Hello dispatchers!

Let’s start with a smart quote by Matt Hougan, Bitwise CIO.

"It's hard to tell yourself that you're building a new and better world on the basis of Fartcoin."

This time, though, we are looking at the real (very subjective) crypto numbers. Yes, staggering is the word.

Robinhood's revenue from crypto business up 700% year-on-year in Q4.

Coinbase hitting $2.9 billion in revenue in 2024.

Wall Street analysts scrambling to raise targets.

When crypto prices surge, people trade where they're comfortable. The familiar apps. The trusted names.

But familiarity isn't always sustainable.

Beneath these headline-grabbing numbers lies a more complex story. About market cycles. About user behaviour. About what happens when the hype fades.

Are these platforms truly evolving? Or just riding another crypto wave?

Personal Security Layer for Crypto Transactions

Record-Breaking Numbers

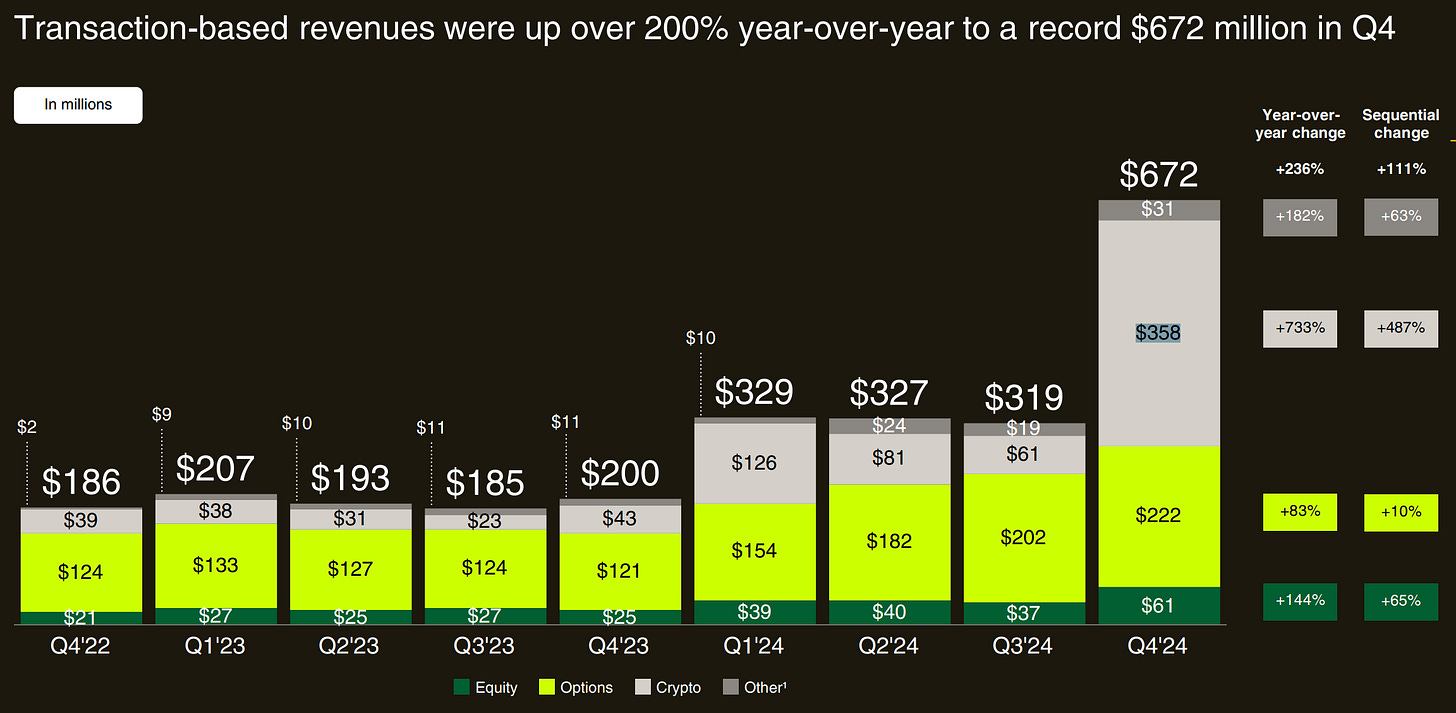

Robinhood's fourth-quarter spread was nothing short of spectacular.

On February 13, the trading app reported $358 million in crypto transaction revenue — its highest contribution from digital assets ever — accounting for over half of its $672 million in transaction-based revenues.

Overall revenue soared 115% year-over-year to $1.01 billion, leaving Wall Street's estimate of $945.8 million in the dust.

The market's reaction was equally impressive. Robinhood's stock jumped 13% in early trading on the day.

JPMorgan raised its price target to $45, Citi bumped it to $60, and Bernstein — in a particularly bullish move — more than doubled its target to $105.

How’s it going?

Coinbase Q4 Story

Coinbase served up its own feast of impressive numbers too.

Fourth-quarter revenue hit $2.27 billion, demolishing the Street's $1.84 billion estimate.

Trading volume exploded 185% year-over-year to $439 billion, while transaction revenue surged 194% to $1.56 billion. For the full year, Coinbase's revenue more than doubled to $6.1 billion.

The catch? These numbers rode a perfect storm of circumstances. Trump's November election victory triggered an unprecedented surge in crypto prices. Robinhood's crypto trading volume jumped 530% to $35 billion — six times the previous month's level.

When prices rise this dramatically, people trade. It's that simple.

This isn't necessarily sustainable growth. It's what happens when retail traders rush to familiar platforms during a market frenzy. The same platforms that saw trading volume evaporate during the 2022 crash.

Trump's promise to make America "the crypto capital of the planet" has fundamentally changed the game. He's already appointed a crypto czar, nominated pro-industry candidates for key positions, and fired off sweeping executive orders.

Read: The On-chain President ⛓️

Yet something more interesting might be cooking beneath this sugar rush. Both companies are using this windfall to build more sustainable business models.

Get 17% discount on our annual plans and access our weekly premium features (HashedIn, Wormhole, Rabbit hole and Mempool) and subscribers only posts.

What's Next on the Menu?

Both companies are cooking up ambitious expansion plans that go far beyond their traditional offerings.

Robinhood's Global Ambitions

The trading app isn't content with just dominating the US market. Through its $200 million Bitstamp acquisition, Robinhood is plotting a significant expansion into Singapore, aiming to launch crypto trading products by late 2025.

"Part of the reason why Bitstamp was attractive was because of their licenses with Singapore, in addition to its institutional business," explains Johann Kerbrat, Robinhood's crypto chief.

But that's just the appetizer.

Robinhood is also teasing bitcoin futures trading alongside oil and gold.

This move positions them squarely in competition with traditional futures markets — a bold step for a company that started with simple stock trading.

The company's also embracing the memecoin mania that's gripped the market since Trump's election. Despite the recent "Libragate" debacle that vaporised $4 billion in market cap, Robinhood remains committed to listing new tokens that customers demand — as long as they can do it safely.

Read: When Presidents Play With Memes 🏛️

Coinbase's Platform Play

Meanwhile, Coinbase is cooking up its own expansion feast.

The exchange just acquired Spindl, an onchain advertising platform. The acquisition aims to solve what Coinbase calls the "onchain discovery problem" — helping promising projects on its Base network go viral. But that's not all. Coinbase is eyeing a comeback in India, engaging with the Financial Intelligence Unit to explore market reentry after its 2023 exit.

The exchange is also pushing into derivatives, launching CFTC-regulated SOL futures in the U.S. This move not only broadens their product suite but could pave the way for eventual Solana ETFs — a market that Bloomberg Intelligence gives a 70% chance of regulatory approval.

The Regulatory Seasoning

The regulatory environment is finally starting to taste sweet after years of bitterness.

The SEC has paused its lawsuit against Binance, signaling a potential end to the crypto crackdown era. This shift has emboldened both companies to accelerate their expansion plans. Robinhood's CEO Vlad Tenev is particularly excited about the possibility of tokenising traditional securities like stocks — a development championed by Wall Street heavyweights including BlackRock's Larry Fink.

"What that means for us is bringing real assets onto crypto technology," Tenev says, "to really unleash the true power of the crypto revolution."

A New Recipe for Crypto Success?

The stunning success of Coinbase and Robinhood is reshaping the entire crypto ecosystem in ways that few predicted.

The Fat App Thesis

There's a compelling theory making rounds in crypto circles: value in the crypto ecosystem will ultimately accrue to the apps that own the users, not the protocols that power them.

And right now, Coinbase and Robinhood own those users.

Think about it. While crypto purists have long championed decentralised applications (dApps) like Uniswap and Aave, it's the centralised platforms that are winning the user adoption battle.

Why? Because they've mastered what matters most to mainstream users: seamless UX and interoperability.

We're already seeing this play out.

Coinbase is integrating DeFi protocols directly into its platform, and when it does, it owns that customer relationship. The protocol becomes just another feature in Coinbase's expanding suite of services. Similarly, Robinhood's future plans for tokenised securities could make traditional blockchain protocols look more like infrastructure than destination platforms.

This shift has profound implications. When Coinbase integrates with protocols like Morpho, it's Coinbase — not Morpho — that controls the user relationship. This means they can push protocol fees downward by threatening to use competitors. The real value accrues to the interface layer, not the protocol layer.

99% of the world doesn't care about self-custody—as crypto analyst Plan B demonstrated by moving his BTC into an ETF for better UX. Even for the 1% who do care, both Coinbase and Robinhood now offer seamless wallet integration.

Token Dispatch View 🔍

The Future is Fat (Apps)... Or is it? The numbers tell two different stories. On one side, Coinbase and Robinhood's record-breaking quarters showcase the power of user-friendly centralisation.

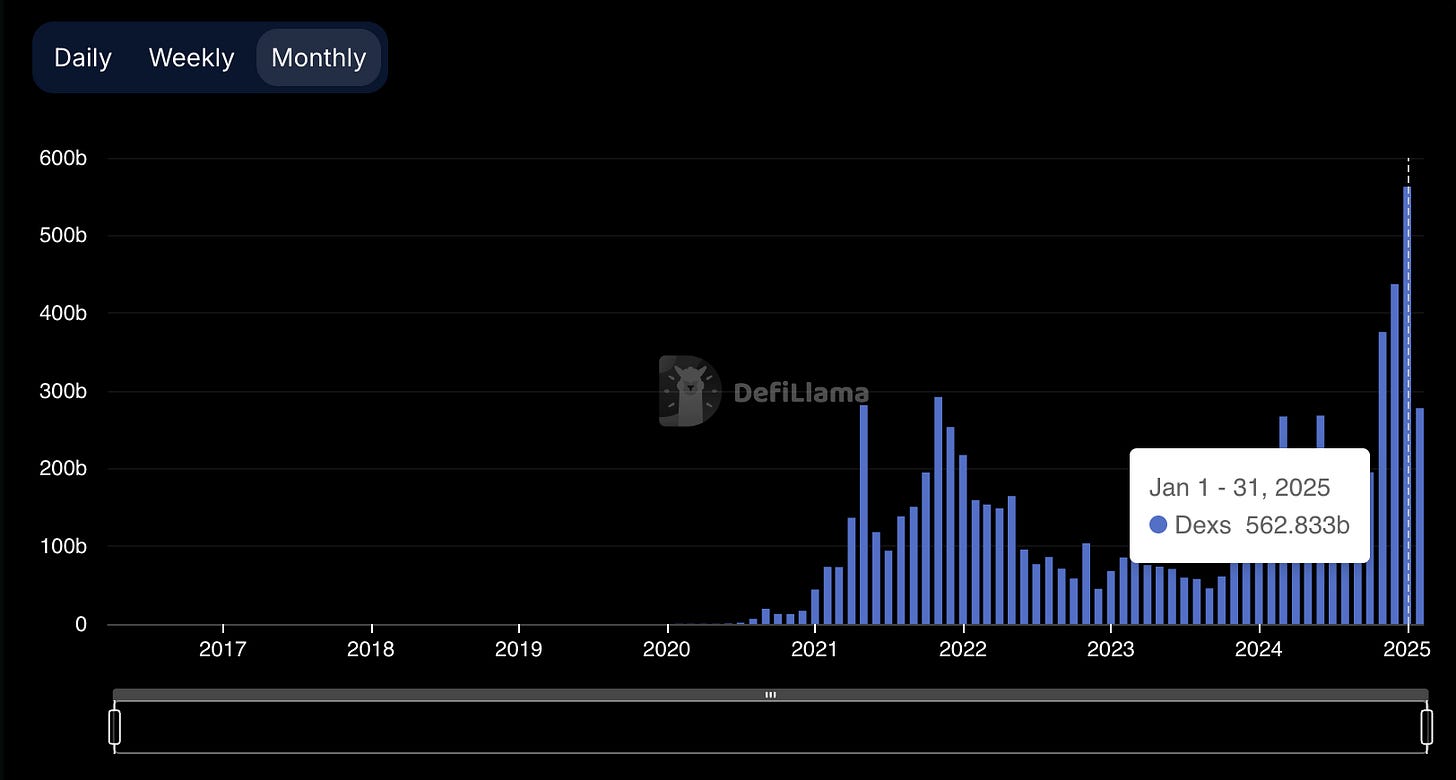

Their success suggests that the Fat App thesis — where value accrues to user-facing platforms rather than protocols — is winning. But there's a plot twist. We are seeing decentralised exchanges (DEXs) process $562 billion in trading volume, as of January— an all-time high.

While still dwarfed by centralised platforms like Binance, who achieved $7.3 Trillion in 2024, and $800 Billion in January 2025, the trend is unmistakable. DEXs are gaining ground.

For investors, this creates a fascinating dynamic.

While publicly traded crypto platforms offer clear exposure to mainstream adoption, they might be more vulnerable than they appear. A single hack, regulatory change, or shift in user preferences could redirect the flow of capital toward decentralised alternatives.

This captures the essence of crypto's eternal tension — between convenience and control, between accessibility and autonomy.

But beneath the euphoria lies an unexpected twist: retail sentiment remains surprisingly muted. As Noelle Acheson notes, it's all a bit "meh." The 2022 crash PTSD lingers. Memecoins dominate headlines. True innovation seems scarce.

This three-way tension — between centralised success, decentralised growth, and lukewarm retail sentiment — hints at a market in transition. While Coinbase and Robinhood dominate today's headlines, they might not be crypto's final destination.

The Fat App thesis dominating today's market might not be crypto's final form. As users grow more sophisticated and privacy concerns mount, the pendulum could swing toward self-custody and true decentralisation. Today's Coinbase trader could become tomorrow's Uniswap liquidity provider.

Can these platforms maintain their current dominance? Maybe. Can they adapt when the next paradigm shift arrives? That will be the pressing challenge. For now, though, Wall Street is betting on centralisation.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.