What is MicrosStrategy Orange? 🍊

Decentralised identity solution built on the Bitcoin blockchain using Ordinal-based inscriptions. Does it add legitimacy or deviates from Bitcoin's core principles, it's an open debate.

Hello, y'all. Feeling orange 🥁

Do try the Music Quiz Game 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 find all about us here 🤟

MicroStrategy, the company with the most Bitcoin on its corporate balance sheet, is venturing into the world of decentralised identity (DID) with a solution called MicroStrategy Orange.

What is it about? This new system lets you control your identity on the Bitcoin blockchain, without relying on a central authority.

What are decentralised identifiers on Bitcoin?

Bitcoin, while primarily known for its cryptocurrency function, can also be leveraged for decentralised identifiers (DIDs).

DIDs are unique identifiers that function like usernames but without a central authority controlling them. This offers several advantages.

User Control: Users own and manage their DIDs, giving them more control over their digital identity.

Privacy: DIDs themselves don't contain personal information. Instead, they link to verifiable credentials that users can choose to share selectively.

Security: DIDs are cryptographically verifiable, making them resistant to forgery or tampering.

In layman terms: Imagine a username you control, not a website.

That's a Decentralised Identifier (DID) on Bitcoin.

It's like a digital ID card you keep safe.

You can prove you own it without showing personal details, like a social security number.

Bitcoin helps store this DID and verifies it's real, giving you more control over your online identity.

Bitcoin achieves DIDs through a couple of methods.

Bitcoin Name System (BNS): Similar to how domain names work on the web, BNS allows users to create unique Bitcoin usernames stored on the blockchain. These usernames function as DIDs, offering a user-friendly way to identify yourself.

DID Methods: There are specific protocols designed to anchor DIDs on the Bitcoin blockchain. These methods, like the "did:btcr" method, provide a standardised way to create and manage DIDs using Bitcoin's infrastructure.

MicroStrategy Orange

MicroStrategy Orange is a DID system built on Bitcoin.

It aims to provide "trustless, tamper-proof and long-lived" decentralised identities (DIDs) that are secure, efficient and reduce transaction fees.

Unveiled at Bitcoin for Corporations conference in May 2024, the company sees it as a way to potentially bring over one billion unbanked people into the financial system using Bitcoin.

It uses the blockchain's security and global network to create tamper-proof digital identities.

Aims to be completely transparent and open-source, with no reliance on separate blockchains.

How does it work? Orange leverages Ordinals, a technology that lets you "inscribe" data onto individual Satoshis (smallest Bitcoin unit).

Issuing DIDs to users and organisations that allow pseudonymity, similar to how Bitcoin transactions are not linked to real-world identities.

Storing DID data in the witness section of Bitcoin transactions using Ordinals, which keeps the data immutable and resistant to tampering.

Comprising an Orange Service cloud to issue DIDs, an SDK for customisation, and pre-packaged Orange Applications.

Integrating with email (Orange for Outlook) and other messaging platforms, social media, e-commerce, enterprise and fintech to provide digital identity verification.

This inscription space stores your DID information.

Stores DID information directly on the Bitcoin blockchain using inscriptions.

Allows updates to DID content and keys while keeping the original identifier itself permanent.

Enables DID deactivation by "spending" an associated unspent transaction output (UTXO).

Uses JSON, a common data format, for updates.

Capable of processing a massive 10,000 DIDs in a single Bitcoin transaction

What are the benefits?

Enhanced Security: Leverages the Bitcoin network's robust security for DID storage.

Pseudonymity: Similar to Bitcoin, DIDs won't be directly linked to real-world identities.

Scalability: The system can handle a large number of DIDs efficiently.

Real-world use case

Email Security: MicroStrategy has already built "Orange For Outlook," which verifies email senders using DIDs.

Enterprise Applications: Potential for DIDs to be used across various business areas like e-commerce and finance.

Social Media and Messaging: Identity verification could be integrated into social media platforms and messaging apps.

Benefits of Bitcoin: By using Bitcoin, Orange takes advantage of its robust security and decentralised network.

Technical Details: Orange utilises a modified version of Ordinals inscriptions. It also benefits from SegWit, a Bitcoin upgrade that reduces transaction sizes and costs.

What’s the criticism?

Some Bitcoin purists object to adding data like DID information to the blockchain, fearing it could bloat and slow it down.

This echoes the controversy surrounding Ordinals and meme coins on Bitcoin.

Some accuse MicroStrategy of promoting "institutional spam" and compromising Bitcoin's core principles.

Company’s Bitcoin Holdings

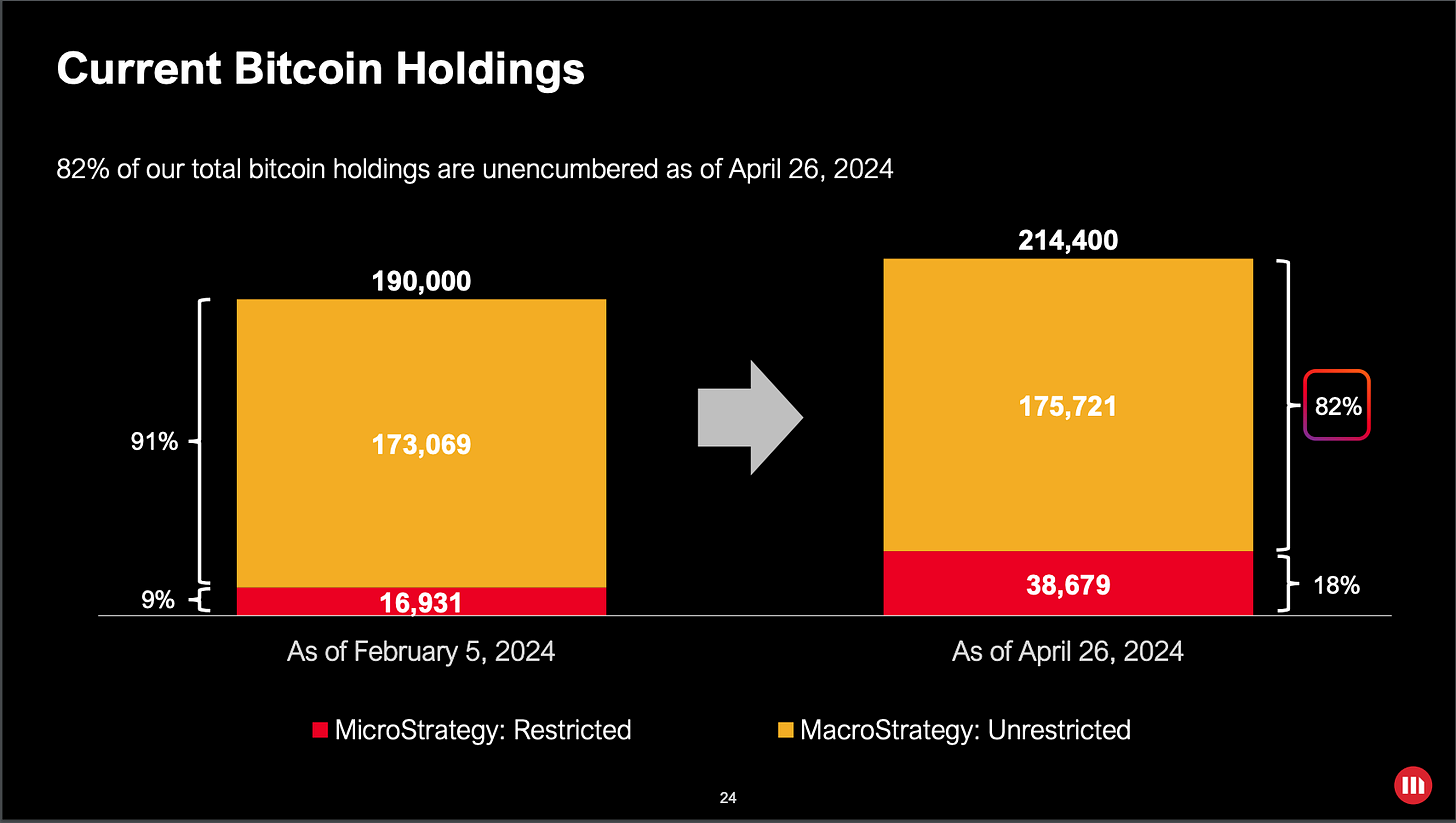

According to MicroStrategy’s Q1 results, the firm currently holds 214,400 BTC.

Graduate To Big Leagues.

MicroStrategy is set to join the Russell 1000 Index.

This change will be part of the annual Reconstitution Process, with the new indexes going live when markets open on July 1, 2024.

The Russell 1000 Index tracks the highest-ranking 1,000 stocks in the Russell 3000 Index, which means MicroStrategy is transitioning from the small-cap Russell 2000 Index to the large-cap Russell 1000 Index.

This move is significant as it reflects MicroStrategy's growth and potential to attract more investors.

Saylor cheers Ethereum ETF approval

Michael Saylor, a vocal Bitcoin advocate and founder of MicroStrategy, surprised many with his recent stance on the approval of spot Ether ETFs - watch.

“Is this good for Bitcoin or not? Yeah, I think it’s good for Bitcoin, in fact, I think it may be better for Bitcoin because I think that we are politically much more powerful supported by the entire crypto industry.”

Previously skeptical of these ETFs, Saylor now sees them as a positive development, even for Bitcoin. Saylor believes these ETFs act as "another line of defense" for Bitcoin, potentially boosting its overall legitimacy.

TTD Week That Was 📆

Saturday: Approval In. What Now? 🤷♂️

Friday: Ethereum ETFs Day 🎉

Thursday: Crypto Wins. FIT21 IS A GO 🔝🤝🏻

Wednesday: Ethereum ETF Countdown⏱️

Tuesday: Ballad Of Ethereum ETF 💃🕺

Monday: Crime In Crosshairs 🎯

TTD Week in Funding 💰

Farcaster. $150 million. Decentralised social network for developers to create social networks, an open protocol that supports multiple clients, similar to email.

Plume Network. $10 million. Layer 2 blockchain platform that integrates real-world assets into the blockchain with fast transactions and low fees.

Weather XM. $7.7 million. Weather network that utilises crypto incentives to improve the accuracy of forecasts, earn rewards for collecting and validating data.

Pencils Protocol. $2.1 million. Decentralised platform for auction services for blockchain native assets and RWAs, and leveraged yield aggregation services.

Alphaledger. $9.5 million. Loan and bond marketplace that streamlines debt financing and increases direct engagement with investors.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋