XRP Leads the Altseason 🪙

Bitcoin dominance drops below two-year support level; kicks off altseason. XRP flips Solana and Tether to become 3rd largest crypto. Grayscale's portfolio surges 85%. ETH ETF inflows outpace BTC.

Hello y’all. Happy Monday, it? Today’s crypto hot sauce is about … XRP

Consider signing up for pay-what-you-want subscription to support our work - which is possible thanks to support from readers like you.

Can you guess the track within 5 seconds to prove your music fandom 🫵

The crypto market has been here before.

That magical moment when Bitcoin's gravitational pull weakens and altcoins begin their dramatic ascent.

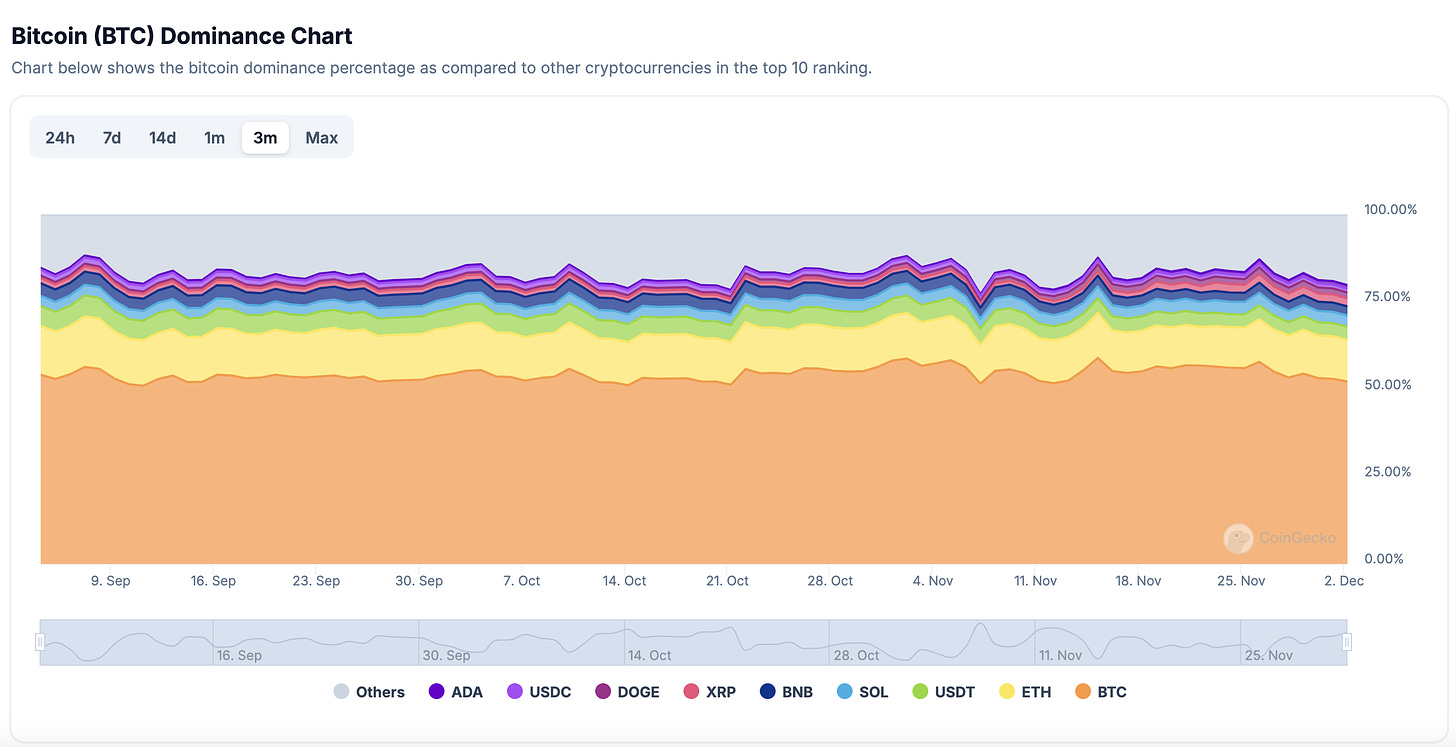

Bitcoin dominance - its share in the total crypto market cap - has fallen below its two-year support level to 56.1%.

For market veterans, this is more than just a number – it's a signal that we're moving towards altseason territory.

Meanwhile, the OTHERS altcoin index has surged 76% since early November, reaching $334 billion.

But why now?

Several factors are converging to create what could be the most significant altcoin season since 2017.

Institutional Bitcoin Saturation: With Wall Street now gobbling up Bitcoin through ETFs, traders are looking elsewhere for higher returns.

Post-Election Clarity: Trump's pro-crypto stance and the imminent departure of SEC Chair Gary Gensler have reduced regulatory uncertainty.

The "Dino" Coin Renaissance: Cryptocurrencies from the 2017 era are roaring back to life, suggesting a broader market revival rather than isolated pumps.

"It's far from a nothingburger, we're on the brink of a full-blown altseason," says Matthew Mena, head of US crypto research at 21.co.

And leading the charge? Our old friend XRP.

The OG crypto just pulled off what seemed impossible months ago - become the world's third-largest cryptocurrency.

The journey to the third spot wasn't a quiet affair. First came Solana's flip, pushing XRP's market cap beyond $122 billion. Then, in a move few saw coming, it surpassed Tether's position.

Talk about a redemption arc.

XRP Number Game

Up 53% this week

Soared 354% in 30 days

Trading at $2.33 (highest since 2018)

Market cap: A massive $132+ billion

Flipped USDT and SOL in market cap rankings

The Stablecoin Wild Card

Ripple's potential entry into the stablecoin market through RLUSD could be a game-changer. New York regulators could approve the project as soon as December 4, giving Ripple a foothold in a $200 billion market currently dominated by Tether and Circle, sources suggest.

Why's this massive?

Standard Custody & Trust Company (Ripple-owned) to issue

Potential to compete with USDT and USDC

Major institutional adoption catalyst

Cross-border payment revolution potential

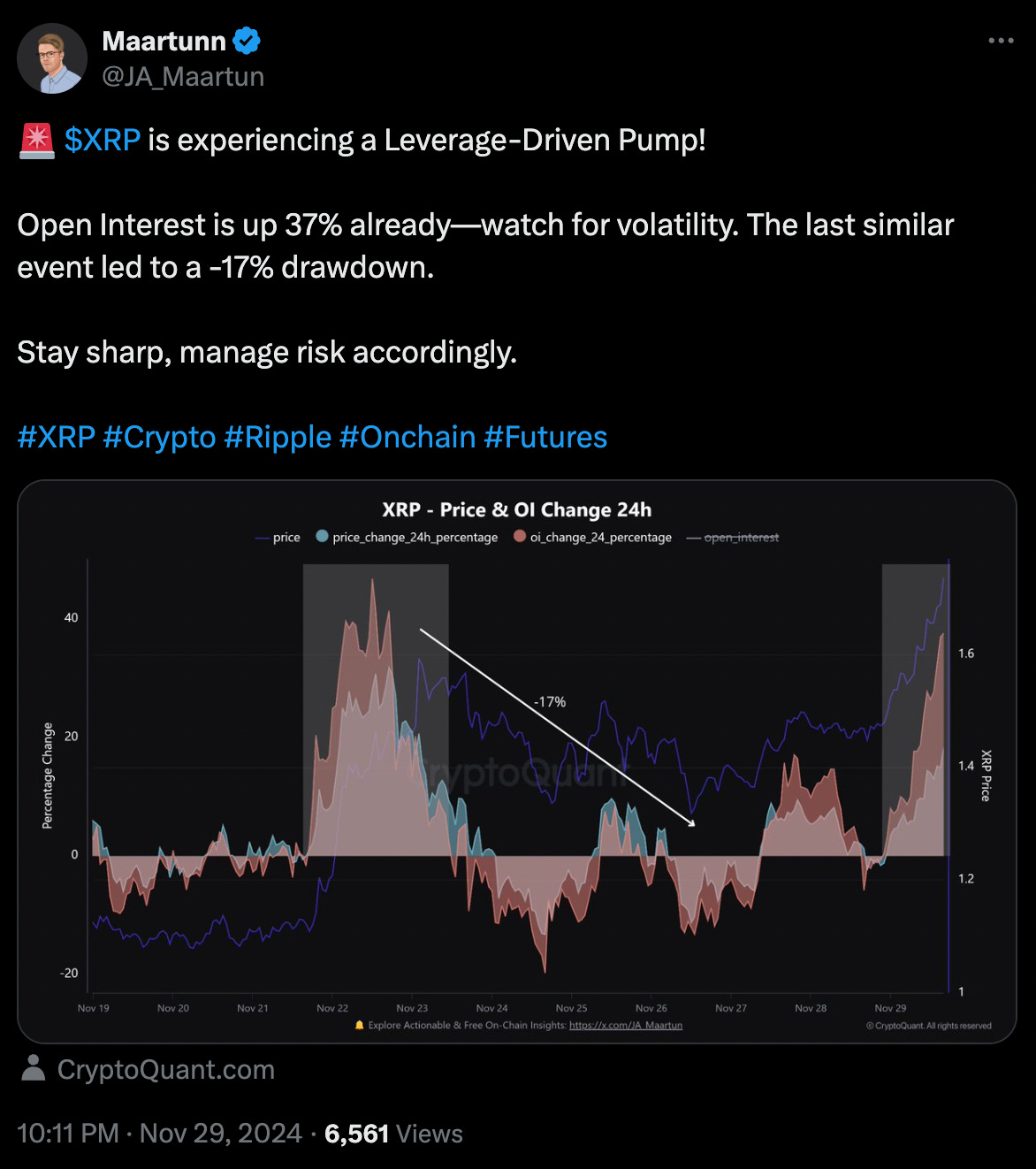

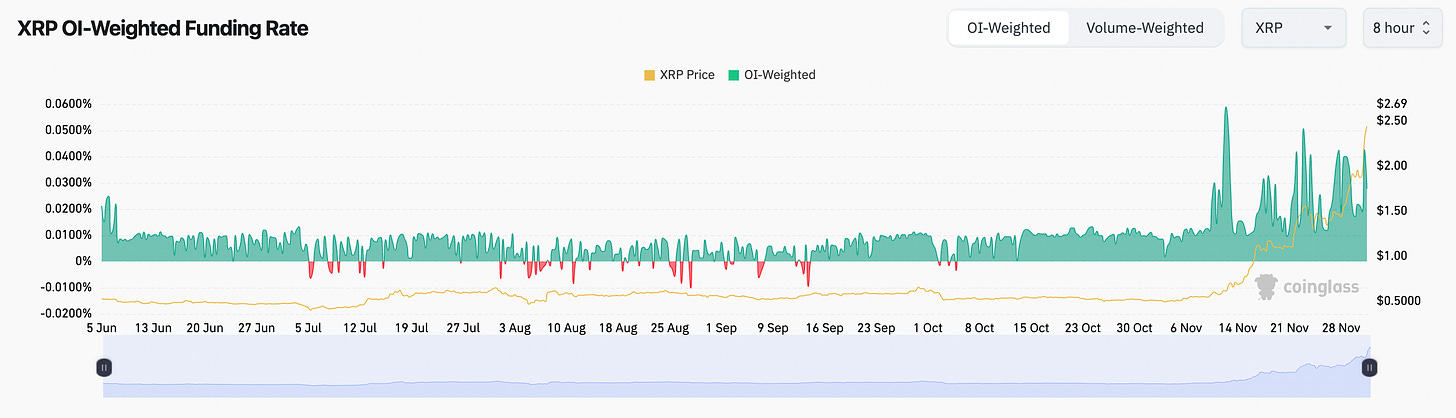

The Leverage Warning

However, this altseason comes with risks.

Open interest in XRP derivatives has exploded by 37% in 24 hours, reaching $4 billion across major exchanges. The last time leverage metrics looked this frothy, XRP dropped 17%.

CryptoQuant analyst Maarten Regterschot warns:

Beyond XRP, other "dino" coins are showing remarkable strength (ATM):

Cardano (ADA): Up 214% in the past month

Dogecoin (DOGE): Surged 167% in 30 days

Stellar (XLM): Posted gains of 136% in 14 days

Axie Infinity (AXS): Delivered 43% returns in two weeks

A New Kind of Altseason

But this isn't your 2017 altseason. The market has evolved in three crucial ways:

Institutional Presence

Unlike previous cycles, this one features significant institutional involvement through crypto ETFs. This creates a new dynamic where "smart money" stays in Bitcoin while retail traders chase altcoin gains.

As Christopher Inks, CEO of TexasWest Capital, notes: "The usual crypto bro cycling out of Bitcoin and into alts will look differently." ETF buyers aren't rotating capital into alternative cryptocurrencies – they're creating a stable base for the entire market.

Sector-Specific Focus

Rather than indiscriminate buying of any altcoin with a pulse, investors are focusing on specific sectors. AI and AI agents are particularly hot, as evidenced by the success of tokens like GOAT.

Regulatory Clarity

The impending change in SEC leadership has created optimism around regulatory treatment of altcoins. This isn't just speculation – we're seeing concrete moves like:

Multiple XRP ETF filings from major players

Ripple's potential entry into the $200 billion stablecoin market

Increased institutional comfort with altcoin investments

Doge Army's Victory March 🐕

Dogecoin just flipped the Porsche's market cap.

The entire memecoin kingdom is having a party.

DOGE now has a market cap of $57.8 billion, surpassing the German luxury automaker's $56.1 billion. If that doesn't capture the zeitgeist of our times, I don't know what does.

How memecoins moved in the past 30 days?

DOGE: up 167%

SHIB: up 65%

BRETT: up 128%

Other dog-themed coins:

Bonk (BONK): up 121%

Dogwifhat (WIF): up 40%

Floki (FLOKI): up 70%

What's driving this surge? The easy answer would be to point to Elon Musk's continued fascination with Dogecoin. His latest venture – creating the Department of Government Efficiency (DOGE)

And there's more...

GOAT Network (a Bitcoin layer-2 scaling project) just dropped a bomb: Soon you'll be able to stake DOGE to earn Bitcoin. Yes, you read that right. The memecoin that started as a joke might just become a serious yield play.

What we're witnessing could be the legitimisation of memecoins as a distinct asset class. When Dogecoin can overtake a century-old automobile manufacturer in market value, it forces us to reconsider what "value" means in the digital age.

The Home for All the Music Lovers

Muzify is a journey into the world of music. An interactive experience through quizzes, stats and a lot of fun tools.

For artists it’s a powerful tool to connect with their fans. For fans it’s building deeper connect with the artists.

Through custom quizzes artists can engage their audience, receive direct feedback, and build a loyal following eagerly anticipating their next release.

The platform offers a direct line to fans, fostering a sense of connection that goes beyond mere listening.

Block That Quote🎙️

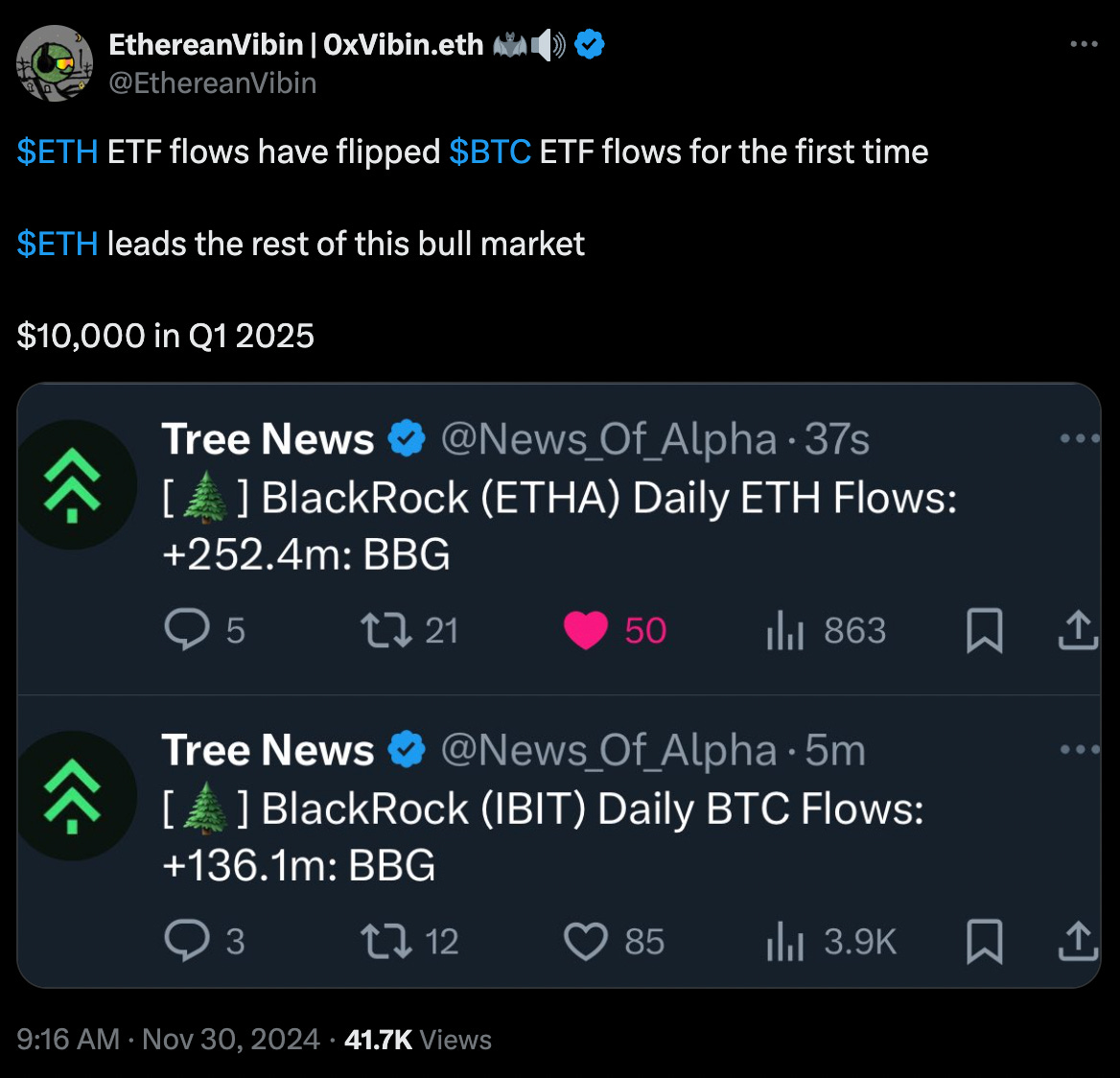

Crypto commentator, Etherean Vibin

"ETH ETF flows have flipped BTC ETF flows for the first time."

The great Ethereum awakening? YES.

Felix Hartmann, founder of Hartmann Capital, puts it in perspective: "First ETH ETF flows > BTC ETF flows. Wall Street is officially joining the fun. Alt rotation has begun."

Adding fuel to the fire, ETF Store president Nate Geraci notes that BlackRock's iShares Ethereum Trust (ETHA) alone has raked in over $2 billion since its July launch.

The numbers tell the story.

$332.9M in ETH ETF inflows (Nov 29)

Beats BTC ETFs by $12.9M same day

BlackRock's share: $250.4M

Total ETH ETF value: $11B+

Behind the scenes, a grander pattern was emerging. Technical analysts pointed to a three-year "cup and handle" formation, whispering predictions of $7,200 ETH by early 2025. Some even dared to dream bigger, calling for $10,000.

As trader Pentoshi puts it.

"Now we have early signs of this happening in ETH, as the flows begin to finally pick up, and sellers begin to get absorbed. It only takes time."

Looks like institutional money isn't just here for Bitcoin anymore. 👀

🔢 In The Numbers

$85%

That's how much Grayscale's crypto portfolio jumped in November. Talk about an alt season kickoff.

While Bitcoin steadily marched toward six figures, it was the underdogs that stole the show. The timing couldn't have been more perfect.

As Bitcoin's market dominance slipped below its two-year support line, institutional money found its way to altcoins. Ryan Lee, Bitget's chief analyst, saw the writing on the wall: XRP could touch $2.57 by year's end.

Grayscale Investments is launching options trading for its spot Bitcoin ETFs this Wednesday, responding to increased investor interest.

BlackRock’s iShares Bitcoin Trust (IBIT) saw a remarkable debut with nearly $1.9 billion in notional exposure and a 4.4:1 call-to-put ratio.

But perhaps the most telling sign? Grayscale, the same firm that built its empire on Bitcoin, was now dancing to altcoin rhythms.

In crypto, as in life, sometimes the most rigid eventually learn to swing.

Token Dispatch View 🔍

While the signs of altseason are undeniable, we're witnessing something more nuanced than a simple repeat of 2017. This isn't just money sloshing around the crypto ecosystem – it's a fundamental realignment driven by regulatory clarity, institutional participation, and actual product development.

The question isn't whether altseason is here (it clearly is), but rather how long this particular version can last. With real catalysts driving prices rather than pure speculation, this cycle could be more sustainable than previous ones.

But sustainability doesn't mean safety. The leverage in the system is concerning, and the speed of these moves suggests we could see sharp corrections along the way.

For investors, the key is understanding that while the music is playing, the dance floor is more crowded – and more sophisticated – than ever before. Position accordingly.

The Surfer 🏄

Pump.fun's weekly revenue plummeted by 66% to $11 million after the platform disabled its livestream feature in response to reports of harmful content being broadcast. The revenue drop followed a peak of $33 million in the previous week, highlighting the impact of community concerns over violent acts during livestreams.

Michael Saylor, co-founder of MicroStrategy, presented a Bitcoin adoption strategy to Microsoft's board, claiming it could increase the company's market value by nearly $5 trillion by 2034.

South Korea's Democratic Party will postpone the 20% tax on cryptocurrency gains for two more years, marking the third delay since 2021. The tax, initially set to take effect on January 1, 2025, will now be reviewed further, allowing traders more time to prepare amidst ongoing discussions about its potential market impact.

Central bank digital currencies (CBDCs) have fallen significantly out of favour for central bankers, with only 13% of respondents in a recent OMFIF survey supporting them as a solution, down from 31% in 2023. Instead, 47% favoured interlinking instant payment systems.

HyperLiquid's native token, HYPE, launched at $3.20 and surged to $4.18 within the first hour of trading, achieving a fully diluted market cap of $4.2 billion. The token price has since doubled to $8.6 currently, with an FDV market cap of $8.49 billion.

If you want to make a splash with us, book a demo call 🤟

You can check out partnership opportunities🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋

Look, I get 50+ crypto newsletters. I delete 45 of them. Token Dispatch stays because they actually do the homework and call out the BS. No hype, just real analysis.