Happy Sunday dispatchers!

By the end of 2022, crypto was looking at an uncertain future. It’s the first quarter of 2025, and we have state heads launching memecoins.

Circle of life, eh?

In the latest hit, Argentina's President Javier Milei endorsed a token that wiped out $4.4 billion in five hours last week.

It was a warning sign of something far more dangerous. The transformation of political power into digital speculation.

This isn't a story about celebrity memecoins anymore.

Those were just the warm-up act. This is about what happens when the people who write the rules decide to play the game themselves – and why that might be crypto's biggest threat yet.

Choose the Right Ledger Wallet for You

Ledger wallet comes with key features to ensure accessibility and security for you wallet. With Ledger live app you can manage and stake your digital assets, all from one place. Ledger recover helps to restore access to your crypto wallet in case of a lost, damaged, or out of reach Secret Recovery Phrase.

Remember when countries were trying to ban crypto?

Those times have changed. We are navigating the present that is witnessing nation heads launching tokens.

The transformation has happened so fast that few noticed the pattern forming.

First came Trump's inauguration token $TRUMP - in January, a move that turned political capital into literal capital overnight.

Read: The On-chain President ⛓️

Then the Central African Republic's President Touadéra launched $CAR, complete with a green-screen video and promises of national development. The token peaked at $894 million before crashing 96%.

Then came the Javier Milei act.

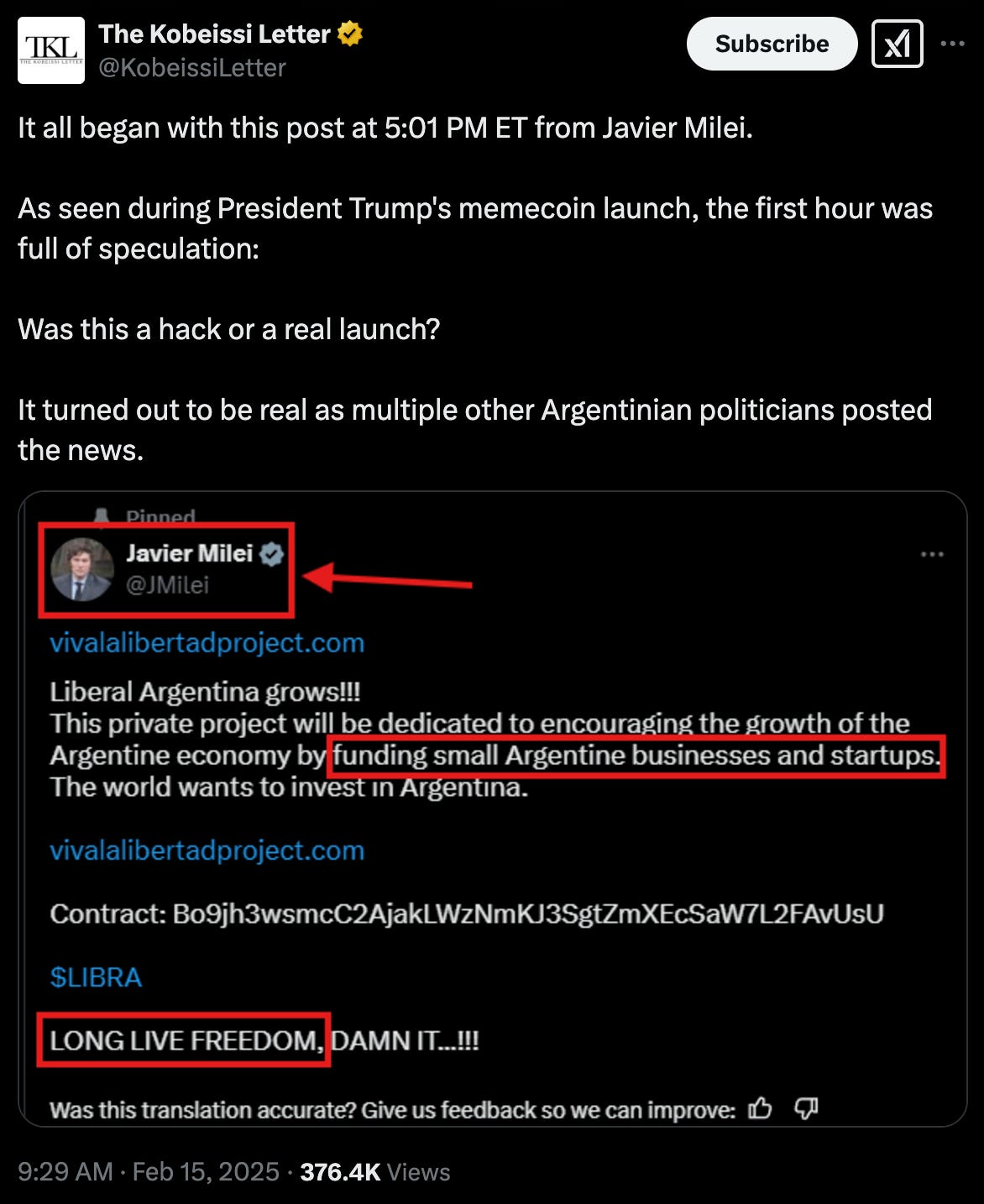

On February 14, at precisely 5:03 PM EST, Argentine President Javier Milei posted on X about a new cryptocurrency called $LIBRA. The token, he claimed, was "a private project dedicated to encouraging the growth of the Argentine economy."

The crypto community experienced what one trader called "massive deja vu," drawing immediate parallels to Trump's coin.

This was different. This wasn't a president-elect preparing for office – this was a sitting president of a G20 nation actively promoting a memecoin.

The website appeared hours before launch, registered for just one year, with no public owner information.

Its grand plan for funding Argentine businesses? A Google Form.

None of these red flags mattered. Other political figures began endorsing the project. The market, already primed by months of celebrity tokens and political coins, went into a frenzy.

Within 40 minutes, $LIBRA's price skyrocketed over 2,000%. Its market cap exploded to $4.4 billion – nearly 1% of Argentina's entire GDP. More than 50,000 wallets rushed to buy the token, generating $1.1 billion in volume.

The trading patterns told a story of mass psychology at work: 74,500 individual buy orders versus just 28,900 sales. Small investors, emboldened by the presidential endorsement, were piling in.

For exactly three hours, it seemed like the perfect validation of crypto's new political era.

A pro-Bitcoin president, a token promising economic renewal, and a market desperate to believe that governments were finally embracing digital assets.

Then the rug was pulled, and the true cost of mixing politics with memecoins became painfully clear.

The damage was done. Opposition lawmakers were already calling for impeachment proceedings.

Get 17% discount on our annual plans and access our weekly premium features (HashedIn, Wormhole, Rabbit hole and Mempool) and subscribers only posts.

When Power Meets Profit

There's a crucial difference between a celebrity promoting a memecoin and a president doing it.

When Caitlyn Jenner's token crashed, the US Securities and Exchange Commission investigated. When Jason Derulo's JASON plummeted 97.8%, lawsuits followed. When the "Hawk Tuah Girl" token wiped out investors' savings, regulators took notice.

While celebrities face SEC charges for crypto promotions gone wrong, presidents seem to operate under different rules. The same regulatory body that fined Kim Kardashian over crypto promotion remained conspicuously silent about political tokens.

Read: Celebrity Memecoin Chaos 🙆♀️

What happens when it's a head of state? The $LIBRA collapse exposed this dangerous double standard.

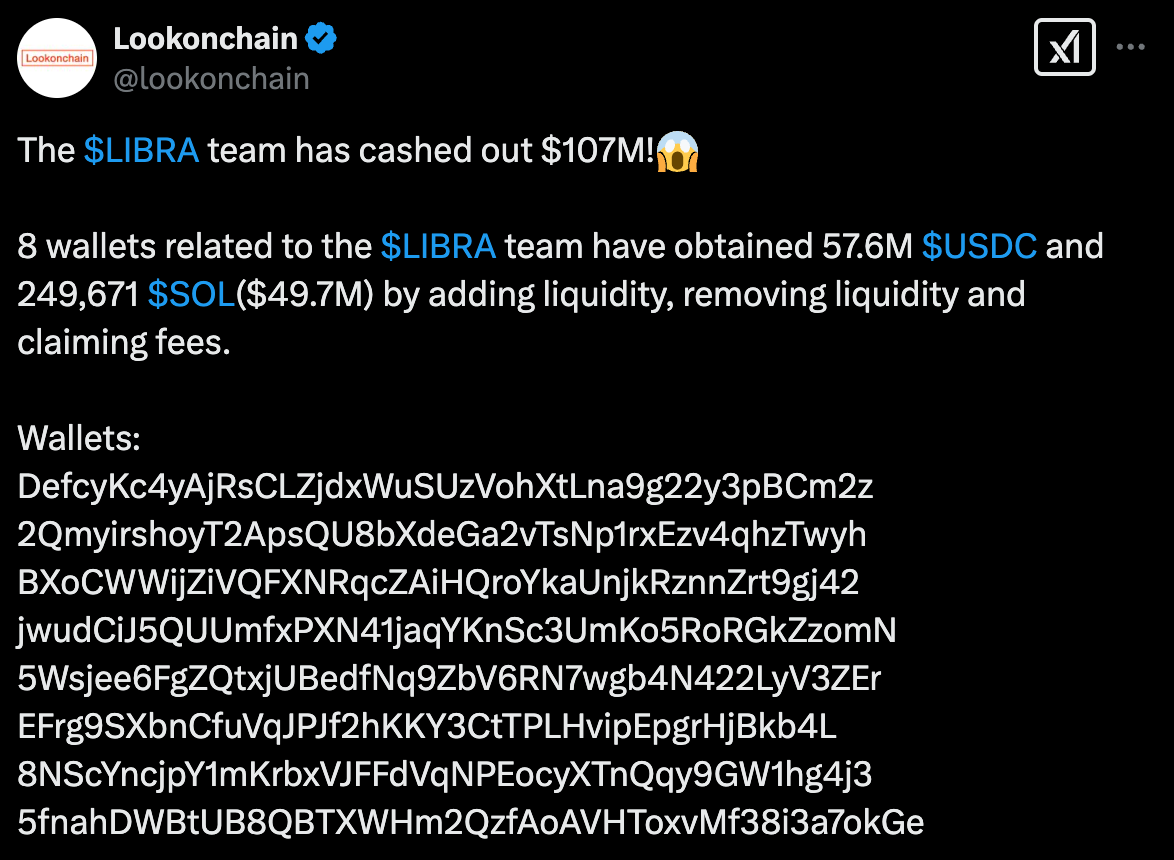

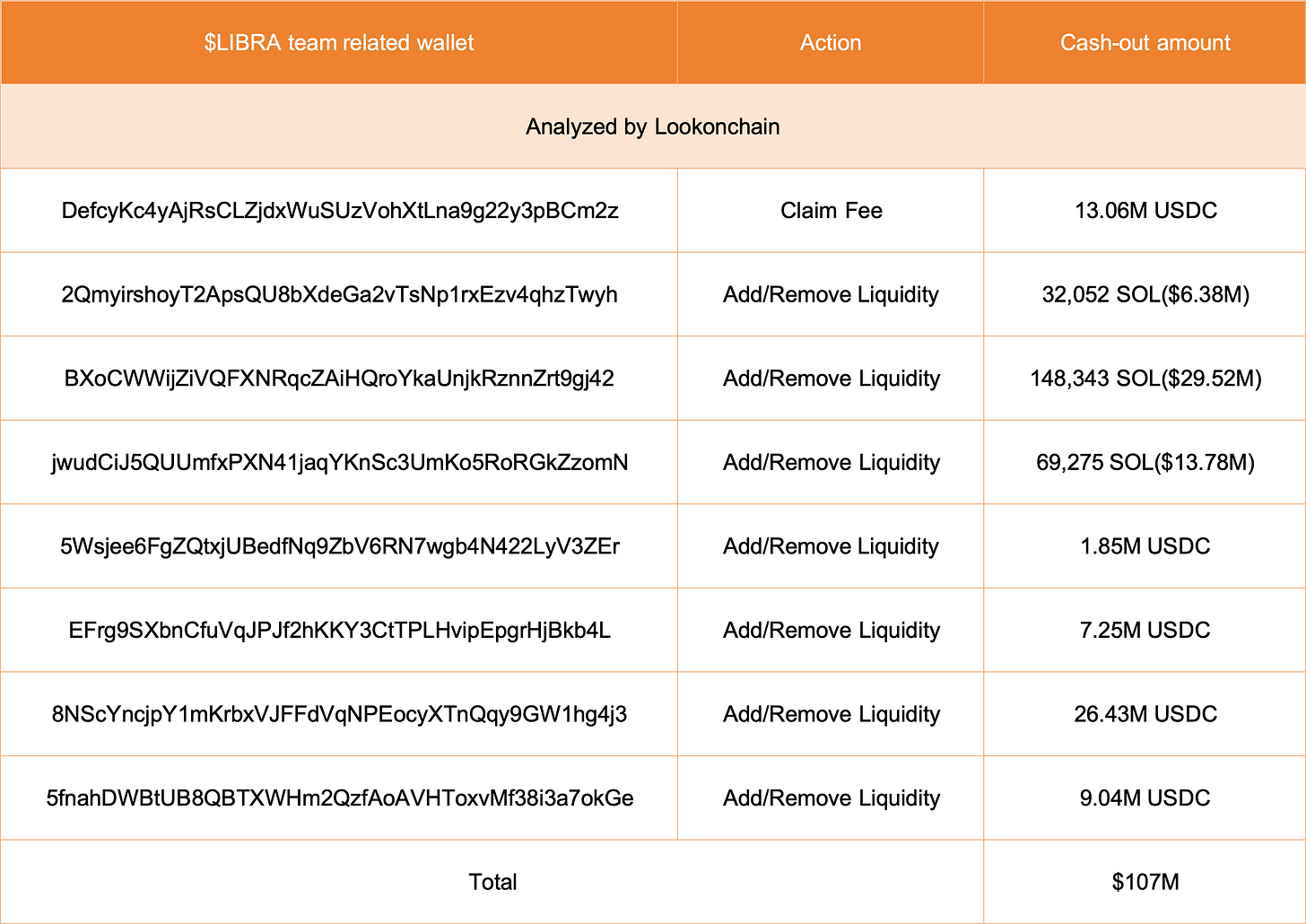

At 1:40 AM UTC, just three hours after launch, blockchain intelligence firm Lookonchain spotted the first signs of trouble: eight wallets linked to the $LIBRA team had begun systematically draining liquidity from the token.

Their method was ruthlessly efficient – adding one-sided liquidity pools on Metora containing only $LIBRA tokens, then removing SOL and stablecoins.

The numbers were staggering: 57.6 million USDC and 249,671 SOL – a combined $107 million – extracted in mere minutes. Bubblemaps revealed that 82% of $LIBRA's supply had been unlocked and sellable from the start.

The project had launched with no tokenomics, no whitepaper, and no lock-up period. As $LIBRA's price collapsed by 94%, wiping out $4.4 billion in market cap, the ripple effects were immediate.

Trump's token shed $500 million in value within 30 minutes. The Central African Republic's $CAR token, already struggling, plunged further.

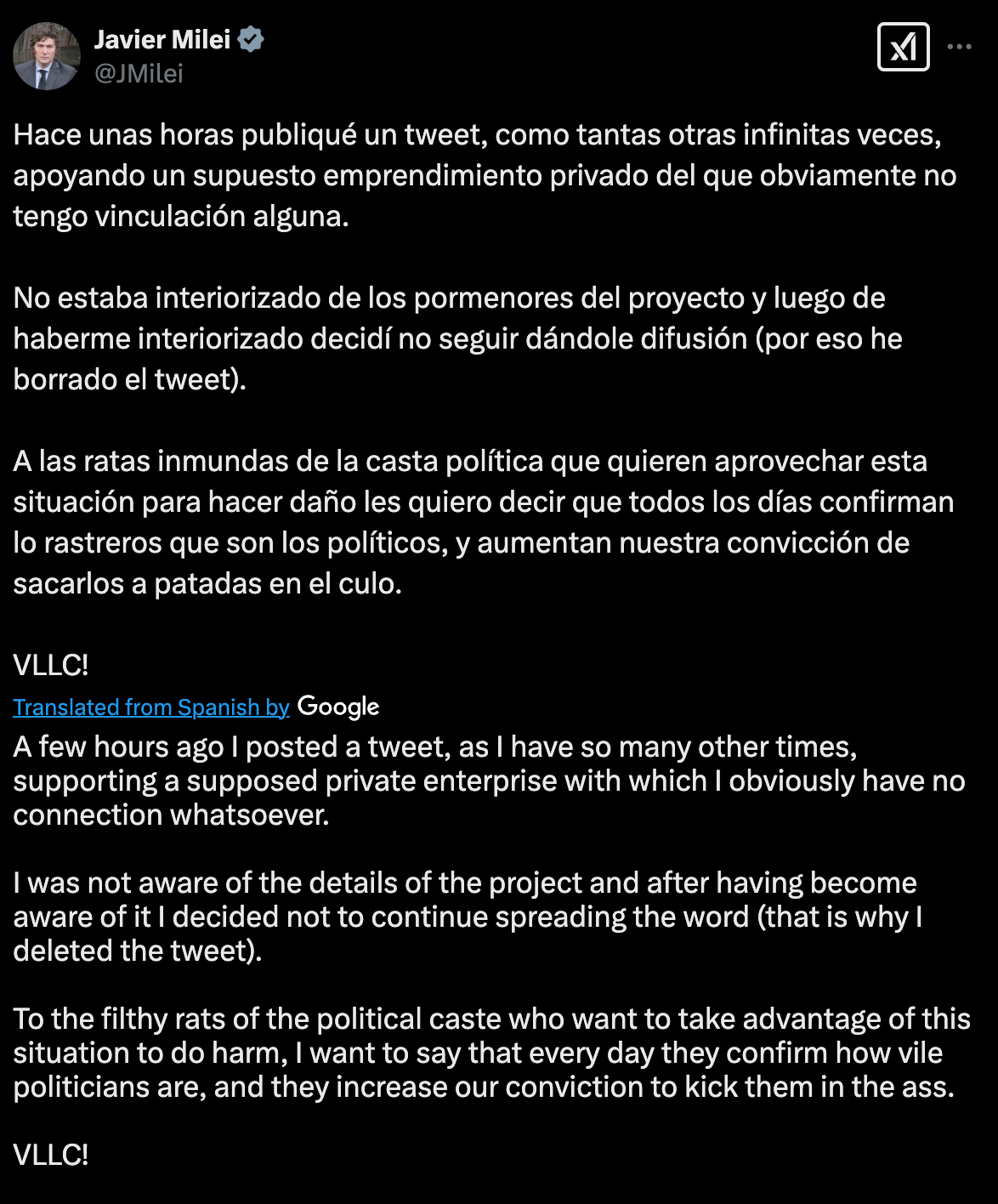

Milei's response followed a now-familiar playbook: delete the promotional tweet, claim ignorance of the project's details, and blame political opponents.

"To the corrupt political elite trying to use this against me—you prove every day why we need to remove you from power," he posted.

The irony was stark. Celebrity token scams might hurt investors' wallets, but political token scams threaten something far more valuable: the credibility of crypto itself.

Token Dispatch View 🔍

In 2022, when FTX collapsed, crypto faced an existential crisis. The industry spent two years rebuilding trust, only to now face a potentially more dangerous threat: political adoption of its shadiest corner.

The trajectory is telling. Two years ago, countries were drafting regulations to control crypto. Today, their leaders are launching memecoins – arguably the most speculative and unstable segment of the crypto market.

This isn't the mainstream adoption crypto advocates dreamed of; it's a nightmare scenario in the making.

The regulatory double standard makes it worse. While the SEC aggressively pursues celebrities like Lindsay Lohan and Jake Paul for token promotions, political figures seem to operate with impunity. The same authorities that fined Kim Kardashian $1.26 million remain silent about presidential memecoins with far larger damages.

"Most celebrities go in here with the worst fucking intentions."

Iggy Azalea candidly admitted about the token scene. At least celebrities face consequences. When presidents launch tokens, who holds them accountable?

Each collapse erodes confidence not just in memecoins, but in the entire crypto ecosystem. As more political figures join the gold rush – the risk of a catastrophic failure grows.

The cruel irony is that this is happening under the banner of "mainstream adoption." Politicians claim they're bringing crypto to the masses. Instead, they're bringing the masses to the riskiest, most manipulated corner of the market.

The political memecoin pandemic isn't just a series of scams – it's an existential threat to crypto's future. Unlike 2022's crisis, this one comes with presidential seals of approval.

Be afraid. Be very afraid.

Week That Was 📆

Saturday: The SOLful Story of Sol Strategies 👻

Thursday: Stablecoin Debate: 2 Bills, 1 Mission 🤺

Wednesday: Hong Kong’s Crypto Visa Gambit ✈️

Tuesday: Binance’s Token Listing Conundrum 📋

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.