UK Firm Withdraws $250 Mn Bitcoin

Whales surfaced after Bitcoin suffered a price slump amid Trump’s tariff tantrums.

A London-based investment firm has quietly executed one of the largest Bitcoin withdrawals of 2025, signalling growing institutional confidence despite recent market turbulence.

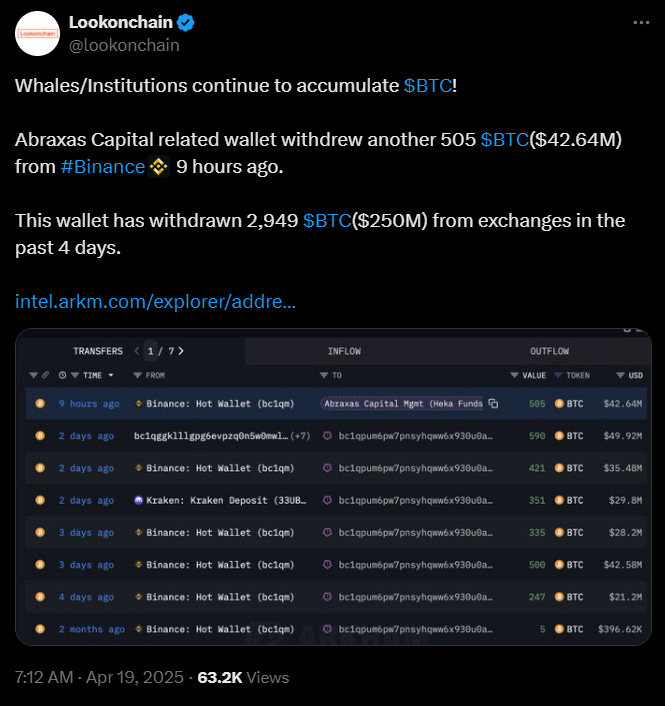

Abraxas Capital removed 2,949 Bitcoin worth over $250 million from exchanges between April 15-19, blockchain intelligence firms Lookonchain and Arkham Intelligence confirmed.

This isn't an isolated move.

American corporate behemoths are similarly strengthening their Bitcoin positions:

Strategy (formerly MicroStrategy) purchased 3,459 BTC for $286 million last week

Semler Scientific announced plans to raise $500 million primarily for Bitcoin acquisitions

Total institutional absorption now exceeds 300% of Bitcoin's yearly issuance

Michael Saylor's Strategy now controls a 531,644 BTC, generating over $9 billion in unrealised profits despite warning investors about Q1 2025 net losses.

Tactical Accumulation or FOMO?

Abraxas' wallet history reveals a pattern of strategic buying and selling.

Its holdings peaked at 7,800 BTC in December 2024 before systematic profit-taking began.

The fund's latest acquisition included a substantial $45 million purchase from Binance on April 18, according to on-chain data — suggesting a tactical response to Bitcoin's depressed prices amid global trade tensions.

The mass exodus from exchanges creates potential supply constraints.

With Bitcoin hovering around $85,000-$88,000 (down from January's $109,000 peak), large-scale withdrawals reduce available liquidity, potentially amplifying price movements when demand surges.

Complicating matters, medium-term holders have released 170,000 BTC into circulation, introducing an element of uncertainty.

Bitcoin's infamous 24/7 trading schedule exposes it to weekend volatility while traditional markets rest.

"On a weekend, there's not much volume. So you have a worse risk of rapid sort of flash crashes or flash dips that get filled in again," warned Blockstream CEO Adam Back, referencing the April 6 plunge below $75,000.

"US markets are closed as we have a long weekend for Easter, so volatility could be suppressed barring headlines from the White House." Bitfinex analysts offered a more measured outlook.

While retail investors panic-sold during the recent Trump-tariff tumble, institutional whales like Abraxas were methodically moving in the opposite direction. This isn't their first rodeo either. their on-chain history shows a consistent pattern of accumulating during fear and distributing during euphoria.

For average investors, the message is clear: major financial players are quietly betting that Bitcoin's current identity crisis is temporary, not terminal. Will they be proven right?

The answer depends entirely on whether Bitcoin can evolve beyond its current state into something that genuinely preserves wealth during crisis — rather than amplifying it.

Until then, expect more whales like Abraxas to continue their systematic accumulation. After all, in markets driven by scarcity, institutional capital tends to arrive early to the party.