Hello, y'all.

"I'm finally able to announce that this case has ended. It's over."

With those two lines from Ripple CEO Brad Garlinghouse, a four-year nightmare for XRP holders officially came to an end.

Yesterday, in a surprise announcement, Garlinghouse revealed that the Securities and Exchange Commission (SEC) dropped its appeal against Ripple, effectively ending one of the most high-profile crypto legal battles in history.

The SEC’s reaction was swift and decisive. XRP investors celebrated the end of regulatory uncertainty that has hung over the token since December 2020.

The XRP price wasn’t the only ripple reaction.

Odds of XRP ETF being approved before July 31 soared

Bitnomial announced XRP futures as regulatory clouds cleared

End of the prolonged debate around XRP being considered a security

CEO Garlinghouse called this “a resounding victory for Ripple, for crypto, every way you look at it.” Let’s see how.

Paris Blockchain Week 2025 – The Future of Web3 Awaits!

Join industry leaders, innovators, and investors at one of the most anticipated blockchain events of the year! From April 8-12, experience groundbreaking discussions, exclusive networking, and cutting-edge insights in the heart of Paris.

10,000+ attendees | 400+ speakers | 100+ sessions

Explore DeFi, NFTs, AI, and Web3 innovations with top global experts!

Secure your spot today and be part of the future. Limited seats available!

The New Dawn

On Wednesday, XRP’s price jumped more than 10% within an hour of Garlinghouse’s tweet, climbing to $2.59 before seeing a slight correction.

It's hard to overstate just how significant this development is.

Get 17% discount on our annual plans and access our weekly premium features (HashedIn, Wormhole, Rabbit hole and Mempool) and subscribers only posts. Also, show us some love on Twitter and Telegram.

When the SEC sued Ripple in December 2020 (during Trump's first term, ironically), it kickstarted what Garlinghouse called "the first major shot fired in the war on crypto."

The allegation? That Ripple had conducted a $1.3 billion unregistered securities offering through XRP sales.

The cost? An estimated $15 billion in losses for XRP holders as exchanges delisted the token and investors fled.

Now, with the SEC waving the white flag, the implications stretch far beyond just a price pump.

Speaking at Blockworks' Digital Asset Summit in New York, Garlinghouse called it "a victory for the industry and the beginning of a new chapter."

That new chapter is already being written.

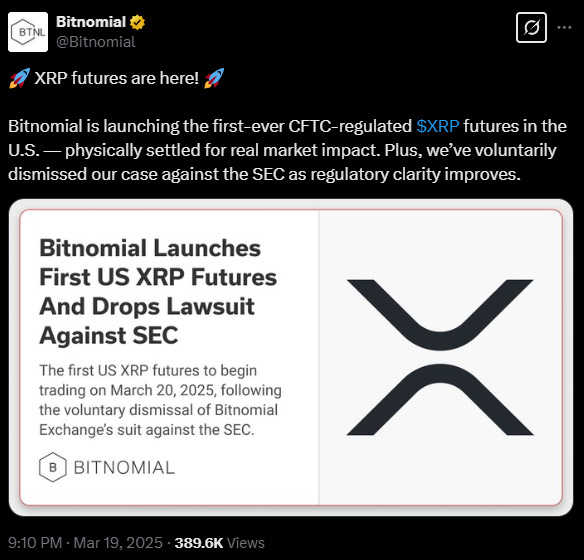

Hours after Ripple's announcement, Chicago-based exchange Bitnomial revealed plans to launch the first-ever CFTC-regulated XRP futures in the US today.

The exchange had sued the SEC in October for asserting jurisdiction over its XRP futures product. Now, it's voluntarily dismissing that case.

How did we get here?

The Trump Effect

The SEC's surrender didn't happen in a vacuum.

Ripple played a key role in lobbying efforts in the run up to Trump’s re-election.

Ripple, along with Coinbase and Andreessen Horowitz, led a $300 million super PAC campaign that's now paying dividends.

Their $5 million contribution to Trump's inauguration fund looks like pocket change compared to the $125 billion their XRP holdings have gained since election day.

Read: A Lobbying Masterstroke

That’s not all.

Since US President Donald Trump's return to office and his promise to make America "the world's crypto capital," the SEC has been in full retreat mode.

Former Chair Gary Gensler's aggressive anti-crypto stance has been completely reversed, with the agency dropping cases against Coinbase, Kraken, and Uniswap - to name a few - in recent weeks.

Read: Case Closed: SEC’s Crypto Cleanup🧹

"The new chapter started with the reset at both the Congress and the executive branch […] when Trump came in and nominated Paul Atkins, Scott Bessent, [and] brought on David Sacks," Garlinghouse said in his video message.

The Ripple case was the final domino to fall.

It’s implications? Beyond just Ripple.

🎙 Block That Quote

John Deaton, crypto lawyer

"This is the final exclamation point that these [XRP] tokens are considered digital commodities, not securities. I remember when this case was first filed. I thought it was an assault on the industry, like the boot on the neck of the industry."

This wasn't just about Ripple – it was about the entire crypto industry fighting back against traditional finance's attempt to crush it.

Those providing XRP derivatives also welcomed the news.

"With the SDNY determination that XRP is not a security in secondary offerings, XRP futures do not qualify as securities futures and are therefore solely within the jurisdiction of the CFTC," explained Bitnomial Exchange President Michael Dunn in an email statement to The Block.

Translation? The debate over XRP's security status is effectively over.

In The Numbers 🔢

50%

That's the odds bettors on Polymarket are now giving for XRP ETF approval by July 31.

Before the SEC dropped its case, the odds stood at 33%. Now, with the security status question settled, confidence is surging.

JPMorgan predicts investors will pour $8 billion into XRP ETFs in their first year of trading, while Northstake estimates up to $800 million could flow in during just the first week.

Major financial institutions including Grayscale, Bitwise, and Franklin Templeton have all filed for XRP ETFs. The SEC has until mid-October to make a decision.

What’s Next — Challenges and Criticism

For starters, there's still the matter of a $125 million fine imposed by Judge Analisa Torres for Ripple's institutional sales of XRP. Deaton believes Ripple now has leverage to negotiate that down.

"Everything's turned. The election's turned, the industry turned, the SEC [has] completely done a 180 as it relates to the industry. Why should we pay $125 million?" Deaton said.

There's also the question of the injunction preventing Ripple from selling XRP directly to institutional investors.

"If Ripple obviously wants to be able to issue XRP to banks in America directly, I think the hang-up is that injunction and how do you get past that injunction," Deaton explained.

These are small obstacles compared to what Ripple has already overcome.

With $2 billion in investments and acquisitions across the crypto landscape, the company is positioned for expansion. As Garlinghouse put it, "if crypto does well, I fundamentally believe Ripple will do well."

And with XRP listed as one of the assets in Trump's planned strategic crypto reserve, its future trajectory looks promising. What a difference four years makes.

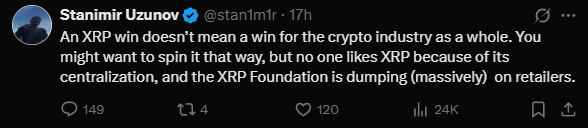

But, this has also become a point of debate among Bitcoin maximalists and others.

Read: Is XRP Crashing BTC's Stockpile Party? 🎈

Even as Ripple celebrates the latest SEC move, it has critics to deal with who have consistently raised concerns around centralisation and the XRP foundation’s massive dumping of its tokens on retailers.

Token Dispatch View 🔍

The SEC's surrender to Ripple does more than merely closing a four-year chapter of legal wrangling; it signals a fundamental power shift in the crypto ecosystem.

While XRP holders celebrate their vindication, the bigger story is how a determined company with deep pockets and political connections managed to outlast one of the most powerful regulatory agencies in the world.

You may criticise Ripple for its centralisation and dumping act, but there’s an acknowledge that’s due. The company knew how to play its cards.

Besides merely surviving the "war on crypto", Ripple emerged as a kingmaker. The $300 million super PAC campaign, the $5 million inauguration contribution, and persistent lobbying efforts have transformed Ripple from regulatory pariah to presidential portfolio asset. The seeds of the court victory that Ripple earned were sown at the ballot box.

For the broader crypto market, Ripple's triumph offers both hope and caution. Hope that regulatory clarity is finally arriving; caution that such victories might require massive political spending and insider connections that most projects simply don't have.

As futures launch and ETF odds improve, we're witnessing what regulatory certainty can do for a token's ecosystem.

This won’t mean the end of struggle for Garlinghouse though. Legal victory doesn't automatically solve fundamental concerns. He will still have to deal with the legitimate questions around XRP's centralisation and foundation token sales that still remain unaddressed.

The test for XRP now will be to prove the skeptics wrong by demonstrating real-world utility beyond speculative trading. Winning in court is one thing. Winning in the marketplace is another challenge entirely.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.