Today’s edition is brought to you by Ledger Wallet. The safest way to secure crypto and digital assets. You can also score a gift of $70 of Bitcoin 🫵

Hello y'all. This week’s volatility has kept us on the edge.

Up or down? Will the bull run sustain? Traders’ death - sideways?

Something significant has happened through this bull rally over the last month, the old forgotten crypto tokens have made a comeback.

In this week’s Wormhole we take you right to the middle of the crypto graveyard to tell you the story of zombie coins.

But before we talk about their return, let’s first understand why are they called zombie coins.

Consider signing up for pay-what-you-want subscription to support our work - which is possible thanks to support from readers like you.

If you want to reach out to 175,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

These are backed by blockchain projects that maintain high market valuations (typically over $1 billion) despite showing minimal actual utility or user adoption.

Then, how do they stay alive without any user adoption?

At least a couple of reasons.

Large treasuries filled with millions or billions in assets

Ongoing trading purely on speculation basis despite failing to deliver on their original promises

And this is precisely what makes them "zombies" - ability to persist indefinitely.

Unlike conventional failing companies that eventually run out of money, these projects can survive for years on their massive treasuries without pressure from shareholders or regulators.

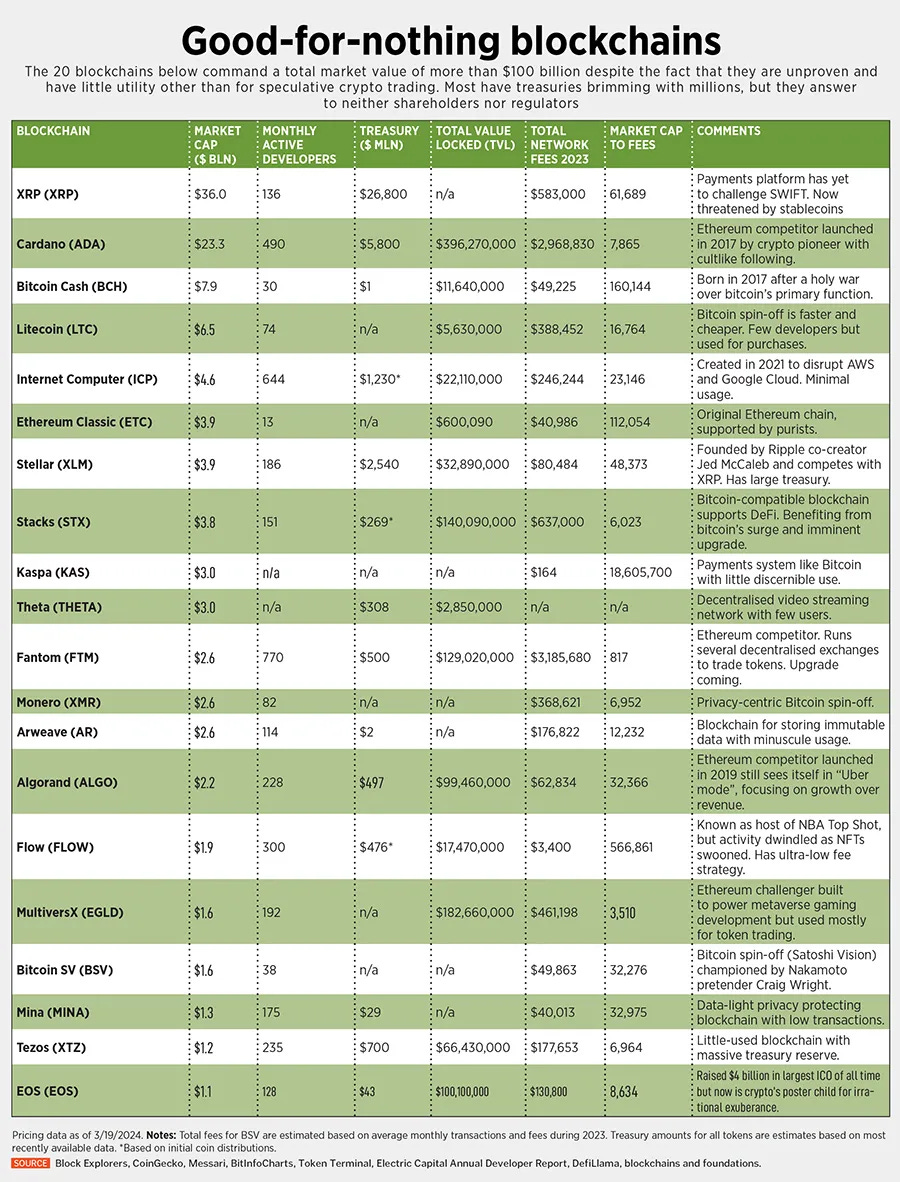

We are talking about those billion-dollar blockchains that Forbes labelled "good-for-nothing" in March 2024. In the world of crypto renaissance it feels like from different lifetime. Nevertheless.

Twenty of them to be precise.

Which ones? Tokens like XRP - which aimed to replace SWIFT but processed a tiny fraction of global payments, Litecoin - a Bitcoin fork that's faster but rarely used and Cardano - valued at $23 billion (in March 2024) despite admitting it hasn't completed development.

XRP, ADA, ALGO, EOS and XLM - these were some of those that were almost written off as zombie coins, but have suddenly surged in the past month or so.

What kind of surge? Some posted gains of several hundred percent.

What’s going on?

Well, the crypto market's most notorious underperformers are seeking their revenge.

But here's what we want to unwrap for you: Is this just another speculative frenzy bringing ‘em back from the dead temporarily, or have these projects actually found a pulse?

This is a loaded question. There is no simple answer. But we will try.

Choose the Right Ledger Wallet for You

Ledger wallet comes with key features to ensure accessibility and security for you wallet. With Ledger live app you can manage and stake your digital assets, all from one place. Ledger recover helps to restore access to your crypto wallet in case of a lost, damaged, or out of reach Secret Recovery Phrase.

The Resurrection

Let's look at what's actually happening. These "zombie" tokens share a fascinating pattern - most haven't seen significant price moves since 2021, some even since 2018. Yet in the past month:

HBAR shot from $0.05 to highs around $0.39 with 600% growth

XRP surged from $0.54 to over $2.86, a 430% increase

ALGO climbed from $0.15 to $0.45, up 200%

IOTA jumped from $0.144 to $0.42, gaining 189%

EOS rose from $0.55 to $1.10, almost 100%

And a lot of this could be indeed driven by speculation.

Speculations of? Well, there are a few theories.

First, there's the Trump effect.

It is expected that the president-elect will eliminate capital gains taxes on US-based crypto projects.

That explains why XRP, HBAR, EOS, and ALGO - all tied to US companies - are leading the charge.

Then, what about other zombies that returned from the grave?

The Fashion Show

We don’t always buy things for purely their utility, do we?

Sometimes it’s just about the status.

Just like people buy Gucci for what it says about them, crypto traders often buy these tokens for what they represent.

Suki Yang, CEO of Solana trading platform xBot, made this comparison: "Cryptocurrencies are like high fashion. Token holders don't just think about quantitative utility - they consider intangible values."

While there are interesting theories, some of these aren't just empty price moves driven by speculation and heavy treasuries.

Some of these coins have also come back from their grave on the back of some serious work being done on their chains.

The Evolution Question

Take Hedera (HBAR), for instance. It has announced major updates including a new privacy layer that will let consumers construct private network instances while still linked to the public ledger.

On the back of such announcements, HBAR shot up 6x.

This "zombie" is actually showing signs of life.

Or look at XRP. After winning its case against the SEC, Ripple's not just sitting pretty.

They have kept themselves busy with business developments and political lobbying.

First they poured in money into US Presidential Elections. And now they are continuing that by sending cheques to PAC Fairshake to help crypto-friendly candidates win the 2026 US Senate Elections.

On the business front, they have scored many wins, lately.

End of what was a torturous ordeal with the outgoing SEC chair Gary Gensler. Securing an NYDFS nod for its stablecoin, RLUSD, and more.

XRP’s market cap has gone 4x in just nine months and it currently sits at the 4th position in the list of most valuable cryptocurrencies.

For a brief moment, it even flipped the global stablecoin leader Tether.

That's actual development, not just speculation.

We wrote all about it here: Ripple Goes Stable 🎯

And then, there was Algorand. The chain recently became the first to integrate with Swift for CBDCs, potentially bringing its tech to central banks worldwide.

That's a far cry from its "zombie" status.

Cardano, despite criticisms, has seen its Total Value Locked (TVL) grow to nearly $590 million. Small by Ethereum standards, but not insignificant.

So, have all the zombie coins evolved beyond their “zombie” status?

Maybe some of them.

What about the rest? They may continue doing what zombies do - prey upon those around them.

How?

The Risk Game

There’s a problem with some of these zombie coins - highly concentrated ownership.

"Substantial portions of the total circulating supply belong to founding teams. This means the actual circulating supply is much smaller than advertised, allowing teams to easily manipulate prices upward," Sam Callahan, a senior analyst at Swan Bitcoin had said.

Translation? When prices start moving, they can move fast because there's less supply available than you might think.

Token Dispatch View 🔍

The zombie resurrection tells us something important about crypto markets in 2024. While Bitcoin and Ethereum have found legitimate institutional adoption, what we're seeing for some of these zombie coins isn't just blind speculation anymore.

Some of these "zombies" have actually been building during the bear market. Ripple’s XRP has been a story for the ages.

But - and this is important - not all zombies are created equal. For every project showing real signs of life, there are others just riding the wave.

The key is distinguishing between …

Projects actually delivering utility (like Hedera's enterprise adoption or XRP’s redemption)

Those making progress but still finding their way (like Algorand's CBDC experiments)

Pure speculation plays with little more than trading volume

The truth is, in crypto, death isn't always final. Sometimes it's just a long nap. And sometimes, during that nap, real work gets done.

The real question isn't whether these projects can maintain their price surges — it's whether they can maintain their newfound utility. Trump's potential presidency and the resulting capital gains implications might be the catalyst, but sustained revival will depend on continued execution.

For investors, the key is distinguishing between the genuinely evolved projects and those just riding the speculative wave. When a project's transaction count exceeds Ethereum's lifetime total (looking at you, Hedera), it's hard to keep calling it a zombie.

But remember — in crypto, as in nature, evolution isn't guaranteed. Some zombies might find new life, while others will remain exactly what they are: walking dead projects sustained by heavy treasuries and hope.

The market will ultimately decide which is which. Until then, we're all watching this fascinating resurrection experiment unfold in real-time.

Week in Funding 💰

KAST. $10M. Cryptocurrency card for stablecoin and cryptocurrency investments and transactions on-chain.

Fantasy. $4.35. SocialFi Trading Card Game (TCG). Trading cards of crypto Twitter influencers to monetise their social capital and research expertise.

Glacier Network. $4.2M. Programmable, modular and scalable blockchain infrastructure for agents, models and datasets, supercharging AI and DePIN.

Superform. $3M. Non-custodial yield marketplace that aggregates vaults, routes assets, and executes transactions across EVM domains.

Yei Finance. $2M. Money market on Sei Network. With wide asset coverage, a comprehensive risk framework for investment opportunities.

If you want to make a splash with us, book a demo call 🤟

You can check out partnership opportunities🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋