Who Will Replace Gary Gensler? 👀

Trump's win brings his most popular crypto promise into focus. Who takes over US SEC might matter more than who leaves. From "CryptoDad" to "Crypto Mom," who can reshape crypto's future in America?

Hello, y'all. In this week’s explainer we put on the table the most popular Trump’s promise. The fate of Gary Gensler. Not as easy at it looks, not that straightforward as it seems ... happy Sunday 🍻

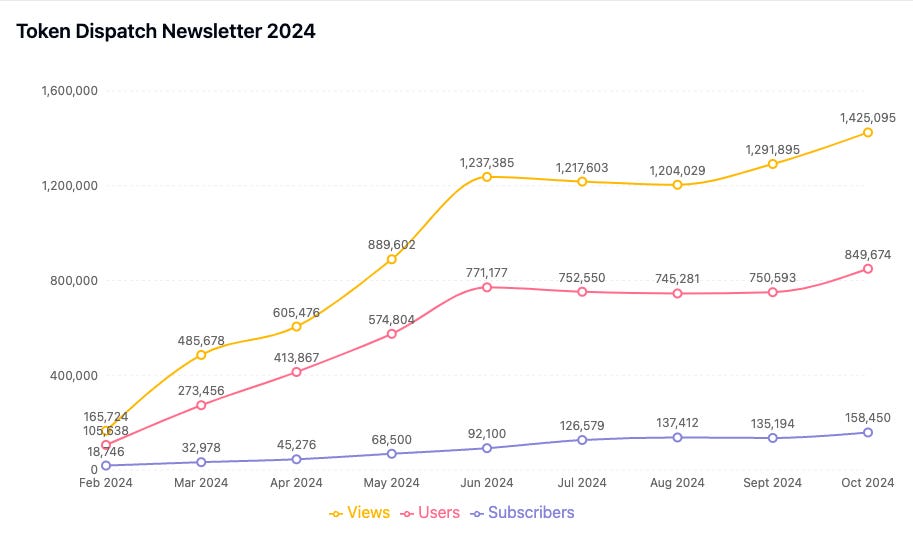

Want to reach out to 150,000+ subscriber community of the Token Dispatch? Ride with us👇

Sometimes, timing really is everything.

Bitcoin is blasting through all-time highs each day …

👉🏻 👈🏻 This close to $80,000.

Welcoming the new president of United States Donald Trump, with all its glory.

Read: Who Set Crypto on Fire 🔥

Now crypto's biggest moment might be coming …

The US Securities and Exchange Commission (SEC) Gary Gensler's exit …

We look at the contenders.

"I will fire Gary Gensler on day one," Trump declared at a Bitcoin conference in July.

Even Trump was surprised at the thunderous applause that followed. "I didn't know he was that unpopular," he quipped.

Well, Gary's report card explains why ...

The Gensler Era

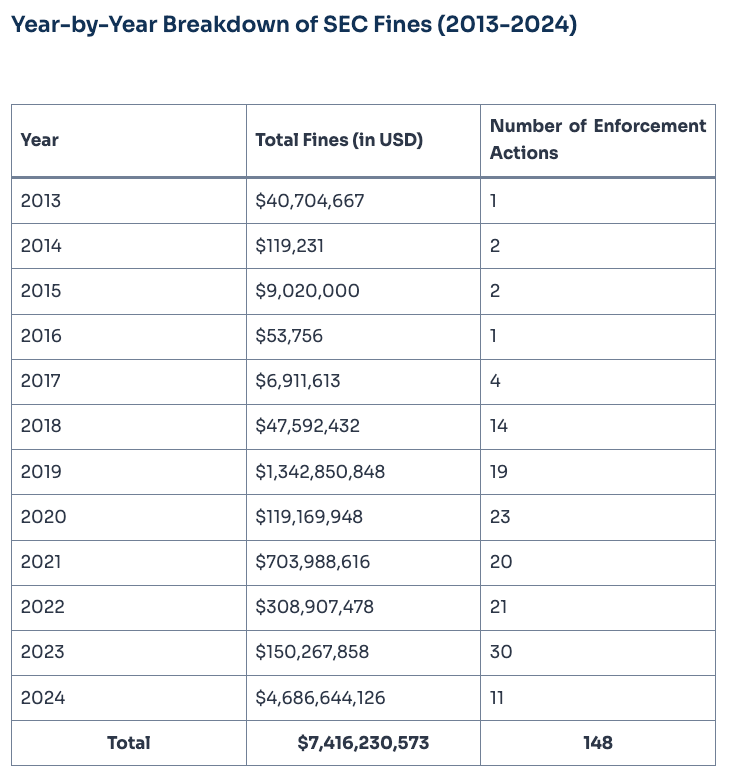

Remember when we said the SEC was going berserk with enforcement?

Over 50% of ALL crypto enforcement actions since 2015 happened under Gensler

Total fines since 2013: $7.42 billion

2024 fines alone: $4.68 billion (63% of ALL fines ever!)

Increase from 2023 to 2024: A mind-boggling 3,018%

Total enforcement actions: 148 since 2013

Basically, if it moved in crypto, Gary tried to sue it.

But here's the thing - it's not just about the numbers. It's HOW he did it.

"Regulation by enforcement" became Gensler's trademark.

No clear rules, just lawsuits. Lots of them.

Operation Chokepoint 2.0

His defense? Cleaning up a "rogue industry" whose "leading lights are in jail, about to go to jail, or awaiting extradition."

The industry's response? Not exactly friendly …

Crypto firms have been taking the US SEC to court.

Read: Gensler's SEC v Digital Asset Industry ⚔️

Gensler's aggressive stance had real consequences

Innovation exodus: Major projects moved offshore. US crypto jobs declined. Investment shifted to Asia and Europe

Market uncertainty: Crypto prices suppressed. Projects afraid to launch. VCs hesitant to invest

Global competition: Hong Kong welcoming crypto. EU moving ahead with clear rules. Singapore becoming a hub

Don’t Miss Out on Our Weekly Features

Connecting dots to bridge the narrative that's shaping the crypto world. Saturday analysis written by Prathik Desai 👇

Crypto world can be a maze. Lot of information, not much context. Lot of noise, not much insight. Sunday explainers written by Thejaswini M A👇

The Next Chapter: Who's in Line?

Now comes the fun part.

Who's going to replace crypto's biggest critic?

Mark "New Sheriff" Uyeda

Current SEC Commissioner since 2022

Former securities counsel to Senator Pat Toomey

Deep regulatory experience

Crypto stance

Calls Gensler's approach "a disaster"

Partners with Hester Peirce on pro-innovation policies

Wants clear crypto guidelines

Key Quote: "Leaving crypto to be addressed in an endless series of misguided and overreaching cases has been and continues to be a consequential mistake."

Dan "The Frontrunner" Gallagher

Robinhood's Chief Legal Officer

SEC Commissioner (2011-2015)

Key player during 2008 financial crisis

Wall Street connections

Strong Republican ties

Crypto stance

Advocates for "tailored rules"

Defended Robinhood's crypto business

Believes most tokens aren't securities

Backed by major crypto figures

Chris "CryptoDad" Giancarlo

Senior counsel at Willkie Farr

Digital Dollar Project founder

Paxos board member

Former CFTC Chair

Crypto stance

Approved first Bitcoin futures

Wrote "CryptoDad: The Fight for the Future of Money"

Philosophy: "Do No Harm" approach to crypto innovation

Paul "Light Touch" Atkins

SEC Commissioner under Bush

Trump's 2016 transition team lead

Financial regulation expert

Crypto stance

Digital Chamber board advisor

Token Alliance co-chair

Pro-innovation stance

Heath "Stablecoin" Tarbert

Circle's Chief Legal Officer

Former CFTC Chair

Treasury Department veteran

Crypto stance

Understands stablecoins deeply

Balance of innovation and regulation

Strong institutional background

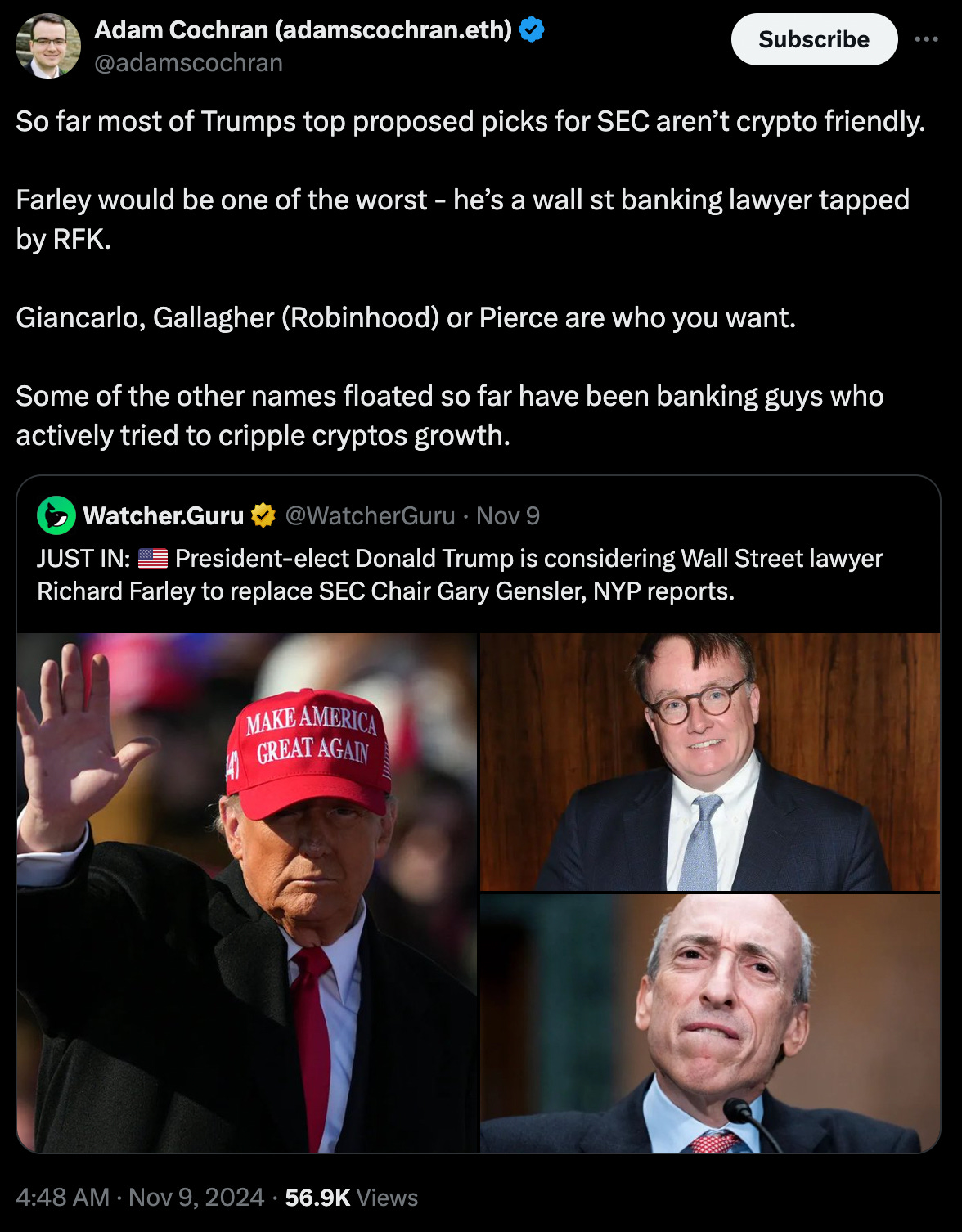

Richard "Wall Street" Farley

Partner at Levin Naftalis and Frankel law firm

Deep Wall Street connections

Traditional finance veteran

Crypto stance

Some worry about his traditional finance background

Others believe his experience could lead to "thoughtful frameworks"

Hester "Crypto Mom" Peirce

And then there's The Wildcard.

The industry's dream candidate consistently opposed the SEC's aggressive stance and advocated for clearer guidelines.

Sources suggest she's more interested in beekeeping in Ohio than chairing the SEC.

Sometimes the best regulators are the ones who don't want the job.

Can Trump Actually Fire Gensler? 🤔

Despite Trump's promises, firing Gensler isn't as simple as pointing to his Twitter account and saying "You're fired."

The president can demote him from chair to commissioner, or make his life really, really uncomfortable.

Removal requires proper cause – neglect, inefficiency, or malfeasance.

Still, history suggests we won't need to test those legal waters.

SEC chairs typically resign when the opposing party takes the White House.

And given Gensler's contentious relationship with the industry he regulated, he might already be drafting his resignation letter.

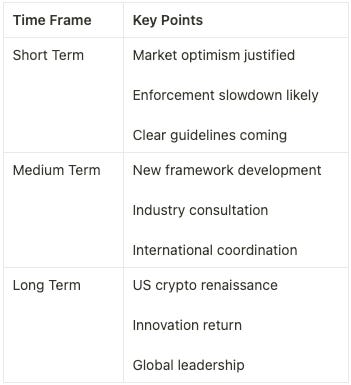

What Changes Can We Expect?

The market's already betting on a crypto-friendly SEC. But what might that actually look like?

Clear Rules Over Lawsuits All potential candidates have criticised "regulation by enforcement"

Crypto-Native Framework Most contenders have actual crypto experience (unlike you-know-who)

Innovation-First Approach The Trump administration is likely to prioritise US competitiveness

Faster Approvals Remember how long spot Bitcoin ETFs took? That might change.

The Timeline

Don't expect overnight changes. Even after inauguration day in January 2025, the transition will take time:

Appointment process could take months

Senate confirmation hearings will be rigorous

Policy shifts might not emerge until mid-2025

Existing enforcement actions will continue

Token Dispatch view

Whoever takes over will inherit an agency at a crossroads.

The hard questions have been asked – now someone needs to provide better answers.

The industry doesn't just need a friendlier face at the SEC; it needs more.

Clear regulatory guidelines

Predictable enforcement standards

Innovation-friendly frameworks

International cooperation mechanisms

After all, a regulatory framework built solely on enforcement actions is like trying to learn road rules exclusively from traffic tickets.

Maybe it's time for an actual map.

This isn't just a changing of the guard - it's a potential revolution in crypto regulation.

The end of the Gensler era marks more than just personnel change. It's America's chance to reclaim crypto leadership while balancing innovation and protection.

The question isn't just who will replace Gensler – it's whether they can transform the SEC from crypto's strict parent to its wise guide.

The industry is watching, and for once, so is everyone else.

Week That Was 📆

Saturday: Dear Mr President-Elect: About Those Crypto Promises ... 📝

Friday: Who Set Crypto on Fire 🔥

Thursday: Good Morning Trump's USA ☀️

Wednesday: From Crypto With ❤️

Monday: Bitcoin Plays Election 🗳️

If you want to make a splash with us, check out partnership opportunities 🤟

Our sponsorship storefront on Passionfroot 🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋

What do you think it means for Polymarket?

Gensler’s enforcement-first approach created a culture of fear in crypto. If his successor focuses on clear guidelines, it could be a real game-changer for U.S. competitiveness.