ZKSync Out Of Sync? 🔄

A Layer 2 blockchain scaling solution on Ethereum, and how its 3.6 million token airdrop went awry. Highlighting the challenges of Web3 project bootstrapping.

Hello, y'all. Smoke in the sky anyone?

Do try the Music Quiz Game 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 find all about us here 🤟

ZKSync is a Layer 2 blockchain scaling solution on Ethereum.

Uses zero-knowledge rollups.

Deliver faster and cheaper transactions on its network.

All along maintaining a high level of security.

ZKSync's attempt to win friends with a massive airdrop backfired.

The 3.6 million airdrop for June 17th.

Instead, what happened? Accusations of favouritism, transparency complaints, a trending hashtag, and finally the Airdrop.

A complete PR nightmare.

Get to know the terms

ZKsync: Verifiable blockchain network, designed to scale Ethereum with the use of zero-knowledge (zk) rollup technology.

ZKsync Era: First mover in ZK rollup technology, aiming to solve Ethereum's scalability woes.

Uses zero-knowledge proofs for faster and more secure transactions compared to optimistic rollups. Built to provide a similar developer experience as Ethereum.

ZKsync Era launched its own governance token, ZK, in June 2024 with a massive airdrop.

The ZK Token (ZK): The native cryptocurrency of the ZKsync network. ZK token holders can vote on proposals, influence protocol upgrades, and even pay network fees.

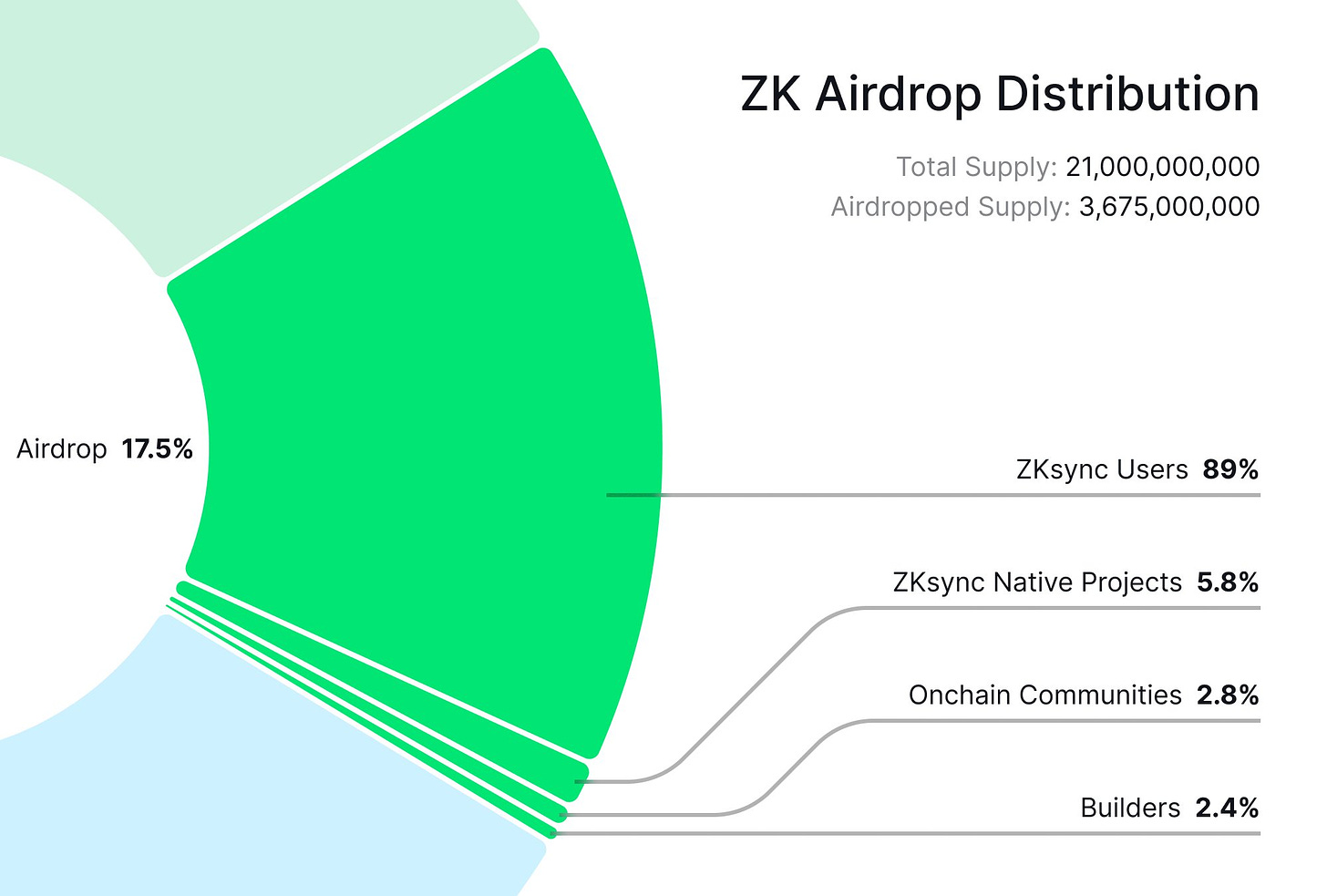

Token Distribution

Airdrop distribution

What went wrong?

Who gets the loot? People felt the allocation wasn't fair. The airdrop excluded key participants.

Favouritism allegations: The allocation of tokens to a crypto exchange (Bybit) and concerns about "insider deals" further fuelled the fire.

Fake followers? Concerns arose that the airdrop might have rewarded fake accounts (called Sybil attacks).

"Switch to another layer 2" became the battle cry, with many users calling for a mass exodus to competitor platforms like Arbitrum.

Adding fuel to the fire - Bybit announced a ZKsync token listing, added fuel to the fire.

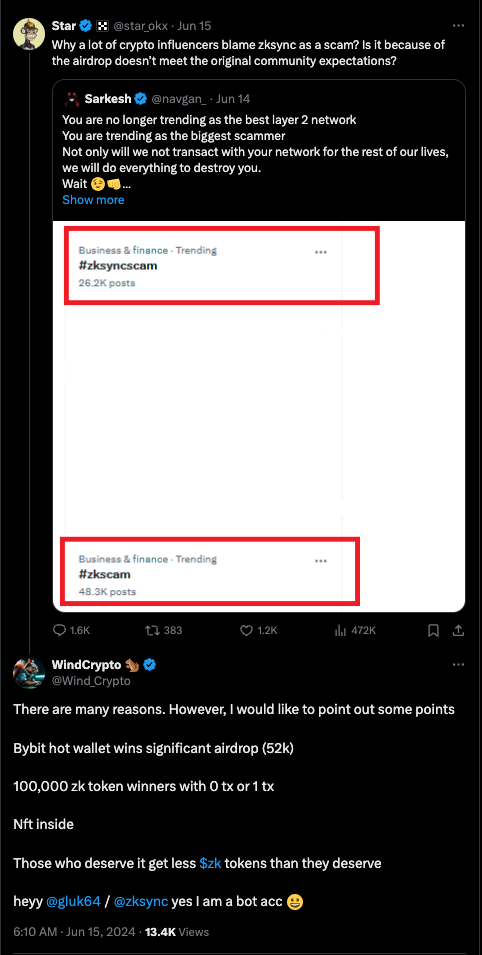

#ZKsyncScam takes over social media

The frustration was palpable.

Social media platforms were flooded with the #ZKsyncScam hashtag, with users like Sarkesh vowing to abandon the network entirely.

WindCrypto, a crypto influencer, pointed out irregularities in the token distribution, alleging that some received far more than they deserved.

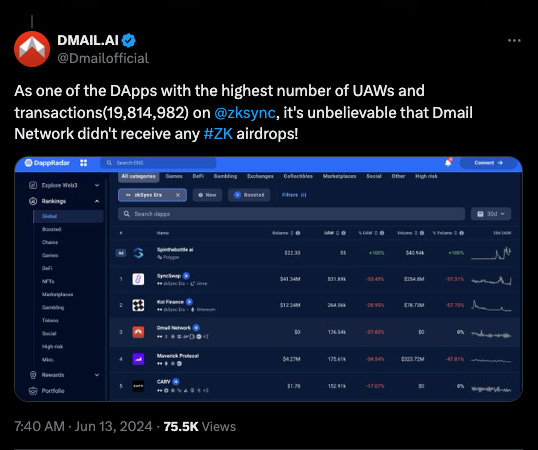

Major ZKSync Era players like Element (NFT marketplace) and ZKApe (project) were left empty-handed.

ZK Nation speaks up

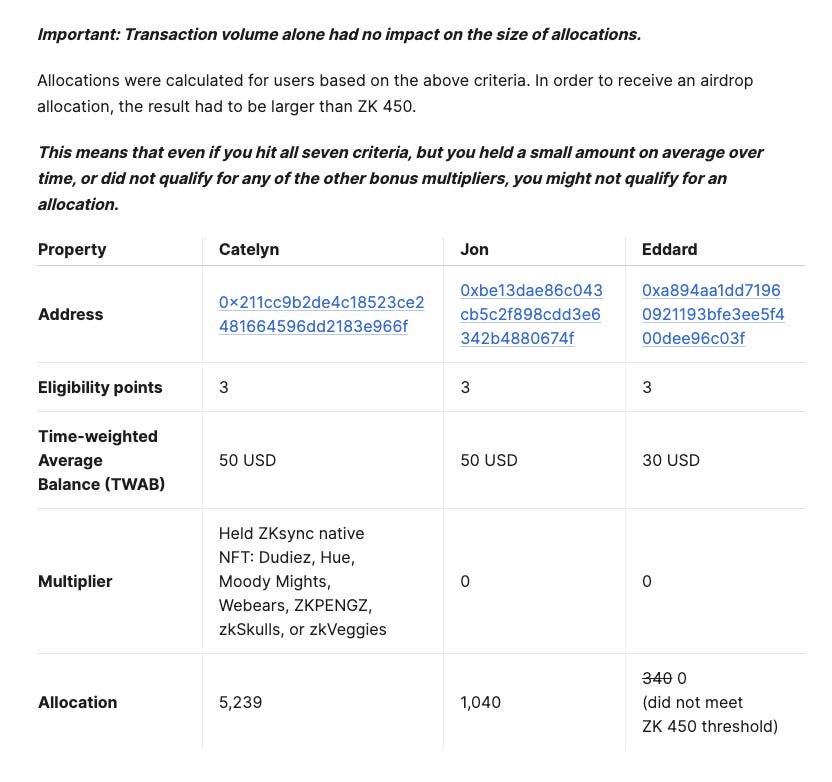

Their claim? the airdrop aimed to reward loyal users, not just those with high transaction volume.

“A wallet’s history across chains can reveal a lot about its owner. Real users tend to be more risk-on, especially when they feel part of a community. They spend time exploring, trying out new protocols, and holding onto speculative assets. On the flip side, bots and opportunists play it safe, putting in minimal effort while trying to blend in and extract value.”

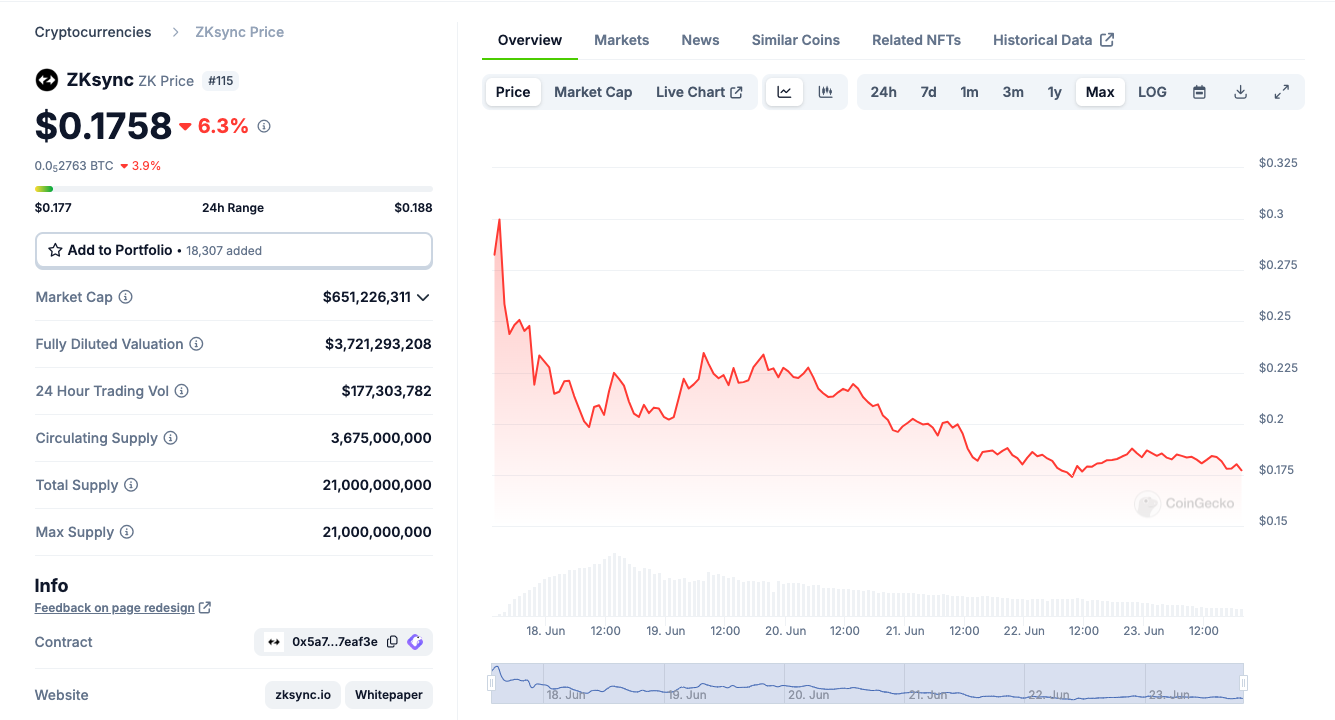

The price of ZK tokens actually dropped over 20% after the whole airdrop mess.

Binance steps in (and maybe steps on toes)

Binance launched a ZK token distribution program running from June 17th to July 16th.

Who qualifies? Up to 52,500 users who actively used ZKSync Era between February 2023 and March 2024 (at least 50 transactions spread across 7 months) can claim tokens.

No double dipping: You can't have gotten tokens from the original ZKSync airdrop.

How to claim? Deposit a minimum of 0.02 ETH from an approved ZKSync Era address to your Binance account. It's first-come, first-served, with 200 ZK tokens per eligible user.

They're also listing the ZK token.

Here comes the airdrop

Crypto users were lining up to claim their free ZK tokens on June 17.

45% of tokens claimed in just two hours.

Lens protocol scores big

Lens Protocol received a huge token offer to build on ZKsync.

What is Lens? A social media protocol, launched by Aave founder Stani Kulechov.

Sources claim ZKsync offered Lens around 0.5% of their total token supply, translating to a cool $22.4 million at current prices.

This offer surpassed deals from competing blockchains, leading Lens to choose ZKsync.

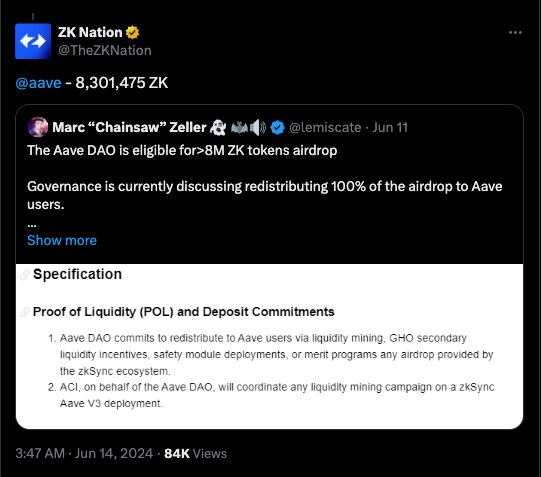

From the airdrop: Aave, the lending protocol, received about 8.3 million tokens and Lens Protocol received about 5.6 million tokens.

The big sell-off

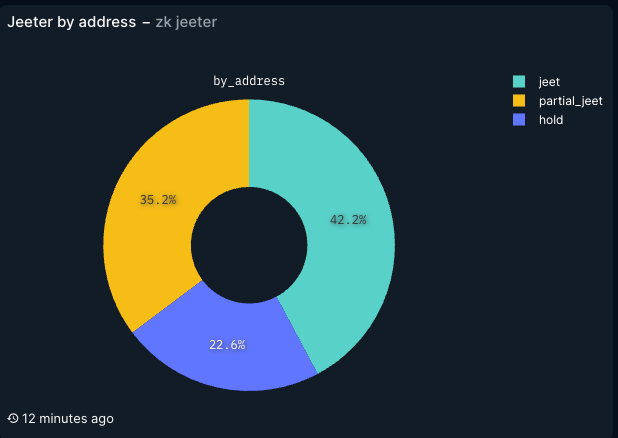

The airdrop recipients are now flipping their tokens.

Over 40% of the top 10,000 recipients sold their entire allocation within 24 hours of the token launch.

41.1% Sold Out: These folks cashed in on their free ZK tokens immediately.

24% Held On: The patient investors, holding onto their entire airdrop.

34.9% Took Profits: They sold some but not all of their airdropped ZK.

It's important to consider

These are just the top recipients, representing a small fraction of the total airdrop.

The airdrop tokens have no lock-up period, allowing immediate selling.

ZKsync is a relatively new project, and the token's long-term value is uncertain.

Token metrics

Traded on major exchanges like Binance, Bybit, GateIO, and KuCoin.

The ZkSync airdrop faced significant backlash due to concerns over unfair distribution and lack of effective Sybil protection:

Unfair distribution: Long-term users received lower token allocations than others with less activity.

Lack of sybil protection: Malicious actors easily "farmed" the airdrop by creating multiple wallets.

Exclusion of legitimate users: Top projects built on ZkSync, like zkApes and Element NFT, were not included.

The controversy has raised questions about the fairness and effectiveness of airdrop strategies in incentivising valuable users in the Web3 space.

Read: ZKsync Airdrop Controversy Highlights the Challenges of Web3 Project Bootstrapping by Wu Blockchain

TTD Week That Was 📆

Saturday: Two Michaels One Bitcoin 🛒

Friday: What Use Memecoins? 🤥

Thursday: Who's Selling Bitcoin? 📉

Wednesday: Ethereum Survives SEC 🏆

Tuesday: Adios Amigo 🫡

Monday: Curve Balls 🪩

TTD Week in Funding 💰

Renzo. $17 million. Restaking protocol on EigenLayer. Abstracts the complex process for end users, simplifies management of operators and reward strategies.

Particle Network. $15 million. Modular L1 blockchain for chain abstraction. Single address interaction point across chains, abstracting gas and unifying liquidity.

Verida. $5 million. Layer zero DePIN ecosystem that combines the performance and privacy of traditional databases with user controlled keys for complex DApps.

SoSoValue. $4.15 million. AI-based classified system news and research for crypto investors, connects macroeconomic data with the cryptocurrency market.

Farcade. $1.75 million. Platform built on Farcaster, suite of tools for developers to build crypto-native games that integrate with on-chain social.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋