What if Crypto Staking is banned in the US? Kraken Reels Under SEC Scrutiny

Hello,

In today’s dispatch we have:

Kraken Reels Under SEC Scrutiny

MetaMask pushes for India growth

Metaverse we love you. Steve don't

And more!

Crypto exchange, Kraken, is facing some heat from the Securities and Exchange Commission (SEC). They have been alleged of offering unregistered securities through their crypto staking-as-a-service platform, and now they have to pay a hefty $30 million to settle the charges.

So, what exactly is staking?

It's a way for crypto networks like Ethereum to maintain their security. Basically, validators in the network deposit crypto as collateral to show that they'll stay honest and in return, they get rewarded with more tokens for processing transactions. Many crypto users loan their tokens to staking-as-a-service providers like Kraken, to get a share of the returns.

Data shows that there are 1,233,728 ETH staked through Kraken, accounting for 7.42% of the total, ranking third in market share, second only to Lido (29%) and Coinbase (12%). Kraken said it would unstake users’ ETH after the Shanghai upgrade.

The SEC has alleged that Kraken's staking setup was a bit too risky for investors and the "easy-to-use platform" they advertised may have been misleading.

🚫Now what?

Kraken will be ending its staking services for U.S. customers immediately.

U.S. clients of Kraken will have their assets unstaked automatically, except for staked ether, which won't be unstaked until after the Ethereum Network's Shanghai upgrade.

U.S. clients will also be unable to stake new assets, including ether. Non-U.S. clients will not be affected.

Crackdown on Staking in the U.S.?

Rumour has it that the U.S. regulators are ready to put their foot down on the staking of cryptocurrencies that are done through U.S. exchanges. This news has the CEO of Coinbase, Brian Armstrong, worried and he's calling it a "terrible path" for the country.

Staking has been a sweet deal for centralised exchanges like Coinbase, Kraken and Binance as they try to find new ways to make more money other than just transaction fees. The SEC is also investigating Coinbase for staking activities, just like they did with Kraken.

💡Benefit for Decentralised Alternatives

The SEC's crackdown on staking may benefit decentralised alternatives such as Lido and RocketPool. Staking has become an important part of many high-value blockchains, making up around a quarter of the crypto industry's market cap. The government's actions against staking stem from a lack of regulations for crypto offerings of returns, which are currently only allowed for banks.

🤔 SEC's Motivation Debated Within Industry

SEC Commissioner Hester Pierce has publicly criticised the SEC for its handling of Kraken's staking program and has called for a more efficient and fair regulatory process. Meanwhile, Nic Carter, the co-founder of CoinMetrics, has accused the U.S. government of using the banking sector to suppress the crypto industry.

Banks Shunning Crypto Firms

Anti-Crypto Lawmaker Elizabeth Warren Reprimands Silvergate

Elizabeth Warren reportedly issued a letter to Silvergate, reprimanding the firm for providing banking services to FTX.

Signature Bank Shuts Down Crypto Accounts

Signature bank informed its customers that it would shut down their crypto accounts and return their money.

Binance announced that it would only process fiat transactions worth more than $100,000.

Metropolitan Commercial Bank Shuts Down Crypto Services

Metropolitan Commercial Bank announced a total shutdown of its crypto-related services.

Federal Reserve Denies Crypto Bank's Application

The Federal Reserve reportedly denied crypto bank Custodia's application to become a member of the Federal Reserve System due to high risk.

Joint Statement from the Fed, FDIC, and OCC

The Fed, the FDIC, and the OCC released a joint statement on Jan. 3 stating the risks banks face by engaging with crypto firms.

Banks were strongly discouraged from doing so, citing "safety and soundness" risks.

Regulators Caution Banks Against Dealing with Crypto Firms

Although the authorities did not openly ban banks from dealing with crypto clients, stringent policies and the DOJ's recent investigations against Silvergate serve as a deterrent to other banks.

A resurgence of Operation Choke Point (OCO) could be seen in the recent regulatory face-off with crypto firms.

Potential Loss of Crypto Businesses and Investors

Carter cautioned that if U.S. regulators don't reconsider their pressure on banks, they risk losing more crypto businesses and U.S. investors to regions with less sophisticated jurisdictions.

Metaverse we love you. Steve don't

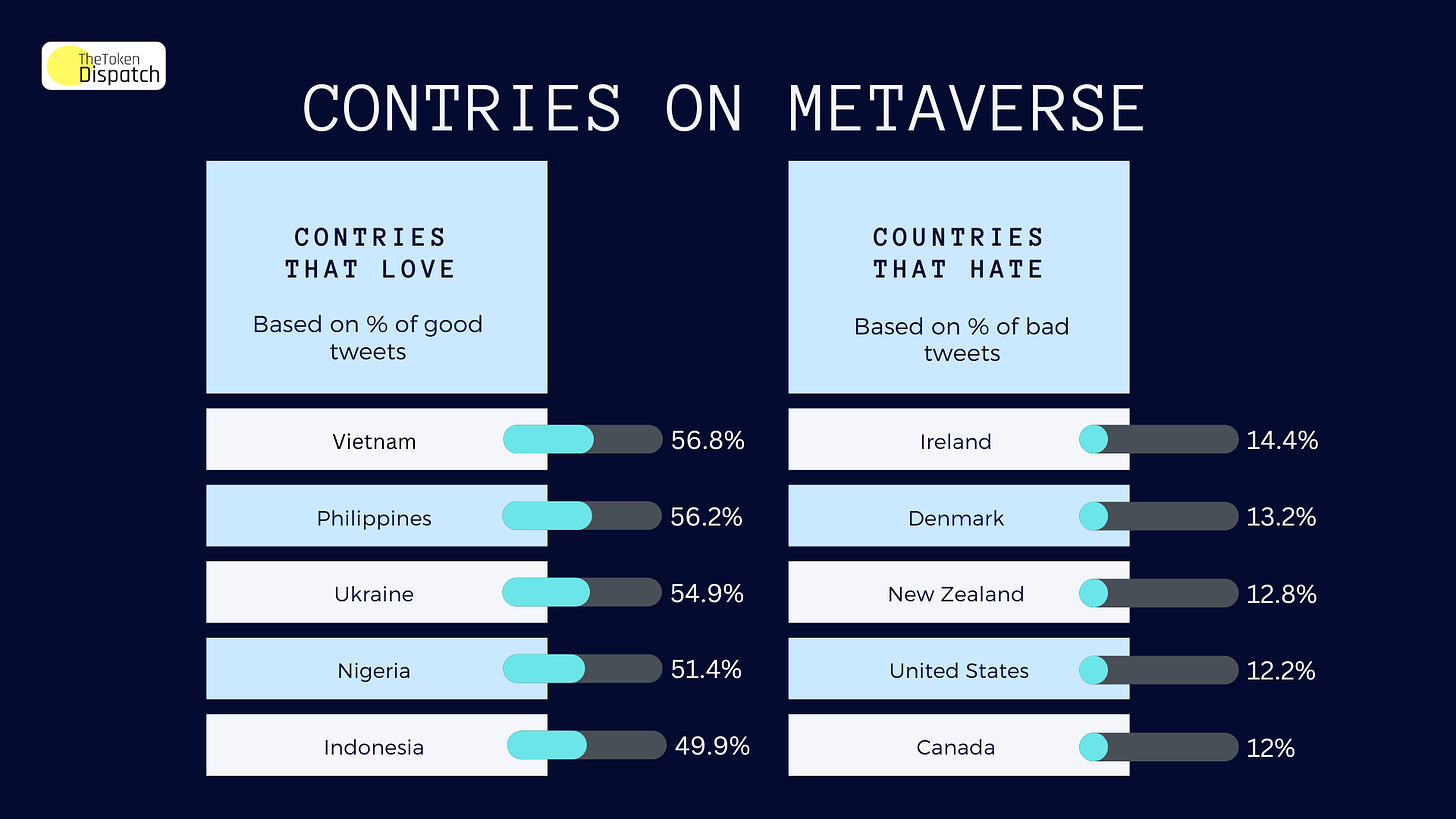

The metaverse is all the buzz! But not everyone is a fan. According to a recent analysis of 1.6 million tweets, Vietnam is feeling the love for the metaverse, but Ireland is feeling a bit skeptical. Meanwhile, in East Asia, people are generally positive about this virtual world, but Western countries are more skeptical.

But don't worry, Paris Hilton is here to bring some love to the metaverse! She's launching a virtual dating reality show called Parisland, where players will get to experience all the excitement of finding love in a virtual world. With tasks like choosing wedding rings, flirting with other contestants, and having a wedding with Paris DJing, it's sure to be a blast!

Meanwhile, Steve Wozniak, co-founder of Apple, doesn't share Paris's excitement. He thinks that the metaverse will just be entertainment and that humans won't be able to fully immerse themselves in the digital world. He sees it as a fun hour of enjoyment, but nothing more.

“Metaverse is tough. You can put on some of the most amazing experiences in the world. But after an hour, I’ve had enough. I see it as entertainment.”

MetaMask pushes for India growth

MetaMask announced its partnership with Onramp.money, which will enable users in India to buy cryptocurrencies directly from the MetaMask wallet. This partnership is going to boost crypto activities in India, even though regulations are a bit of a challenge.

The finance minister didn't even say anything about crypto in her budget speech, but she did mention the importance of having a clear plan for regulating it. With this integration, it'll be super easy for Indians to invest in Ethereum, BNB, and Polygon Chain, and use them in all sorts of DeFi apps.

LocalBitcoins shuts down. Coin Cloud goes bankrupt

It looks like the crypto-winter has now hit two of the early players in the game. LocalBitcoins, a popular peer-to-peer Bitcoin exchange, is calling it quits after a decade in the biz. The team cited the tough times in the crypto world as the reason for the shutdown. New signups have been put on hold, and customers have a year to withdraw their funds. But don't wait too long!

And Coin Cloud, one of the biggest cryptocurrency ATM operators, has taken a hit and filed for bankruptcy in the US. The company has assets estimated between $50 million to $100 million and liabilities estimated between $100 million to $500 million. They operated over 5,000 crypto ATMs across the US and Brazil, offering the ability to buy and sell over 40 cryptocurrencies. But, even with being the second largest crypto ATM operator with 4,826 machines, the crypto-winter has proven too much for Coin Cloud to handle.

Who is buying BBHMM NFT? 💥

Rihanna is about to drop some serious NFT heat with her hit song "B*TCH Better Have My Money". There are only 300 limited edition copies up for grabs, and each one will set you back about $210 in ETH. But don't worry, it's worth it - not only do you get a piece of digital art, but you'll also get a slice of the song's streaming royalties. It's like being in a secret club with RiRi. And if that wasn't enough, she's also slaying the halftime show on February 12. Michel D. Traore, CEO of another block, said that they are excited to use their drops to help fans connect with their favourite music and show their support for the artists.

TTD Surfer 🏄🏻

Flare Network announces a partnership with Uppercent, a Web3 ed-tech startup, to launch “Masterclass-like” courses on the blockchain.

The New York University School of Professional Studies to launch Web3 learning workshop in partnership with Near Protocol

Binance is working with Canadian University Dubai to boost cryptocurrency adoption.

German bank DekaBank is planning to launch a blockchain-based tokenization platform in collaboration with the digital asset firm Metaco.

Fan token platform Chiliz has launched its own layer-1 Ethereum Virtual Machine (EVM) compatible blockchain ecosystem