Warner Music Group expands Metaverse plans with new job listings

Warner Music Group, a global music and entertainment company, is aggressively expanding its Web 3 strategy. For starters, we know that they teamed up with OpenSea last week to expand the Web3 opportunities for artists.

And now, they are hiring!

According to a LinkedIn post by Warner Music Group, the company is looking for at least two people who can develop and oversee web3-related projects.

The first position calls for someone based in New York to lead the company's metaverse strategy, which includes "music entertainment experiences in metaverse and gaming." Warner Music Group wants a candidate who is well-versed in gaming and has an interest in blockchain.

The second job is for building connections. It focuses on business partnership strategy in the web3, metaverse, and gaming fields - connecting with brands, firms, platforms, and individuals in these spaces.

WMG mentions that their metaverse projects will focus on immersive experiences and strategic content integration.

WMG has always been a fan of web 3 and metaverse. They have already established their presence in the space with some major announcements:

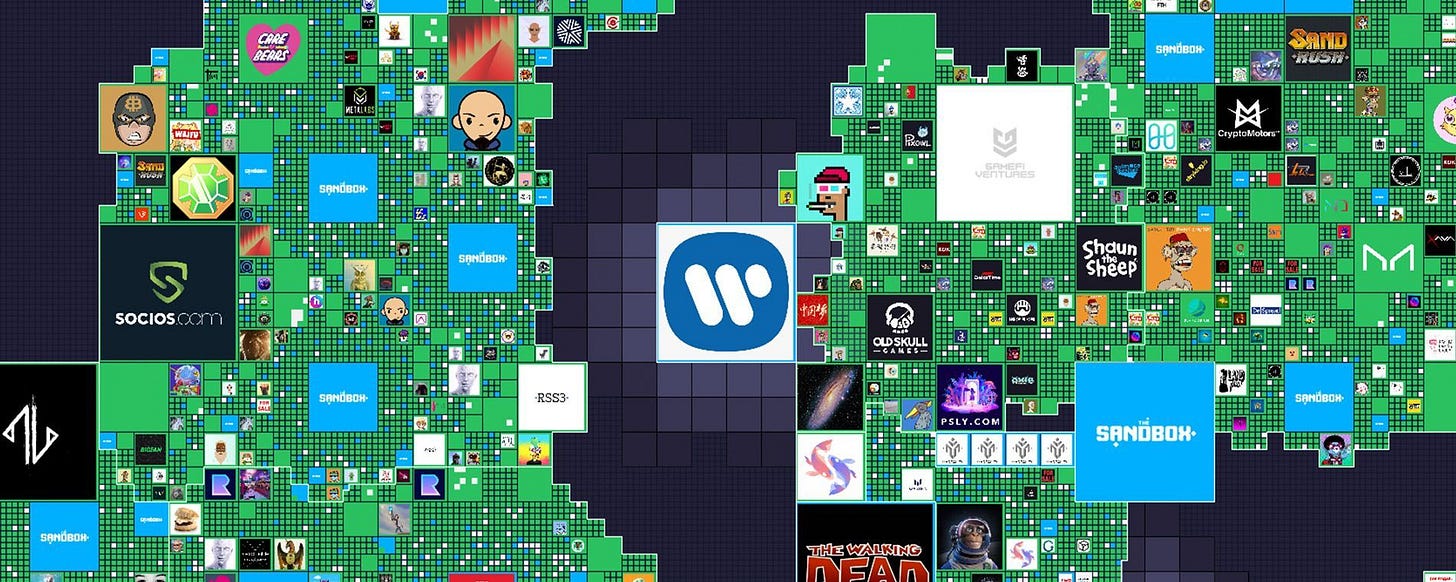

Announced the launch of a music-focused theme park on metaverse platform The Sandbox featuring artists like Ed Sheeran, Bruno Mars, Dua Lipa and Cardi B.

Partnered with fantasy-themed collectible card game developer Splinterlands for play-to-earn, arcade-style blockchain games.

Worked on interactive experiences with Roblox, Blockparty, Wave, Genies.

Partners with NFT marketplace OneOf to create exclusive NFTs for a range of artists across WMG’s catalog of music.

And announced a partnership with OpenSea to provide a platform for select musical artists to extend their fanbase into the Web3 community.

So, the job posting is not at all surprising!

The record labels Atlantic, Warner Records, Elektra, and Parlophone, are among the many popular music properties owned by the music conglomerate.

Does this mean more mainstream adoption? We think so!

Coinbase Expands Services in Australia

To make it simpler for Australian consumers to purchase, sell, and trade digital assets, Coinbase (COIN) has announced the expansion of its services to retail clients in Australia.

The cryptocurrency exchange announced that PayID, a local payments platform, will be added as a mechanism for clients to move Australian dollars to their Coinbase accounts.

The Reserve Bank of Australia and the Australian financial services industry collaborated to create the PayID payments infrastructure, which enables recipients to link a bank account to a mobile phone number or email address to receive payments.

The company said it would offer advanced trading tools, better pricing, and 24/7 chat assistance to its local retail customers.

MakerDAO invests $500 million in US treasuries and corporate bonds.

The creator of the stablecoin DAI, MakerDAO, has set aside $500 million to invest in corporate and US Treasury bonds. The DAO intends to distribute 80% of the funds to short-term US treasury bonds, with the remaining 20% going to corporate bonds.

The decision, according to MakerDAO, was made to improve the project's financial sheet by increasing exposure to liquid, low-risk traditional assets. The DAO has teamed up with Monetalis, an asset advisory company, for this allocation.

Since the collapse of the $40 billion Terra ecosystem and its stablecoin UST, which had repercussions on the larger crypto market, stablecoins and their collaterals have been a topic of discussion.

According to CoinGeko data, DAI has a market valuation of about $6.3 billion, making it the fourth-largest US dollar stablecoin. Maker's investing strategy illustrates decentralised governance participation and an industry attempt to improve the stability of tainted algorithmic stablecoins.