, directly contradicting the plan's objective. The Fed has held rates steady in early 2025, signalling wariness about tariff-driven price shocks.

Global fallout presents another risk. Canada and Mexico have already announced retaliatory tariffs, threatening US exports and further straining the economy. A US-triggered global recession would only compound domestic economic challenges.

"The prospect for manipulating a long-term yield through some kind of financial or political engineering operation is very limited," said Larry Summers, who served as Treasury Secretary under President Bill Clinton, a Democrat.

Though yields have fallen in recent weeks, many investors believe this reflects growing economic uncertainty rather than optimism about fiscal management.

The plan assumes a level of economic precision that past evidence suggests is unrealistic. What happens if investors conclude there's default risk in what has historically been considered the risk-free asset? As Edelberg and Harris warn: "An abrupt and sustained increase in Treasury rates of, say, three or four percentage points would likely cause a crisis."

What This Means for Crypto

Crypto markets have become increasingly correlated with traditional finance, making them particularly vulnerable to this economic turbulence.

Arthur Hayes, co-founder of BitMEX, offered a stark assessment: "The plan: Be fucking patient. $BTC likely bottoms around $70k. 36% correction from $110k ATH, v normal for a bull market."

His roadmap suggests crypto investors should expect further pain before relief arrives: "Then we need stonks, $SPX and $NDX to enter free fall. Then we need TradFi muppet to go under. THEN we get Fed, PBOC, ECB, and BOJ all easing to make their country great again."

Only after central banks begin easing monetary policy does Hayes recommend "loading up the truck." This timeline suggests crypto investors might need to weather months of volatility before a sustainable recovery takes hold.

During previous recessions, cryptocurrencies have lacked the historical data to predict performance. The 2020 COVID crash provided limited insight, as crypto initially crashed with traditional markets but recovered faster amid unprecedented stimulus.

The Fed's rate cut timeline becomes critical for crypto's recovery. Current market expectations show >75% odds of two or more rate cuts in 2025. Each cut could provide incremental relief for risk assets, including cryptocurrencies.

Bitcoin's January-February supply reduction typically precedes bull market continuation in the second half of the year. If rate cuts materialise by summer, they could accelerate this historical pattern.

Token Dispatch View 🔍

The "Trump market crash strategy" theory offers a compelling narrative for current conditions, but its deliberate implementation remains unproven. Whether calculated or accidental, the effects on crypto are the same: immediate pain with potential long-term benefits for those who hold on to their belief in the digital assets.

This counterintuitive approach to economic policy — intentionally disrupting markets to force monetary easing — upends conventional investment wisdom. For crypto investors accustomed to volatility, it's another reminder that digital assets don't operate in isolation from broader economic forces.

Bitcoin's 30% decline from $109,000 represents a significant correction but isn't historically unusual even during bull markets. Previous cycles saw multiple 30-40% corrections before reaching new highs. The correlation with traditional market weakness suggests this isn't a crypto-specific problem but rather a macro-driven repricing.

The global implications extend beyond US borders. Canada and Mexico, facing tariff threats, have already announced retaliatory measures. European markets are bracing for spillover effects, with the ECB watching closely for signs of contagion.

Emerging markets, typically hardest hit during US economic turbulence, could see capital flight and currency devaluation—potentially driving some investors toward crypto as a hedge against local currency weakness.

Hayes' timeline offers a practical roadmap: expect the S&P 500 and NASDAQ to fall further, followed by possible stress in traditional finance before central banks intervene with coordinated easing. Only then will the stage be set for a sustainable crypto recovery.

If Trump's apparent strategy succeeds, the resulting lower interest rates would eventually create a more favourable environment for risk assets, including cryptocurrencies. The question becomes one of timeline and magnitude. Can investors endure potential further drawdowns to $70,000 BTC? Will central bank easing, when it arrives, be sufficient to overcome other economic headwinds?

For strategic crypto investors, the path forward isn't about timing the exact bottom but positioning for the inevitable recovery. Accumulating gradually during this period of maximum fear, keeping dry powder for potential further declines, and maintaining conviction when others panic has historically rewarded crypto investors.

The journey from market fear to renewed optimism is rarely linear. Whether Trump's market strategy is intentional or just a byproduct of his economic policies, the opportunity it creates for disciplined investors remains the same. Those who understand market cycles recognise that periods of extreme fear are precisely when the foundation for the next bull run is laid.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.