When Pump.fun Is No Longer Fun 🥵

Viral memecoin factory hits pause after livestreams turn deadly. Shots, threats, and rugpulls - the platform witnessed all of it. Industry claim the acts tarnish crypto's reputation.

Welcome to Tuesday’s dose of crypto. Today, we take you through how crypto’s larger reputation is at stake at Solana’s Pump.fun.

Consider signing up for pay-what-you-want subscription to support our work - which is possible thanks to support from readers like you.

Can you guess the track within 5 seconds to prove your music fandom 🫵

"Shots fired."

Nah, that's not a metaphor. That's what happened on a Pump.fun livestream when a creator started shooting a gun out his window every time his token price pumped.

And that's not even the darkest part of this story.

The platform that turned anyone with an internet connection into a token creator just had to slam the emergency brakes.

Why? Because the line between viral marketing and criminal behaviour didn't just blur – it … err … just vanished.

Welcome to crypto's latest nightmare.

The Memecoin Chaos Factory 🏭

In just 10 months, Pump.fun became Solana's memecoin kingmaker.

Their pitch? "Create tokens in clicks, not code."

And boy, did people click.

In The Numbers 🔢

83%

That’s the share Pump.fun accounts for among all Solana token launches.

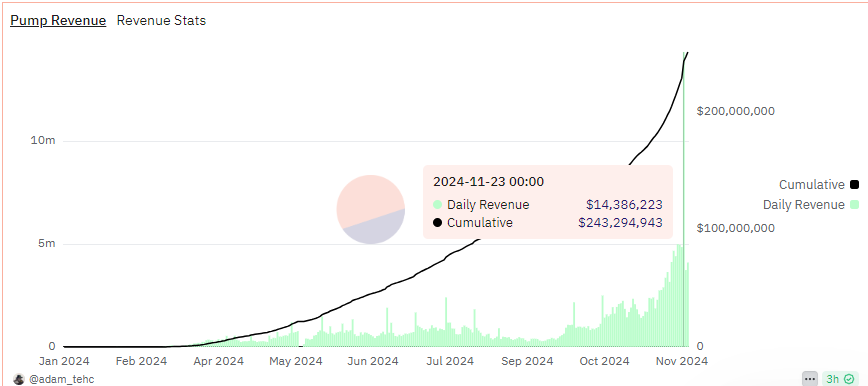

And, amid all these controversies, it just recorded $14.3 million in revenue on November 23, the highest single-day figure so far.

That’s some domination, isn’t it?

And that’s not all.

$215 million in revenue since March

More than 3.8 million total tokens launched so far

More than 50,000 new coins being launched daily

Unique Active Wallets (UAWs) just hit an all-time high

100x - Livestream growth in one week

So, how did the fun in Pump.fun turn toxic?

The Fall

It started with memes. Funny dog tokens. Rocket emojis.

Then things got dark. Like, really dark.

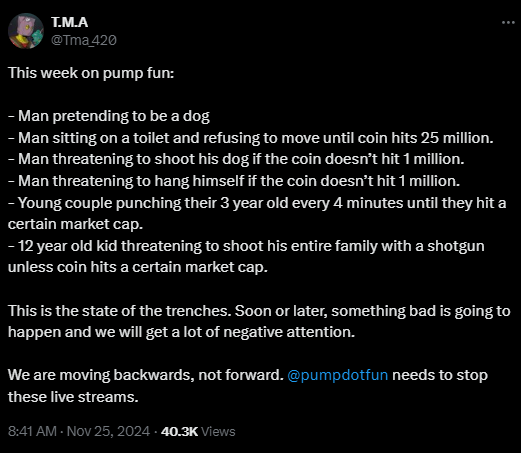

The Horror Show

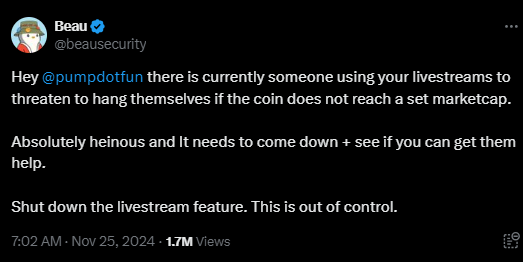

Creator threatening suicide if market cap doesn't hit target

Minor pointing shotgun at family over token price

User endangering pets for token pumps

School shooting threats tied to price action

Live self-harm attempts for market gains

Pudgy Penguins' safety manager Beau also warned the platform on X, asking them to shut down the feature.

The Scam Factory

But violent content wasn't the only problem.

It became a breeding ground for crypto scams

Middle schoolers running six-figure rug pulls

Fake adult content creators dumping tokens

Death threats over failed pumps

Community doxxing revenge

Mass manipulation schemes

One teen creator's story went viral just last week

Launched "QUANT" token

Raised $30,000 in minutes

Flipped off investors on livestream

Vanished with funds

Got doxxed, family harassed

But how well has Pump.fun really fared?

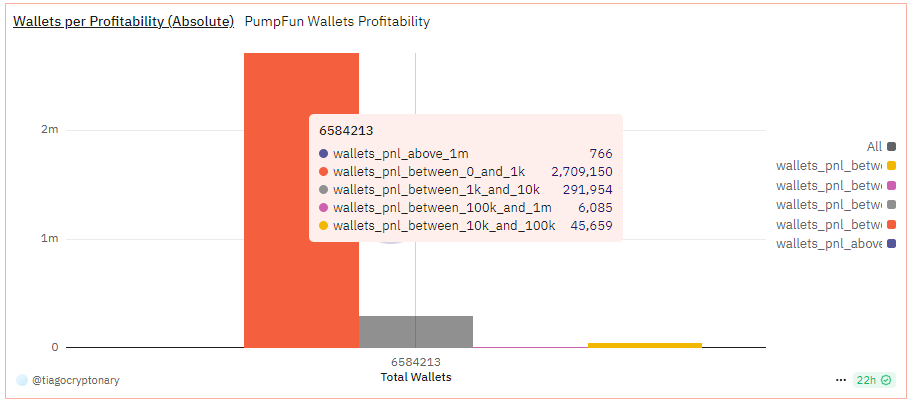

Well, if the numbers are anything to go by, then they suggest that success stories are rare.

60% of traders lose money

<10% see significant profits

Only 3% make over $1,000

1.2% reach DEX listing threshold

Most tokens die within hours

And yet, it witnessed 100x growth in livestreams. In. One. Week.

And when virality goes 100x, something’s bound to go wrong, you’d think.

And when things go so south, you got few options left other than applying the brakes.

And brakes, they applied…

The Home for All the Music Lovers

Muzify is a journey into the world of music.

It provides an interactive experience through quizzes and exploration tools. For artists it’s a powerful tool to connect with their fans.

Through custom quizzes artists can engage their audience, receive direct feedback, and build a loyal following eagerly anticipating their next release.

The platform offers a direct line to fans, fostering a sense of connection that goes beyond mere listening.

Block That Quote

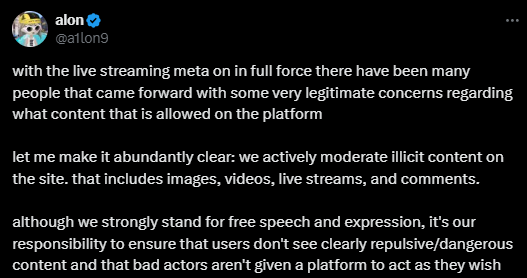

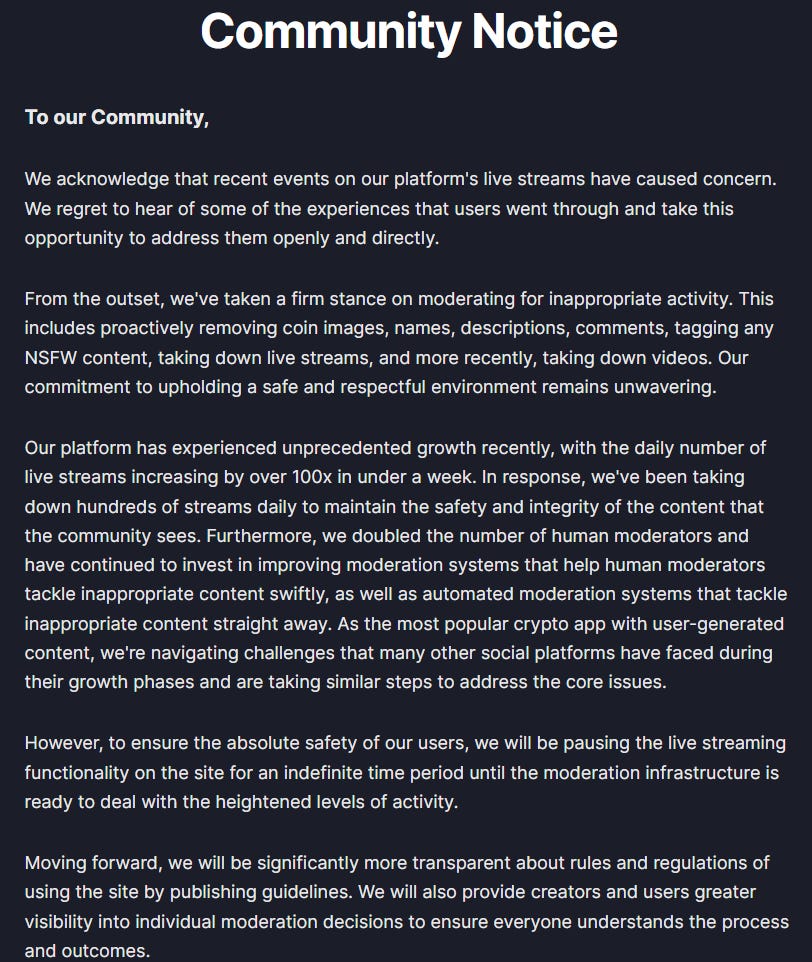

The Pump Team

"We're navigating challenges that many other social platforms have faced during their growth phases.”

That’s what the Pump Team said in their community notice.

But most social platforms don't have to deal with life-or-death token pumps.

And this is where it got interesting.

The suspension was announced just a day after Pump.fun's pseudonymous founder Alon tried damage control.

Initial Response

"Large team" of moderators

24/7 content monitoring

Hundreds of streams removed

NSFW toggle added

Community reporting enabled

But when all that failed, Monday brought reality.

All livestreams suspended

New guidelines promised

Moderation infrastructure overhaul

Transparency commitments

Indefinite suspension period

Crypto Twitter Erupts 🌋

The community that usually celebrates anything "bullish" wasn't having it this time.

"Pump Fun is going to become a massive reputational stain on the crypto industry, on par with FTX," Chainlink's Zach Rynes warned, sparking a viral thread.

Pro-Shutdown Camp

"This is beyond degen, it's criminal"

"Turning on a camera to showcase depravity isn't innovation"

"We're watching felonies in real-time"

But there were those who believed there was room for free speech.

Free Speech Advocates

"Every platform faces moderation issues"

"Let the market decide"

"Don't invite regulators in"

But experts aren't buying the "free speech" defense.

"It's a legitimate reason for criminal investigation and civil lawsuits," warns Yuriy Brisov, partner at Digital and Analogue Partners, told Cointelegraph.

The Risks

Wire fraud charges

Securities violations

Criminal liability

Civil lawsuits

Regulatory crackdown

The Industry Impact 🌋

This isn't just Pump.fun's problem anymore.

When Solana's biggest token platform becomes a hub for criminal threats, everyone pays:

Institutional trust damaged

Regulatory scrutiny increased

Public perception tainted

Innovation questioned

Adoption threatened

And when all this happens, the ecosystem suffers.

You know it’s gotten so bad when even crypto czar and Former CEO of Binance doesn’t hold back his words.

Token Dispatch View 🔍

Crypto's racing toward mainstream adoption. Bitcoin ETFs are live. ETF Options too. Wall Street's diving in. Institutions are opening their doors.

And then there's this.

A platform that turned token creation into performance art, where the performance became a crime scene.

While crypto loves to celebrate its "move fast and break things" ethos, this time things broke in ways that threaten not just a platform, but potentially the entire industry's reputation.

The numbers are impressive - $215 million in revenue, 3.8 million tokens launched, 83% market share. But these metrics mask a darker reality: an ecosystem where desperation masquerades as entertainment, and virality trumps responsibility.

What's particularly concerning is how this mirrors traditional finance's worst moments - pump and dump schemes, market manipulation, and predatory behaviour - but at internet speed and scale. We've essentially created a speed-run version of everything regulation was designed to prevent.

The crypto industry often argues against regulation by claiming we can self-regulate. But when a platform needs to suspend operations because users are literally threatening violence for token pumps, it suggests otherwise.

This isn't about stifling innovation or opposing free speech. It's about recognising that even in crypto's wild west, there need to be some sheriffs. When middle schoolers can run six-figure rug pulls and creators threaten self-harm for price action, we've crossed a line from "degenerate finance" into something far more sinister.

The industry now faces a choice: wait for regulators to step in (which they inevitably will after incidents like this), or proactively develop frameworks that balance innovation with responsibility.

Because if we don't solve this ourselves, someone else will do it for us. And they probably won't be as sympathetic to crypto's ideals of decentralisation and financial freedom.

The real "fun" in finance isn't about creating tokens in a click - it's about building sustainable systems that create genuine value. Until we embrace that truth, we'll keep seeing these nightmares repeat themselves.

The Surfer 🏄

MicroStrategy has expanded its Bitcoin holdings by acquiring 55,000 BTC for $5.4 billion. The purchase was made between Nov. 18 and 24, at an average price of $97,862 per coin. This acquisition boosts MicroStrategy's total Bitcoin holdings to 386,700 BTC, costing a cumulative $21.9 billion.

Rumble plans to invest up to $20 million in Bitcoin as part of a new treasury strategy. CEO Chris Pavlovski hinted at the idea on social media, leading to a poll where 93.9% of respondents supported the move. The timing of the first Bitcoin purchase will depend on market conditions and the company's cash needs.

Trump and the GOP are set to challenge Europe's MiCA, aiming to shift crypto regulation back to a more lenient US framework. The crypto industry has raised nearly $200 million to influence the 2024 US elections, seeking a law that classifies cryptocurrencies as distinct assets.

WisdomTree has registered an XRP exchange-traded fund (ETF) in Delaware, indicating plans to seek SEC approval. The firm joins Bitwise, Canary Capital, and 21Shares as early applicants for an XRP ETF in the U.S., although no applications have been approved yet.

Ethereum has overtaken Tron as the leading blockchain for Tether (USDT) as of November 21, 2023, after two years. USDT supply on Ethereum rose by 10% recently, reaching $60.3 billion, while Tron's supply decreased by 1.5% to $58.1 billion.

If you want to make a splash with us, book a demo call 🤟

You can check out partnership opportunities🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋

Started reading for the analysis, stayed for the memes. Seriously though, where else can you get high-quality research served with a side of top-tier humor?