What Is WATER 🚰

Messi, Ronaldinho pump Solana memecoin: what’s the deal? Memecoins a legal minefield for celebs. MicroStrategy most profitable short play in the US market last quarter. USDC hits $23B trading volume.

Hello, y'all. This is WATER, and it is heavy 🎙️

Do try the Music Quiz Game 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 find all about us here 🤟

What is WATER?

This is WATER 👇

Why is everyone talking about it?

A little-known Solana memecoin.

Not-so-little ever since football legends Lionel Messi and Ronaldinho both posted about.

What happened to WATER?

Good things.

It’s become a Messi endorsed crypto project.

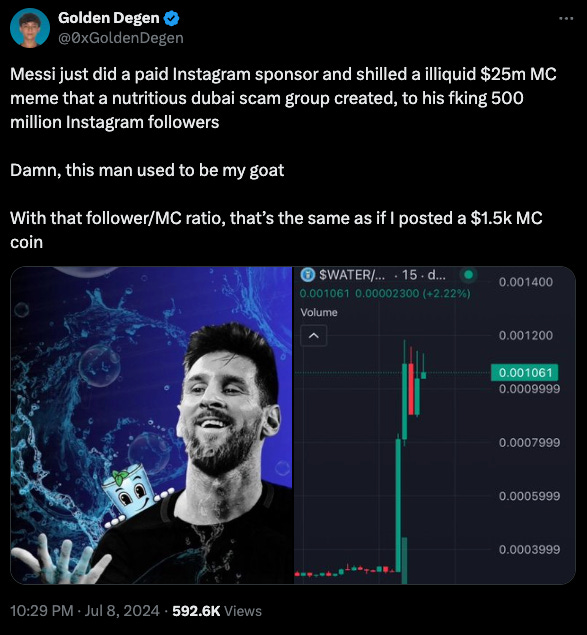

His Instagram story (which stayed up, unlike some shady promos) sent WATER soaring 194% on July 8.

Ronaldinho followed suit with a similar post.

Did Messi accidentally promote a questionable crypto project?

Is this another pump and dump memecoin?

So many questions.

Reality check: WATER is now trading at $0.00089, 4 % down in 24H.

Down 71% from its June 26 all-time high.

Fans are speculating that Messi's account might have been hacked by crypto tricksters.

With 500 million followers, wouldn't that be a hack for the history books?

Messi and Ronaldinho haven't been hacked, and both have dabbled in crypto before.

Messi backs Socios and Sorare, while Ronaldinho … well, he got burned by a fake crypto project in 2023.

So what's the deal with WATER?

WATER coin was launched on June 24th, following a presale and a "collaboration" with the BEER meme coin (both with similar branding).

Holders of over 1 million BEER tokens were promised an airdrop of WATER, hinting at a possible connection between the two projects.

WATER positions itself as a "charity token," but details are scarce.

Their website mentions a "publicly known" charity wallet, but the address remains a mystery.

They also claim 25% of tokens sent to a "burn contract" will be donated to unspecified charities.

Questionable Roadmap: WATER's roadmap includes an NFT collection, eco-friendly projects, and prizes for holders – a Maldives vacation, a world cruise, and even a mid-sized yacht (seriously?).

Red flags abound

Similar Branding to BEER: The resemblance in art style and website design between WATER and BEER raises concerns, especially with BEER's recent price crash (down 94% from its peak).

Large Insider Holdings: On-chain data suggests 30% of WATER's supply might be controlled by insiders, potentially allowing for manipulation.

Vague Charity Efforts: The lack of transparency around charity recipients raises doubts about their commitment to good causes.

The disappointed DEGENS

What’s up with the fellow Solana memecoins?

While Bitcoin takes a beating from US and German government sell-offs and Mt. Gox repayments, some meme coins are seeing gains.

Doja Cat's X Hacked

Rapper Doja Cat's X account was hacked on July 8th.

What do we know?

Hackers promoted a fake token named "Doja Cat (DOJA)" through the account.

The token's market cap surged to $1.65 million before crashing to $16k.

Investors lost over $1.63 million due to the scam.

Doja Cat denied involvement, calling the post an "imposter."

The hack also included negative comments about Iggy Azalea.

Iggy Azalea defended Doja Cat and criticised the hackers.

A trader misses millions

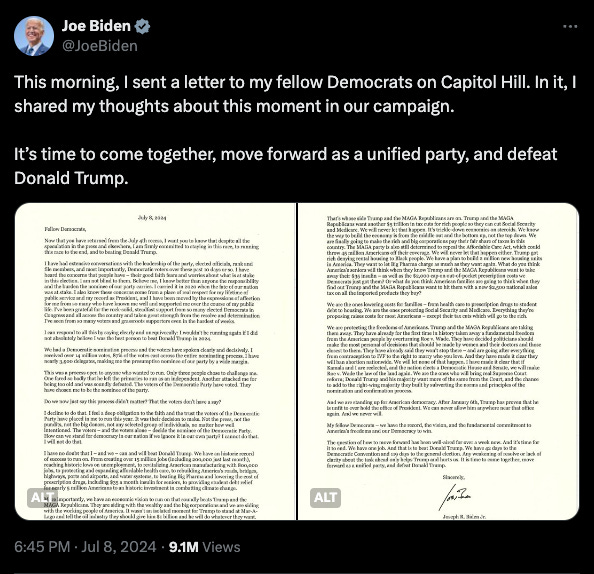

A Solana memecoin trader held over $5 million in BODEN (Joe Biden-themed) tokens in early April.

Firetruck.sol bought BODEN tokens for $227,000 in March, shortly after launch.

Could have sold for $5.4 million at the peak on April 10th.

But, he held onto the tokens as their value plummeted.

Then? sold for just $139,000 on July 9th, a 97% loss from the peak.

They sold on July 9th for a fraction of the price, missing a massive profit opportunity.

BODEN surged recently after Biden's letter reaffirming his candidacy.

Block That Quote 🎙️

Social media personality, Andrew DADDY Tate

”Before I could do anything in the crypto space, I had to prove I was the king of the crypto space.”

Tate, the internet's favourite (or maybe least favourite) controversial figure, is diving headfirst into the world of crypto.

... and not everyone is convinced he knows how to swim.

“The crypto culture before I jumped into a month ago was a mess … Once I decided I was going to fix it. I decided I had to come up with an idea that allowed people to make money from the things they should make money from, which is hard work, which is dedication.”

Hates the game, wants to change the rules (maybe after making a buck)

“I didn't like the crypto culture as a whole because the culture was based on getting in early, which I guess you could argue is a skill, but to a degree, is luck … In the real world, if you want to get rich, it's nearly impossible to get rich without learning lessons along the way.”

Tate says he finds the "get rich quick" mentality of crypto culture childish.

Funny, considering his recent promotion of a meme coin called $DADDY 🙄

He claims he wants to fix crypto and make it about "hard work" and "dedication," but his methods so far involve... promoting meme coins.

He points to the success of $DADDY compared to Iggy Azalea's $MOTHER coin 🦗

Tate promises a "global tour" and a detailed video explaining his grand crypto vision.

Memecoins A Legal Minefield For Celebs?

Anyone can create a memecoin,

The massive reach and influence of social media make them go viral overnight.

This has celebrities lining up to launch their own memecoins.

With that, the potential or cashing in big.

We know that: Celebrity Memecoin Chaos 🙆♀️

While meme coins offer the allure of community building and potential riches, they can be a legal minefield according to former law professor Carlo D’Angelo.

Pump-and-dump Schemes: Fraudulent actors can exploit the hype to inflate prices and then dump their holdings, leaving investors with heavy losses.

Regulators on the lookout: For schemes, and celebrities promoting them could face civil or even criminal charges.

Misleading claims: Promising unrealistic gains or falsely representing the token's future utility can be grounds for lawsuits if investors lose money.

Securities vs Commodities: The legal classification of a meme coin (security or commodity) determines the regulations that apply. Regardless, fraudulent marketing can lead to penalties.

SEC is watching

Token launches by stars like Caitlyn Jenner and Jason Derulo has caught the eye of the US SEC and could lead to lawsuits.

Both Jenner and Derulo distanced themselves from Sahil Arora, a controversial figure linked to their tokens.

Lawyers warn that if their involvement is proven, it won't shield them from legal trouble.

Lawyers believe these memecoin promotions could violate securities laws.

Creo Legal founding director David Chung.

“The SEC could potentially go after her [Jenner] for selling unregistered securities without an appropriate license”...”Nothing gets the SEC to act faster than shilling a memecoin.”

In The Numbers 🔢

$1.1 billion

Profit made by short sellers betting against software company MicroStrategy in the last quarter - new report from financial data firm S3 Partners.

Short sellers are piling into bets against companies they believe will fall in price, and some big names in crypto are high on their target list.

MicroStrategy most profitable short, sellers are up nearly 23%. Short interest nearing $5 billion, translating to $1.1 billion profit.

Coinbase wasn't far behind, ranking as the 6th most profitable short. Bears are up 20%. Pocketing $500 million on their $2.4 billion short position.

Chipmaker Nvidia, the most shorted stock on the market at almost $30 billion in short interest. The stock went up 48% in the second quarter. Short sellers are down 31%, translating to a $9.4 billion loss.

Short interest in the US\Canada markets increased by $57.9 billion, that’s +5.1%, to $1.20 trillion in the second quarter of 2024.

VC Partner Accused Of Side Deal

Polychain just found out its ex-partner, Niraj Pant, was moonlighting with Eclipse Labs.

Accused of making an unauthorised deal with Eclipse Labs, violating fund policies.

Deal Details: Pant allegedly received a secret allocation of 5% of Eclipse's upcoming crypto token, reduced later to 1.33% worth $13.3 million.

Here’s the twist: Niraj got these tokens just after he convinced Polychain to invest a hefty $6 million in Eclipse.

But shh, he didn’t tell anyone.

This secret deal was so hush-hush that not even the top bosses at Polychain knew about it until Niraj had left the company.

CoinDesk's investigation uncovers the undisclosed deal involving former Eclipse Labs CEO Neel Somani.

Pant confirms receiving tokens but claims no formal deal was made until after Polychain's investment in Eclipse.

Polychain was in the dark about this until Niraj left the building in 2023.

They’re not thrilled about the surprise.

Background: Polychain, founded by Olaf Carlson-Wee, is a major player in the crypto venture space, with over $11 billion in assets under management.

Current Role: Niraj Pant is now co-founder of the blockchain AI startup Ritual, another Polychain investment.

The Surfer 🏄

USDC's trading volume has reached $23 billion, surpassing other regulated stablecoins. USDC's weekly trading volume has more than doubled in 2024, compared to the previous year.

PayPal's stablecoin, PYUSD, has surpassed a market cap of $500 million. The supply of PYUSD has grown from 270 million to over 533 million in the past month.

BlackRock's tokenised fund, BUIDL, has surpassed $500 million in market value. It has become the largest blockchain-based tokenised fund, surpassing Franklin Templeton's FOBXX fund.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter and Instagram🤞

So long. OKAY? ✋