What Are Bitcoin Runes? 🙇♀️

A protocol for efficient and user-friendly token management on the Bitcoin blockchain. In short, brings memecoin trading on Bitcoin. What is it about? How will it play out? We try and bring a lowdown.

Hello, y'all. If you think you know your music, then this is for you frens. A complete go. Check out 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

Runes protocol.

Bitcoin ecosystem just got a new addition.

Enter Runes.

New protocol that makes it easier to create fungible tokens (like memecoins) directly on the Bitcoin blockchain.

Remember Ordinals that brought memes and stuff to Bitcoin?

Runes are the next chapter, letting folks build whole new things on top of the BTC.

The creator? Casey Rodarmor, the creator of Ordinals, developed Runes.

What are Bitcoin Runes?

Unlike traditional protocols like BRC-20 and ORC-20, Runes are native to the Bitcoin blockchain. This means they leverage Bitcoin's security and immutability without requiring a separate sidechain or relying on additional infrastructure.

The Runes protocol utilises Unspent Transaction Outputs (UTXOs), the core building block of Bitcoin transactions, to represent and manage these tokens.

Runes simplifies the creation and management of tokens by allowing multiple tokens to be stored in a single UTXO, which could enhance efficiency compared to address-based or off-chain protocols.

Runes stands out for its simplicity, direct integration with Bitcoin's UTXO model, and avoidance of off-chain data or a native token, offering a more unified and effective system within the Bitcoin network

How do Runes Work?

Creating and managing Runes involves a two-step process

Runestones: These are special messages embedded within Bitcoin transactions using the OP_RETURN opcode. Runestones encode information about the creation, minting, or transfer of Runes.

UTXO Model Integration: Each Rune is assigned to a specific UTXO. This integration minimises the creation of "junk" UTXOs, which can bloat the network.

What are Runestones?

Runestones are messages within the Runes Protocol that contain various fields for managing and parsing data on the Bitcoin blockchain:

Data Storage: Runestones are stored in Bitcoin transaction outputs, starting with an OP_RETURN script pubkey followed by specific data pushes.

Functionality: Each transaction can have one runestone for etching new runes, minting existing ones, or transferring runes within the transaction.

Rune Identification: Runes are identified by IDs consisting of the block where they were etched and the transaction index within that block (e.g., 500:20).

How Runestones are used?

Parsing Data: The Runes Protocol extracts runestones from transaction outputs to interpret instructions and values.

State Updates: When a new block is mined, the protocol updates the state of the index, handling outputs and sat range mappings. Specialised updaters manage specific updates like inscriptions and runes.

Safety Valves (Cenotaphs): Malformed runestones are termed cenotaphs, and any runes included in such transactions are burned. This protects the system's integrity and allows for future protocol updates without jeopardising existing systems.

Benefits of Runes Protocol

Security: By leveraging Bitcoin's robust security measures, Runes inherit the same level of trust and immutability.

Efficiency: The UTXO-based model aims to streamline transactions and minimise unnecessary data on the network.

Compatibility with Bitcoin: Runes integrate seamlessly with Bitcoin's UTXO model, eliminating the need for off-chain data or complex interactions.

Minimised On-Chain Footprint: Runes operate within Bitcoin's UTXO model, reducing the creation of unnecessary data and enhancing network efficiency.

Interoperability: Theoretically, Runes could potentially interact with existing Bitcoin infrastructure and wallets.

What's special about Runes?

Brings fungible tokens to Bitcoin, expanding its uses.

Could attract more users and developers to Bitcoin.

Potentially increases transaction fee revenue for miners.

Potential Drawbacks of the Runes Protocol

While the Runes Protocol offers exciting possibilities, not without challenges.

Community Hurdles: Gaining widespread adoption can be difficult, as seen with BRC-20. Competition from other protocols and the market's openness to new ideas will influence the Runes Protocol's future.

Market Hype and Risk: The current enthusiasm surrounding Runes could lead to investor disappointment if transaction fees rise on Bitcoin or traders lose interest due to a crowded market.

Usability Learning Curve: Despite aiming for simplicity, Runes still requires users to understand concepts like OP_RETURN codes and navigate Bitcoin transactions, which might be a barrier for some.

Ecosystem Integration Uncertainty: While designed to work with Bitcoin's UTXO model, the protocol's full integration with the broader Bitcoin ecosystem and its impact on network efficiency are yet to be determined.

Regulatory Concerns: As with any tokenisation protocol, regulatory issues may arise, especially if Runes are used to create tokens resembling traditional securities or other regulated financial instruments.

Bitcoin Halving block breaks fee record

Bitcoin's halving block became the most expensive ever, with users spending huge fees.

Runes might be to blame.

Launched at the same time as the halving, the frenzy to use Runes on the historic halving block led to record-breaking fees.

Bitcoin users paid 37.7 Bitcoin (over $2.4 million) to have their transactions included in the block.

This is the highest fee total ever recorded for a single Bitcoin block.

The miner who produced the block, ViaBTC, walked away with a total reward of 40.7 Bitcoin (around $2.6 million), including both transaction fees and the mining subsidy.

People rushed to inscribe rare assets and limited-edition "satoshis" (the smallest unit of Bitcoin) onto the blockchain.

Added to the excitement: Epic Satoshi

The Runes protocol activated at the halving, also sparking a "hunt for the epic satoshi" - the first Satoshi in the halving block (worth over $1 million).

This specific Satoshi is expected to be highly valuable due to its historical significance (first of the post-halving era).

Things to keep in mind

There are concerns about "symbol squatting" - people grabbing desirable token names.

While the UTXO model is efficient for Bitcoin transactions, it remains to be seen if it can scale effectively for a high volume of token transactions.

Bitcoin has traditionally been seen as just a store of value. Runes and Ordinals are changing that.

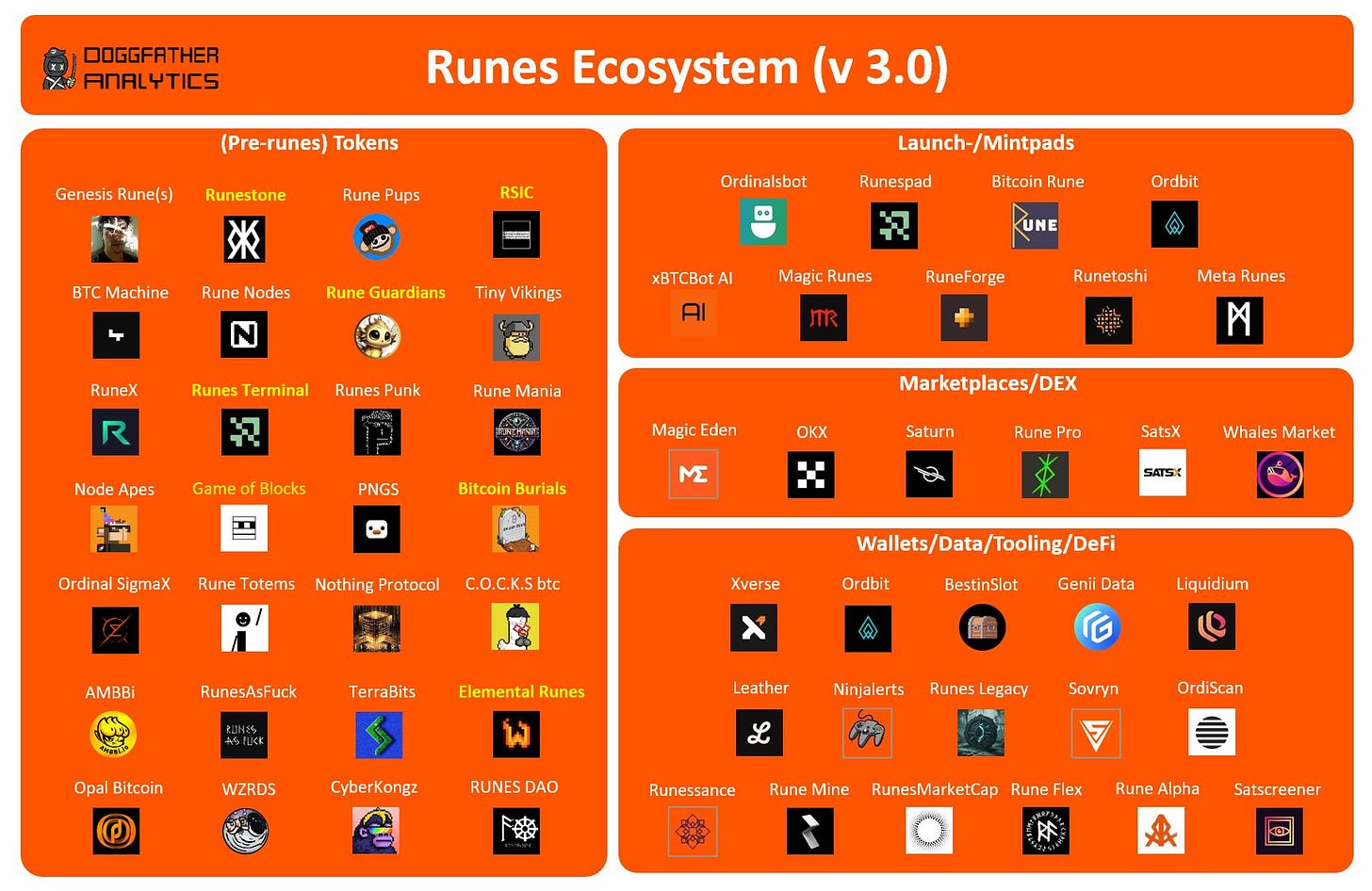

These protocols are attracting new interest in building on Bitcoin, leading to advancements in wallets, nodes, and DeFi possibilities.

The Future of Runes

The success of Bitcoin Runes will depend on various factors.

Community buy-in, developer adoption, and overcoming technical hurdles will be crucial. If successful, Runes could usher in a new era of innovation for Bitcoin, allowing it to compete more effectively with other smart contract platforms.

However, challenges remain, and only time will tell if Runes can truly revitalise the king of cryptocurrencies.

TTD Week That Was 📆

Saturday: 840,000 Blocks of Truth 🙌🏼

Friday: A Guilty Verdict ⏳ The Final Countdown

Thursday: Buckle Up Crypto 🐿️

Wednesday: Bitcoin Halving In Uncertain Times 🌓

Tuesday: Hey Crypto, what now? 👀

TTD Week in Funding 💰

Lambda. $1.8 million. Bitcoin-based USD stablecoin protocol that enables bitcoin holders to take advantage of DEFI's money-making opportunities

Thurster. $7.5 million. Blast's native DEX for traders, LPS and developers with Blast native yields, custom liquidity solutions.

Plena. $5 million. Multi-chain, self-custodial wallet that supports account abstraction and offers encrypted news and insights.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋