Howdy!

Barely a couple days ago, the US Securities and Exchange Commission (SEC) approved Bitwise's Bitcoin and Ethereum Exchange-Traded Fund (ETF).

Crazy times of ETF that it doesn’t even feel surprising, right? Except if you zoom out to see the bigger picture.

It was SEC’s second such mixed crypto ETF approval in just over a month after it gave Hashdex and Franklin Templeton the green light in December.

That’s not all the ETF drama we’ve seen of late.

In fact, as we write this, Grayscale just debuted its Dogecoin Trust and filed with the NYSE to convert into an ETF.

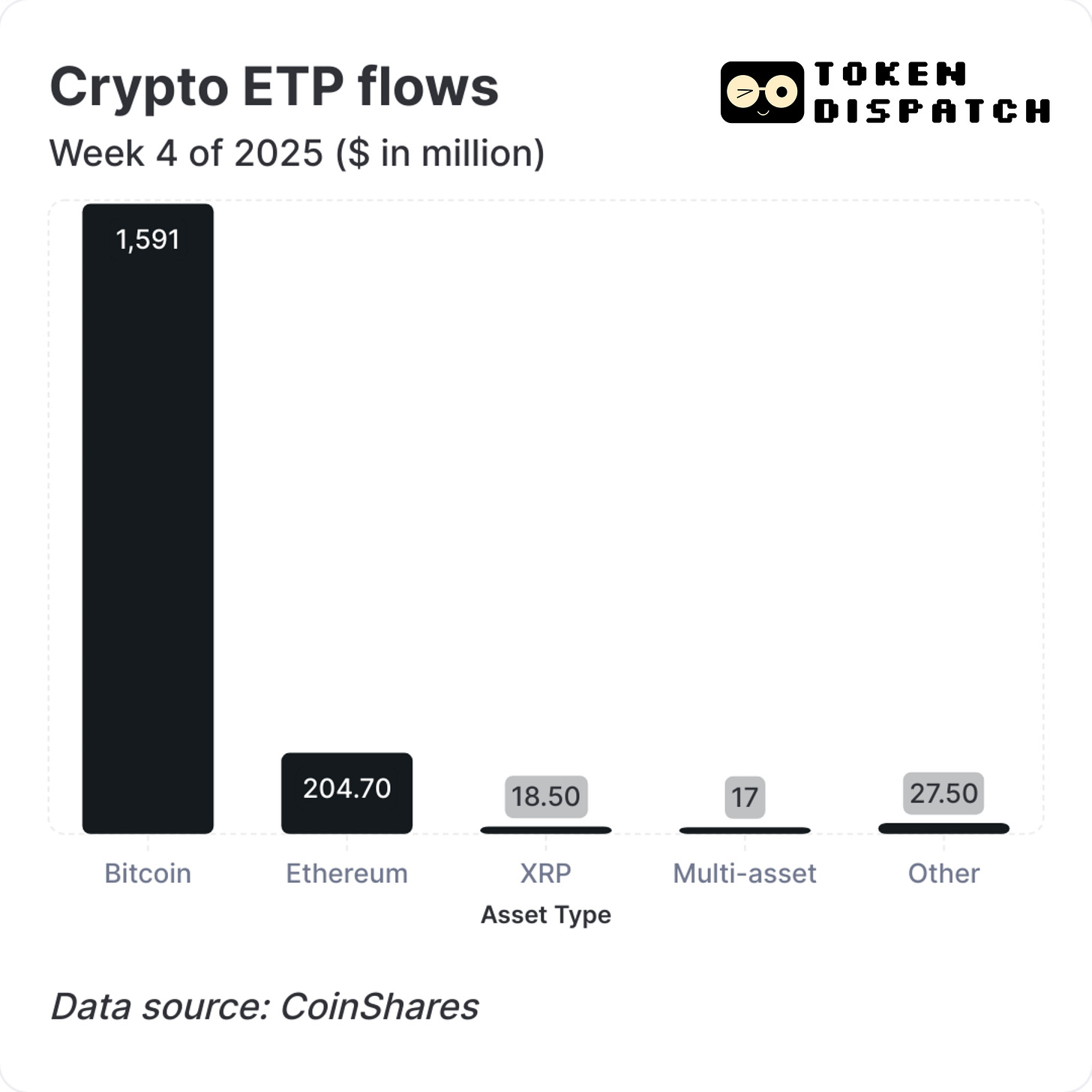

Exchange traded products pulled in a staggering $1.9 billion in the week of Donald Trump’s inauguration - up dramatically from just $48 million the week prior, CoinShares report showed. As institutional money flooded in, asset managers were busy filing for every kind of ETFs - from memecoins to Layer-1s.

In today's Wormhole, we explore this unprecedented surge in crypto ETF applications and what it means for the industry's institutional future.

Choose the Right Ledger Wallet for You

Ledger wallet comes with key features to ensure accessibility and security for you wallet. With Ledger live app you can manage and stake your digital assets, all from one place. Ledger recover helps to restore access to your crypto wallet in case of a lost, damaged, or out of reach Secret Recovery Phrase.

The 2025 Surge

2024 saw ETFs lead the crypto journey. They led the adoption both at institutional and retail levels. Broke records every now and then to a point that it no longer feels surprising.

Meanwhile, 2025 has begun bigger and better.

$1.9 billion fresh inflows into crypto ETPs in one week

Bitcoin ETPs grabbed 92% ($4.4 billion) of all inflows YTD ($4.76 billion)

Total crypto ETP assets reached $171 billion

The scale of these inflows signals a fundamental shift in institutional appetite. Even more telling? No digital asset investment products saw outflows last week.

But there’s something different about the ETF movement in the last two months.

REX Shares launched the first memecoin wave by filing for DOGE, BONK, and TRUMP ETFs. Bitwise followed with a Delaware entity for Dogecoin. VanEck joined with their "Onchain Economy ETF".

While Bitcoin and Ethereum ETFs blazed the trail, 2025's ETF landscape looks radically different. Bitwise's recent Dogecoin trust registration in Delaware hints at a broader strategy - one that could reshape how retail investors access crypto.

To get full access to our weekly premium features (HashedIn, Wormhole, Rabbit hole and Mempool) and subscribers only posts.

The ETF Variety

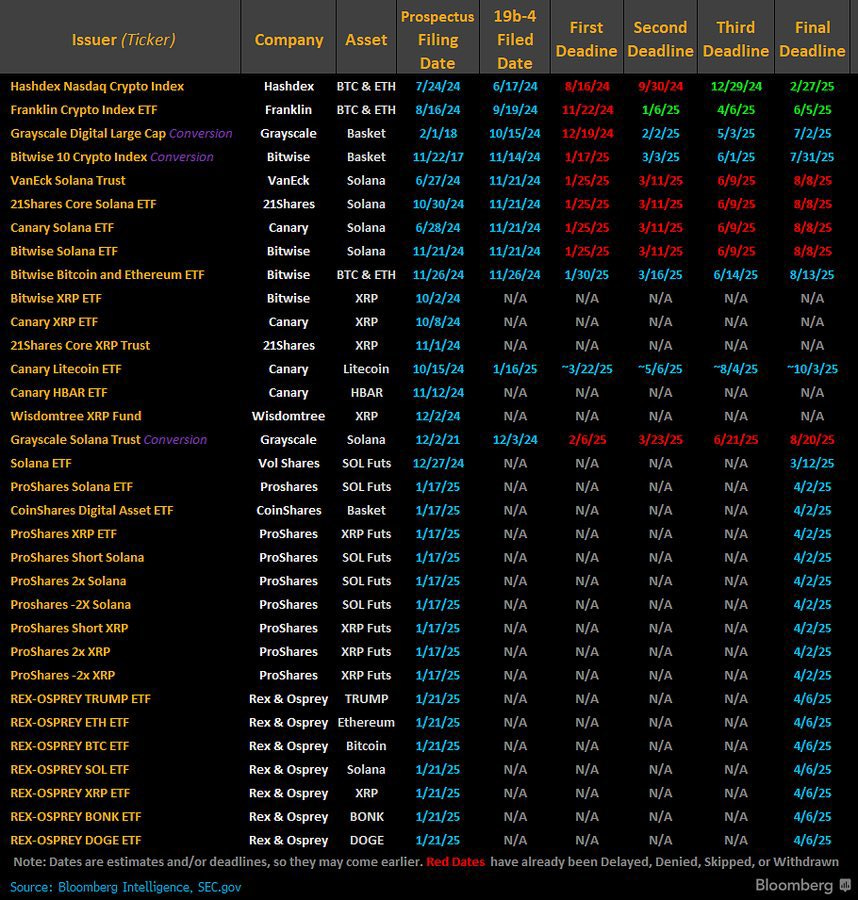

As many as 33 ETF applications - in all colours and shapes - have been filed and pending with the SEC.

Think of an ETF that allows you to benefit of Bitcoin’s price rise, but gives you a downside protection. No, we aren’t dreaming.

Calamos Investments introduced a new concept designed for institutions still hesitant about crypto's volatility.

"Such a capital-protected Bitcoin strategy should exhibit relatively low volatility, though likely higher than a capital-protected strategy tied to the equity market," explains Calamos's ETF head Matt Kaufman.

And there are a lot more such ones lined up for approval.

See the meme in the list of ETFs above? $DOGE, $BONK, $TRUMP?

That’s not some random filing by Rex-Osprey. They know what they are up to.

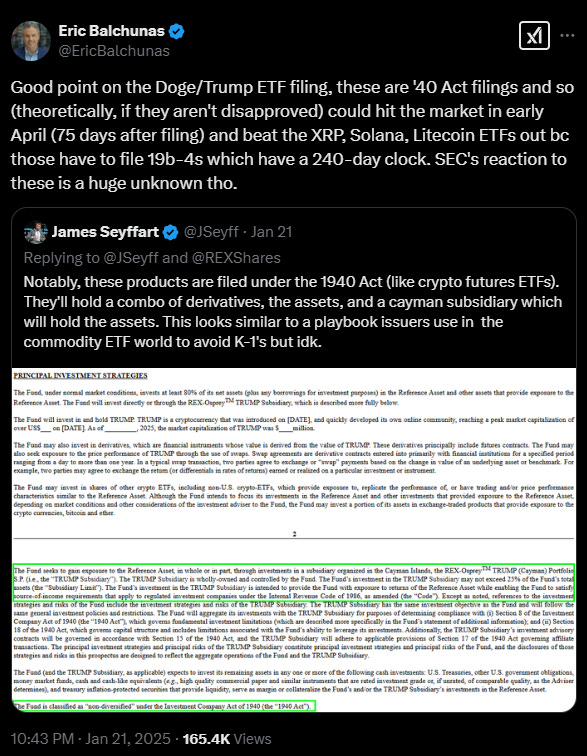

Bloomberg ETF analysts James Seyffart and Eric Balchunas feel that Rex could beat even the long-awaited XRP and SOL ETFs in terms of getting approval for the memecoin ETFs.

Asset managers are reimagining what's possible.

Oasis Capital's Digital Asset Debt Strategy ETF aims to invest in convertible bonds of crypto companies. ProShares is pushing boundaries with leveraged and inverse products for multiple tokens.

Even traditional powerhouses like VanEck are evolving, with their Onchain Economy ETF targeting companies driving digital transformation.

What’s Different This Time?

Timing and approach. Several factors aligned to create this moment.

Firstly, the leadership shift at the SEC marks a fundamental change in the regulatory approach. Gary Gensler's departure opened the door for pro-crypto Mark Uyeda to step in as acting chair, with Paul Atkins - known for his innovation-friendly stance - nominated as permanent chair.

This change of guard signals a potential new era for crypto regulation.

Market momentum has played an equally crucial role.

Bitcoin's surge to new all-time highs has reignited institutional interest, while the success of spot Bitcoin ETFs - pulling in over $35 billion in their first year - has proven the market's appetite for regulated crypto products.

Then there’s the Trump effect.

When there’s the President himself going about launching memecoins named after him and opening up trade of merchandise using the token, there’s little left to imagination about what is possible under his administration.

"The approval of TRUMP, BONK, and DOGE ETFs is more likely now with Trump's new crypto-friendly SEC picks. It's a bold move, potentially bringing more liquidity and mainstream acceptance to memecoins," Dmitrij Radin, founder of Zekret, an EVM-compatible blockchain, told Cointelegraph.

The market's response to Trump's crypto initiatives has been decisive.

"We began the week with minor outflows, but as weaker-than-expected macro data followed in and the euphoria around Trump escalated, we saw substantial inflows," said James Butterfill, head of research at CoinShares.

The numbers tell the story - $1 billion in net inflows on a single Friday. This is beyond just Trump's policies; it's about the broader shift in market sentiment his administration represents.

What’s interesting is the 2025’s ETF wave has also managed to attract pension funds.

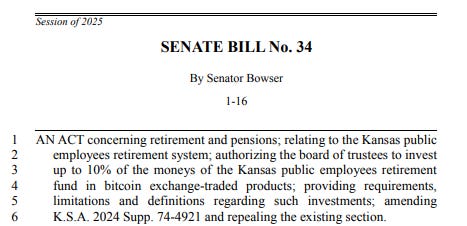

Kansas’ State Senator Craig Bowser moved a bill to allocate 10% of public employee retirement funds to Bitcoin ETFs.

The bill's structure is fascinating.

Board of trustees to manage Bitcoin ETF investments

Up to 10% allocation permitted

No forced selling if allocation exceeds 10%

Annual examination requirements

This could create a template for other states to follow.

The Infrastructure Challenge

As promising as it sounds, even with Trump's pro-crypto stance, launching these ETFs won’t as simple as filing paperwork.

The "Winklevoss standard" - SEC's requirement for a regulated futures market - remains a significant hurdle.

CME Group's recent slip revealed potential plans for SOL and XRP futures, but the exchange quickly clarified it was just a test environment. This highlights a crucial challenge: most altcoins lack the regulated futures markets that helped Bitcoin and Ethereum ETFs succeed.

Beyond futures markets, each token category faces unique challenges.

For memecoins, liquidity is the primary concern. While DOGE maintains significant trading volumes, newer tokens like BONK and TRUMP lack historical data for proper risk assessment.

ARK Invest’s Cathie Wood said she would not be investing in the $TRUMP token, with her focus remaining on the three largest cryptocurrencies.

Layer-1 tokens face regulatory uncertainty. The SEC previously labelled SOL a security, and despite Ripple's victories, the XRP case appeal continues. This regulatory ambiguity could delay approvals.

Former SEC senior counsel Adrienne Gurley, too, sees a measured approach ahead.

"The SEC will have to coordinate with the CFTC on certain guidelines. So I don't expect an overnight response to this, but rather a slow rollout of approvals," said Gurley.

Despite these challenges, asset managers are innovating their approaches.

Hours ago, Grayscale did something that even the ETFs experts had never before heard of.

They debuted their Dogecoin Trust and immediately filed with the NYSE to convert into an ETF.

Grayscale isn’t alone.

Canary Capital, founded by ex-Valkyrie's Steve McClurg, initially planned to launch a hedge fund. They pivoted to ETFs after Trump's election prospects improved.

"If he wins, then there'll be changes in regulatory agencies and it's probably likely that other crypto ETFs will get approved, so why don't we file some ETFs and see what happens," McClurg had explained.

The strategy appears to be working. Institutional investors are already positioning themselves.

BlackRock's iShares Bitcoin Fund became history's most successful ETF launch. Ethereum ETFs collectively gathered $12 billion in their first year.

These successes are encouraging more traditional firms to enter the space.

The Path Forward

Timing remains crucial. The 75-day review process under the '40 Act could see the first memecoin ETFs launch by April. But as Adrienne Gurley warns, coordination between SEC and CFTC could extend timelines.

For traditional investors, these ETFs represent more than just new investment vehicles.

Token Dispatch View 🔍

The ETF flood we're witnessing is a testament to how far crypto has come from its rebellious roots to becoming a cornerstone of institutional portfolios.

Today's wave is fundamentally different from previous cycles.

When BlackRock and Fidelity launched their Bitcoin ETFs, they proved institutional demand existed. Now, with everything from downside-protected Bitcoin products to memecoin ETFs in the pipeline, we're seeing the market mature in unexpected ways.

What makes this particularly fascinating is the democratisation of crypto access.

A Kansas pension fund exploring Bitcoin ETFs while Calamos designs protected products for conservative institutions shows how these instruments are bridging gaps we didn't even know existed.

Most telling is how the market is innovating.

Grayscale's move to debut a Dogecoin trust and immediately file for ETF conversion shows that even established players are rewriting their playbooks.

Yet, amid this euphoria, caution is warranted.

The "Winklevoss standard" remains a real hurdle, and CME's accidental SOL and XRP futures reveal reminds us that crucial infrastructure pieces are still missing. Each token category - from memecoins to Layer-1s - will face unique scrutiny.

The winners in this new wave might be those who can navigate the delicate balance between innovation and compliance while building sustainable products.

As Wall Street's passive investment machine becomes crypto's unlikely ally, we're watching the industry mature in real-time.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

This whole ETF wave is wild! It’s crazy to see how much institutional money is flooding in, and the fact that even Trump’s crypto moves are shaking things up just adds another layer. I never thought we’d see Dogecoin and memecoins being taken this seriously. Do you think this push towards more crypto ETFs is a sign that the market is ready for more mainstream adoption, or is it just hype that could fade out?