- A new report reveals that over 400 million people worldwide now own cryptocurrencies.

- According to the report, Generation Z is jumping into crypto, with over half of 18-25 year olds investing.

- Singapore leads the crypto adoption index judging regulatory environments and public acceptance.

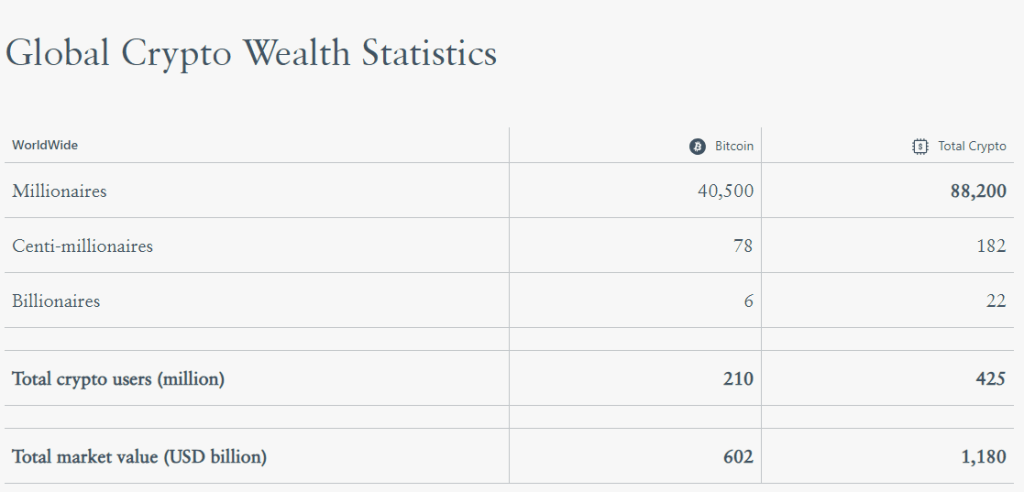

Hundreds of millions of people worldwide have joined the ranks of cryptocurrency enthusiasts, with 425 million individuals engaging in various digital assets, not just Bitcoin. This revelation comes from Henley & Partners’ recent Crypto Wealth Report, which delves into the ever-evolving landscape of digital finance.

While the crypto market may have shed some of its previous exuberance, it remains a ubiquitous investment. Surprisingly, over half of Generation Z, aged 18 to 25, have dipped their toes into this digital realm, as per a report by the CFA Institute and the Financial Industry Regulatory Authority’s Investor Education Foundation.

Nonetheless, a Pew Research survey from April revealed that 75% of Americans remain cautious about crypto, unsure of its safety and reliability. Additionally, 45% expressed disappointment in their crypto investments, with only 15% celebrating exceeding expectations.

Yet, amidst the skepticism, some have struck gold in the crypto sphere, accumulating holdings worth millions, or even billions, of US dollars, as highlighted by Henley & Partners’ report.

The Crypto Elite

According to the report, 88,200 individuals boast crypto assets exceeding $1 million. This elite group represents less than 1% of all crypto users. Interestingly, nearly 46% of these fortunate few have their investments tied up in Bitcoin.

On a grander scale, a mere 182 centi-millionaires are in possession of crypto holdings surpassing $100 million, with a significant 78 of them dedicated to Bitcoin.

For the crème de la crème, 22 individuals flaunt crypto portfolios valued at a staggering $1 billion or more. Astonishingly, only six of them have Bitcoin as their chosen asset, signaling a preference shift among the wealthiest crypto investors. To put these numbers into perspective, the entire crypto market, at the time of the report, amounted to a colossal $1.18 trillion.

Global Crypto Adoption

Henley & Partners didn’t stop at mere statistics; they developed a crypto adoption index to gauge various factors influencing crypto adoption. This comprehensive index takes into account public acceptance, regulatory environments, tax considerations, infrastructure, innovation, and economic factors related to crypto use.

Singapore emerged as the global leader, with Switzerland and the United Arab Emirates securing second and third place, respectively. Notably, the United States and the United Kingdom ranked fifth and seventh, respectively. Other prominent nations in the top ten include Australia, Canada, Malta, and Malaysia.

In conclusion, the world of cryptocurrency continues to evolve and captivate a global audience. While challenges and uncertainties persist, the allure of digital assets remains undeniably strong, with enthusiasts and investors from all walks of life participating in this financial revolution.

No Comment! Be the first one.