What’s wrong with ETH? 🤔

Is this the end of ultrasound money? ETH up only 36% vs BTC's 109% this year. ETH ETFs bleeding while BTC ETFs boom. The L2 dilemma and a bull case that nobody can see coming.

Welcome to your Wednesday dispatch. Today, we're exploring why crypto's former golden child is sitting quiet at $3,100 while everything else moons.

Consider signing up for pay-what-you-want subscription to support our work - which is possible thanks to support from readers like you.

Hello, y'all. FOMO about missing out on Coldplay live? Play Muzify quiz to score the concert ticket👇

Bitcoin casually crossed $93K. Memecoins are mooning. Even Layer-2s are breaking records.

But Ethereum? It's giving us awkward silence at $3,100.

The silence from the Ethereum community is deafening. The same folks who couldn't stop talking about "ultrasound money" and "the merge" are suddenly very... quiet.

The second-largest crypto is still 44% below its all-time high while Bitcoin's making history. Something's not adding up.

Numbers tell a brutal story

ETH up only 36% this year

BTC soared 109% in comparison

All-time high of $4,832 feels like ancient history

Only 10% chance of hitting $4,000 by December

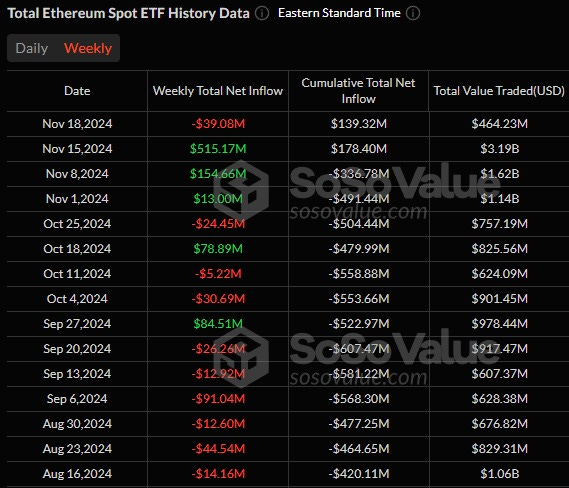

Even institutional money seems to be giving ETH a cold shoulder. While billions flow into Bitcoin ETFs, Ethereum's ETFs are not seeing the same level of enthusiasm.

ETH ETFs bled $180M in last three days, while Bitcoin ETFs raked in $700M.

The cumulative net inflow is incomparable.

ETH ETFs - $58M.

BTC ETFs - $28B.

Block That Quote 🎙️

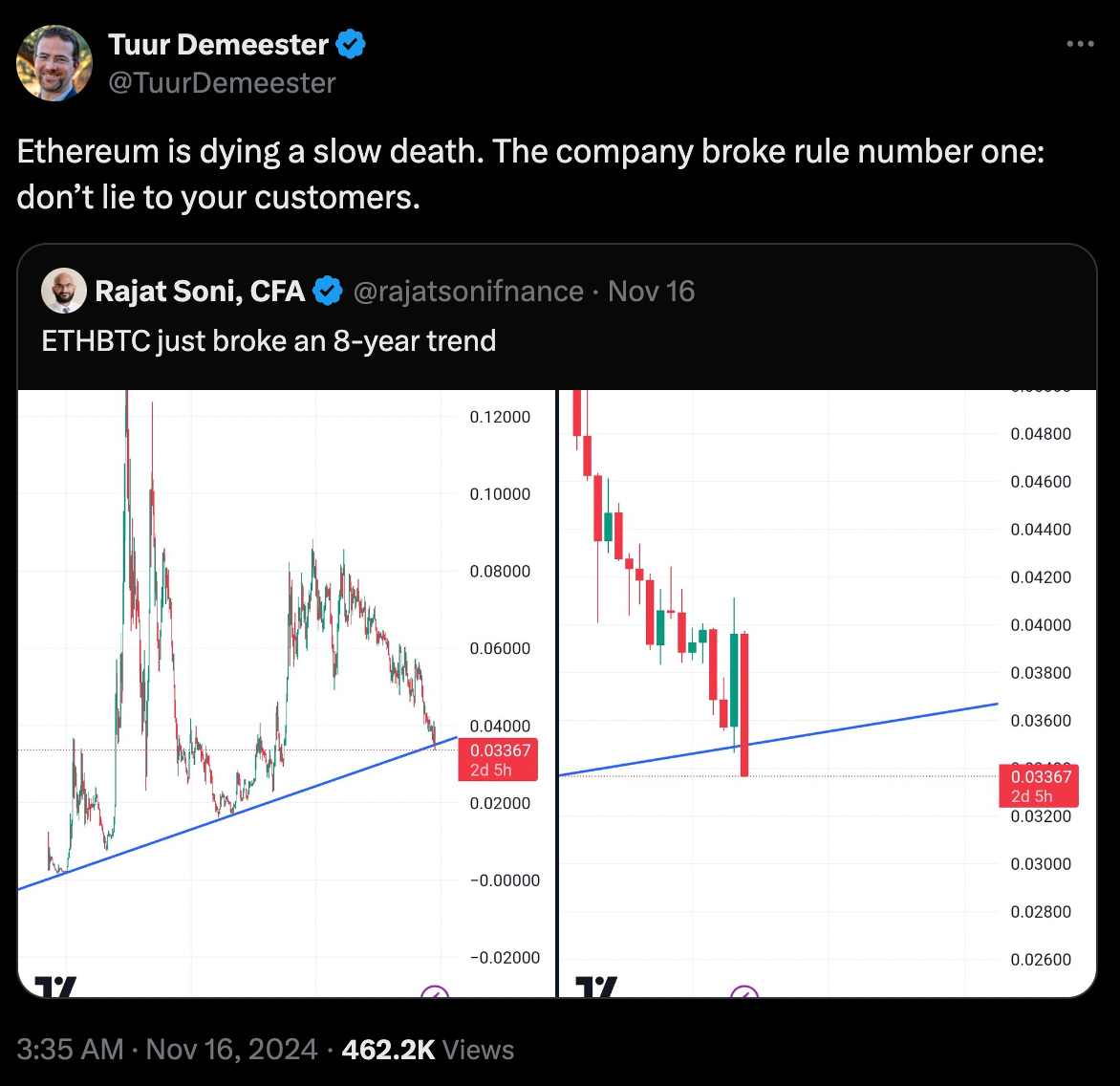

Tuur Demeester, founder of Bitcoin hedge fund Adamant Capital

"Ethereum is dying a slow death"

Strong words, but the charts back him up.

Let's break this down

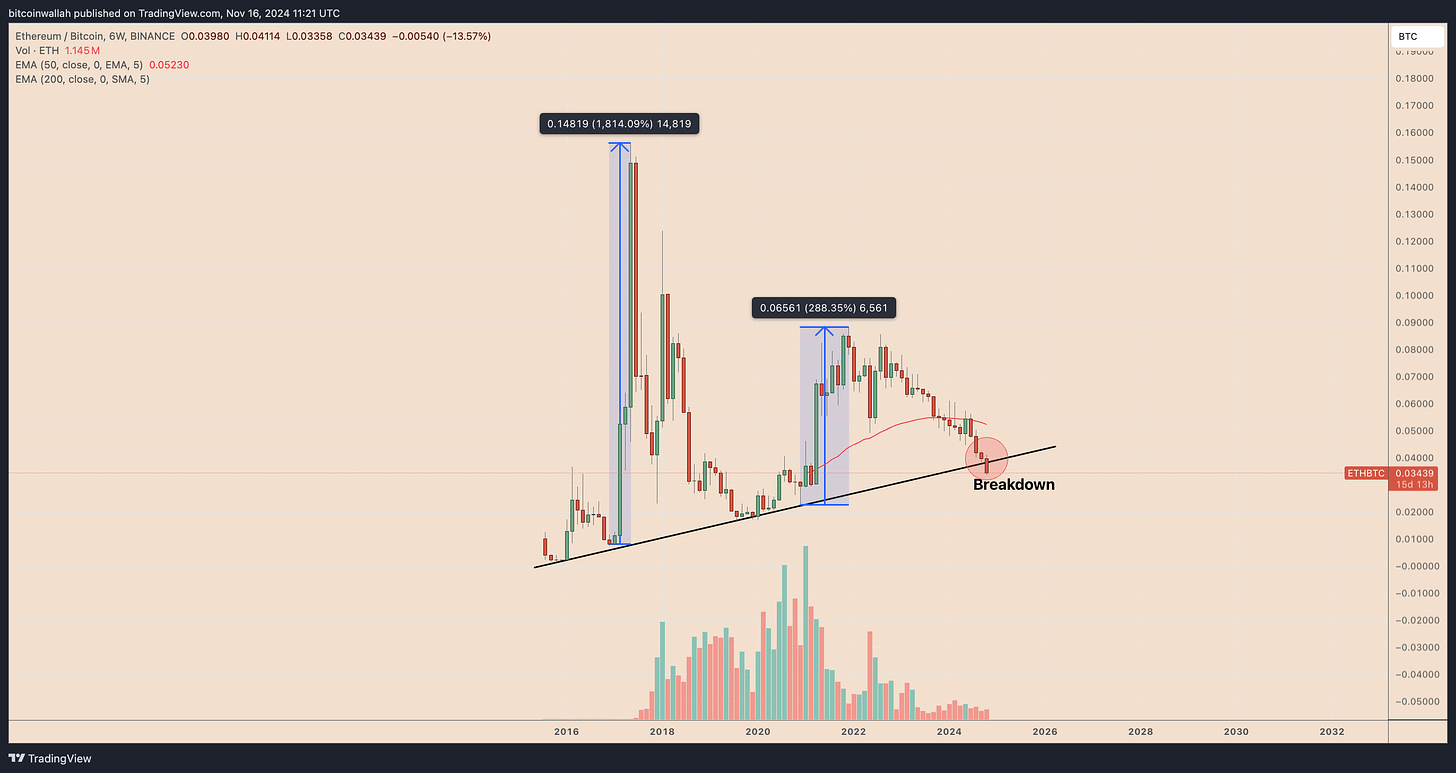

ETHBTC support level that held since 2016? Gone

15% drop below the trendline

Heavy trading volume (meaning this isn't a fake-out)

ETH dominance at lowest since April 2021

This isn't just another dip. This support level previously triggered:

1,800% recovery in 2017

300% rebound in 2020-2021

Multiple major rallies

But this time? **crickets**

The Trump Effect

Sometimes what's not happening matters more than what is. During the entire election campaign:

Trump talked about Bitcoin as strategic reserve

Memecoins got their spotlight

Even Solana got some love

Ethereum? Not a mention

Speaking of Solana... SOL/ETH is up 925% since December 2022. That's not just competition – that's domination.

The Home for All the Music Lovers

Muzify - With close to 2 million plays, is more than just a platform.

It's a journey into the world of music.

It provides an interactive experience through quizzes and exploration tools. For artists it’s a powerful tool for artists to connect with their fans.

Through custom quizzes artists can engage their audience, receive direct feedback, and build a loyal following eagerly anticipating their next release.

The platform offers a direct line to fans, fostering a sense of connection that goes beyond mere listening.

The L2 Dilemma

This might be Ethereum's biggest strength... and weakness.

While Layer-2s like Arbitrum, Optimism, and Base are thriving, they're potentially stealing Ethereum's thunder:

Less fee burning on mainnet

Reduced ETH demand for gas

Value accrual shifting to L2 tokens

Main chain becoming "boring infrastructure"

"ETH faces serious headwinds as the value proposition of 'sound money' has flipped," says Greg Magadini from Amberdata.

The problem? All the action's happening on L2s, not Ethereum mainnet.

But, all’s not gloomy.

The end of the tunnel is perhaps just around the corner.💫

The market might be turning.

In The Numbers 🔢

$200M

That’s how much flowed into ETH futures on November 19.

Open interest?

Ethereum's fundamentals are actually... improving?

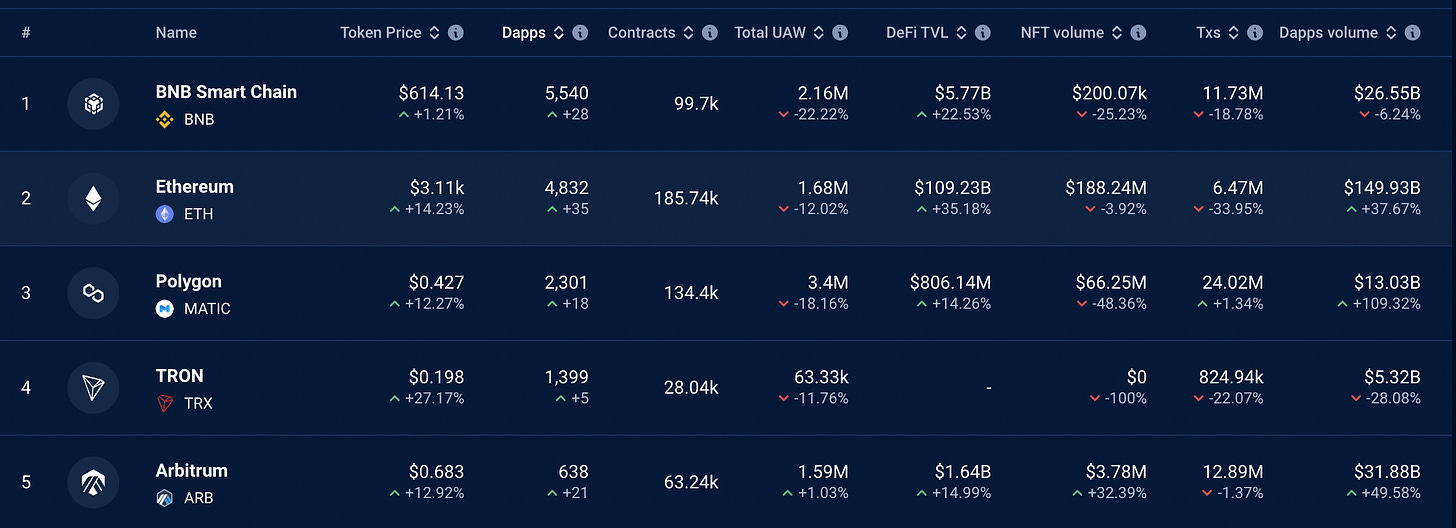

The Network Stats

DApp volumes up 38% in a month

$149.9B in onchain volume (BNB Chain's at just $26.6B)

$163.7M in monthly fees

Still dominates in TVL ($109B)

Staking rewards beating inflation

While everyone's chasing the next moon shot, Ethereum:

Hosts the majority of DeFi activity

Powers most of the NFT ecosystem

Maintains the highest developer activity

Continues to innovate (albeit slowly)

Ethereum 3.0 promises solutions:

Sharding for scalability

zkEVM at base layer

Potential L2 integration

Improved tokenomics

Not All Who Scale Are Lost

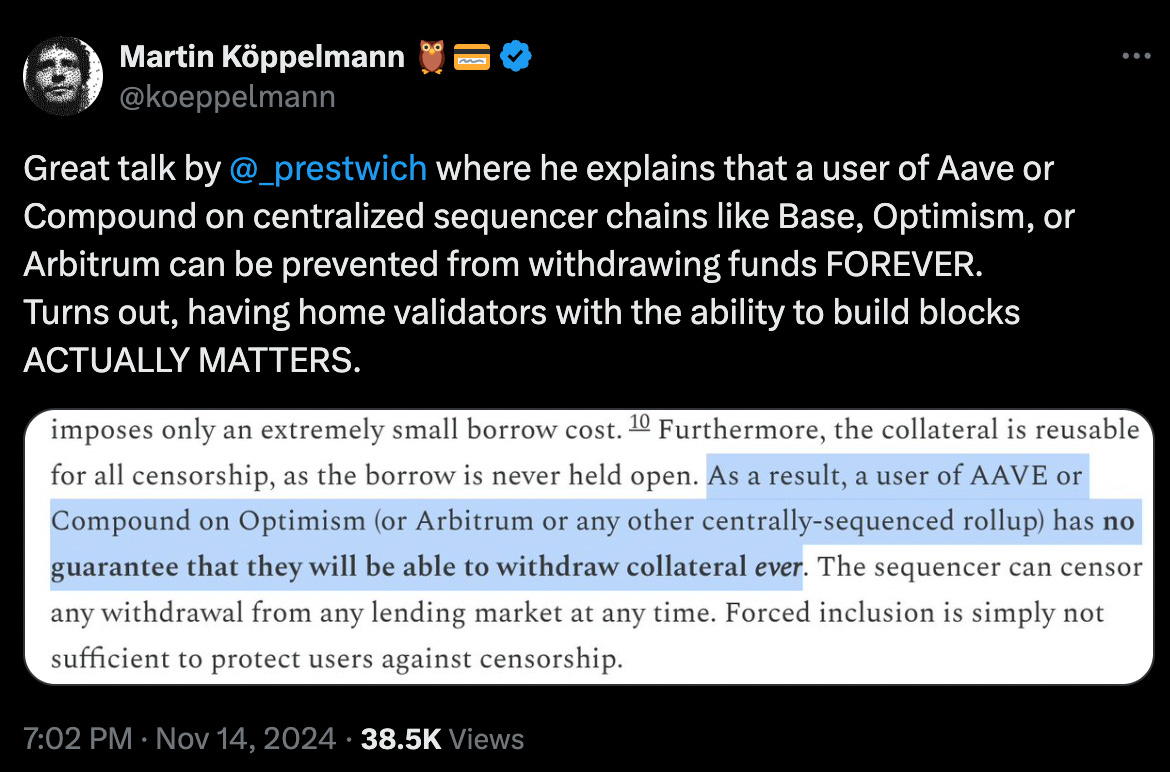

At Devcon Bangkok this week, someone finally said what many have been thinking about Ethereum's scaling strategy.

Martin Köppelmann, the founder of Gnosis, took the stage wearing a Tornado Cash t-shirt (a statement in itself) and said: Ethereum needs its own layer-2s.

This isn't just another technical proposal. It's a fundamental rethinking of how Ethereum should grow.

Remember how everyone says rollups "inherit Ethereum's security"? Well, according to Köppelmann, none of them actually do.

At least not in practice. Your withdrawals can still be censored by central sequencers, and most assets on these rollups aren't even subject to Ethereum's security guarantees.

The current landscape of layer-2s, Köppelmann argues, is leading users not to Ethereum but away from it.

When you're on Base, for example, you're not really on Ethereum - you're in Coinbase's ecosystem. This might sound fine until shareholders start demanding new fees or changes that don't align with Ethereum's ethos.

Köppelmann's solution? 128 identical, interoperable native layer-2s built to Ethereum's exacting standards. No multisigs, multiple client implementations, and the kind of community scrutiny that made Ethereum what it is.

The goal? A 100x increase in effective block space within two years.

This isn't just about technical specs - it's about Ethereum's soul. Without native layer-2s, Ethereum's connection to its scaling solutions could become nothing more than a meme. With them, it could become "the most important economic zone in the world."

The options ahead are clear: Ethereum either becomes a foundation for corporate-controlled platforms; or it scales while staying true to its decentralised roots?

Token Dispatch View

While everyone's busy writing ETH's obituary, there's another narrative brewing beneath the surface.

Here's what the bears are missing: Ethereum's seeing record staking levels – we're talking 29% of all ETH locked up. Most of it? In liquid staking tokens, being put to work across DeFi and restaking protocols.

Translation: Less ETH available to sell than ever before.

The institutional whispers? They're getting louder. Bitwise just acquired Attestant, a $3.7B Ethereum staking provider. That's not a company preparing for ETH's funeral – that's someone betting on its resurrection.

Maybe, just maybe, the "ETH is dying" crowd is looking at the wrong metrics.

After all, when was the last time a "dying" asset had record staking levels, increasing institutional demand, and its L2s breaking records? 🤔

The Surfer 🏄

Coinbase will delist Wrapped Bitcoin (WBTC) on December 19, 2024, citing failure to meet listing standards, amid growing concerns over Justin Sun's influence following BitGo's partnership with BiT Global. This decision comes as Coinbase's own wrapped Bitcoin token, cbBTC, gains traction.

CryptoPunks prices have more than doubled recently, with the cheapest now trading around $112,000, reflecting a broader rally in the NFT market. This surge has led to increased sales activity, with 189 CryptoPunks sold for a total of $23 million in the past week.

PayPal has partnered with Xoom to enable cross-border payments using its stablecoin, PYUSD, expanding access to Asian and African markets.

El Salvador is set to launch its first regulated public offering of tokenised US Treasury Bills (USTBL) through a partnership between NexBridge Digital Financial Solutions and Bitfinex Securities. The initial subscription period runs from November 19 to November 29, aiming to raise at least $30 million.

BIT Mining has agreed to pay a total of $10 million to resolve bribery allegations involving Japanese officials, including a $4 million civil penalty to the SEC and a $6 million criminal fine to the DOJ.

If you want to make a splash with us, check out partnership opportunities 🤟

Our sponsorship storefront on Passionfroot 🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋