What do Crypto scammers dig?

Crypto scammers feel the heat. Women Web3 founders need to catch-up. Bitcoin becomes 11th largest asset by market cap. YouTube boss upbeat about NFTs and Metaverse. NFT marketplace battle heats up.

Hello y'all. This is The Token Dispatch. Winter spares no one, crypto scammers are no different. Open Sea v Blur, gloves are off. Everybody loves a good fight, NFT marketplaces are no different. Dispatched trying our best to get through a contemplative Monday with a sumptuous amount of coffee, and scheming to make that perfect trade.

If you dig what we do, show us some love on Twitter, Instagram and Telegram #prettyplease

It's not just investors feeling the burn of the crypto market's ups and downs. Those sneaky scammers are also feeling the sting! As per Chainalysis report, In 2022 crypto they could only earn half of what they did the previous year!

In 2021, those guys raked in a whopping $10.9 billion, but this year they're down to just $5.9 billion! We feel for you, scammers, we really do.

Seems like their ill-gotten gains are directly tied to Bitcoin's crazy price swings. Who knew?

Scam Revenue Patters📈💰

🕵️♀️ Hyperverse was the top scam, generating almost $1.3 billion in revenue.

🤑 All ten of 2022's top scams were investment scams.

📉 Scam revenue throughout the year tracked almost perfectly with Bitcoin's price, except for romance and giveaway scams.

💰 Scammers increasingly turned to stablecoins for revenue from victims instead of Bitcoin.

⛏️ Scammers also saw a spike in Bitcoin use in mid-2022 when asset prices were trending down.

🎨 NFT-related scams get most of their revenue from the U.S.

💸 The majority of victim payments to scams come from centralized crypto exchanges.

🏧 At least $35.3 million was sent to scammers through crypto ATMs.

Big heartbreaks, bigger losses💔💸

Romance scams took an average victim deposit of almost $16,000, nearly triple the next-closest category.

And because these scams are so personal, a lot of victims might not even report them, so we don't really know how much money they're making. Unlike other scams, romance scams don't seem to care if the price of Bitcoin is going up or down - people are always looking for love! Investment scams are more likely to do well when the market is good. So, basically, romance scams and other types of scams have their own revenue patterns that don't always match up with Bitcoin's price.

Take the story of a sweet British lady who thought she found her knight in shining armor in the form of a U.S. Army surgeon she met online. They chatted for months, exchanging sweet nothings until the scammer convinced her to transfer some dough to a Bitcoin wallet. Next thing she knew, she was out of cash ($207,000👀), and the guy was out of sight! She had to resort to depositing cash in BTC ATMs all over Nottingham, and it wasn't until later on that she realised she had been had. Thankfully, the cops managed to retrieve some of her money!

Similarly, an unlucky chap from the U.K. got swindled by his online love interest. A lady named Jia persuaded him to invest in bitcoin using a sketchy app, and before he knew it, he had put in a whopping $200,000! *Sigh*

A Confusing trend🤔

Scammers used to prefer Bitcoin for their revenue fix, but in 2021, they started to turn to stablecoins. Even when Bitcoin was going up, they wanted the stable stuff. But when the market started going down, they were like, "Hey, remember that Bitcoin we said we didn't want? We want it now!". These scammers are smart and know that in a bull market, people are too busy hodling their Bitcoin to give it away, so they ask for stablecoins instead, which are less likely to go up in value.

Who's Getting Scammed? 👀

Different scams seem to work better in different parts of the world. NFT-related scams are most successful in the U.S. (since NFTs are really popular there), while investment scams are a big problem in Australia and some parts of South America. Scammers are probably just better at talking to people in their own language and culture.

Catch-up play for Women founder #GoWoman🚀

Breaking into the male-dominated crypto industry isn't easy, and It's time to cheer for the incredible women who are building successful brands in the male-dominated world of crypto bros.

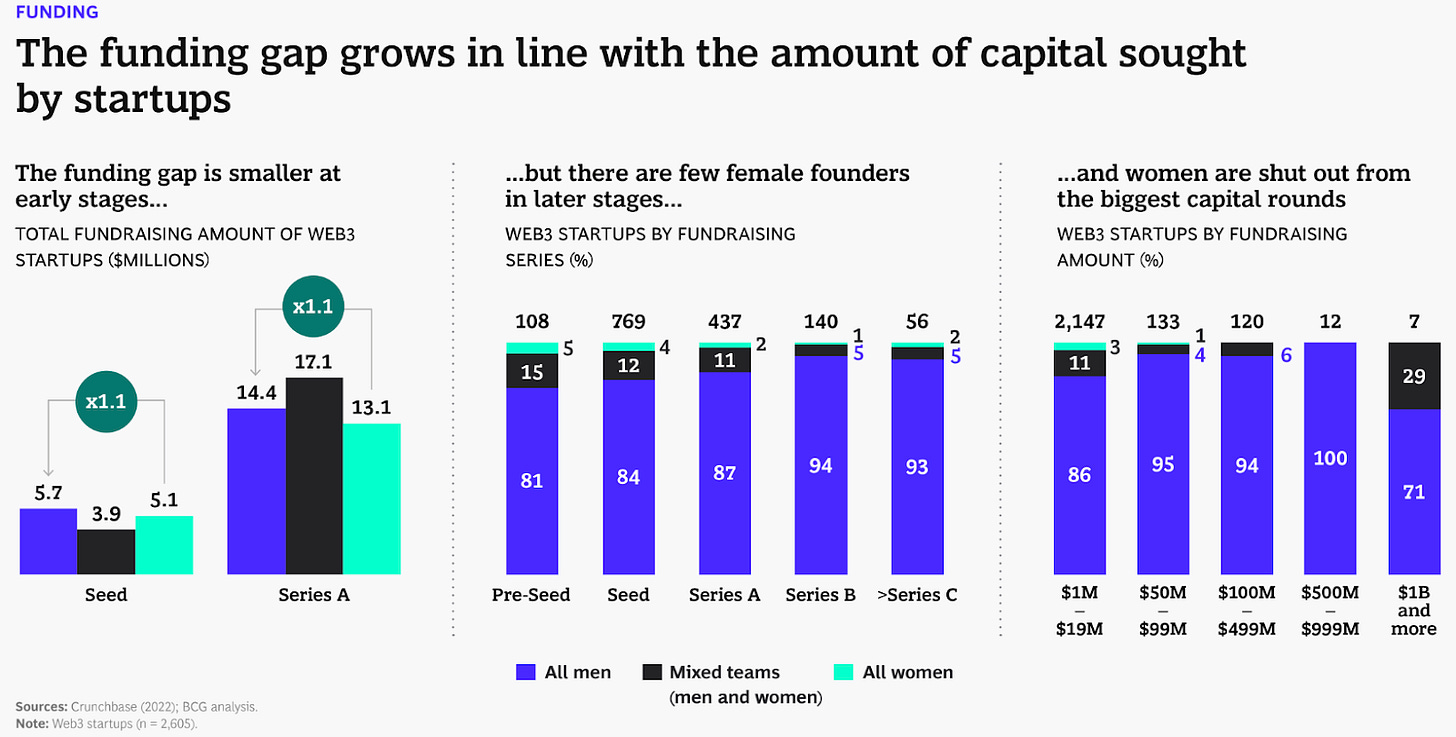

Recent research shows that women-led Web3 startups are at a disadvantage when it comes to raising capital, with male-only founding teams typically raising four times as much capital, or about $30 million compared to just $8 million for all-female teams. This may be due to the fact that only 13% of Web3 founding teams include a woman, and only 3% have teams exclusively made up of women.

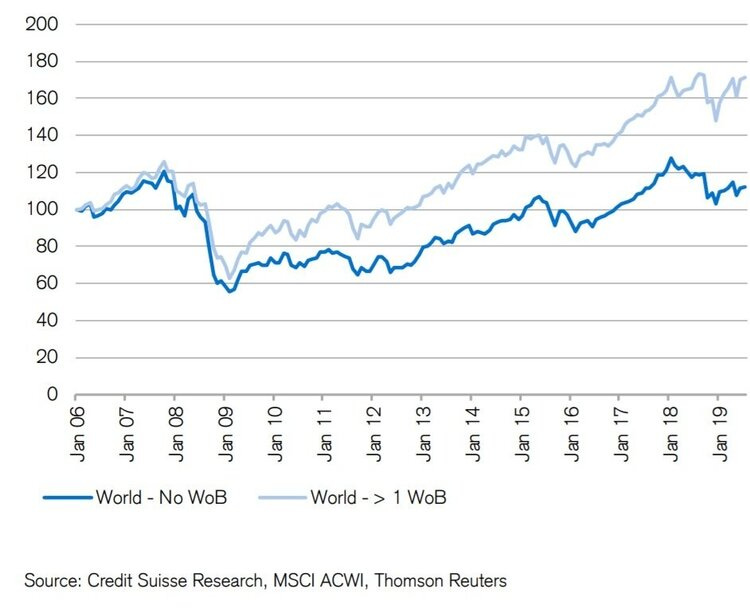

Despite these challenges, research suggests that having more women on founding teams brings many benefits. Women on corporate boards have been proven to have positive effects on performance, communication, problem-solving, and innovation. Companies with at least one woman on the board have seen 3.5 percentage points of excess compound returns per year, higher price/book valuations, and superior stock price performance.

City AM recently published an article about the gender gap in venture capital which reveals that blockchain firms with a female founder are more successful than All-male ones. #GoWoman 🎉

Bearish. Might be. Bullish. Definitely🔥

Bitcoin is the 11th largest asset by market cap in the whole damn world! and, bitcoin just overtook Visa and Mastercard in the money game! With a market cap of $469.87 B, Bitcoin is now richer than Visa and Mastercard combined. Visa's got around $400 billion and Mastercard has about $330 billion - not too shabby, but still no match for Bitcoin's awesomeness.

Even though some folks have been sceptical about Bitcoin and it's had some ups and downs, it's proven that it's got staying power in the world of finance. And get this - Bitcoin just bounced back from the FTX fiasco and has soared 48% since the start of the year, zooming past Visa for the third time. It's like a thrilling rollercoaster ride - one minute Bitcoin's in the lead, the next minute Visa's back on top.

Binance Out. Binance In.

So, CZ, the big boss of Binance, has said "false" to rumors that his company is thinking of booting US-based tokens off the exchange. He fired off a tweet about how "blockchain has no borders," all while Uncle Sam's regulators are looking into Binance and its crypto crew. Apparently, Binance US does its own thing, but a news report got people wondering when $400 million of Binance US's moolah was sent to a trading company run by CZ.

According to Reuters, Catherine Coley, the former CEO of Binance US, was left scratching her head when some unexpected transfers went down. But alas, she eventually left her role, making way for the former Coinbase big shot Brian Brooks to take over as CEO.

San Francisco wants to do what New York did

The Federal Reserve Bank of San Francisco is on the hunt for a super cool software engineer to join their team! What's the gig, you ask? Well, they're looking for someone to help design and implement systems related to a central bank digital currency (CBDC)! So, if you're into cutting-edge tech and you're ready to help revolutionise the financial industry, the job could be yours!

The posting says that the lucky candidate will be responsible for developing systems related to CBDCs, identifying improvements, and mitigating risks. There are already 45 applicants vying for the spot! That's some serious competition.

But wait, there's more! Over in India, they've already launched their digital rupee CBDC and are testing it out with 50,000 users and 5,000 merchants. The project is currently active in five cities, and nine more cities might be joining the pilot soon.

NFT #DailyBuzz🎨

YouTube Bullish. Polygon ready with the fuel: The new CEO of YouTube, Neal Mohan, is optimistic is excited about NFTs and the Metaverse believing "creators to build deeper relationships with their fans." Meanwhile, Ryan Wyatt, President of Polygon Labs, says 'the next Jeff Bezos will come from Web3.' -for him, the real thrill of Web3 is all about digital ownership.

OpenSea makes its move. Goes zero-fee as Blur steals their trading crew. To win them back, they made a few changes - zero fees, creators get their earnings, and other operators are treated with leniency.

NFTs on the LG TV near you as LG Electronics displayed showcased NFT artworks on their fancy OLED TVs in the USA. They teamed up with sculptor Barry X Ball to showcase some of his groovy works, including a moving NFT and a gold-plated statue, at an art exhibit.

TTD Surfer🏄

Blockchain.com denies attempts to sell assets to cover $270 million deficit caused by its major exposure to Three Arrows Capital.

Yuga Labs accused of IP theft for trademarking the iconic wolf skull logo of Bored Ape Yacht Club (BAYC) without proper licenses.

Former Boston Celtics player, Paul Pierce, has been fined $1.4 million by SEC for promoting the cryptocurrency Ethereum Max.

Platypus, a DeFi firm, is developing a compensation plan to reimburse users who suffered losses following a flash loan attack that resulted in the loss of around $8.5 million.

WallStreetBets leaders are trying to launch a decentralized app on a blockchain.

If you like us, do tell us. If you don't like us, still tell us. ✌️

Finally, after you done reading and telling, don't forget to share with everyone you love. Each one in your little, big world can sign up here. 🤟

So long. OKAY? ✋