What will happen to NFTs in 2024? 🔮

NFTs had a tough year but made a comeback. But what about 2024? 2023 Highlights: Bitcoin Ordinals, Nickelodeon, and them Pudgy Penguins. 2024 Trends: Utility, mass-market, and sustainability.

Hello, y'all. Sunday we give our hearts and minds looking back and looking ahead ...👇

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

NFTs had a rough year.

But we are happy about the rebound.

Read: Is NFT winter over? 🕵️

2023 saw renewed interest in NFTs, with their integration into mainstream retail and online spaces, and the launch of major blockchain-based games.

What happened in 2023?

Rise of Bitcoin Ordinals: Software engineer Casey Rodarmor introduced Bitcoin Ordinals, creating "digital artifacts" on the Bitcoin network, addressing issues of blank images and content storage.

Optional Royalties Model: NFT marketplaces experimented with optional royalties, leading to creators losing out on royalties. Some marketplaces like Rarible and Enjin took steps to support creators and ensure royalty payments.

Nickelodeon NFTs: Recur's NFTs featuring classic kids' cartoons, such as "Rugrats," which became available at low prices after the platform's closure.

NFT Market Activity: Despite criticism, NFTs continued to thrive, with top blockchains recording over $1.5 billion in sales volume in the last 30 days of 2023.

Game of Thrones: Build Your Realm: NFT avatars tied to the Game of Thrones franchise that received criticism for their design and lack of appeal.

Bitcoin vs. Ethereum: Bitcoin's Ordinals transactions boosted its sales volume, surpassing Ethereum in monthly and 30-day sales, signalling competition in the NFT space.

Stoner Cats: An animated web series backed by Mila Kunis and Ashton Kutcher that sold Ethereum NFT access passes but faced SEC charges, leading to bans on trading.

Trump NFTs: Former U.S. President Donald Trump's multiple NFT collections, including a "MugShot Edition," with varying degrees of success and humour.

SEC's Regulatory Actions: The U.S. SEC charged companies like Impact Theory and Stoner Cats 2 for selling unregistered securities in the form of NFTs, raising concerns about regulatory scrutiny in the NFT space.

As we enter 2024, how optimistic are we about the future of NFTs?

Shift towards utility: The focus will move away from purely speculative NFTs towards those with real-world utility. This could include NFTs used for:

Ticketing and access control: Imagine using NFTs for event tickets, concert passes, or even gym memberships.

Fractional ownership of real-world assets: The tokenisation of RWAs is predicted to continue, expanding NFTs' utility beyond just profile pictures (PFPs).

Digital identity and reputation: NFTs could be used to store and manage personal data, such as medical records or educational credentials.

Shift in NFT Strategy: Future successful NFT projects will likely target a broader consumer market with large quantities and affordable prices, focusing on direct value creation over speculation.

Mass-Market NFTs and Brand Involvement: Major brands like Nike, Reddit, Starbucks, and even Donald Trump have experimented with mass-market NFTs as digital collectibles. NFT-native brands are exploring "phygital" activations, combining physical products with associated NFTs.

Accessible Digital Assets: NFTs are becoming more user-friendly, often integrated into platforms with partially or fully custodial wallet systems.

Community Building Through NFTs: NFTs enable brands to transform customers into communities, linking them to the brand and each other.

Example: Starbucks Odyssey.

Niche communities will form around specific interests and use cases.

Focus on sustainability: The development of more sustainable blockchain solutions and a greater emphasis on energy-efficient NFT minting processes.

Increased regulation: Governments are likely to take a closer look at the NFT market in 2024, potentially leading to new regulations.

GameFi Revolution: NFTs to transform gaming with true ownership of in-game assets and play-to-earn models.

Bitcoin NFTs Mainstreaming: Bitcoin-based NFTs, like Bitcoin Ordinals, are expected to gain more traction due to their on-chain data storage and the inherent security and scarcity of the Bitcoin blockchain.

NFT-fi and Decentralised Finance: Financial innovations like lending, borrowing, and fractional ownership using NFTs.

Immersive Art Experiences: Interactive and dynamic NFTs for unique art appreciation in virtual galleries.

AI-Powered NFTs: Artificial intelligence is expected to personalise NFT experiences, offering tailored engagement and new creative use cases.

The recent signs of comeback

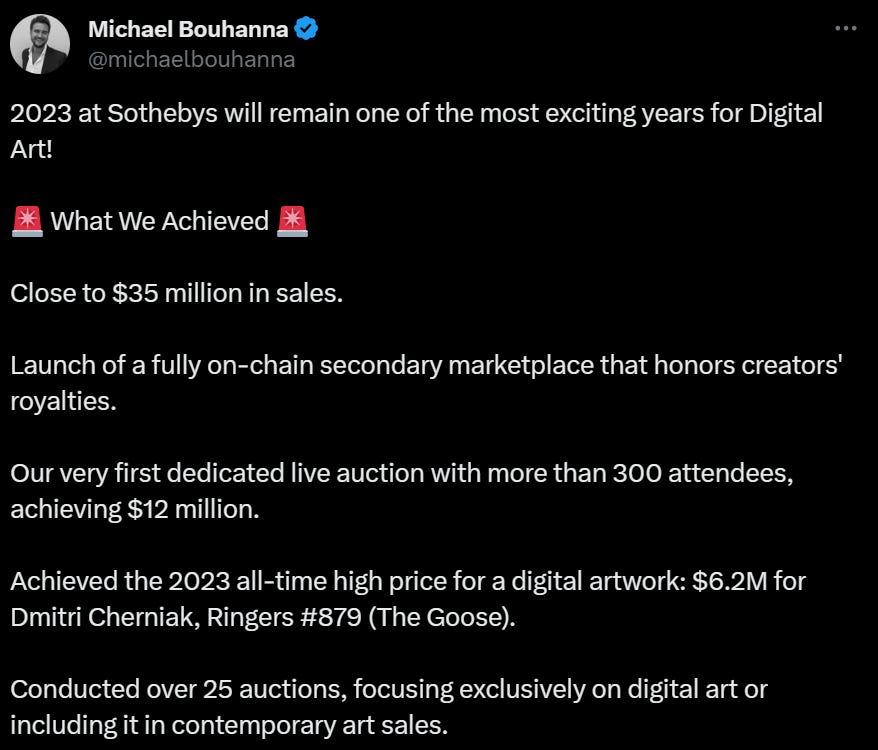

The big Sotheby's number: Sotheby's, the fine arts auction house, had a successful year in digital art sales, making around $35 million.

F1 x NFTs: Red Bull's Formula 1 team is releasing a collection of NFTs to celebrate their dominant season in 2023. With drivers Max Verstappen and Sergio Pérez leading the standings, Red Bull emerged as the top team.

Penguins on top: Pudgy Penguins, the NFT-linked toys, are set to launch a Webkinz-like virtual world called Pudgy World in 2024.

Read this: It's a Pudgy World 🐧

Challenges Ahead

Scam and bubble fatigue: The initial hype surrounding NFTs led to numerous scams and speculative ventures that left a negative image. Regaining public trust and showcasing legitimate use cases will be crucial.

Environmental concerns: The energy consumption of some blockchains used for NFTs generates criticism and potential regulations. Finding green solutions will be vital.

Regulatory Complexities: The NFT space continues to face regulatory uncertainties. While progress is being made in the crypto asset domain, NFTs still operate in a regulatory grey area, making the establishment of a clear legal framework crucial as the market grows in 2024.

TTD Week That Was 📆

Saturday: Will AI and Crypto score big in 2024? 👩🎨

Friday: ETF: Yay or Nay👍🏻👎🏻

Thursday: Bitcoin's Peekaboo 🙄

Wednesday: A Cold Red Birthday 🔻

Tuesday: 2024 Crystal Ball🔮

Monday: Ethereum's 2024 game plan 🎊🎈

TTD Week in Funding 💰

Bracket Labs. $2 million. Launch of "Passage," a volatility trading product available on the project’s BracketX trading platform..

Character X. 2.8 million. Decentralised synthetic social network that combines AGI technology with blockchain.

Powerpod. 1 million. Shared EV charging network powered by blockchain technology and economics.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋