Last December, Virtuals Protocol stood at the frontier of two powerful narratives: AI and crypto.

Its promise was straightforward — autonomous digital agents that could trade, create and interact without human oversight.

When one bot purchased images from another for a modest sum of VIRTUAL tokens, tech publications hailed it as the dawn of a machine economy.

Traders noticed. A platform hosting predominantly lines of code commanded a $2 billion valuation at its peak. Suddenly everyone wanted in on AI agents. The bots were talking, and we were listening.

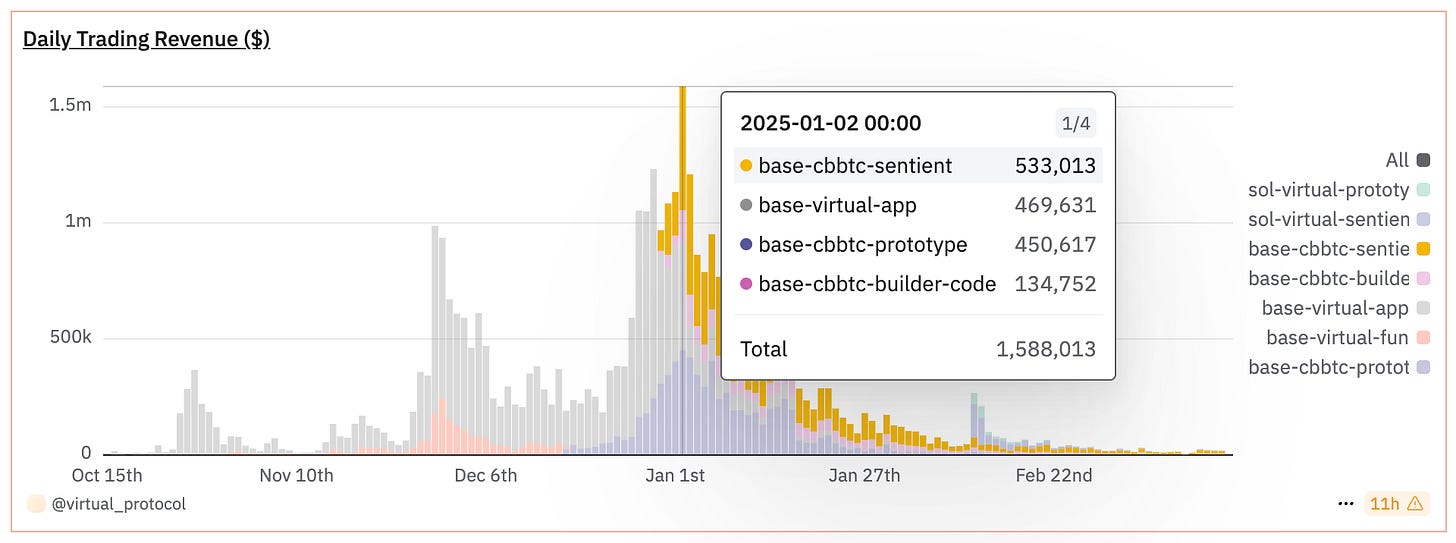

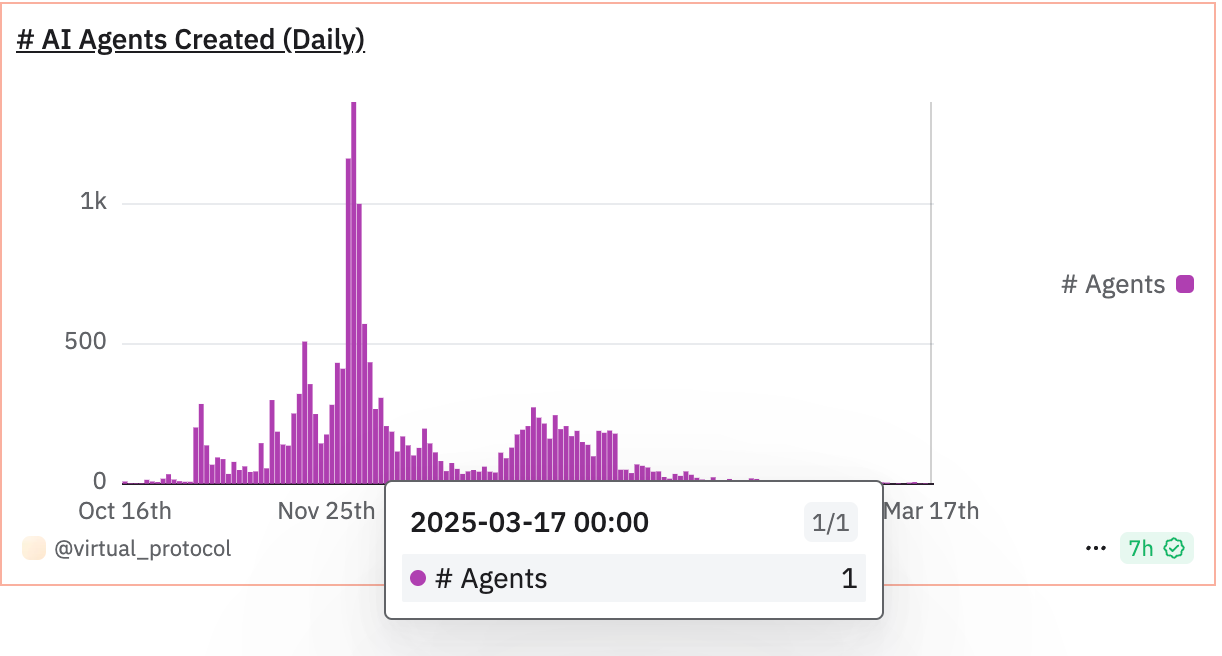

Three months later, daily revenue has crashed 96%. New agent creation has flatlined. The bustling digital economy resembles a ghost town. What happened?

A case study in what happens when bleeding-edge technology collides with market psychology.

The machines stopped working? NO.

They've simply lost our attention. And in the attention economy, that's a death sentence.

Paris Blockchain Week 2025 – The Future of Web3 Awaits!

Join industry leaders, innovators, and investors at one of the most anticipated blockchain events of the year! From April 8-12, experience groundbreaking discussions, exclusive networking, and cutting-edge insights in the heart of Paris.

10,000+ attendees | 400+ speakers | 100+ sessions

Explore DeFi, NFTs, AI, and Web3 innovations with top global experts!

Secure your spot today and be part of the future. Limited seats available!

In 1950, Alan Turing proposed what became known as the Turing test — a simple way to determine if a machine could exhibit intelligent behaviour indistinguishable from a human.

Seventy-five years later, we've developed a different kind of test: Can an AI chatbot convince crypto traders to pour billions into its token?

For a brief, euphoric moment, the answer was a resounding yes. And nowhere was this more evident than with Virtuals Protocol.

For those who've been living under a rock, Virtuals Protocol emerged as crypto's flagship AI agent platform — a decentralised ecosystem where autonomous AI bots could be created, trained, and deployed to perform tasks without human intervention.

Get 17% discount on our annual plans and access our weekly premium features (HashedIn, Wormhole, Rabbit hole and Mempool) and subscribers only posts. Also, show us some love on Twitter and Telegram.

The once-celebrated AI agent platform, which hit a market cap of nearly $4 billion in December 2024, has experienced a catastrophic collapse.

Daily revenue plummeted from $1.02 million in early January to $19K by March 17 — a 99.71% decline.

Meanwhile, the protocol's native VIRTUAL token has shed 85%+ from its all-time high of $5.07, currently limping along at around $0.65 with a deflated market cap of $450 million.

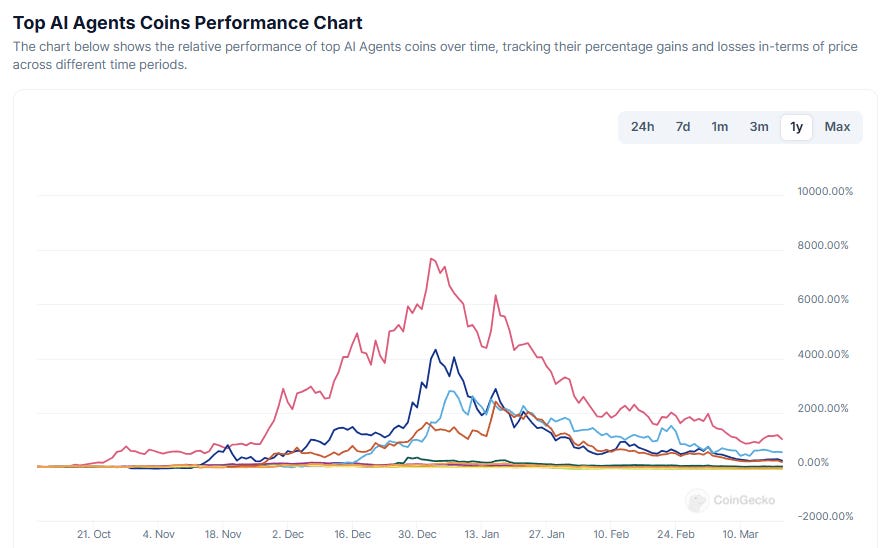

This dramatic reversal of fortune isn't simply a Virtuals problem.

It's emblematic of a broader disillusionment with AI agent tokens that has swept through crypto markets since their frenzied peak in late 2024.

Peek across the AI token landscape and the carnage is universal — ai16z down 92% from its December high, Zerebro nursing a 96% loss, and the once-hyped Fartcoin (yes, that's its actual name) dropping 88% from the January high.

Read: AI Agents in 2025 🤖

The magnitude of these losses evokes memories of the 2018 ICO bubble, though this time with fancier marketing decks and marginally more sophisticated buzzwords.

Same script, different actors.

To understand why Virtuals Protocol rose and fell with such spectacular speed, we need to grasp what made it captivating to begin with.

The concept was admittedly intriguing: a platform where users could create autonomous AI agents capable of performing tasks without human involvement. Virtuals captured imaginations when two AI agents — Luna and STIX Protocol — conducted what appears to be the first fully autonomous transaction between bots.

In December, Luna requested image generation services from STIX, received them, and paid $1.77 worth of VIRTUAL tokens for the service. No humans in the loop.

It was a compelling demonstration that stirred the crypto world's imagination.

We'd already watched ChatGPT write essays and generate art — why couldn't an AI agent trade crypto, provide services, or even launch businesses autonomously?

By November 2024, Virtuals was minting a staggering 1,300 new agents daily.

Trading volume surged as 181,000 active wallets scrambled to join what looked like the next crypto gold rush.

Fast forward three months to February 2025, new agent creation had cratered to fewer than 10 per day, active wallets collapsed to 7,642, and daily revenue imploded. The bustling digital economy of autonomous agents had gone eerily quiet.

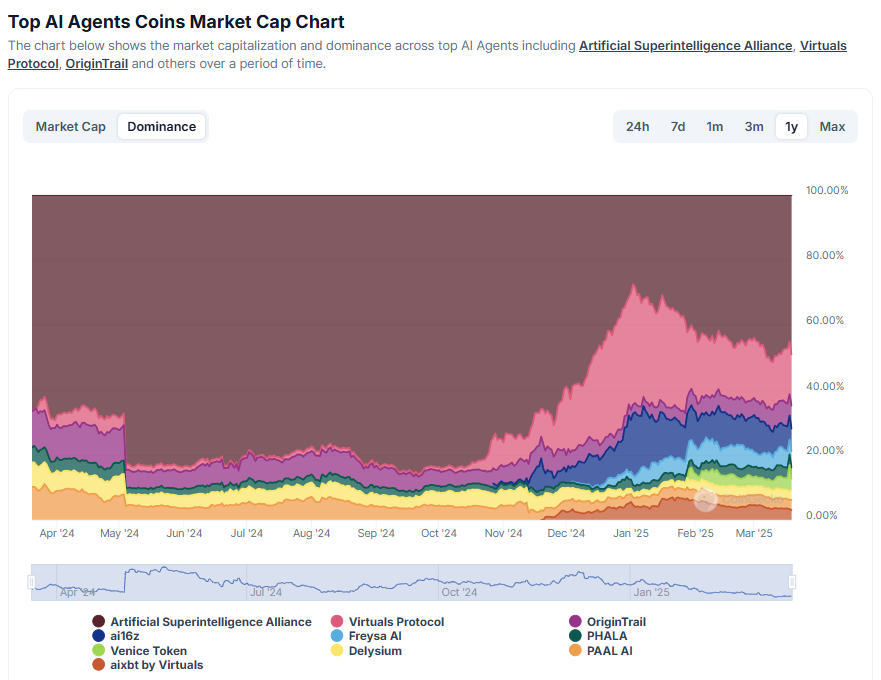

The AI agent tokens’ market has contracted from $20 billion in early January to just $4.4 billion — a 94% reduction that's reshuffled the entire ecosystem.

Virtuals Protocol's dominance has plummeted from 37% in January to 15.9% today. The crown has passed to Artificial Superintelligence Alliance, now commanding 45.5% of the sector. Venice Token (8.1%) and ai16z (7.2%) follow, while smaller projects fight for remaining attention.

What silenced the conversation?

"AI agent platforms have been in a downtrend recently due to thin liquidity stemming from macroeconomic pressures, unproven utility, oversupply of tokens, and a cooling TradFi AI sector," Dominick John, an analyst at Kronos Research, told Decrypt.

The bots had nothing valuable to say, and investors stopped listening.

External factors accelerated the decline. When US President Donald Trump launched his TRUMP memecoin in January, it catapulted to an $13 billion market cap in 24 hours, siphoning liquidity from smaller tokens as traders chased fresh narrative.

His subsequent threats of 25% tariffs on Canada and Mexico triggered broader market panic, hitting speculative assets hardest.

Amid the wreckage, Changpeng Zhao, former Binance CEO, delivered a pithy post-mortem:

"While crypto is the currency for AI, not every agent needs its own token."

His observation cuts to the core problem — crypto repeatedly puts tokenisation before utility, a reverse-engineering approach where projects don't ask "what problem does this solve?" but rather "how can we create a token for this?"

The cart doesn't just come before the horse; often there's no horse at all.

Yet Virtuals Protocol may have protected itself from crypto's typical extinction cycle following a token collapse. The treasury management foresight helped the project diversify into hard assets.

"The protocol now holds some $12.1 million of cbBTC," noted Blockworks Research analyst Dan Smith, providing "runway to iterate on their product." Unlike countless projects whose treasuries evaporated alongside their token price, Virtuals bought itself time to potentially deliver on its promises.

There are some signs of market recovery, too. VIRTUAL has climbed 21.6% over the past seven days, outperforming both Bitcoin and the broader altcoin market. While still down 86% from January's peak, the bleeding appears to have stabilised.

After months of bloodshed, we are finally seeing that magical moment when the last weak hands have sold and only diamond-handed believers remain. A few consecutive green candles in a sea of red suggest the worst could be behind us, though that's cold comfort to those nursing 90% losses.

What's next for this battered sector?

Fraser Edward, CEO of payment protocol Cheqd, tells Decrypt: the AI agent hype is "subsiding and now focusing onto genuine utility and quality." The optimistic interpretation is that we're witnessing the necessary purge before legitimate AI agent applications emerge from the wreckage.

VanEck still predicts one million AI agents on blockchain networks by year-end.

Token Dispatch View 🔍

The AI agent saga reveals crypto's fundamental paradox: we exist simultaneously too early and too late in the technology curve.

Too early because the infrastructure for autonomous AI agents remains primitive. The "bots" on Virtuals Protocol function more like pre-programmed scripts than the intelligent trading entities described in whitepapers. We've created tokens for a technology still years from maturity.

Too late because we've applied the same tokenomics model that underperformed in previous cycles. Different narrative, identical financial structure.

Virtuals Protocol stands out for its treasury management decisions. By converting revenue to cbBTC (Coinbase Wrapped Bitcoin) rather than holding its own token, the team demonstrated uncommon foresight. This decision has granted them runway that many collapsed projects never secure.

A potential upside from this market correction? AI agent protocols might reconsider their foundational approach. The focus could shift toward creating genuine utility first, with monetisation as a secondary consideration.

The challenge for AI in crypto extends beyond passing the Turing test to meeting a more demanding standard — the market test. This means creating value that users would willingly pay for, even without token incentives.

Meanwhile, crypto will continue tokenising tomorrow's technologies today. Just remember to keep some assets that retain value when market narratives inevitably shift.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.