What Are Bitcoin Whales? 🐳

What you need to know about the people or organisations with substantial Bitcoin holdings who are capable of influencing the market through their trading tactics.

Hello, y'all. If you think you know your music, then this is for you frens. A complete go. Check out 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

Ever wonder who secretly controls the Bitcoin market?

Look no further than Bitcoin whales.

These crypto giants hold massive amounts of Bitcoin, giving them the power to influence prices with their trades.

So, who are they?

Bitcoin whales are individuals or groups with at least 1,000 BTC (around $65 million as of April 2024).

They can accumulate Bitcoin over time, hold for long-term gains, or manipulate the market through tactics like pump-and-dump schemes.

The prominent Bitcoin whales list

Individuals and entities with significant holdings of Bitcoin.

Brian Armstrong: Holding an estimated net worth of $5.49 billion, Brian Armstrong, the CEO of Coinbase, ranks as the top crypto whale.

Chris Larsen: With a net worth of $2.44 billion, Chris Larsen is another significant Bitcoin whale.

Michael Saylor: Holding approximately $1.69 billion worth of Bitcoin, Michael Saylor is a prominent player in the cryptocurrency space.

Changpeng Zhao: Known for his role as the founder of Binance, Changpeng Zhao is a notable Bitcoin whale with a net worth of $1.61 billion.

The Winklevoss Twins: Tyler and Cameron Winklevoss, with a combined net worth of $2.7 billion, are influential Bitcoin billionaires.

Barry Silbert: Holding a net worth of $1.26 billion, Barry Silbert is a significant player in the crypto market.

Jed McCaleb: With a net worth of $1.18 billion, Jed McCaleb is another prominent crypto whale.

Tim Draper: Known for his involvement in the crypto space, Tim Draper holds a net worth of $930 million.

Matthew Roszak: With a net worth of $850 million, Matthew Roszak is a notable figure in the Bitcoin market.

The mysterious ones

Mr.100 has captured the attention of the crypto community due to their consistent accumulation of Bitcoin in large quantities.

They are known to possess nearly 52,996 Bitcoins, valued at around $3.5 billion, making them the 14th largest Bitcoin holder in the world.

Mr.100's wallet began accumulating BTC since November 2022, coinciding with the downfall of the FTX exchange.

They have added a minimum of 100 BTC almost every day since February 14, with several significant Bitcoin transfers received from secondary wallet addresses that have been accumulating 100 BTC since 2019.

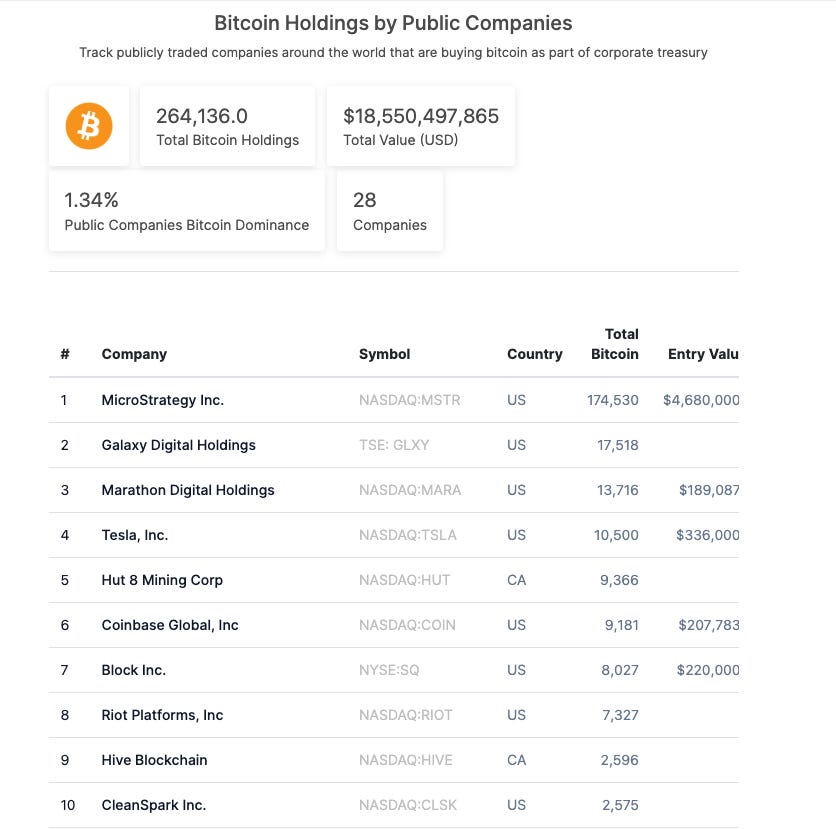

The public whales

These are companies that hold Bitcoin and are traded on bourses

The nation whales

The top governments with the highest Bitcoin ownership.

How do they impact the market?

Whales can cause price surges by buying large amounts of Bitcoin.

Conversely, they can trigger price drops by selling off their holdings.

Their actions can also create a sense of scarcity, driving up demand and value.

How do Whales spot opportunities?

Whales aren't just blindly throwing their money around. They often use sophisticated tools and analytics to identify trends and potential buying or selling opportunities.

They might track things like

Market sentiment: Is everyone feeling bullish (optimistic) or bearish (pessimistic)?

Trading volume: Is there a sudden surge in buying or selling activity?

Technical indicators: Charts and mathematical formulas that can suggest future price movements.

Bitcoin whales trading strategies

Unlike retail investors they take a long-term view of the cryptocurrency market and often use advanced investment tactics.

Market Dominance

Pump-and-dump schemes.

Social media hype creation.

Price control via strategic selling.

Capital Gain Tactics

Gradual accumulation at opportune moments.

Profiting from potential long-term appreciation.

Portfolio expansion via diverse crypto investments.

Momentum generation through timely acquisitions.

Manipulative Techniques

Exploiting stop-loss orders for better pricing.

Scare tactics to deter smaller competitors.

Artificial price movements influencing investor behaviour.

Can you spot a whale?

Keep an eye out for large trades on the Bitcoin blockchain.

Analyse trading patterns like spoofing or wash trading.

Monitor social media for whale commentary (though some operate anonymously).

Look for unexpected market movements that might signal a whale's presence.

Whale watching 101

Stay informed: Follow crypto news outlets and on-chain analysis platforms to track large Bitcoin transactions.

Consider the context: Don't blindly react to every whale movement. Look for patterns and consider broader market sentiment.

Do your own research: Whale activity can be a helpful indicator, but it shouldn't be your only investment strategy. Always conduct your own research before making any trades.

Follow what movements: Blockchain trackers on X, that help you identify big movements in the market - like Whale Alert.

The recent ones: Sleeping Bitcoin giant stirs

A Bitcoin whale that's been dormant for 10 years has woken up and moved $16.7 million worth of BTC.

The whale transferred the Bitcoin to two new wallets, so it's unclear if this is a sign of profit-taking.

Another whale has been on a buying spree, accumulating $89.75 million worth of Bitcoin in the past month and just recently buying even more.

Here's another one

Friend or Foe?

Whales can be a double-edged sword.

On the positive side, their large investments can boost confidence in Bitcoin and attract new investors.

They also add liquidity to the market, making it easier for people to buy and sell.

However, the downside is their power to cause significant price swings.

This volatility can be unsettling for new investors and make it difficult to predict the market's direction.

TTD Week That Was 📆

Saturday: Solana Congestion ⚖️ Solana Sell-off

Friday: Macro Tailwinds For Crypto? 🌬️

Thursday: Memecoins Boss 2024 Q1 🔥

Wednesday: Bitcoin Emoji Anyone? 🙏

Tuesday: Crypto Takes A Tumble 🔴

Monday: DEGEN Takes Off From Base 🪽

TTD Week in Funding 💰

Planet Mojo. $5.5 million. Web3 gaming metaverse platform to create a sustainable and expansive suite of games for the next generation of gamers.

QuantAMM. $1.85 million. Decentralised exchange designed to provide superior on-chain liquidity.

RootData. $1.25 million. Web3 asset data platform for both on-chain and off-chain data, providing higher data structure and readability.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋