Yield Farming: Putting Crypto To Work

Since the DeFi boom and global meltdown of TradFi(traditional finance), investors have been contemplating new and innovative ways to earn and use the crypto assets they've been sitting on for a while. Even though the markets are going through a bear cycle, DeFi provides a unique proposition to participate and earn rewards unheard of in TradFi. But do note there is a lot to unpack.

What is Yield Farming?

Yield farming is the process of token holders maximising rewards across various DeFi platforms. Yield farming allows investors to earn yield by putting coins or tokens in a decentralised application, or dApp including DEXs, Lending and Borrowing Protocols, AMMs and much more.

Yield farming across DeFi is facilitated by smart contracts — pieces of code that automate financial agreements between two or more parties.

Why Now?

When one talks about yield farming, they discuss the percentage of yield earned on the value of assets invested or put to use. More often than not, this invites a comparison to the interest rate earned on a savings account at a bank. Today, most developed economies offer record low-interest rates to facilitate and promote pandemic struck businesses.

For the non-finance folks, let’s try to break it down even further. Primarily, banks are in the business of lending and borrowing. They borrow money from individuals like us, promising particular interest on the amount deposited and lend the same to individuals/groups/businesses for a certain period. The interest earned on the loans disbursed is their revenue. Out of this revenue, they provide depositors with the above-promised interest on the money kept with them in savings accounts, fixed deposits, and various other deposits.

Since the pandemic had put a halt to all business activities, Central banks across the world have cut the interest rates on borrowing, thus making it cheaper for businesses to borrow and initiate commercial activities. Therefore, this leaves little room for banks to earn from lending, and if they can’t earn, they obviously won’t be paying much to their depositors.

Amidst all this, DeFi led yield farming comes as a promising prospect. They claim to produce APYs much higher than banks provide (triple digits in some cases), which makes them gather all the investor eyeballs.

Also, before diving into how yield farming works, let’s understand how earnings are calculated on these instruments.

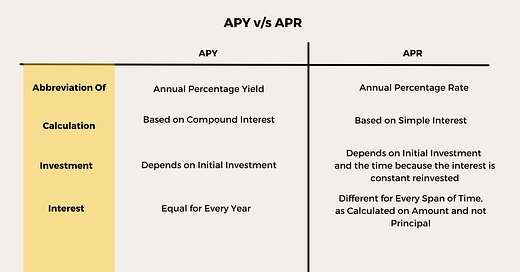

APR

APR is an abbreviation for ‘Annual Percentage Rate’, which means yearly funds that one gets as investment interest. This usually includes any additional costs or fees you have to pay along the way but does not incorporate compounding.

APR simply tracks how much interest a depositor will earn on their crypto over a year. If a yield farm consistently offers 5% APR, and one supplies $100 to it, after one year, they’ll have $105.

APY

APY stands for ‘Annual Percentage Yield’, the actual rate of return earned on an investment, considering the compound interest. Another way to put it is that APY tracks how much a deposit will earn in a yield farm over the year if its interest earnings are continuously reinvested in the yield farm.

Types of Yield Farming

1. Liquidity provider: Users deposit two coins to a DEX to provide trading liquidity. Exchanges charge a small fee to swap the two tokens paid to liquidity providers. This fee can sometimes be delivered in new liquidity pool (LP) tokens.

Supposedly, a user has provided liquidity to the Ether/DAI pool on Uniswap. The liquidity provider must deposit an equal value of both DAI and ETH. Let’s assume today’s worth of 1 ETH is $100. Thus, the LP will provide 1 ETH and 100 DAI (DAI being a stablecoin is always pegged to the USD in 1:1 ratio), bringing their exposure to $200.

So, when someone goes to Uniswap to exchange their Ether for DAI, Uniswap will take some DAI out from the liquidity pool and add the Ether to the pool that the user is exchanging. Uniswap charges a flat fee of 0.3% whenever someone trades, regardless of how much or how little the trade is.

Assuming the pool has a total value of $2000, the share of the LP in question is 10%. This means they’re entitled to 10% of 0.3% of the total value of all trades.

2. Lending: Coin or token holders can lend crypto to borrowers through a smart contract and earn yield from interest paid on loan.

If someone becomes a lender on one of these lending protocols like Aave or Compound, they’ll earn the interest paid by borrowers of their assets. The interest rate is determined by supply and demand and can vary from minute to minute. Some protocols will work to stabilise interest rates for lenders seeking more consistent returns.

When one wants to lend, they exchange the tokens they want to lend for their equivalent tokens of the protocol. The exchange rate on those tokens is constantly improving as loans collect interest from borrowers. Once the lender decides to exchange their tokens back to the original cryptocurrency they had lent, they’ll receive more than what was initially exchanged.

Supposedly, If one deposits 100 DAI worth $100 with Compound, they’ll receive $100 worth of cDAI in return(assuming the exchange rate was 1:1 when they made their deposit). If the interest rate for DAI is 10% and remains there for a year, the exchange rate of DAI to cDAI will be 1.1:1 after one year. When they remove their DAI from the protocol, they’ll receive 110 DAI back, worth $110.

Yield Farming v/s. Staking

As mentioned earlier, Yield Farming is not a particular method but the act of putting tokens to use in the best possible way and maximising earnings on them. As per this definition, some folks consider yield farming an umbrella concept encompassing - providing liquidity, lending and staking.

There is much debate about staking being a subset of yield farming and vice versa.

Let’s try understanding staking.

Staking refers to pledging your crypto-assets as collateral for blockchain networks that use the PoS (Proof of Stake) consensus algorithm. Similar to how miners facilitate the achievement of consensus in PoW (Proof of Work) blockchains, stakers are chosen to validate transactions on PoS blockchains.

PoS is generally preferred over the more popular PoW algorithm because it is more scalable and energy-efficient. PoS also provides a window of opportunity for stakers to earn rewards. With PoS, the chances of a staker producing a block are proportional to the number of coins they have staked.

Thus, the higher stakes you hold, the bigger the staking rewards from the network. In staking, the rewards are distributed on-chain, meaning every time a block is validated, new tokens of that currency are minted and distributed as staking rewards.

Liquidity Mining

Again, Liquidity Mining comes under Yield Farming in one way, but there is much debate around this as well. In this investment process, participants provide their crypto-assets (trading pairs like ETH/USDT) into the liquidity pool of DeFi protocols for crypto trading (not for crypto lending and borrowing). In exchange for the trading pair, liquidity mining protocol provides users with a Liquidity Provider Token (LP), which is needed for the final redemption.

As long as the tokens provided by the user remain in the pool, he earns both 0.3% swap and the governance tokens that are “mined” at each block. At the time of redeeming, the user, by returning the LP, receives in exchange both the fees and the “farmed” GOV.

These ‘GOV’ tokens would give them rights to participate and vote(in proportion to the tokens held) on governance and important issues like updates, treasury, operations and other essential matters where the community will decide the course of the project.

Risks

1. Rug pulls: Rug Pulls are a form of an exit scam in which a cryptocurrency developer collects investor cash for a project and then abandons it without repaying the funds to the investors. Rug pulls and other exit scams, which yield farmers are particularly vulnerable to, accounted for about 99% of big fraud during the second half of 2020, according to a CipherTrace research report.

Chef Nomi and an anonymous developer for SushiSwap released the platform, inviting investments in its farms. A week later, Chef Nomi sold his Sushi tokens, resulting in $14 million worth of tokens worthless for the rest. There was a lot of backlash from the community after that, and luckily, he took the high road and came back briefly to mend whatever they could.

2. Smart Contract Risk: Smart contracts control yield farming and DeFi. One bug in the smart contracts can cause the price of a token to drop to zero. A malicious hacker can exploit that bug or security issue to manipulate the project for any possibility, including losing all your cryptocurrency assets in the pools affected. To mitigate this risk, confirm that the smart contract has been audited; good Defi projects get smart contract audits.

Look for open source code and audited by a reputable person/team. Never send your money to a protocol unless both of these are in place. Even so, this does not fully eliminate risk.

3. Strategy Risk: Yield farming strategies include lending, arbitrage trading, or loan pool participation. Yield farming strategies change over time. The methods which are the hottest today may not work tomorrow because of certain conditions. For example, loan pools might be saturated because of low liquidity on the platform. Arbitrage trading involves scanning multiple exchanges to take advantage of price inefficiencies. Arbitrage trading may no longer be profitable if volatility decreases.

4. Impermanent Loss: Impermanent loss happens when you provide liquidity to a liquidity pool, and the price of your deposited assets changes compared to when you deposited them. The bigger this change is, the more you are exposed to impermanent loss. In this case, the loss means less dollar value at the time of withdrawal than at the time of deposit.

It’s called impermanent loss because the losses only become realised once you withdraw your coins from the liquidity pool. At that point, however, the losses very much become permanent.

Popular Yield Farming Protocols

Curve Finance: Curve is the largest DeFi platform in terms of total value locked, with nearly $19 billion on the platform. With its own market-making algorithm, the Curve Finance platform makes greater use of locked funds than any other DeFi platform — a beneficial strategy for swappers and liquidity suppliers.

Curve provides an extensive list of stablecoin pools with good APRs tied to fiat cash. Curve keeps its APRs high, ranging from 1.9% (for liquid tokens) to 32%. As long as the tokens don’t lose their peg, stablecoin pools are quite safe. Impermanent loss may be entirely avoided because their costs will not alter drastically in comparison to each other. Curve, like all DEXs, carries the danger of temporary loss and smart contract failure.

Curve also has its own token, CRV, used for governance for the Curve DAO.

Aave: Aave (AAVE), initiated in 2017 under the name ETHLend, is one of the original DeFi platforms. Aave is a decentralised liquidity platform that allows for borrowing assets and earning rewards on deposits. It brings together lenders and borrowers in a decentralised space to allow for an equal opportunity lending system.

Aave also has its own native token, AAVE. This token incentivises users to use the network by providing benefits such as fee savings and governance voting power.

It is common to find liquidity pools working together for yield farming. The Gemini dollar, which has a deposit APY of 6.98% and a borrow APY of 9.69%, is the highest-earning stablecoin accessible on Aave.

Compound: Compound enables users to borrow or and lend a small range of cryptocurrencies such as ETH, USD Coin (USDC), Basic Attention Token (BAT), Ethereum (ETH) and DAI. The platform uses lending pools and charges interest on loans. The protocol requires borrowers to deposit a given amount of supported coins for collateral.

Compound announced in 2020 it wanted to truly decentralise the product and give a good amount of ownership to the people who made it famous by using it. That ownership would take the form of the COMP token.

Uniswap: Uniwap is a DEX system that enables token exchanges with no trust. Liquidity providers invest the equivalent of two tokens to create a market. Traders can then trade against the liquidity pool. In return for providing liquidity, liquidity providers get fees from trades in their pool.

Due to its frictionless nature, Uniswap has become one of the most popular platforms for trustless token swaps. This is useful for high-yield agricultural systems. Uniswap also has its own DAO governance token, UNI.

PancakeSwap: PancakeSwap works similarly to Uniswap. However, PancakeSwap runs on the Binance Smart Chain (BSC) network rather than Ethereum. It also includes a few extra gamification-focused features. BSC token exchanges, interest-earning staking pools, non-fungible tokens (NFTs) and even a gambling game in which players guess the future price of Binance Coin (BNB) are all available on PancakeSwap.

PancakeSwap is subject to the same risks as Uniswap, such as temporary loss due to big price fluctuations and smart contract failure. Many of the tokens in PancakeSwap pools have minor market capitalisations, putting them in danger of temporary loss.

PancakeSwap has its own token called CAKE that can be used on the platform and also used to vote on proposals for the platform.

Centralised Platforms

Now that we're aware of decentralised DeFi protocols that facilitate yield farming, here are a few consumer-focused platforms for non-technical investors. These apps serve as an on-ramp and make it easier to invest in fiat currency; then they themselves invest these sums into a mix of the above protocols, keeping a share of the earning and returning the rest to the individuals.

Celsius: Celsius is a peer-to-peer lending platform that allows investors to provide Celsius loans in return for weekly rewards. Lenders can receive their rewards in the same currency as their lent asset or supercharge their earnings by opting to receive CEL tokens instead. Unfortunately, boosted CEL rewards are only made available to non-US users and accredited US investors in order to avoid regulatory scrutiny from the SEC.

BlockFi: BlockFi is a platform that offers cryptocurrency trading, interest-bearing accounts, and crypto lending. A BlockFi interest account (BIA) could earn users up to 10% APY paid every month with no minimum balance required. All you need to do is register an account and deposit any of its supported assets.

SeaShell, Flint and Pillow.Fund: There has been a flurry of DeFi apps offering non-technical investors earn through investing their fiat currency and avoiding touching smart contracts.

These apps promise to provide the easiest on-ramp for users to generate high yields, especially when inflation is rising, and bank interest rates are falling. These platforms promise to offer up to 10% yields.

The fiat money will be converted into stablecoins via “a licensed custodian,” and those stablecoins will be deposited into decentralised finance (DeFi) protocols to generate high yields.

While SeaShell, a US-centric product, is avoiding regulatory crackdown from the SEC by only opening up to accredited investors, for the time being, Pillow.Fund and Flint, which have sprouted from the Web3 entrepreneurial boom in India, are just out of their beta and made KYC a mandatory step.

Regulatory Environment

Apart from the risks around Yield Farming and DeFi in general, there is always a regulatory aspect to all things crypto.

Last year, in September, Coinbase Global Inc. said the SEC threatened to sue if the exchange lets customers earn interest on some digital tokens. At issue is Coinbase’s Lend product, which had not yet been opened to investors but promised to let them make 4% annually by lending out their USDC virtual tokens.

The SEC has long argued that a range of tokens falls under its jurisdiction. Over the past four years, the SEC has consistently asserted that many digital assets are investment contracts or securities based on a legal theory known as the ‘Howey Test’ laid out in a 1940s Supreme Court case. The regulator’s stance is that almost anything that gives investors the expectation of profiting from the work of others can be labelled an investment contract. The industry has countered that the SEC’s view is too vague and unsuitable for virtual coins.

Howey Test: The Howey test, named after a 1946 Supreme Court case in which the SEC went after a citrus grove company that claimed its investors were buying shares of real estate whose value was independent of the company’s grove business, even though the company leased most of the land back from investors and farmed on it.

The court backed the SEC’s contention that investors were investing in the business, not just real estate, making the sales an unregistered securities offering. The agency has since been applying the Howey test to go after any company that sells anything to the public that even indirectly represents a way to bet on the future success of the company’s operations—unless, of course, the company registers the sales as a securities offering and meets the exhaustive public-disclosure requirements that go along with it.

Precautionary Note:

One thing to keep in mind is that yield farms’ earnings constantly fluctuate per changes in participants, token distribution schedules, and trading fees. In this sense, think of a yield farm’s APR or APY as a snapshot of current yield performance rather than a static interest rate.

Yield farming can be a high-risk, high-reward venture for the curious, tech-minded few who are comfortable with the possibility of losing their principal investment.

Since the summer of 2020, when DeFi was at the height of its popularity, enthusiasm has waned somewhat. But one needs to proceed with caution, deep understanding and an eye to read between the lines.

Stay informed in just 5 minutes

Get a daily email that makes reading crypto news informative. Have fun keeping up and getting smarter.

The dispatch is sent in time zones at 8:30 am. Choose your preferenceEastern Time Zone (UTC-05:00)USTISTGMTSST

Subscribe