Who's Betting on Solana? 🎲

VanEck sets $330 Solana price target. Can it challenge Ethereum? Snowden slams Solana over centralisation. ETH startups outpace SOL in the $12B VC battle. PYUSD on Solana down to $320M from $660M.

Hello, y'all. Enjoy long-form articles trusted by the best in Web3? Get them right in your inbox 👇

VanEck Research’s Matthew Sigel has set a bullish target of $330 for Solana.

A recent report from VanEck suggests that’s where Solana could reach, capturing 50% of Ethereum's current market capitalisation.

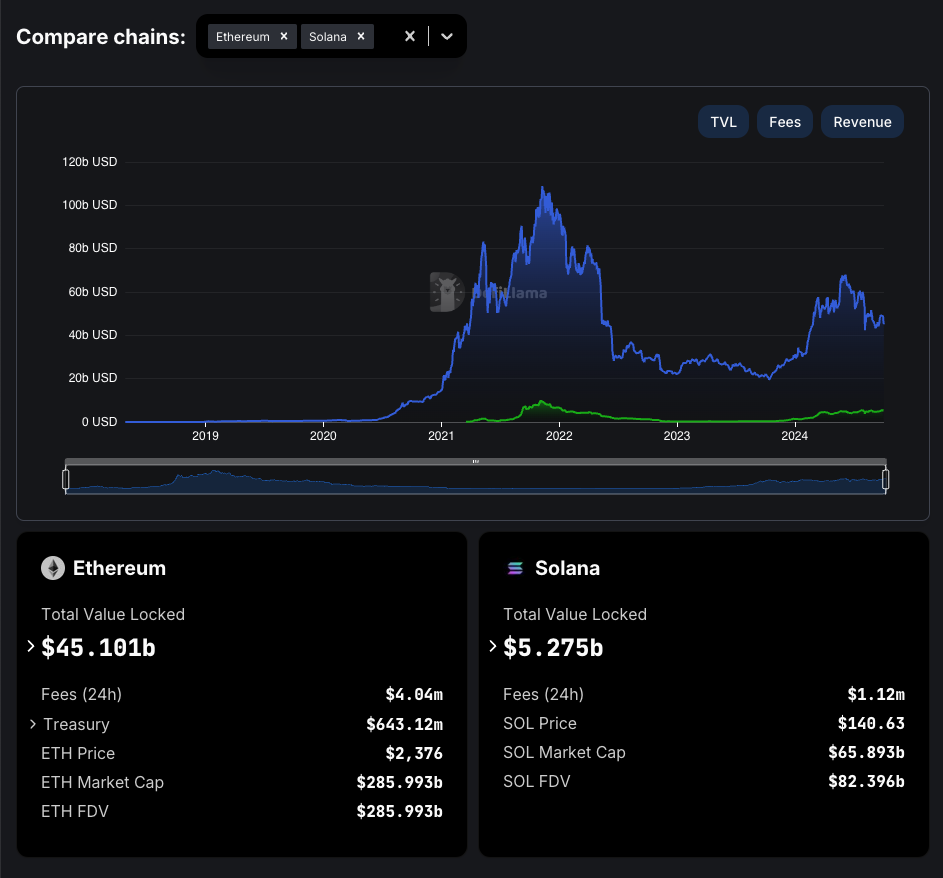

Can it really challenge Ethereum that’s 5x the market cap and 9x the total value locked?

Then what’s driving the optimism?

Just the undervalued and untapped utility of Solana, says Sigel.

Reasons why Solana is regarded as “Ethereum killer”

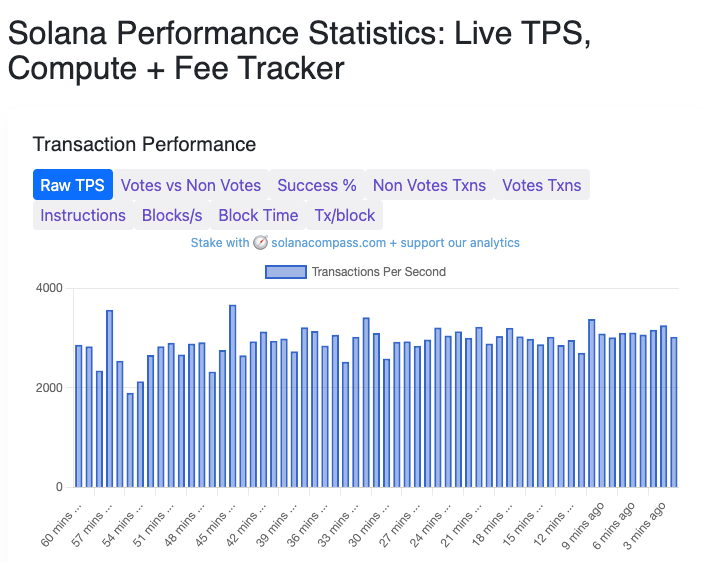

Performance metrics? Solana processes 3,000% more transactions per second (TPS) than Ethereum.

1,300% more daily active users and offers transaction fees that are nearly 5 million percent cheaper.

Speed and cost efficiency make it a strong contender for decentralised finance (DeFi) applications and payment systems, particularly with stablecoins driving activity.

All these things give Solana an edge over Ethereum for payments and remittances.

Can Solana pull that off?

Well, the price chart doesn’t suggest so.

If Solana continues to scale and attract users, its market cap could significantly increase.

It’s been building ecosystems leveraging its speed and cost advantage.

Its chain got over $800 million in net flows in the last three months.

How much is that?

More than double of what OP Mainnet, an Ethereum layer-2, received and a lot more than what Sui, another scalable blockchain, posted in the last three months.

So, investors are finally waking up to its potential.

Activity on chain: The network's total value locked (TVL) rose to ~$5.5 billion, a multi-month high, as per DefiLlama.

A perfect recipe for a bullish outlook? Bitget Research Chief Analyst Ryan Lee said so, to The Block.

Solana teased its new phone at Token 2049 in Singapore last month. Solana Seeker is set to launch in mid-2025 and has already bagged 140,000 pre-orders.

But the use-case won’t be limited to a phone.

What else? Token airdrops targeting phone buyers. Upgraded decentralised applications (DApps) store.

Its DApps is already seeing good activity lately.

The DApp volumes on Solana shot up 46% in the previous 7-day period.

Ethereum DApps? Gained 12% during the same period.

Read: Solana DApps volume increased by 46% in a week — Is $180 SOL next stop?

So, all well for Solana?

It’s got a few things to take care of.

Network congestion and outages: Solana has experienced multiple instances of network congestion and outages, with reports indicating that around 70% of transactions were failing during peak congestion periods.

Complexity and technical challenges: Solana's technology and unique architecture present a learning curve for developers and users, impacting adoption rates.

Reputation damage: The network's association with FTX and its collapse in 2022 significantly impacted Solana's reputation and price.

Bot activity and spam transactions: The network has been plagued by high levels of bot activity and spam transactions, contributing to congestion issues.

Centralisation concerns: Critics have argued that Solana is more centralised compared to other blockchains, with a smaller number of validators having significant control over the network.

Security vulnerabilities: The network has faced security issues, including hacks and exploits, raising concerns about the safety of funds and applications on the platform.

There are also concerns around the network's governance and validator distribution.

It may not be as decentralised as Ethereum's. That leaves the network open to attacks and failures.

Solana has been heavily reliant on venture capital funding.

This raises questions about its long-term sustainability and independence in the crypto ecosystem.

Unlock Web3 Insights by the Web3 Builders

A weekly podcast that takes you closer and deep into things that are shaping the world of crypto and Web3. Senior executives from 140+ enterprises trust them to keep them updated on what's going on in crypto.

Do tune in for depth, insight & numbers on how the internet is evolving.

Brought to you by Joel John, Saurabh Deshpande, Shlok Khemani and Siddharth.

Block That Quote 🎙️

Edward Snowden, American intelligence contractor and whistleblower

“A lot of people—and I don’t want to name names, but Solana—are taking good ideas and they’re just going, ‘Well, what if we just centralised everything? It’ll be faster, it’ll be more efficient, [and] it’ll be cheaper.”

Snowden said this during his talk at Token 2049 in Singapore, raising eyebrows about Solana’s centralisation.

The clip of Snowden’s comments caught fire on social media - over 733,000 views.

The community took over the debate.

Ethereum Startups Outpace Solana in the $12B VC Battle?

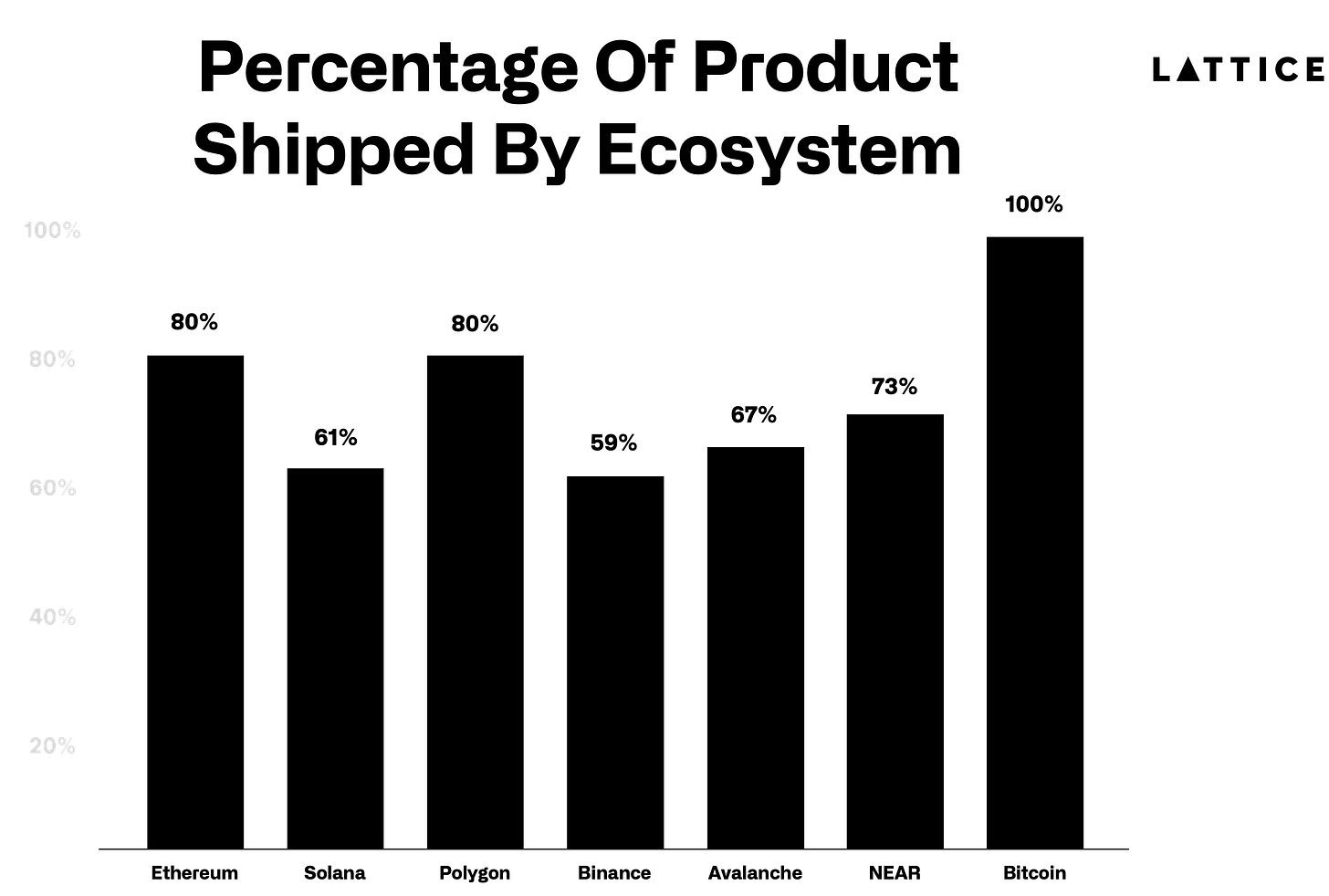

Yes, according to a report from Lattice.

Ethereum startups from 2022 have outperformed Solana - 80% shipping products compared to just over 60% for Solana projects.

20% of Ethereum projects shut down in the last two years, which is better than the 26% failure rate for Solana projects.

Venture capitalists are expected to invest $12 billion in crypto startups in 2024.

In 2022, approximately $1.4 billion went to Ethereum-based startups, while early-stage Solana projects attracted only $350 million.

In The Numbers 🔢

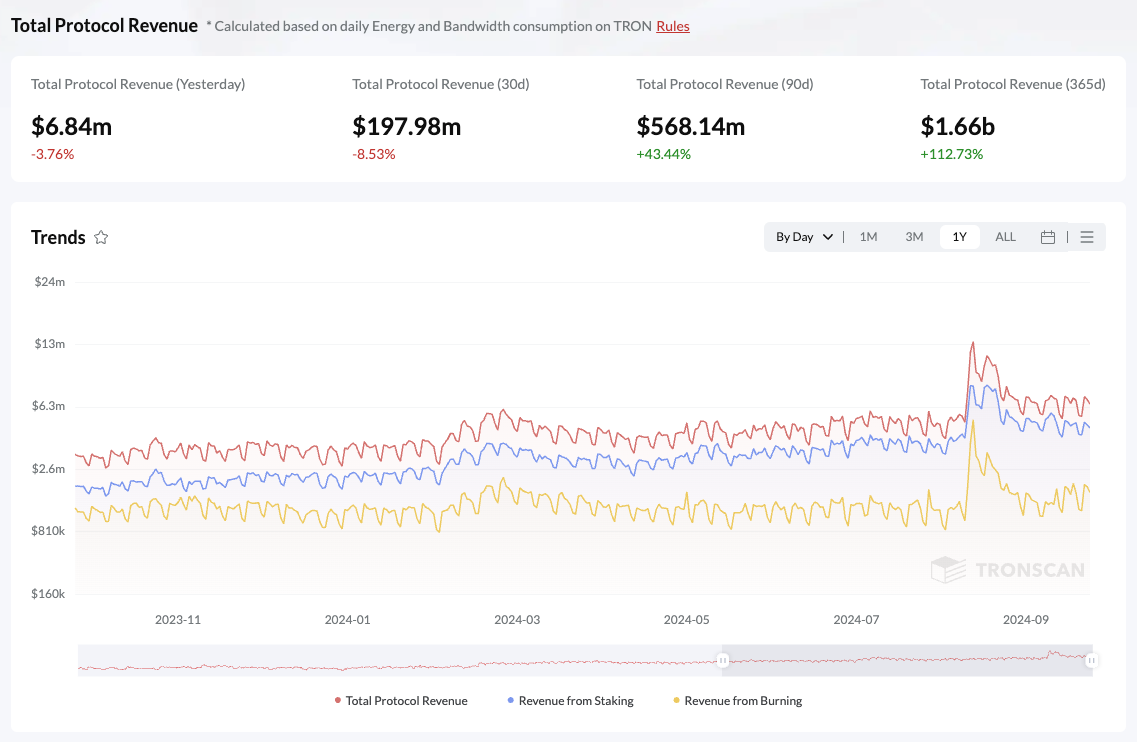

$568 Million

That’s how much Tron generated in revenue during Q3 2024 - outperforming major Bitcoin, Ethereum, and Solana.

43% increase from Q2 and contributes to a total annual revenue of approximately $1.66 billion, reflecting a 113% year-on-year growth.

Tron's revenue is more than 2x higher than Ethereum's $253 million.

It is 5x higher than Solana's $105 million and 9x greater than Bitcoin's $57 million.

Tron's revenue surge is largely attributed to its robust stablecoin activity.

The network holds 34.8% of the stablecoin market, with a supply of $59.8 billion, primarily driven by Tether's USDT.

The recent launch of SunPump, a memecoin launchpad, has increased network visibility and activity.

Tron boasts over 8 million daily transactions, fueled by stablecoin transfers and the memecoin craze. Average transaction fees have risen from about 20 cents to $1 over the past two years, enhancing revenue.

PYUSD Down 50% Supply on Solana

PayPal's stablecoin, PYUSD, has seen its supply on Solana plummet by about 50%, according to a recent report by Blockworks

From $660 million to $315 million in just a month.

As of now, Ethereum holds a supply of $377 million in PYUSD - a shift back towards Ethereum after Solana briefly led.

The decline coincides with the winding down of liquidity incentive programs by DeFi protocols like Kamino, which had previously attracted yield farmers with lucrative returns.

Yield changes? At its peak, PYUSD offered an 18% yield on Kamino, but this has since dropped to around 9.24%, leading many investors to seek better opportunities elsewhere.

Despite the recent decline, PYUSD remains the third-largest stablecoin on Solana, behind USDT and USDC.

The Surfer 🏄

Kalshi has resumed its prediction markets for the upcoming US elections after a federal appeals court lifted a halt imposed by the Commodity Futures Trading Commission (CFTC). The platform will list its contracts on which party will control each house of Congress.

The SEC has appealed a recent court ruling in its ongoing case against Ripple, arguing that the decision conflicts with established Supreme Court precedent regarding securities law. Ripple CEO Brad Garlinghouse criticised the appeal, adding that XRP's status as a non-security is already established law.

SEC Enforcement Director Gurbir S Grewal is stepping down after three years in the role, effective October 11. During his tenure, Grewal led enforcement actions against around 100 crypto firms, including major players like Coinbase, Kraken, and Ripple Labs.

If you want to make a splash with us, check out partnership opportunities 🤟

Our sponsorship storefront on Passionfroot 🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋